Blue Earth: STRONG SELL on Fraud Allegations, SEC Investigation, Bankruptcy and Paid Stock Promotion, -93.3% Downside

Published October 21, 2014

Summary

- BBLU CEO Johnny Thomas and John Francis have presided over financial disaster at many companies, including ABTX which resulted in fraud allegations and bankruptcy.

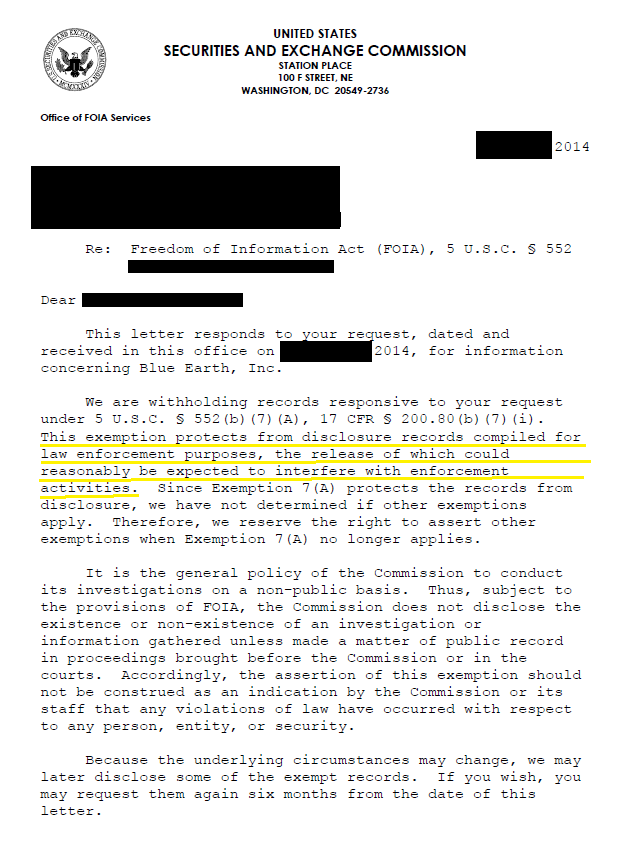

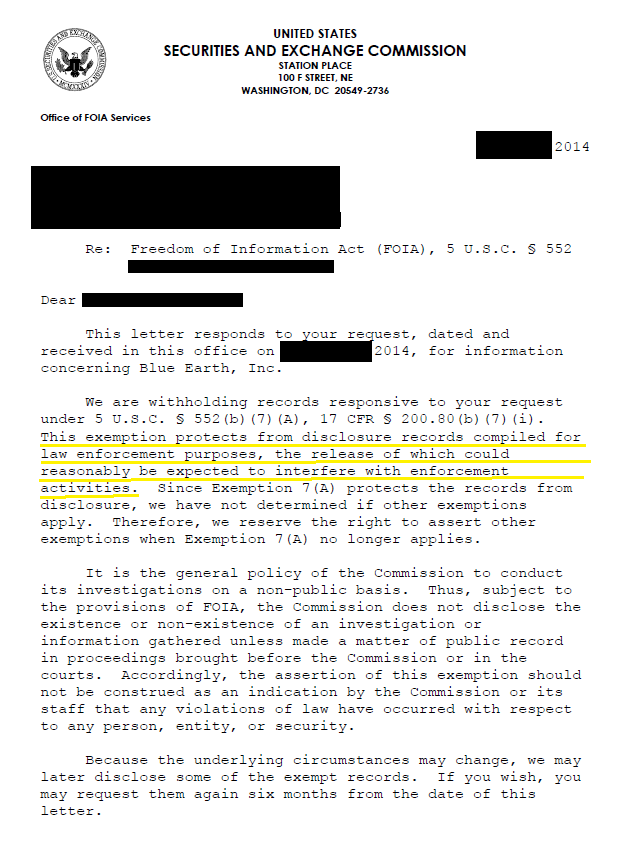

- A recent FOIA response from the SEC indicates evidence of a current law enforcement investigation related to BBLU.

- BBLU has hired multiple questionable stock promoters, including infamous John Liviakis, who was involved in countless stock market wipeouts and I estimate has recently sold BBLU stock.

- Multiple accounting red flags including BBLU’s previous auditor’s license revoked and barred, while current BBLU auditor has multiple PCAOB deficiencies including “failure to perform sufficient audit procedures”.

- BBLU CHP business already failing with due diligence turning up serious regulatory risks that could make it “not viable” while traffic battery business has apparently already failed before.

I believe Blue Earth (NASDAQ: BBLU) is a reverse merger with paid stock rpomoters that has immediate -93.3% downside with longer term bankrupcty risk.

BBLU is a questionable reverse merger led by CEO Johnny Thomas and Vice President John Francis, a team involved with numerous failed rollups that have wiped investors out. Thomas and Francis are now applying their rollup strategy anew with BBLU. These executives were co-founders and executives at the famous AgriBioTech (formerly ABTX) shareholder wipeout that occurred during the late 1990s, which led to a plethora of lawsuits and fraud accusations after the SEC forced ABTX to restate its financials – the result was the loss of nearly a billion dollars of market capitalization and bankruptcy. More recently, these two presided over Consolidation Services (formerly CNSV), also a near total wipeout for shareholders. Curiously, neither CEO Johnny Thomas nor John Francis have any real renewable energy or power plant operation experience that I could find at all, leading me to question why they are even involved in BBLU.

Furthermore, BBLU has hired many of the most questionable paid stock promoters on Wall Street to tout their stock. Among them, infamous stock promoter John Liviakis who was also involved in the ABTX wipeout and sold his entire stake before the SEC forced the company to revise its financial statements. Similar to ABTX, using the recent proxy I estimate Liviakis has been selling his BBLU stok. Meanwhile, BBLU is 60% owned by retail investors who have been drawn into the promotion but I don’t believe they know the real history of this company and the people involved.

Furthermore, a recent SEC FOIA response indicates evidence of a current law enforcement investigation . While the SEC has not released details of what this could be about, I do not view this as a positive. Meanwhile, BBLU’s previous auditor Lake & Associates had their license revoked and were barred. BBLU’s current auditor HJ & Associates has multiple PCAOB deficiencies spanning a gamut of issues outlined below.

Now after the failures of Xnergy and Castrovilla, research into the new traffic signal battery business turns up evidence it seems to have already failed once with ProGenix’s previous partner having moved on to lead acid batteries. Furthermore, BBLU’s much touted CHP business appears completely unviable while facing a shocking regulatory headwind that could make the entire thing “not viable” per BBLU partner JBS.

BBLU currently trades for a sky-high p/e of 268x using optimistic estimates and given that the value of all acquired businesses BBLU bought to build their company total just $63.5m, BBLU’s current $200m market cap is absurd in my view. Even using wildly optimistic estimates BBLU has -93.3% downside but based on all of the above, I believe BBLU is a terminal short on an inevitable path to $0.

I believe the evidence is irrefutable and has been linked, cited and sourced for you.

Agribiotech: Fraud Allegations, SEC Investigation, Accounting Issues, Lawsuits and Bankruptcy

The collapse of Johnny Thomas’s Agribiotech was so disastrous it is literally used as a published example of a stock market debacle by David Faber. The issues at ABTX ran the gamut from an SEC investigation, allegations of a “ massive fraud“, alleged revenue “double counting”, financial restatements, “accounting manipulations”, CEO contradictions, margin calls for executives, lawsuits, and then bankruptcy as shareholders lost everything, ultimately wiping out more than $1,000,000,000 of equity value. A full summary of this debacle is beyond the scope of this report but it will certainly go down in history as one of the worst stock market disasters of all-time. When it was all said and done Bloomberg News reported February 22, 1999 AgriBioTech had hired armed guards to protect defendant Thomas at the AgriBioTech annual shareholders meeting.

Johnny R. Thomas: History of failed rollup strategies that wipeout shareholders

(picture credit CNSV)

Johnny R. Thomas: CEO, Director, Pres and Co-Founder of Agribiotech

Now: CEO, Director and previous “Principal Accounting Officer” of BBLU

The AgriBioTech Wipeout: The Beginning of an Interesting Pattern Emerges

If, one time, a group of people take people’s money, claim they are building a business but instead investors are wiped out while insiders benefit, then that might be explainable with bad luck or a mistake. Stuff happens. However, if the same people do this repeatedly over and over again for decades I believe most people would consider that something far different and much worse.

I believe to understand Agribiotech it is best you read the lawsuits and the very serious issues alleged. I will quote the lawsuits regarding Thomas’s previous M&A/rollup AgriBiotech (ABTX), then walk you through the subsequent wipeouts and then we can see the similarities with BBLU to get a clearer picture of what is truly going on at Blue Earth.

It seems to me that one of the first steps they took at ABTX was to hire the extremely questionable paid stock promoter Liviakis Financial (a recent promoter of BBLU) and paid 2 MILLION options for an 18 month consulting agreement to “assist with investor communications” (much more on Liviakis later).

