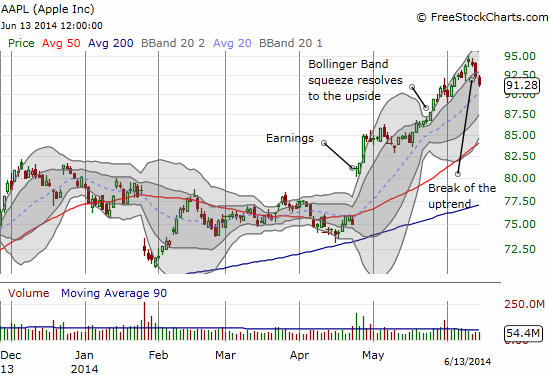

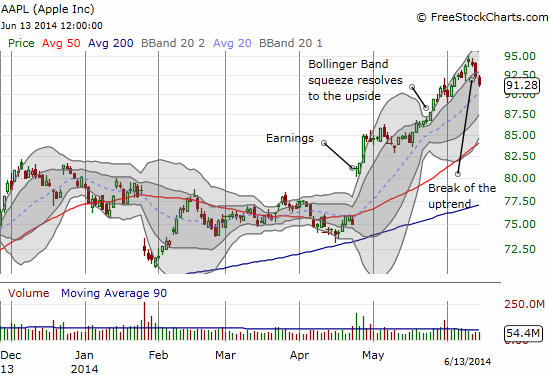

| | | I was surprised by the AAPL stock action this week. When opened post-split on Monday I expect big

topping action on high volume and then downward the rest of the week. This would be quite normal for

a stock that had run up pre-split. Instead, Monday saw AAPL actually GAIN a point and a half on volume

of 75k compared to a three-month average of 70k. In addition, AAPL continued to climb for the first half of

the week on lower than average volume. What the heck kind of profit taking is this? The last half of the

week DID see AAPL decline, but on much lower volume of 45k, 54k and 54k. There were some Price

Targets that got raised and some CNBC traders bought the stock but (in general) a quiet news week.

I was not the only one surprised by this week's action apparently. A guy with his own trading system:

Trading Check-In for Apple’s First Post-Split Week

Apple (NASDAQ: AAPL) finished its first post-split week in disappointing fashion. Sure a sell on the news

reaction should have been expected, but the strong trade going into the split, right through the Worldwide

Developers Conference (WWDC), produced some hope AAPL could hold its own. Apple even entered the

week featuring a dramatic shift in trading sentiment to a bullish advantage. Next, the stock even gained the

first two post-split trading days. Unfortunately, not only did AAPL end the week down 1.1%, but it also broke

the primary uptrend since last May’s big breakout.

More at: investing.com’s-first-post-split-week-216023

o~~~ O |

|