Contrary to BoA's article, ... here is another opinion, ... so choose your poison wisely if your trying to make money.

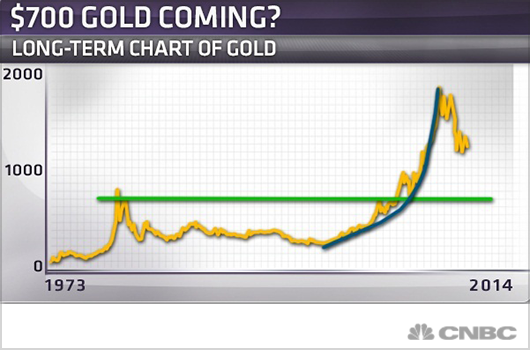

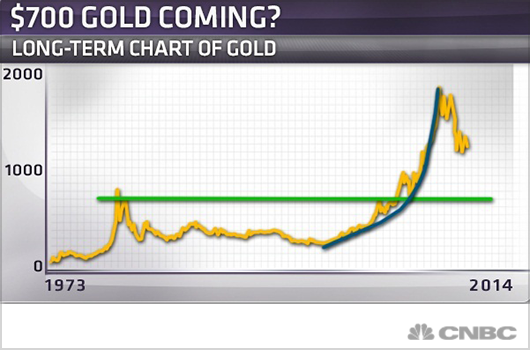

Technician who called gold bust predicts $700 gold

July 16, 2014 at 09:22

When Yoni Jacobs’ book “Gold Bubble: Profiting from Gold’s Impending Collapse” was published in April 2012, gold was trading around $1,650 per ounce. Now gold is below $1,300. But Jacobs, the chief investment strategist at Chart Prophet Capital, doesn’t think the gold plunge is over just yet.

“The long-term target is still $700, which sounded a lot more ridiculous a few years ago” Jacobs said on Tuesday.

“If you look at the long-term chart, you’ll see that we reached $800, around $700 in the late ’70s, in the ’80s bubble of gold. In the 2008 recession, gold bottomed right around $680, which is around $700. So there’s a clearly defined trend line there,” he said.

Gold suffered two tough days on Monday and Tuesday, as the metal lost $40 over the course of two sessions.

Still, Jacobs doesn’t think it will be a straight path down.

“Obviously, nothing falls dramatically that fast. It has to take some pauses on the way down,” he said.

Currently, he sees support levels at $1,000 and $1,200, and notes that gold could bounce higher from there. But over the long-term, the picture is clear.

Jacobs says gold “is in a lose-lose situation.” On one hand, in a growing economy, people won’t want safe-haven assets like gold. But on the other hand, when a recession hits, deflationary pressures tend to make all asset classes fall together. After all, gold didn’t provide much of a safe haven in 2008.

So even if one has concerns about the global economy, “I don’t think buying gold is going to be your solution,” he said. “I don’t think that gold is going to be your safe haven and your savior.”

truthingold.com |