A subsequent ABTX lawsuit (emphasis mine), alleged “fraud and deceit on purchasers of AgriBioTech securities”. The lawsuit further goes into detail about “ accounting manipulations” around revenue as “AgriBioTech set “effective dates much earlier than the closing dates of the acquisitions” while furthermore “defendants frequently touted the rapidly increasing amount of the Company’s “annualized net sales” but failed to disclose that these reported annualized “net sales double-counted intercompany sales,” apparently “in violation of ‘GAAP’ and SEC rules” and “resulted in the artificial inflation of AgriBioTech’s revenues” and therefore stock price. This occurred while Thomas was CEO of company.

Apparently these accounting issues were strong enough to attract SEC attention and resulted in an SEC investigation. This seems to have resulted in this concerning discussion between investors and ABTX about “documents that say you defaulted on two banks in Albuquerque” and a surprised shareholder “You mean the SEC is investigating right now?”

Perhaps even more alarming, apparently in response to SEC inquiry:

- “ Gillespie stated that Ingalls said they had to show the SEC ABT was managing the acquired company. He asked her to write down the things she did at each acquired entity to justify the Effective Date. When she was asked to document control, she told Ingalls that ABT did not have control at all. Ingalls responded, ‘Yeah, I know, and ABT could lose them all.’

- Then “On June 11, 1998, ABT responded to the SEC’s comments, and indicated ABT obtained effective control of the acquired entities” – “She said you don’t want them to know we put together a bunch of letters to get profits up front.”

- And then most shocking: “Gillespie‘s statement that if ABT needed the truth ‘flowered up’ or stretched, she would do it (for the SEC comment process).”

- In this legal document we find another interesting quote about Thomas: “Gillespie had discussions with others, including Thomas, where she said ABT did not have control by the effective date. (Ex. 35 at 3.)”

- “Defendant Thomas knew or with deliberate recklessness disregarded that AgriBioTech’s accounting practices and policies regarding acquisitions, as alleged herein, artificially inflated reported revenues and earnings because he was involved in the day-to-day operations of AgriBioTech and signed the Form 10-K for fiscal 1997.”

- “Thomas repeatedly reassured the investing public that AgriBioTech was aggressively exploring strategic alternatives to maximize shareholder value and that these efforts were ‘on schedule’ and would culminate in finding a buyer or substantial equity partner for the Company by early February, 1999.” And ABTX stated they had hired Merril and Deutsche Bank to run a process.

- “ With the stock trading around $10 in October, Thomas told The Wall Street Journal that he could sell his company for $30 to $70 a share. Two weeks ago, AgriBioTech said it had ‘elected’ to stay independent after, according to news reports, receiving no bids.” Oops.

- With the stock in free fall Johnny Thomas blamed “lies placed on the Internet by short sellers, with no basis in fact” and said that there would be no accounting or financial restatements.

- “[D]efendant Thomas wanted the market to believe that there was a realistic opportunity to sell the Company… if the price continued to fall, defendant Thomas would be subject to margin calls on the more than 900,000 shares (or almost half of his holdings) of AgriBioTech which he had on margin.” [Thomas did get a margin call and was forced to sell all 900,000 shares].

Does that sound like honest management to you? Are these the kind of people you want to financially partner with using your hard earned money? After reading this I think it is obvious why Bloomberg reported AgriBioTech hired armed guards to protect CEO Johnny R. Thomas at the shareholder meeting.

Ultimately the SEC required ABT to restate their financials and the whole thing began to come unraveled. By March 1999 Johnny R. Thomas and John Francis had both been replaced and then shortly after AgriBiotech went bankrupt. This bankruptcy is outlined in Thomas’ current biography.

Johnny Thomas Invisible Profits and Magical Guidance? = BANKRUPTCY

(click to enlarge)

(picture credit capiq with my commentary)

John C. Francis: CFO Agribiotech 1994-1996 and VP, Secretary and Director until 1999

Now: VP, Corporate Development and IR at BBLU!

(picture credit CNSV)

I tried calling the lawyers involved with Agribiotech as I was unable to pull the actual court documents, I believe since the case is so old. So I cannot tell you in detail exactly how this all ended for insiders and what kind of punishment or outcome they may or may not have experienced. What I can tell you is that it seems to me the ending involved insiders paying out a multi-million dollar settlement as “Other company directors, officers, employees and consultants were also defendants in that litigation but have since settled for more than $18 million.” I very strongly encourage you to read all the legal documents related to Agribiotech so you can learn how this happened and develop an informed view of who you are investing with in BBLU.

Perhaps ABTX was a one-off event or just bad luck for Johnny Thomas and John Francis?

If it happens once, it might be bad luck. If it happens twice, some call that a pattern, but what do you call it if it happens repeatedly?

While AgriBiotech filed Chapter 11 Bankruptcy January 2000, Johnny Thomas and Francis were not wasting time and while their last company was still dealing with the consequences of bankruptcy, Johnny R. Thomas and John Francis apparently teamed up for some sort of Honduran resort slash spiritual wellness center with Hunapu Inc and the attempted IPO of Crest View Inc. But perhaps unsurprisingly, this seems to me to have failed also.

You’d think after that much failure in such a short period of time they’d maybe take a break and revaluate? Why Johnny Thomas and Francis’s experience at ABT or this failed Crest View IPO qualifies them to give advice to anyone about business is just mind boggling but Johnny Thomas also appears to have become involved in “Falcon Financial Group” literally the same month ABT filed bankruptcy in January, 2000.

“ Falcon is engaged in the business of providing assistance or advice to private companies on capital formation and on becoming a publicly traded company and introductions to investment banking firms”

It appears it’s not just outside investors that get wiped out when Johnny R. Thomas is involved. With Falcon Financial it looks like Johnny Thomas owned so much (9.8% of shares out) of Wasatch Interactive stock at $6 per share that he had to file a 13D with the SEC April 2000. How did investors fair this time with Johnny Thomas? Wasatch Interactive stock price declined by -81.17% over the time frame below.

(click to enlarge)

(picture credit capiq)

It appears Johnny Thomas and Falcon Financial were also involved with Winsonic Digital Media Group. It is not clear exactly what time frame he was involved here but as you can see below the stock pretty much wiped investors out over basically any longer time frame and has declined -99.86%.

(click to enlarge)

(picture credit capiq)

It didn’t stop with his investments either, as it also appears Falcon Financial Group, LLC “has suspended its operations ” and is now inactive, so presumably it wasn’t shut down because it was such a resounding success.

But Wait! You Also Get!

Then Johnny R. Thomas was also an executive officer and director at Decision Link, inc (formerly known as FiberChem) which was also a “blank check” company. It looks like Decision Link was also a wipeout with the stock falling -99.8% and now listed as inactive by CapIQ.

(click to enlarge)

(picture credit capiq)

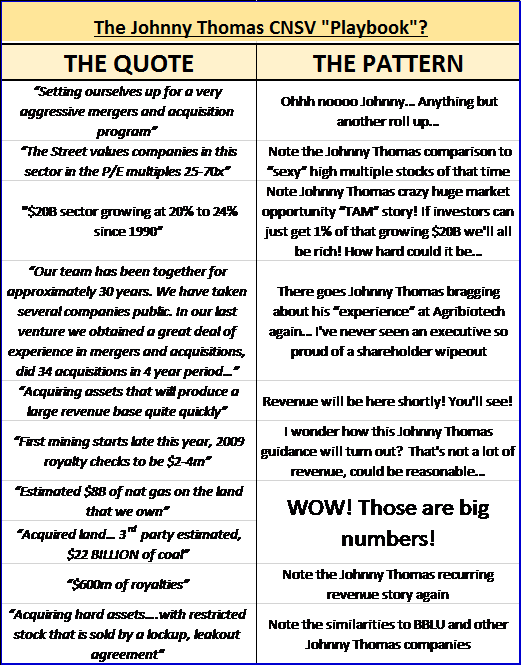

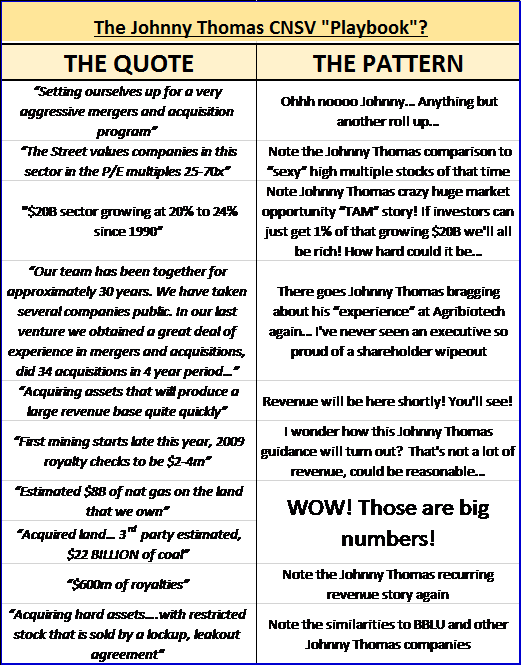

THE MORE RECENT WIPEOUT WITH ABSURD $22 BILLION MANAGEMENT “GUIDANCE” AT CNSV

After Agribiotech failed and subsequent attempts all seem to have failed, Johnny Thomas and Francis found themselves in another frothy bull market in 2007 and seem to me to have decided to take another swing at it. Neither executive has any apparent background in oil and gas or managing an organic farm but that didn’t stop them from launching Consolidation Services, Inc., another Henderson Nevada shell company (formerly CNSV before it failed and was renamed Mongolian Holdings).

