Republican Supreme Court passes gas and chance to reverse NDAA? Hard to say, without a vote count.

=

Proven Reserves, IOCs and Other News

by Ron Patterson Posted on May 2, 2014

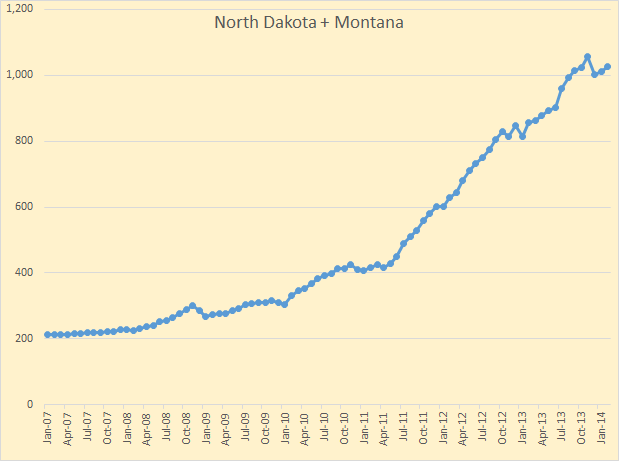

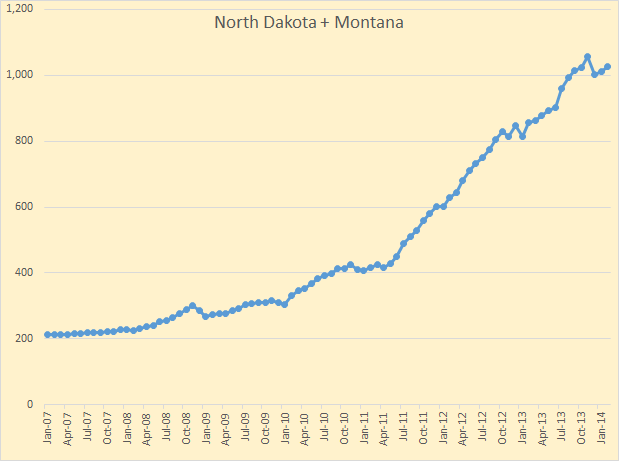

Not much new data to report this past week but I did try to hammer out a few things of interest. The EIA released their Crude Oil Production report for the US and individual states with data through February 2014. I combined Montana and North Dakota to show their production.

Their combined production was 1,027 kb/d. This is still below their production of 1,055 kb/d in November. This is more than just the Bakken as both Montana and North Dakota have production outside the Bakken. Their combined production was 1,027 kb/d. This is still below their production of 1,055 kb/d in November. This is more than just the Bakken as both Montana and North Dakota have production outside the Bakken.

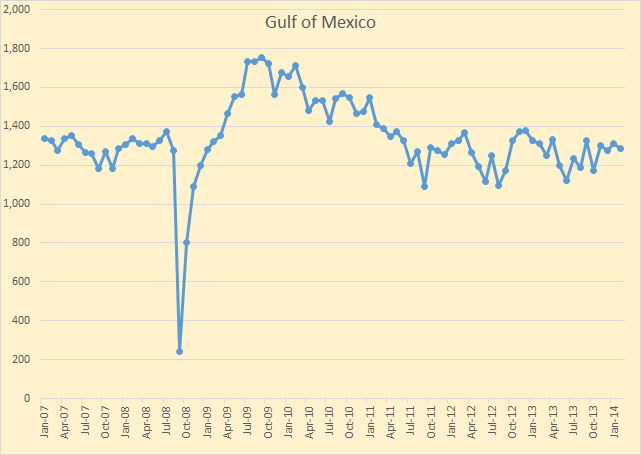

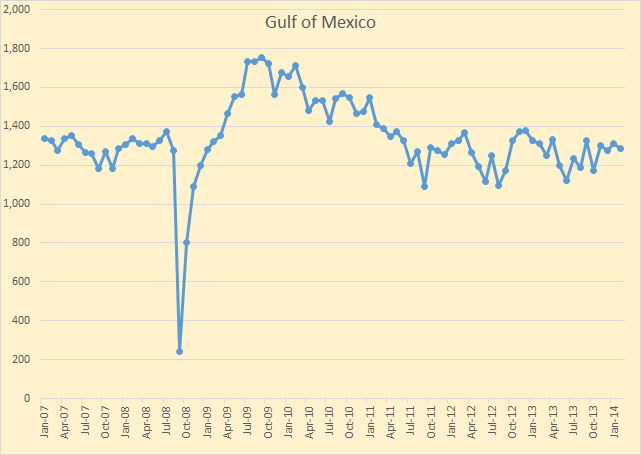

Part of the EIA’s plan for 9.6 mb/d of C+C by 2016 has The Gulf of Mexico going to 2 million bp/d by 2016. The GOM does not appear go be going anywhere however. There are new fields coming on line but they are just barely keeping up with those very high decline rates of the deep water fields. The Gulf of Mexico has her very own Red Queen. Part of the EIA’s plan for 9.6 mb/d of C+C by 2016 has The Gulf of Mexico going to 2 million bp/d by 2016. The GOM does not appear go be going anywhere however. There are new fields coming on line but they are just barely keeping up with those very high decline rates of the deep water fields. The Gulf of Mexico has her very own Red Queen.

