Hi Colin, sure, ... Rob has a very good grip on the GDXJ, I think he's the one that can shed light on that ETF, as he has over the weeks, but basically speaking, ... it follows gold's lead, as we can see from this chart, ... screencast.com ...

... gold manages to stay above GDXJ both up and down. This weeks action regarding GDXJ weakened, its dipped lower while gold thus far holds its gains, but I imagine they will par each other in due time.

Watching gold is a good indicator regarding the GDXJ and the GDX, ... and the exceptional volume it saw this past week, seems to be evening out between the buy and the sell this week.

Regarding the dollar and gold: Both have been so darn manipulated that the short term view is distorting matters.

We do know that the dollar is in trouble and once it begins to break further lower support, ... gold will rise sharply, but as of this week, gold is going sideways to lower, ... as the dollar sits in neutral territory, but getting weaker.

If the dollar was left alone? ... the dollar would probably be in the mid to low $70s range by now, but so much is going on around the world that its created a lot of mistrust, confusion and indecision, and rightfully so.

Here are the daily, week and monthly views of the Dollar vs Gold.

Let me start by showing you this, ...

Last Wednesday (the 18th) Gold crossed above the dollar for the first tine in months, ... and we all know what happened the following day (Thursday), ... gold broke out with a $40.00+ gain in one day, ... something its not done for a year or more, ... screencast.com . ...

... but I am still a bit speculative, with this being end of Quarter-2-2014, ... this spike looked like a quick bear-trap to milk the gold bugs, as they need to show profits to customers. This is just a personal view, due to the fact that the Big-3 are so overbought, not much milk left for the squeezing.

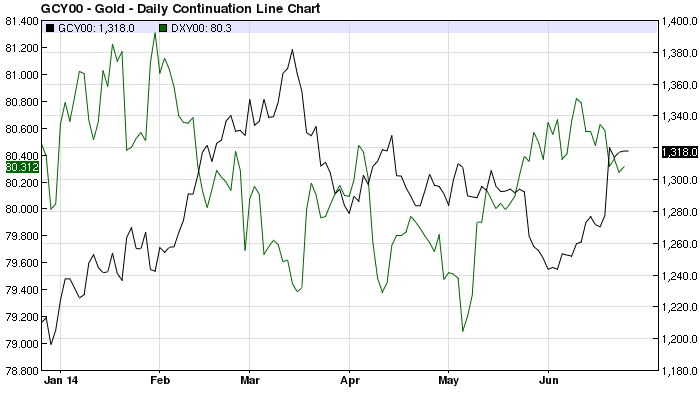

Here are the charts, ... gold is in black throughout.

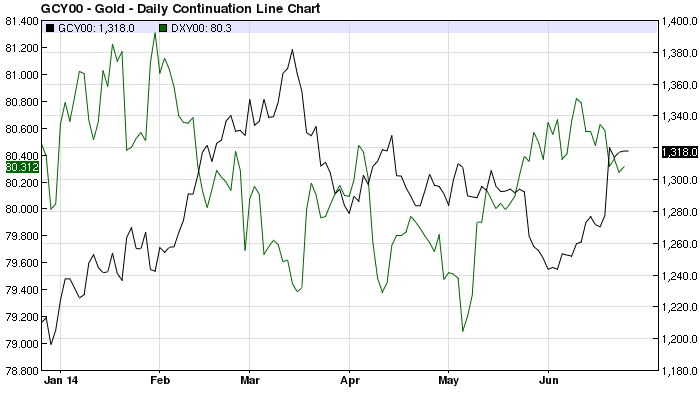

6-Month-daily.

You can see the cross-over that occurred last week, but has since been flat. This to me is a sign of weakness on the part of the dollar, they are losing control, or shall I say ... others options are gaining leverage, .... but golds being stalled as well Even though the dollar's made a lower low since the cross-over, golds gone sideways, it stalled in and around the $1,320.