Apparently using the AgrioBiotech playbook, Johnny Thomas and Francis quickly hired another stock promoter to help them promote their stock: This time it was the infamous Agoracom! (More on Agoracom later.)

This wayward company floundered, first claiming it would roll up the food distribution industry, then aiming at organic farming, until eventually entering the energy industry by acquiring oil wells. Hilariously, management claimed they would do all of these and that modern coal and nat gas recovery techniques actually, synergistically “enhance arability” of organic farmland (tastes like oil!).

The Company intends to make energy resource recovery and organic/natural farming work synergistically, because modern recovery methods not only avoid damage to theand but also enhance arability.”

Does farming for organic produce on top of a coal mine or natural gas well even make any sense to you at all? That seems like an obviously terrible idea to me.

In a familiar playbook by now, CNSV got started via reverse merger with Vector Energy, bought from James Francis for $ 10. Johnny Thomas then hired his wife and began acquiring assets primarily in stock. Then management came out with their familiar stories about some amazing (!!!) potential opportunity, like this press release from John C. Francis at CNSV trying to tell investors that someone had just sold them a coal property for $1m that they “guided” investors to expect $30-40m in royalty revenue.

Next the company hired Agoracom, a firm that allegedly used“fraudulent postings” with more than 670 fake aliases created by Agoracom representatives posting more than 24,000 alias posts on client message boards. In exchange for this, Agoracom offered pricing models for its clients which incorporated a monthly fee and stock options equaling the greater of 250,000 shares or 0.5% of a company’s fully diluted outstanding share total at current prices.

Quoting from a lawsuit in which Agracom directors received fines and bans:

“Tsiolis and Kondakos required their representatives, as part of their daily responsibilities, to post anonymously to the client forums using aliases. To post messages anonymously, therepresentatives created fictitious usernames and posed as investors blending in with other users, investors and interested persons. Representatives had between 40-50 aliases (some had up to 200) and were required to make a requisite number of posts per hub per day or risk having their pay docked. On occasion, Agoracom staff conversed with themselves on the forums using different aliases.”

This is really bad stuff, and in my opinion, no legitimate management team would ever hire such a stock promoter. However, in my opinion, the Agoracom promotion pales in comparison to Thomas’ own promotional statements. I strongly encourage you to listen to this interview he gave as CEO for Consolidation Services, inc. (formerly CNSV) to “Emerging Issuer”. It is a real gem.

(picture credit “Emerging Issuer”)

I will share a few of my favorite quotes from this amazing video:

(Chart by me using quotes from Emerging Issuer interview)

By the way, this interviewer Emerging Issuer was a paid stock promotion company that Johnny Thomas and James Francis at CNSV paid $20K for a 3 month program.

Despite having “$22 BILLION of coal” (oh wow!!) and Johnny Thomas guidance of $2-4m in 2009 revenue, the CNSV 10-K literally shows $0 in revenue for both 2008 & 2009. Johnny Thomas seems to have missed his own guidance he fed investors by -100%.

According to this yahoo finance stock price chart, CNSV declined from ~$9 per share ultimately to $0.08, losing -99.11% of its value, essentially wiping investors out before changing its name to Mongolia Holdings Inc.

(click to enlarge)

(picture credit: Yahoo Finance)

Johnny Thomas and John Francis seem to have stepped down from management roles in 2010 but retained involvement “to use their extensive acquisition experience to further the CNSV goal of increasing shareholder value through acquisitions.”

From 2010, CNSV fell another -98% so apparently this is just about inline with Johnny Thomas and John Francis’s “acquisition experience” for shareholders.

(Picture Credit: Spiderman)

BBLU’s QUESTIONABLE PARTNERSHIPS WITH PAID STOCK PROMOTERS

I personally believe no investor should ever invest in any company that is hiring paid stock promoters because it speaks to the highly speculative nature and low quality of the company. In my opinion, “real” companies run by honest management don’t do this. There are 60K+ public companies globally and you simply don’t have to take the total wipeout risk paid stock promotion usually entails. I recommend if you come across something like this, just “pass” and find something else to speculate or invest in.

In my opinion, BBLU hired a collection of the worst stock promoters available for hire on Wall Street. Why would they partner with people like this? BBLU has partnered with Liviakis Financial, Red Chip, First Equity Group’s SmallCapStockPlays, SmallCapNetwork and now is associated with SeeThruEquity as well.

Who is John Liviakis?

Nice Looking Jet, John

(picture credit to Liviakis)

Who is the mystery man behind promoting BBLU stock? Let’s investigate, going all the way back to his humble beginnings in 1985 as a stock broker who was sued for allegedly wiping out the entire lifesavings of a family in Sacramento, CA and ended up settling.

Silicon Investor’s website contains a copy of a media piece covering Liviakis called Tale of Tout I recommend reading as a balanced look at Liviakis. In fact, Liviakis’ very first client was Cascade International, a stock that went down in flames with criminal charges and fraud allegations, creating brutal financial losses for shareholders. I strongly encourage you to go to the Liviakis site and watch these absolutely hilarious Liviakis Financial “promo” videos.

Unfortunately, this was not an isolated incidence for Liviakis. One of his next “greatest hits” was a public company called Projectavision, the CEO of which liked to describe the company as “The most conservative of Liviakis’s companies.” Projectavision later changed its name to Vidikron and went bankrupt, resulting in a disaster for shareholders.

(click to enlarge)

(picture credit capiq)

Quoting the Tale of Tout article:

“Other stocks that Liviakis promoted never met his high expectations. Among them were Airship International Ltd., a Florida blimp operator; Holmes Microsystems, a Utah modem maker; Quadrax Corp., a Rhode Island manufacturer of lightweight extra-strength materials for a variety of uses from aerospace to bicycle production; and Big Sky USA Inc. (now known as Organik Technologies, Inc.), a Washington State clothing manufacturer that had developed a system for nonshrinking cotton without using harmful chemicals.”

All of these stocks ultimately went bankrupt, ceased to trade or were just financial disasters for shareholders:

Airship International Ltd.

(click to enlarge)

(picture credit capiq)

(click to enlarge)

(picture credit capiq)

Holmes Microsystems

Quadrax Corp: No chart available, eventually was reverse merged several times into other failed / failing companies.

Big Sky USA: No chart available, appears to have already failed by the time the Tale of Tout article was written.

Let’s look at some of the “successes” on Liviakis’ own website within the testimonials section. With friendly testimonials like these, who needs enemies?

Molecular Diagnostics, Inc:

“ He brings success to all those to which he embraces his intelligence and passion.”

Molecular Diagnostics, Inc. changed its name to CytoCore Inc. in 2006. The stock was a disaster.

(click to enlarge)

(picture credit capiq)

Particle Drilling Technologies Inc.:

“John took a personal interest in the Company and definitely helped create a good trading market for our stock ”

Particle Drilling Technologies Inc., now a subsidiary of PDTI Inc., seems to have been a wipeout.

(click to enlarge)

(picture credit capiq)

Procera Networks: According to SEC filings, Liviakis was involved in Procera between 2003 and 2006. The chart below also looks like a wipeout with -84.6% stock price decline.

(click to enlarge)

(picture credit capiq

Webb Inractive Services:

“ Their dedication, focus and work ethic certainly set them apart from other firms associated with the stock market,”

Webb stock now trades for a fraction of one penny.

(click to enlarge)

(picture credit capiq)

Just how many wipeouts has Liviakis been involved with? It’s hard to say, the companies above are just a small fraction of the total he has been involved with. Due to CapIQ data limitations (doesn’t go back into the 1980s), as well as the sheer volume of questionable microcaps Liviakis has promoted, it is difficult to fully track out his handiwork – I simply got overwhelmed. I believe it would most likely take an entire branch division of the SEC months if not years with a large team to fully untangle the entire Liviakis web. Nevertheless, it’s clear for anyone to see that a startling amount of Liviakis stocks have resulted in large shareholder losses over the years.

Don’t bet against Dan Loeb, that is not a good bet for you

I am not the first person to write about John Liviakis. According to the book Hedge Hunters, Dan Loeb used to specifically target Liviakis stocks to short:

“Many of Loeb’s short ideas came from a promoter named John Liviakis. ‘We used to go through his [Liviakis'] client list because it was a particularly fruitful universe of attractive short candidates,’ he says.”