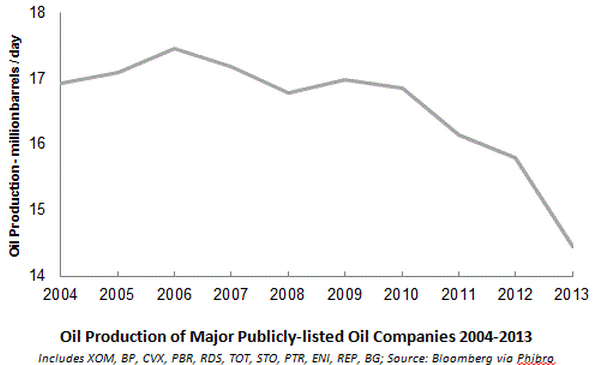

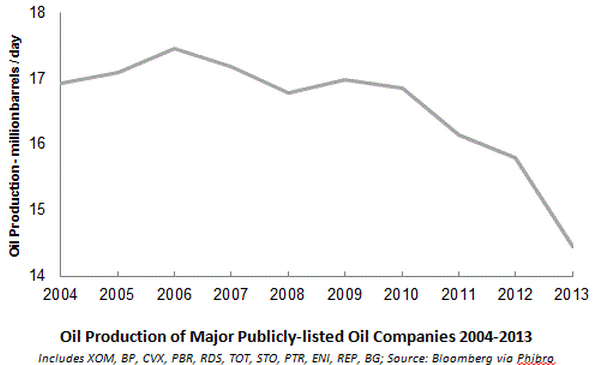

There is some news of late. Quarterly reports for the IOCs are beginning to trickle in, and they are dismal. For the world’s three largest IOCs profits were down primarily because production was down.

Exxon earnings slip on lower production, refining

Exxon’s oil production fell 2 percent to 2.1 million barrels per day from 2.2 million barrels per day. Natural gas production fell 9.1 percent.

Someone needs to check their math. A drop from 2.2 to 2.1 is a drop of 4.5%, not 2%.

BP 1QFY14 Profits Drop On Lower Production

The decline in revenues is largely attributable to an 8.5% YoY decline in production to 2.13 million barrels of oil equivalent a day (BOE/D), excluding production from Russia’s Rosneft.

Shell Profit Falls 45 Percent as Oil Production Drops

Oil production in the quarter fell 9 percent compared with last year’s first quarter, equivalent to an average of 3.24 million barrels a day.

IOC’s oil production from “The Barrel” guest post by Steve Kopits, link below.

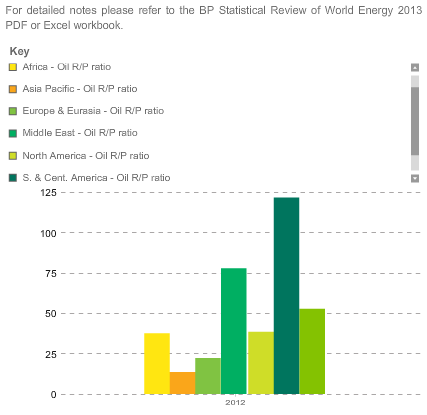

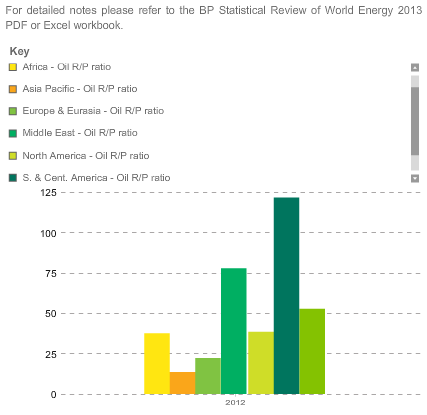

Okay, now I want to talk a minute about two things that go together, so called “Proven Reserves” and “Reserves to Production Ratio”. R/P Ratio is basically how many years of reserves a country or oil company would have if they kept producing at the current level until, suddenly, they had no oil left. Of course it would not work that way as production would continue to decline along with reserves while R/P Ratio would remain relatively constant. Anyway BP has this chart:

The last green column on the right is “World”, not in the legend but stands at 52.93. The other six are Africa – 37.7, Asia Pacific – 13.64, Europe & Eurasia – 22.36, Middle East – 78.06, North America – 38.68 and South & Central America – 121.91.

The S & C America R/P Ratio is so high because of Venezuela which claims 297.7 billion barrels of reserves. I did the math and this gives them a R/P Ratio of 248. That is, at current production they have 248 years of proven reserves left. Saudi Arabia, by comparison, only has 75 years of oil, at current production, left.