~~

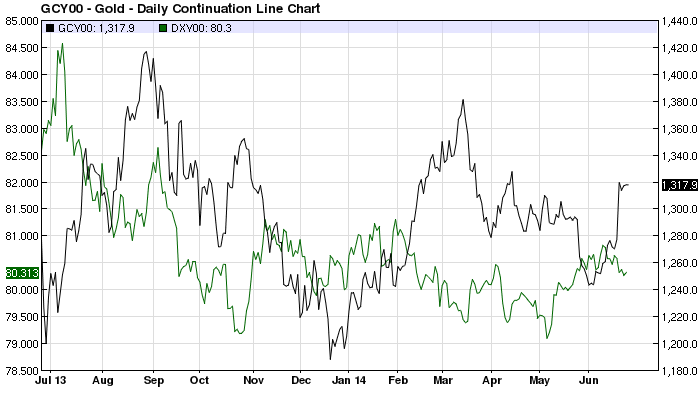

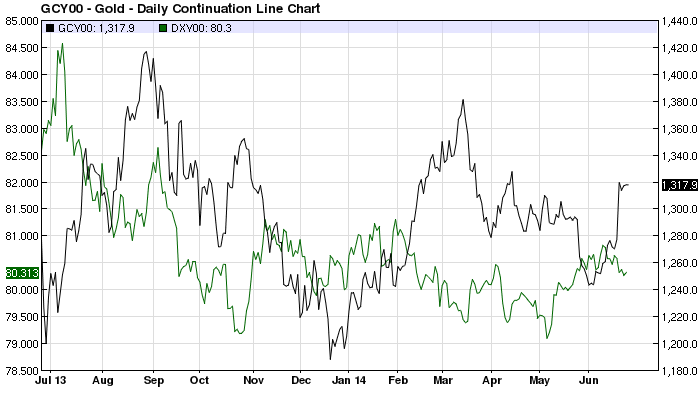

1-year daily.

Looking back a full year, ... we see gold well ahead now, but the dollar has not nearly dropped as much as gold has gained. The next hurdle is the $1,330 area, I talked about it in a recent post, once above it, nothing much in the way on up to the $1,380/90 area, as the dollar seems to be headed down to the $80.00 range.

~~

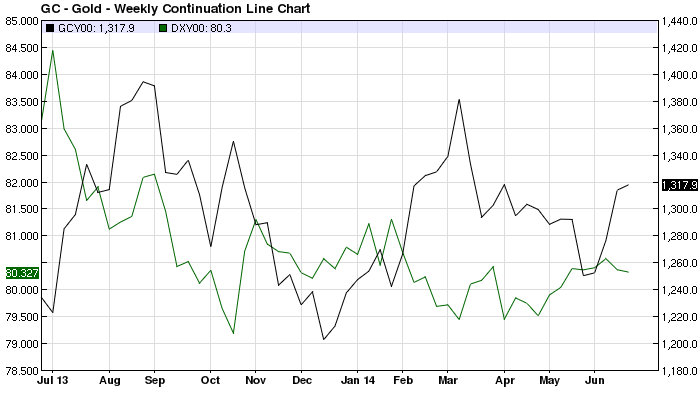

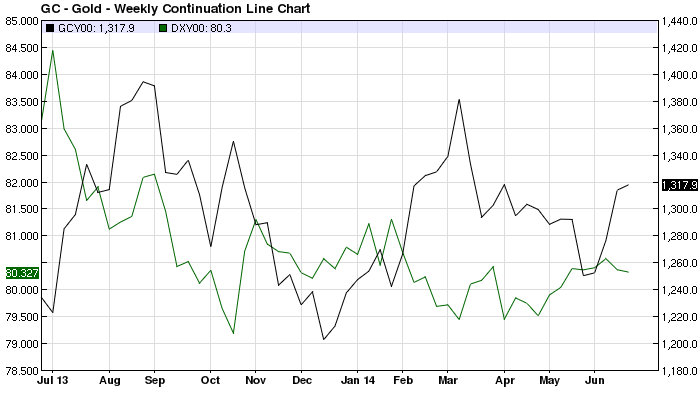

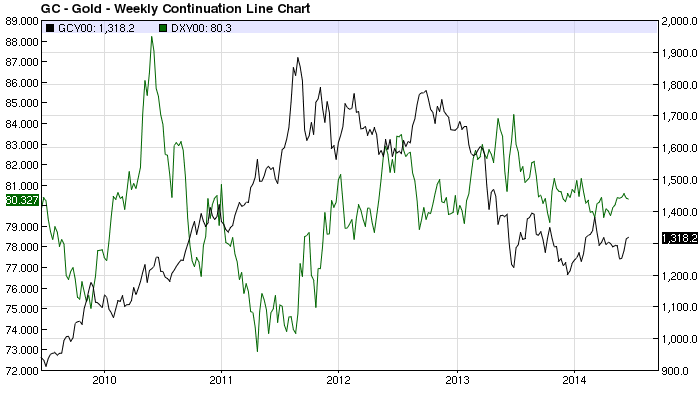

1-year weekly.