Quoting the relevant portions from a recent Vanity Fair Articlediscussing Loeb’s short selling efforts against Liviakis:

“That same year, 1999, Loeb got into more legal trouble, this time with John Liviakis, a San Francisco public-relations executive, who also sued Loeb for libel. Using a pseudonym, allegedly Loeb had written an imaginary monologue, supposedly in Liviakis’s voice: I have registered 1.7 million shares to sell and these will soon flood the market. Hopefully I will sell these before the company loses its Nasdaq listing… Then I will laugh at you fools for buying my shares and I will celebrate with a bottle of grappa, some fresh feta, and a nice young boy-just like in the old country.”

In this dealbreaker article we see that Dan Loeb allegedly posted under the Yahoo Finance message board pseudonym “John Crimiakis StockSwindler”.

These alleged comments resulted in a libel lawsuit against Loeb that was settled. Based on the above, I think it’s clear that Liviakis is not Dan Loeb’s favorite person and Dan Loeb thinks shorting Liviakis stock promotions is a profitable endeavor. The charts above seem to support this view as well I believe.

I don’t have to remind readers that Dan Loeb runs Third Point Management, one of the most successful and best hedge funds on the planet with over $10 billion in assets built off a ridiculously good long-term track record. My advice is don’t bet against Dan Loeb.

Citron Has Also Dominated Liviakis Multiple Times in Print

Liviakis has also been a long-time Citron favorite, here and here. There’s something particularly offensive to me about a stock promoter willing to promote BioPulse, a Tijuana-based cancer clinic that utilized the amazing medicinal healing powers of urine, and was ultimately raided and shut down by the Mexican health authorities.

BBLU = MORE Paid Stock Promoters

While it is nearly impossible to get worse than Liviakis in my opinion, BBLU is making a good effort. BBLU recently retained Red Chip, and paid them a monthly cash fee plus 50K shares for stock promotion and comically bad interviews like this one discussing BBLU’s energy efficiency debacle before it happened (explained below).

(picture credit to RedChip)

RedChip is notorious for promoting multiple Chinese reverse mergers later accused of being frauds, many of which essentially wiped investors out. This is common knowledge to anyone with the internet, so why would BBLU further tarnish themselves furhter by associating with such a questionable stock promotion firm like RedChip?

Unfortunately, BBLU also hired First Equity Group with such dubious newsletters as “Penny Stock Warrior”. First Equity group was paid 80Kin BBLU shares for a paid stock promotion campaign.

How do First Equity Group stock promotions turn out? Perhaps there is another pattern we can see that will help us predict where BBLU is going?

We can see a list of penny stock and microcap companies that have paid First Equity for stock promotion here. First Equity Group appears to have covered “Vision Industries Corp” (VIIC) which saw its stock spike up, then tried to increase shares outstanding from 500m to 10 BILLION before going bankrupt a few months later.

Or CDII which appears to have given First Equity Group 1M shares but after a brief stock price pop, CDII stock appears to have wiped out investors, losing most of its value. Over the past 5 years CDII stock has declined -96% and now carries a mere $3.6m market cap.

Or PSID, which has a very suspicious looking stock price chart. PSID paid First Equity Group what looks to me like well over 1M shares and PSID promoted their stock.

Small Cap Stock Plays also seems to have allegedly performed a paid email stock promotion campaign on BBLU as well. I could go on and outline all the wipeouts all these stock promotion firms have been associated with but honestly this is just overwhelming and not necessary at this point.

What kind of company partners with people like this?

Just Stop Already

(picture credit PumpStopper)

“Getting the Band Back Together”: BBLU and The Thomas “Playbook”

(click to enlarge)

“We’re getting the band back together… we’re on a mission from God.” – The Blues Brothers

(picture credit: Blues Brothers)

It seems Johnny Thomas and Francis have a keen eye for a frothy “anything goes” bull markets and so despite an overwhelming amount of failure in their past, it seems to me they decided to “get the band back together” and have another go.

Now just 5.5 miles down the road from the ABTX HQ, and 4.9 miles away from the latest failure CNSV, Johnny Thomas seems to have “gotten the band back together” for another run with a disparate group of random companies acquired primarily for stock based on a high stock price, with paid stock promoters, with the additional goal of now piling on a large amount of debt. As a reminder, it was leverage combined with lack of profits that ultimately drove ABTX into bankruptcy.

Blue Earth Has an Even Worse Acquisition Record than ABTX (so awful)

First let us run through the numbers of BBLU and have a high level look before showing that the current story of CHP is completely unviable, and that BBLU is likely worthless as it gets closer and closer to the eventual bankruptcy and wipeout I expect.

While ABTX was a value destroying rollup that resulted in large shareholder losses, the most shocking part to me is that ABTX was vastly superior to BBLU on the numbers: ABTX had an incremental return (EBIT, or operating income) on incremental assets of -4% (bad) while BBLU has generated a -28% on the same ratio (horrific capital destruction – it would be faster to just light the money on fire). Another way of saying this is the more acquisitions BBLU makes (or ABTX made), the more money they lose, creating a vicious cycle of capital destruction. Since both companies rely on a high stock price, they can use the stock as currency to make acquisitions (note the massive share dilution in the chart below), I believe it is clear that this can only end one way – huge shareholder dilution and eventual crushing losses leading to bankruptcy.

(click to enlarge)

(picture credit: charts built by me with public information)

I believe this is why BBLU has been a “dilution machine” with shares outstanding increasing by ~600% since 2010 with revenue going up by 1/3 of that and losses with cash burn actually accelerating. Note that when Johnny Thomas talks about BBLU revenue or guidance, he doesn’t measure it in a “per share” metric that current stockholders should be focused on.

BBLU Dilution

(click to enlarge)

(picture credit CapIQ)

This stock promotion has temporarily added buying demand to the stock despite the story falling apart. As you can see below the market capitalization and BBLU valuation, while now breaking down, is still near all-time highs.

BBLU Market Capitalization is Near All-Time Highs?

(click to enlarge)

(picture credit CapIQ)

As with most stock promotions, the shareholder base ends up being made up primarily of retail investors who lack the time or resources to perform true institutional quality due diligence.

BBLU Ownership Profile – Mostly Retail Investors

| Type | Common Stock Equivalent Held | % of Total Shares Outstanding | Market Value (USD in mm)2 | | Institutions 5 | 6,816,610 | 9.27 | 18.2 | | Corporations (Private) | 182,000 | 0.25 | 0.5 | | Individuals/Insiders | 23,075,918 | 31.37 | 61.6 | | Public and Other 3 | 43,485,472 | 59.12 | 116.1 | | Total | 73,560,000 | 100.00 6 | 196.4 | (Source: CapIQ)

Furthermore, I consider Liviakis the smartest money in the room here, and I estimate based on the last proxy that he has been selling his stock, similar to when he completely liquidated his ABTX holdings before it went bankrupt.

According to CapIQ data, Liviakis originally became a shareholder in late 2009. The first time Liviakis’ name shows up in BBLU’s SEC filings is 11/5/2009 in an 8-K when BBLU disclosed that Liviakis and his representatives were granted 1,384,000 shares of stock for an 18 month investor relations consulting agreement with BBLU through May, 2011 – this represented more than 7% of BBLU shares outstanding at the time. Interestingly, the 8-K lists the company’s name as Genesis Fluid Solutions Holdings, indicating to me that BBLU management planned a stock promotion before Blue Earth even existed in its current form – obviously the recurring Johnny Thomas playbook was well planned out in advance. Then this 13 filing showed Liviikis owned nearly 10% of BBLU stock. However in this proxy Liviakis is not listed. Interpret this to mean that Liviakis has sold some or all of his BBLU stock.

John Liviakis was also a large shareholder of ABTX and liquidated his entire position before the company went bankrupt. The original ABTX Liviakis 13D filing dated May 6th, 1996, in which Liviakis disclosed that he owned 1,125,000 shares of ABTX stock. In another 13D filed on May 6th, 1997, Liviakis reported that he owned zero shares, indicating he liquidated his entire position.

Liviakis appears to have helped BBLU uplist to the NASDAQ but then sold all his shares? When a stock promoter sells all his stock what does that tell you?

I am not suggesting that Liviakis in any way influenced the bankruptcy of ABTX or likely bankruptcy of BBLU, rather that his job is to increase the stock price. Once the price is high (and the company can use it as currency to make acquisitions), Liviakis can exit the stock. As prior experience has shown, this is the time to exit the stock. That time is now for BBLU.

Make no mistake though, this service has been extremely profitable for Liviakis. In one interview, Liviakis apparently bragged that he makes as much as $40,000 an hour. Based on the long running history of investor wipeouts, I suspect most people who buy into Liviakis promoted stocks do much, much worse than that (probably negative dollars per hour). If you’re going to own a Liviakis stock, you want to do it early on in the promotion, not after he sells, in my opinion.

BBLU ALREADY FAILING: Castrovilla & Xynergy

“Watch What We Do, Not What We Say.”