But just as the Orinoco bitumen distorts the S & C America R/P Ratio the Canadian Tar Sands distorts the North America R/P Ratio. The US on on January 1st 2013, increased her proven oil reserves by 4.5 billion barrels giving us a total of 33.4 billion barrels. So at 8 million barrels per day that gives the us a R/P Ratio of 11.4. That is if we could continue to produce at 8 million barrels per day we could continue production for 11.4 years.

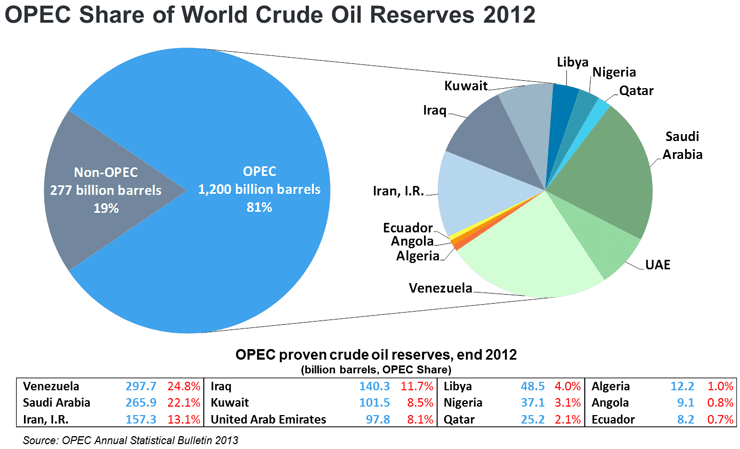

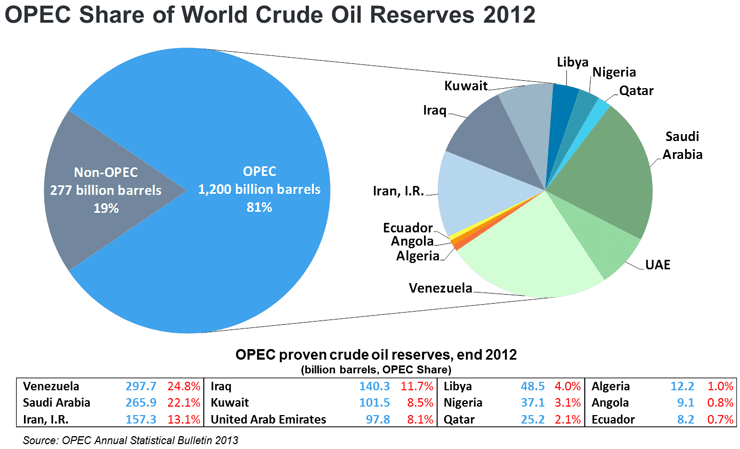

But back to OPEC and their claimed proven reserves:

Now if you believe Non-OPEC nations are producing 59% of the world’s crude oil from 19% of the world’s proven reserves, then you should be working for either BP or the EIA. I don’t believe that and I dearly hope no one reading this blog is dumb enough to believe that. Now if you believe Non-OPEC nations are producing 59% of the world’s crude oil from 19% of the world’s proven reserves, then you should be working for either BP or the EIA. I don’t believe that and I dearly hope no one reading this blog is dumb enough to believe that.

The point I wish to make is the oil a country produces is directly related to the oil they have to produce. There has been, historically, one exception to this rule, Saudi Arabia. Saudi Arabia has, for many years, held old fields in mothballs. That is they were kept off line because of production problems. Manifa was extremely heavy and contaminated with vanadium and Khurais was remote in the desert with no reservoir pressure. But higher oil prices have made it economical to bring these old reservoirs on line. Now Saudi no longer has any mothballed giants.

Bottom line, the term “proven reserves” is political and totally meaningless. The amount of oil reserves any nation has depends on the price of oil. That is if the price is high enough a country, like the USA, can produce oil from areas that were originally though to expensive and too difficult to produce. If Oil were $25 a barrel the US would be producing about 4 million barrels per day. Every country is producing every barrel they possibly can produce at the current price of oil.

But the production vs. price incline is non linear. If the price of oil were to go to $150 a barrel then production would increase slightly. But if the price dropped to $60 a barrel then production would drop dramatically. And it is getting worse. One year ago Bernstein Research pegged the marginal Non-OPEC barrel of oil at $104.50, up 13% from 2012. Now you know why those IOCs listed up top are losing money. Steve Kopits addresses this point in a guest post on “The Barrel”, don’t miss it:

More Debate on the Future of International Oil Companies

One more bit of news. I believe Russia has peaked and will likely be down about 3% this year from their December 2013 peak.

Russian Oil Output Down for Fourth Month in a Row

Russian oil output, the world’s largest, slipped by 0.2 percent to 10.54 million barrels per day in April, declining for the fourth month in a row as production from new fields failed to offset a slowdown from mature deposits….

Oil output has declined every month this year, after touching a post-Soviet monthly high of 10.63 million bpd in December.

peakoilbarrel.com

|