Similar to the 1-year daily, this 1-year weekly says the same thing, a break above the line directly above golds present position, it moves on up into the $1,380 range, and quickly.

~~

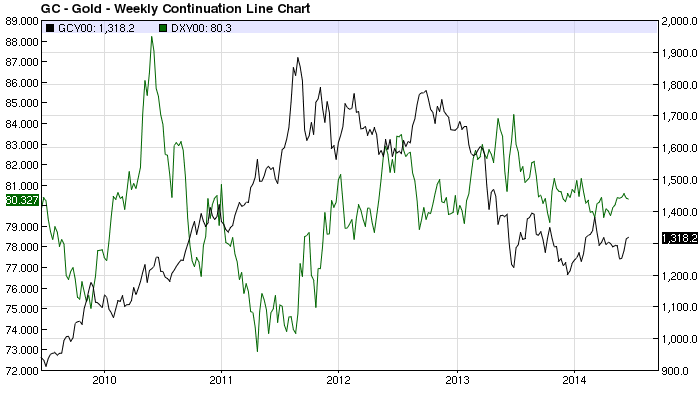

5-year weekly.

The 5-year weekly puts the dollar in charge, as they met each other back in March but failed to cross. If you look backwards, you can see several attempts, .. and failures on both sides, late 2010 is when they traded places, as the dollar took control, ... and its held since, as they are looking at each other once again.

Makes me wonder if the dollar will ever see those higher levels ever again, sad in a way.

~~

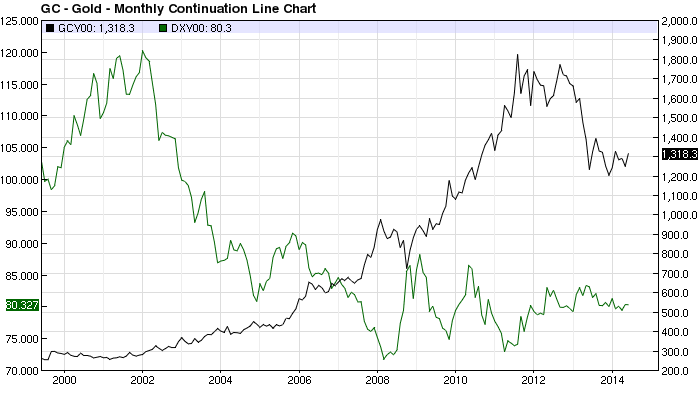

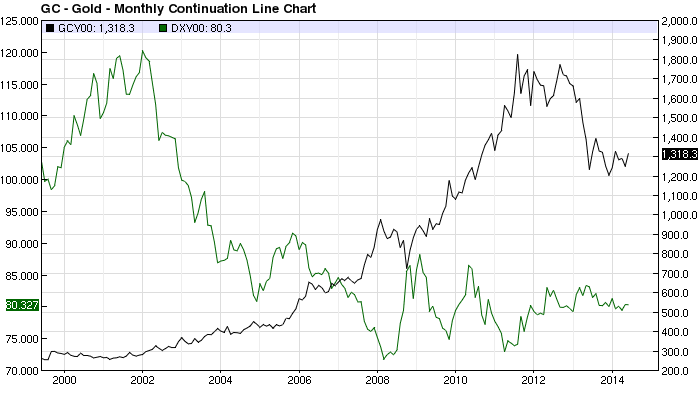

5-year monthly.

The dollar is still in control on this 5-year monthly as well, while both topped-off in consecutive years in and around the same area, at golds $1900+ level, ... while gold keept its vaule in and around the $1,200 level, the dollar dropped below $73.00.

~~

15-year monthly.

Gold is KING in the long run. Not much to say about it, other than the dollar is trailing sideways since mid to late 2007, ... gold is back to late 2010 to early 2011 levels

|