-Nixon Attorney General, John Mitchell

Once at BBLU, Johnny Thomas and John Francis wasted no time and began acquiring companies in 2011 largely with stock while immediately offering extremely promotional guidance to investors of huge potential numbers. In 2011 Johnny Thomas stated his guidance to investors of “$100m next year of revenues” with positive EBITDA of “>$10m” while “comfortable” with these forecasts. Actual revenue in 2012 for BBLU was barely $9.96m (or -90.04% below guidance) with a -$9.6m loss. Are you seeing a pattern yet? How long can this continue?

The first was a company they bought that became “Castrovilla” on 1/1/2011 for the whopping price of $1.7m paid mostly in stock (purchased for a valuation of about 0.5x revenue). This company seems to have historically had a large refrigeration gasket business but the “story” Johnny Thomas put forth was for them to sell energy efficiency retrofits. Thomas guided to projected $30-60m of revenues (up from ~$3.5m) with the “eecoaStation” opportunity as they do 250 stores per quarter in a >$3.5B “potential” market.

Then on 10/5/2011 BBLU signed a financing agreement with Gexpro of Shelton, CT and G&N Holdings LLC but this was terminated on 2/14/2012 (valentines day fail = :(. So it does not seem to me BBLU was able to provide growth capital to help the people who sold this business.

At least one investor seems to have viewed this as “charging $30k to change the lightbulbs” though and the Castrovilla story seems to have come unwound just as quickly as it was promoted.

Johnny Thomas “Guidance” for $30-60m In 2012 Castrovilla Revenue: Actual Was $3.44m…

(picture credit Blue Earth, apologies for poor picture quality but curiously I was unable to find this slide deck anywhere on BBLU’s website? But only in this archived low-res RedChip interview)

Shockingly, Johnny Thomas’s guidance seems to have again turned out to be wildly incorrect. Actual REAL revenue from Castrovilla in 2012 was just $3.44m which is -94.1% less than guidance. Most shockingly, this is actually a DECLINE of -11% yoy vs. 2011. Missing the “expecations” given to investors, who bought and valued the stock based on that, by -94.1%.

(click to enlarge)

(chart built by me with public information)

It doesn’t stop there though: Xnergy also an “epic fail”.

Xnergy was acquired 10/2011 for ~$15m mostly in stock (again, valued at ~0.5x forecasted revenue) with the promise of a $500m+ “project pipeline” with “guidance” for Xnergy revenues to double from 2010 to a 2012 level of $36m. Johnny Thomas went on further to guide investors to a $579m pipeline that could generate a $15m total net income. Actual REAL revenue for Xnergy however was just $6.5m in 2012, which I estimated is -76% below “guidance” Johhny Thomas gave out. Even more alarming for companies considering selling to BBLU, Xnergy 2012 revenue was actually down tremendously from Xnergy’s revenue before BBLU acquired them of $18.9m in 2010. It also appears that the Xnergy insiders did not receive their earn-out bonuses.

(click to enlarge)

(chart built by me with public information)

I find this Xnergy debacle particularly offensive. Xnergy was quoted as having worked on in some way on “nearly 100mw of traditional and alternative energy systems” as of 2013. However, you can see from the company’s own news releases published going back to 2005 that the company has been in operations for over 8 years so that’s an average of only 12.5mw per year. Yet Thomas’s guidance to investors seems to have been for a 579mw pipeline of projects to come soon? Even if BBLU had executed on 100% of this pipeline for 5 years that would be more than 10x the mw volume that Xnergy had done historically. Does that sound like an honest expectation to you?

Furthermore, Xnergy has been doing work for big companies like LG since 2004. However, claiming Xnergy has a “partnership” with LG is similar to some landscaper claiming he has a “partnership” with Goldman Sachs simply because he does their yard work. Obviously that is absurd.

(click to enlarge)

Johhn Thomas Guidance That Never Came Even Close:

(picutre credit Blue Earth)

Most comically, Johnny Thomas has been guiding investors to expect positive EBITDA for quite some time now too. Here is another BBLU investor presentation I was surprised is not displayed on BBLU’s website. Johnny Thomas was “forecasting” revenue of $100m with >$10m in EBITDA in 2012. We can see the past revenue in 2010 and 2009 of Xnergy and Castrovilla before Johnny Thomas got his hands on them. Revenue then seems to have done quite badly in 2011 and we can see more amazing Johnny Thomas “guidance” for 2012. Does this “guidance” told to investors seem credible and honest to you? Are we to think Johnny Thomas truly believed he was going to go from ~$10m in 2011 total revenue straight to $100m in one year with two companies he had just bought?

You may be just flabbergasted to hear this but BBLU had ACTUAL 2012 total revenue of just $9.9m and instead of generating positive EBITDA, BBLU actually had a net LOSS of -9.6m for 2012. This followed a -$14.01m net LOSS in 2011.

Do you think it is interesting that BBLU does not host these presentations or webcasts on their website? Is the Company deliberately making an effort to shirk accountability of prior guidance? And where are the past earnings call or investor presentation recordings typically offered to investors by most companies? And why does the “ press releases” page on BBLU’s website only go back to early 2014? How are retail investors supposed to be able to do their due diligence? I have never seen a publicly traded company offer so little historic information to their shareholders before and I find it troubling.

Johnny Thomas “Guidance” at BBLU So Far: Do You Notice a Pattern?

Johnny Thomas also seems to be referring “Agribiotech” as his and James Francis’s “most successful project” ( LOL At 3:30 mark) but curiously doesn’t mention the name of the company or the rest of the story of what happened there? Does that seem honest to you?

IT GETS WORSE: BBLU’S CURRENT “STORY” WITH TOTAL LOSS RISK, TOTALLY UNVIABLE WITH CONFUSING STORY CONTRADICTIONS

Now with two “epic fails” behind them already at BBLU, Johnny Thomas and BBLU wasted no time moving on to the next story. BBLU is now touting two new “businesses” recently acquired but unfortunately for BBLU shareholders, serious cracks are already appearing in both of these businesses as the risk of “total loss” is becoming clear.

BBLU BATTERY BUSINESS: OBVIOUSLY UNVIABLE AND LIKELY WORTHLESS

With the past two failures still fresh, BBLU moved onto expanding into the battery business by acquiring two business interests primarily in stock, with Millenium Power Solutions for $14.5m and then a $10mequity investment in PowerGenix. Curiously, it appears no information on what percent of PowerGenix was bought for this $10m though? As a result, BBLU shareholders have literally no idea how attractive this investment is. Did BBLU wildly overpay? We just don’t know but given the track record of people involved with BBLU I’d say odds are likely this is going to end up worthless.

In case you missed it, it appears that PowerGenixseems to have already tried to enter this traffic signal battery market as far back as 2011, apparently failing. Considering they just sold the opportunity to BBLU I would assume that this was not a resounding success? What happened last time PowerGenix attempted this? Why was no discussion of this disclosed in BBLU’s investor presentations? Have you called and spoken with the last company PowerGenix partnered with in this space to see what happened? Here is their website and phone number.

The “story” being fed to investors now is that there is a $500m (WOW!) in the traffic $2.4B (!) battery backup market for BBLU. I think both of these points seem obviously mistaken, confused and the battery “opportunity” for BBLU is so obviously unviable I question why BBLU management is even wasting their time and shareholder money on this.

Let me explain:

First, I believe the size of the market “opportunity” BBLU presents appears misleading to me and is not even close to accurate. BBLU seems to quote different numbers in different presentations too. In the slide below BBLU states there are 400k traffic intersections in the US for their market and their opportunity is $6k per intersection.

(click to enlarge)

(picture credit Blue Earth)

However in this presentation, BBLU seems to “shift” that number and is claiming there are 313k intersections in their addressable market? Even if you add the Canadian intersection estimates I believe you still don’t get even close to 400k intersections quoted above so not sure what is going on here?

(picutre credit Blue earth)

The $500m+ market potential number BBLU throws around here is without credibility and misleading as well. It’s not exactly clear where BBLU gets that $504m number from but best I can tell it seems to have been fabricated using the 313k intersection number from BBLU’s slide above multiplied by a price point of $1,450 for the batteries. I’d like to state that if BBLU’s traffic signal batteries indeed have a $1,450 price point they are in serious trouble as this document from 2009 states their signals had $832 battery cost per signal and that is using retail price to end user and not wholesale price that BBLU would be expected to receive. This document states the batteries are only $185 each, and if you search around you can find them even cheaper.

(click to enlarge)

(picture credit Blue Earth)

Furthermore, the battery content of a traffic intersection is only a tiny component of the $5-6k it costs to install a battery backup system anyway. In that context how does that “Canada Market Potential” Section make sense? Does BBLU even have a current construction presence in Canada anyway?

This is absurd though for multiple reasons. First of all, no city or area is going to battery backup every signal because these are not free and a cost-benefit analysis must be done. We can see this from countless city generated analysis like this, or this. This takes 1 minute with Google to prove for yourself so I question why BBLU management presents it this way.

Further impairing this market analysis, per this CA state report battery backup systems seem to only be possible when used on signals that have been upgraded to LED lights. While this is increasing in prevalence, not every single traffic intersection in the US has LED lights or ever will have.

Also, battery backing up traffic signals in the US has been going on for decades. Any signal already done has a battery cabinet, making some battery alternative that is more expensive than current lead acid batteries but replaces the cabinet simply not useful. As far back as 2012, Baltimore had already done 10% of its intersections and was working on more. Remember, backing up every single intersection is never going to happen, so if 10% of the total has been done, I estimate this is more like 30-40% of the total addressable signals. Even more obvious, why would any city design their battery backup systems so they could only use one company’s batteries? They could then be hostage to that company for price increases and hassle. I think it’s obvious this doesn’t make sense.

The currently offered batteries work just fine anyway and are extremely cheap. For cash strapped municipalities, saving money is always crucial. Per this document, they last 7-8 years and only cost $185 each. I don’t see how PowerGenix could ever compete with this price point and I would imagine lead/acid batteries have come down in price further since 2009. Also, the batteries are typically required by the municipality to have tool free maintenance so the current battery options are not difficult to work with apparently. Plus, the company that did the install and the manufacturer will get battery replacement sales in my view anyway as they already have the relationship and the trust with the people involved. Furthermore, any new vendor would typically have to go through a process or their product put out to competitive bid again.

Not ever traffic signal backup will even be done with batteries anyway. This NYC report shows they are exploring solar backup, fuel cell, generator and other options. To ever think that batteries will get 100% of this market seems absurd.

Third, these systems come with warranties and the batteries last a long time. See this on page TP-13 to see the batteries have 5 year unconditional warranties with full replacement. So if there is a battery issue it is not the municipalities’ issue. It is the installer or manufacturer that has to fix that. I would have to imagine that installing some battery with unclear long-term reliability could void a battery backup signal equipment warranty as well. If this is true, why would any municipality take this risk?

Fourth, and most importantly, the last company to partner with PowerGenix now appears to have moved back to Lead Acid batteries. This is the company PowerGenix partnered with previously in the traffic intersection space. Here is the data sheet on this company’s currently listed product. As you can see under “Electrical”, this system now uses a “sealed AGM” 65 amp batter setup. AGM batteries are lead acid. Here is the data sheet from the other currently listed traffic signal battery backup system offered by this company as well. As you can see on the second page on the upper left, AGM batteries are also listed as what is offered.

Furthermore, in the information sheet we can see “these batteries can be supplied to be installed within the traffic cabinets or in a separate battery pack enclosure.” So there are already traffic signal battery backup systems that include the batteries in the cabinet.

The datacenter story BBLU management touts is a joke too. Do you really think BBLU, which doesn’t even state any R&D on its income statement (literally zero spent on lifetime R&D?), is going to take a tiny license for a technology they don’t even own and out compete GE or any of the other huge global leaders that have been dominating this space for decades? If I need to get into this in further depth in the future I can do that but I think you are hopefully starting to understand what is going on here.

I could keep going but I will stop here. Based on the above, this whole thing seems like such an obviously bad idea I question what management and Johnny Thomas are honestly doing here.

BBLU CHP “STORY”: Unviable with “total wipeout” risk unappreciated

BBLU appears to have been attempting the CHP business with Xnergy since 2011 but redoubled their efforts when they acquired (primarily with stock) “IPS Power Engineering”. IPS was bought for stock valued at $18.34m with ~2/3 of that highly restricted and not available to the buyers yet. BBLU immediately came out touting a headline of “over $750m of recurring revenue”! (Does this sound familiar yet? I wonder how this will turn out?)

The foundation for BBLU’s current CHP story, seems to have been brought to BBLU by a “Robert Nickolas Jones” who was given 50k shares of BBLU stock as a finder’s fee. Assuming this is the same “Robert Nickolas Jones” from Utah, then this individual also appears to have been connected to the questionable “Fonu2 inc.” blow up which seems to have had a rally only to collapse. Fonu2 stock now trades for $0.0013 per share and has a $143k market cap.

(click to enlarge)

A “Robert Nickolas Jones” seems to have also been to CFO of BnetMedia Group, which announced a delayed 10q filing, executive resignations after their auditor expressed doubt the company can continue as a going concern. Does this sound like someone you should be taking business input from?

Ignoring this, given the large retail shareholder base I do not believe investors have “done the homework” on this CHP theoretical story and understand that this “CHP story” seems likely to me to ultimately be the downfall of BBLU due to the extreme leverage BBLU is attempting.

BBLU has no discernible sustainable competitive advantage I can find in this sector as they hire outside EPC firms and use off the shelf parts available to anyone. So unsurprisingly, as in all extremely competitive and crowded industries and even using BBLU’s wildly optimistic profit guidance, I estimate these CHP projects are incapable of covering BBLU current cash burn issues and the enormous net income earnings investors seem to be expecting will not occur.

To claim BBLU is like Solar city is absurd too, there are literally hundreds of companies in the US doing CHP projects and have been for many decades. BBLU competes in a commodity CHP business where, unlike Solar City, CHP projects also have volatile commodity inputs costs and so the two are not even close to comparable. BBLU has no competitive advantage in this space and in fact, the wipeout history of people involved is a strong competitive disadvantage as I cannot imagine that helps them get capital when they go to banks and compete against credible CHP contractors run by people without multi-decade history of creating investment losses.

What exactly is BBLU’s value add here exactly? They hire someone else to build something using off the shelf componentry and a group of people with connections to countless wipeouts is supposed to be the people who will raise the money? Pardon me if I don’t sound surprised that people aren’t lining up to give these people money. One quick Google of the CEO’s name turns up a bankruptcy with fraud allegations along with a string of wipeouts. I personally would not give these people a dime, let alone put them in charge of managing a power plant. I find the whole thing both scary and absurd.

Any business that is (attempting) to generate returns on projects that are greater than the cost of their capital is, by definition, unviable.

Unfortunately for BBLU, the CHP business is a business where scale matters too. The business is extremely competitive. If you don’t’ believe me, then verify for yourself. Look at this EPA website which lists the EPA’s “ partners” involved in CHP.

There are a full 475 companies listed just on this website and I am sure this website is far from encompassing the industry. Even worse for BBLU there are 147 “CHP project developers” listed here. That is a lot of competition from companies dedicated solely on this niche with many years of experience. As a result of the intense competition here, this is a business where your cost of capital and scale are vital. Most of these projects are generating a “teens” return. For a tiny unprofitable company like BBLU, I estimate their cost of debt alone is 8-12%+ (if they can even get it) and cost of equity is much higher. Even wildly optimistic conference provider SeeThruEquity seems to estimate BBLU cost of capital at 13%. I don’t see how BBLU possibly is generating a return higher than their cost of capital, and that is the definition of an unviable business in my view. If you add tremendous debt leverage to a situation like that, rapid bankruptcy can occur.

As we can see below, since this is an incredibly competitive space occupied by huge global companies, the returns on these CHP projects are not attractive.

(click to enlarge)

(picture credit EPA study)

BBLU hopes to compete against some credible and established companies. For instance, global EPC juggernaut SNC Lavalin Constructors inc has over 70 years of specialized experience in gas cogeneration plants. CAT is already focused on cogen in food processing in Canada and the US (as well as globally) and has been for many years. BBLU does not even appear as a top 600 specialty contractor yet competes against vertically integrated giant companies like Gem Energy, which had $168m in revenue back in 2011. If you can choose between legendary global businesses with the smartest employees on the planet like Caterpillar to do your CHP plant or a team of people with decades of failure and a wake of financial disaster in their path, which would you choose?

Furthermore, people will fight these CHP projects the same way they fight any new power plant being built in their backyard.

If you are a BBLU shareholder, I encourage you to pose the question:

“In 2 years, Blue Earth will grow from an unprofitable $10m in sales, to generating $100m+ of revenue from CHP with extremely high profit margins despite having no proprietary technology when competing against hundreds of other companies because…”

Then call any CHP project developer on this EPA list (where phone numbers are clearly listed) and ask them to fill in the blank.

JBS: Already in the CHP/Cogen Business

(picture credit JBS)

It is not even clear the terms or if there is any exclusivity with JBS anyway. This JBS document states JBS is in the cogeneration business and this doc covers 2010-2011. Furthermore, it is not unusual to see customers operate their own CHP facilities like this ADM CHP cogeneration plant in Decatur, IL. Assuming they want to and end up building these CHP plants, what is stopping JBS from using multiple contractors or financiers to build their plants? What is stopping them from operating them on their own or hiring someone more credible outside company to do that for them? Any terms of BBLU’s long-term involvement, even if you believe Johnny Thomas, is not clear.

More “Johnny Thomas Guidance”: CHP Projects Already Being Pushed out

Johnny Thomas guiding for CHP project to commence operation during Q3 2014 but now end of September has come and gone and no announcement of that plant in operation. Plus he initially guidedinvestors to “turning on” 3-4 power plants before the end of 2014 and that seems clearly not possible given not one of them is turned on yet. As the CHP business for BBLU seems to get pushed out further and further without widescale financing locked in, the risks here increase that investors grow concerned and the whole thing comes unraveled.

CHP Business Faces Future Uncertainty From Utility: Unrecognized Risk of Total Loss

This past legal dispute involving JBS, IPS Engineering (BBLU’s acquired CHP company) and FERC (regulator of energy/power plants in the US) could threaten any JBS cogen/CHP project in the US. I advise you to read that right now (emphasis below mine) but I will attempt to explain how I see this situation because this has ENORMOUS potential implications for BBLU’s CHP Business:

“the partners (JBS) say the plant won’t be feasible without a contract to sell at least 10 years of its excess energy and capacity to PPL.”

I read this legal dispute to mean the current regulations require utilities to purchase excess power if a plant is 20mw or smaller. The utilities currently have a pathway to challenge this to avoid taking on these PPLs. The risk however is that the wording of the current regulations essentially mean the utilities cannot prove the small plant has “non-discriminatory access” until it is already built and the utility is then already forced to buy the extra electricity. This seems like an obviously circular argument that makes little sense. The FERC commissioner agrees too, as they state:

“PPL could not make that showing, the commission acknowledged, because the Souderton QF has not begun operation. And that, saidCommissioners Philip Moeller and Tony Clark, is a problem“

I do not think it is an accident that BBLU is focusing on cogen projects 20mw or smaller. However, this loophole where the utility is currently “forced” to buy the electricity seems to me to be a clearly unsustainable model already in the process of being addressed. Why should utilities be forced to buy electricity from small plants without any ability to protest at rates that don’t reimburse them for the infrastructure they built? This whole thing seems quite unsustainable to me and this 20mw “loophole” threshold at which power plants can be build and then force utilities to buy the power without protest makes little sense in my view.

This is obviously a serious legal dispute between JBS, IPS Power Engineering (BBLU’s subsidiary) FERC, and the utility whose power purchases seem to be what makes the project viable. IPS engineering also claims the local utility PPL Electric “has denied interconnections” so why was this not disclosed to shareholders in investor presentations so retail investors can understand this risk?

I think if BBLU thinks they can scale into a real power plant operator selling electricity into the markets as if they were a utility without crushing their own business they may be in for a bad surprise. Their very goal of becoming a power plant operator in scale while trying to come in below this 20mw threshold where they can force the utility to buy the power without contest seems absurd to me. Utilities are already fighting this on a project-by-project basis and BBLU hasn’t even gotten one JBS plant running in the US yet.

The entire concept of distributed generation poses great risk to the utilities as well. The risks here and the many moving parts are beyond the scope of this report but I’d encourage you to look into it more yourself here, here, here, here and here. While the risks to the CHP industry are widespread, suffice to say there is a very real risk the utilities step in here and impair or shakeup the entire industry. Where BBLU will land if this happens is anyone’s guess but I am assuming they will not come out well from that, and likely even worse if they carry enormous levels of debt.

I’m as much a fan of local energy production and renewable energy as anyone but at some point the utilities will need to get paid for providing, operating and maintaining the infrastructure or the whole thing is not sustainable. Couple this with extreme proposed debt levels and there is very real risk of “total wipeout” to investors if this goes against BBLU.

Could this 20mw project loophole risk be why Xnergy never panned out according to the huge expectations Johnny Thomas fed investors?

PLANS TO ADD BIG LEVERAGE SOUNDS LIKE ABT AND LOOK LIKE THE ROAD TO ANOTHER BANKRUPTCY

Have you sat down and modeled out what BBLU’s net income per share will look like with these projects? I get the impression nobody has sat down with a sharp pencil and figured this out so let me provide some fair and balanced insight on this.

(click to enlarge)

(picture credit Blue Earth)

BBLU is guiding investors that they plan to build 7 plants in the near term, which will require layering $119m on this tiny and unprofitable company. First I do not believe banks will finance $130m of these with just $11m of BBLU equity (more dilution) as that would leave these projects with an astounding 91.5% debt to equity. Furthermore, even using what seem like extremely optimistic assumptions from management of $1.9m EBITDA per project, that would leave project debt/EBITDA at an unbelievably high 8.95x. I really doubt any bank will finance anything with these people involved at those types of extreme leverage and even if they do this creates an extremely leveraged balance sheet at BBLU.

Given the multi decade track record of failure and bankruptcy I find BBLU’s guidance of adding significant debt to their business model to be particularly alarming and I believe will likely accelerate the eventual shareholder wipeout or bankruptcy.

EVEN IF BBLU CAN GET THESE DONE (DOUBT IT) IT APPEARS THEY WON’T EVEN MAKE BIG PROFITS FROM THEM

Even if they get many of these CHP projects done, they are only supposed to generate $1.9m in EBITDA each and with BBLU’s -$28m in 2013 net losses I don’t see how these will stem the losses and create a profitable company. Furthermore, assuming BBLU can borrow debt at 5.5% interest rates (this seems unrealistically low but we’ll be generous here) I estimate that would mean interest expense per project alone would be >$1.0m also. So after paying the debt off, each CHP project would only leave BBLU an estimated ~$900k in earnings and that is before tax and before accounting for the very real expense of depreciation (equipment wearing out) in this capital intensive business. This is all probably not even worth discussing though because given their multi-decade track record of failure and lack of ability to provide financing I doubt they will be able to get these done.

So even if everything goes right exactly according to BBLU management guidance and even if you choose to ignore the “total loss” risk of the 20mw project loophole that could get changed anyday, these CHP projects still don’t’ provide an exciting return to BBLU shareholders.

I HAVE SERIOUS CONCERNS ABOUT BBLU ACCOUNTING INTEGRITY, AUDITORS ARE SKETCHY

Getting back to ABTX for a minute, we can see a very questionable auditor situation here for a company later facing accounting manipulations allegations and lawsuits:

“Defendant Henry A. Ingalls (“Ingalls”) was Vice President of Finance, Chief Financial Officer and Treasurer of the Company until he was replaced on November 2, 1998, and thereafter became Vice President of Capital Formation, Mergers and Acquisitions. Ingalls joined AgriBioTech effective April 1, 1996 after more than 25 years in the Albuquerque office of KPMG Peat Marwick (“KPMG”). Prior to his departure from KPMG, Ingalls was the head of the audit department of the Albuquerque office and thus was responsible for the AgriBioTech audits. Pursuant to his employment agreement entered into on February 13, 1996, defendant Ingalls received options to purchase up to 1,250,000 shares of AgriBioTech common stock, exercisable at $2.12 per share vesting over five years.”

As a result, I think all investors should pay very close attention to who is verifying financial statement accuracy and protecting shareholders, especially if you insist on speculating on tiny, unprofitable reverse mergers like BBLU.

Are BBLU’s Financials Reliable and Trustworthy?

Given that BBLU CEO Johnny Thomas oversaw and led an acquisition-driven company later alleged to be a “massive fraud” with “accounting manipulations” I believe this is a valid question – one made especially relevant by BBLU’s history of choosing questionable auditors, starting with Lake & Associates, CPA.

In the 2011 BBLU 10-K Lake & Associates is listed as the auditor. In 2013 the PCAOB (Public Company Accounting Regulators) censured both the firm (Lake & Associates) and founder Jay Charles Lake,revoked the registration of the firm and barred Lake from being an associated person of a registered public accounting firm. This 2013 PCAOB statement is an amazing read, detailing how Lake “audited” China Fruits Corporation and China Logistics Incorporated.

Furthermore: “…[Lake] had overall responsibility at the firm for promoting compliance with Board standards, after engagement teams under his supervision had failed to perform required audit procedures to address fraud risks at their clients.”

Lake’s 2010 and 2012 PCAOB inspection reports were also both alarming with examples found by examiners of “failure to identify, or to address appropriately a departure from GAAP that related to potentially material omission from audited financial statements of required disclosure concerning related party transactions”. Then there’s: “[F]ailure, in two audits, to identify or address appropriately departures from GAAP that related to potentially material misstatements in the audited financial statements concerning the statement of cash flows.”

The 2010 and 2012 PCAOB reports show us that patterns of questionable behavior and poor oversight were occurring and found easily online in less than one minute of Googling. What kind of companies does Lake & Associates, CPA typically work with? There are countless nightmare investments but for example (before they were revoked) Lake was apparently the auditor for GRZG. GRZG was a “company” where the stock was allegedly promoted with a paid $1.1mhard glossy mailer stock promotion campaign before it declined -99% from the peak to current price of $0.03 per share.

(click to enlarge)

(picture credit Blue Earth)

Lake & Associates seems to be based in Tampa with some business in Chicago, while BBLU is headquartered in Nevada. Why did BBLU choose Lake and Associates? Why would any legitimate company partner with an auditing firm of that quality?

After Lake & Associates, Blue Earth engaged marginal auditor HJ & Associates, a Salt Lake City audit firm that offers Rent-A-CFO services to public companies, among other things. According to CapIQ data, HJ & Associates has 48 public company clients including BBLU. Of these clients, 44/48 sell for <$0.50 per share, and 43/48 have <$50 million market cap. Many of these stocks sell for less than a nickel per share. My opinion is that HJ & Associates is simply not a credible auditor for any legitimate public company.

Don’t take my word for it though, see these PCAOB deficiency reports for HJ & Associates from 2006 and 2010.

2006:

“The inspection team identified matters that it considered to be audit deficiencies. The deficiencies identified in two of the audits reviewed included deficiencies of such significance that it appeared to the inspection team that the Firm did not obtain sufficient competent evidential matter to support its opinion on the issuer’s financial statements. Those deficiencies included-the failure to perform and document sufficient procedures to test revenue

This issue seems shockingly similar to me to what contributed to the ABTX wipeout.

“2010: The deficiencies identified in one of the audits reviewed included a deficiency of such significance that it appeared to the inspection team that the Firm, at the time it issued its audit report, had not obtained sufficient competent evidential matter to support its opinion on the issuer’s financial statements. That deficiency wasthe failure to perform sufficient audit procedures to evaluate the accounting for financial instruments.”

In the process of appointing Mr. Krusi to the board, Chairman Laird Q. Cagan also voluntarily resigned from his position on the Audit Committee. It also seems there were past “ material weaknesses” in BBLU’s internal controls.

I’d like to state for the record that I am not accusing BBLU of accounting fraud at this stage. What I am saying is that a management team with direct ties to alleged prior accounting issues and restatements with a history of wipeouts owes it to shareholders to hire top quality auditors and err on the side of conservatism with its financials. Based on the foregoing evidence, I believe it is wise to be cautious when analyzing BBLU’s financial statements.

BBLU SEC FOIA 7(a) REPONSE: INDICATES EVIDENCE OF A CURRENT LAW ENFORCEMENT INVESTIGATION REGARDING BBLU

Most worrisome, a recent FOIA request to the SEC about BBLU returned a 7(a) exemption which indicates to me there is evidence of some kind of law enforcement investigation related to BBLU.

(picture credit SEC FOIA)

Until the SEC releases more details to public investors about this we honestly don’t know what is going on. This could be about something minor or something devastating.

This is yet another reason I believe investors should remain cautious on shares of Blue Earth though. We know the SEC has investigated at least one prior Thomas company, requiring financial restatements in the case of ABTX and resulting in bankruptcy. Therefore, I view this 7(a) exemption response as a red flag that deserves attention.

BBLU Looks like a Free Call Option for Management at Shareholders’ Expense

In my view, it is clear all 3 companies, ABTX, CNSV and BBLU are failed, capital destroying Johnny Thomas and John Francis rollups. I can’t blame them for trying though, in a sense this is actually a great business strategy for insiders as its effectively private equity via the public markets. You get involved with a reverse merger shell company, issue yourself lots of low strike warrants or nearly free stock, hire questionable stock promoters to promote the stock, and begin buying assets left and right primarily in overpriced stock. The strategy is asymmetric: If it works, you will get the upside of the low strike warrants and can cash out very profitably plus your cash salary and any benefits. If it doesn’t work, then unlike private equity, you are not on the hook because your personal capital is not really at risk and you still get your cash salary and any other benefits. Shareholders will likely get wiped out in that scenario, but no biggie since it isn’t management’s personal cash that bankrolled the company.

I believe, this strategy is best encapsulated by the following YouTube video:

BIG MONEY BIG MONEY NO WHAMMIES

I think BBLU is a Whammy

(picture credit to the legendary Press Your Luck game show)

In the meantime, insiders collect hefty salaries, which is a good deal for them because I speculate that no private company would put people with resumes like this in charge of anything important. It seems entirely possible that Johnny Thomas and John Francis don’t really have any other options for work other than unviable reverse merger rollups using paid stock promoters.

EVEN IF YOU LISTEN TO STOCK PROMOTERS AND TAKE THE “BLUE SKY” CASE, BBLU STOCK IS STILL IMPOSSIBLY OVERVALUED, -93.3% DOWNSIDE ON VALUATION ALONE

I think there is a compelling case to be made Johnny Thomas’ guidance to investors is not something you want to bet your life (or your wallet) on. That being said, perhaps the single craziest aspect of BBLU stock is that it is dramatically over valued even if you trust management and assume the Johnny Thomas’ dream comes true as planned! Below are the SeeThrough Equity estimates which seem to me to line up closely with BBLU management guidance.

(click to enlarge)

(click to enlarge)

(picture credit SeeThrough Equity)

As you can see, even these wildly optimistic estimates show BBLU only generating 2015 earnings per share (NYSEARCA: EPS) of $0.01 with that increasing to a whopping $0.02 in 2016. That means that even assuming all these proposed projects and “guidance” come through that BBLU is currently valued at an insane 268x P/E on 2015 estimates and 134x P/E based on 2016 numbers. Since BBLU has a history of large losses and cash burn, if we value BBLU on this optimistic 2014 revenue numbers, which means BBLU is currently valued at ~12x revenue. These valuations are clearly ridiculous and remember we are using wildly optimistic estimates I feel are virtually impossible.

Let me elaborate:

Shareholder Peer company Tetratech (TICKER: TTEK) is a “real” $1.5 Billion company with ~$200m in cash that is global in scale and focused on solving the world’s water problems and exposure to renewable energy end markets. It is larger, growing, profitable and run by some very credible people with PhDs. I believe TTEK is obviously a vastly superior company to BBLU in virtually every possible way. TTEK trades for ~0.80x revenue (BBLU is not profitable and burns cash so you can’t value it using any profitability or cash flow metrics).

If we are generous and value BBLU at the same valuation as superior peer company TTEK while simultaneously using the absurdly optimistic estimates from SeeThrough (which I believe are obviously impossible), BBLU would be valued at $0.17 per share based on 2014 estimates or $0.82 per share on 2015 estimates, for something between -93.3% to -68% downside. These are probably generous valuations for BBLU.

BBLU: -67.66% Downside Just to Acquisition Value

BBLU had paid a total of $63.5m, primarily in stock, for its acquisitions so far. Despite repeated failures so far and I believe due to the temporary impact of paid stock promoters, the current market market cap of BBLU is a whopping $196m. If BBLU was valued just at the value of their acquired businesses and ignoring the disappointing failures so far, BBLU would be valued at just $0.863 per share, creating immediate -67.66% downside.

(click to enlarge)

Remember, BBLU has not been able to provide capital or financing necessary to come even close to their guidance and BBLU’s last 10qfiling shows no broken out R&D spending. I would argue BBLU should trade at a discount to their acquisition value based on that and history of losing money and dilution. I think it is irrational to value BBLU at over 3x the value they paid for the businesses that make up their company. Especially when the management team is literally one of the worst I have ever seen based on their ability to destroy capital.

Furthermore, why are business sellers willing to be paid in stock at this absurd valuation? And why would these business owners feel comfortable being paid in stock that could be inflated by questionable paid stock promoters? Anyone being paid in BBLU stock at anything close to current stock prices is taking a very dangerous gamble in my view and I believe has near term risk of losing -80% or more of the value of that stock.

MANAGEMENT RESPONSE

After calling BBLU’s headquarters multiple times I was eventually able to get in touch with someone involved with BBLU. When asked detailed questions about unit economics and returns on capital on their proposed businesses, they were unable to answer. Instead more stories about large potential markets and potential opportunities were given. None of my questions were answered satisfactorily. Upon receiving the SEC FOIA response I again made an effort to get management’s feedback by calling them repeatedly but was unable to get anyone on the phone. I look forward to them clarifying the issues presented here.

BBLU Chart Now Officially Breaking Down: Indicating Near Term -77% Downside “Best Case”

(click to enlarge)

(picutre credit capiq)

I believe it is clear BBLU stock has now obviously broken through technical support and is heading lower. BBLU’s next level of technical support is at $0.62 per share, which matches relatively closely with near term valuation downside from multiple fundamental valuation analyses presented. It is rare to see both the fundamental and technical pictures align so perfectly. Note however that BBLU has 600% more shares outstanding than it did back in 2011. So $0.62 near term support may be a “false bottom” that may not hold. As a result, BBLU may have considerably more near-term downside than this conservative technical picture indicates as it “round trips” the recent move benefitting from the multiple paid stock promoters.

CONCLUSION

The Plungefather Calls His Shot: Shares of BBLU Will End Up Worthless, Long Term Price Target $0

(picture credit Godfather, with edits by me)

I believe BBLU stock will collapse as investors and partners come to understand the disturbing truth and recognize the mistake they have made by being involved with these people. Continued disappointment seems a near certainty to me with BBLU and as the story we’ve seen so many times happens here again, I expect the outcome will be similar: shareholder wipeout and bankruptcy.

The strangest thing to me is that not only have ABTX, CNSV and the others been wipeouts for investors, but for the people that sold their businesses to Johnny Thomas and John Francis, it wiped them out also if they didn’t sell their stock in time.

And what partner would sell their business to BBLU in exchange for stock that is being promoted by paid stock promoters? Doesn’t that mean by definition that BBLU stock is likely far over valued?

Johnny Thomas was given 1M options for BBLU stock at $1, worth nearly over $1.5m fully vested. John Francis also received nearly the same package with slightly lower salary.