Ex-fraudster warns UNI business students about white-collar crime

111814ho-Sam-Antar COURTESY PHOTO

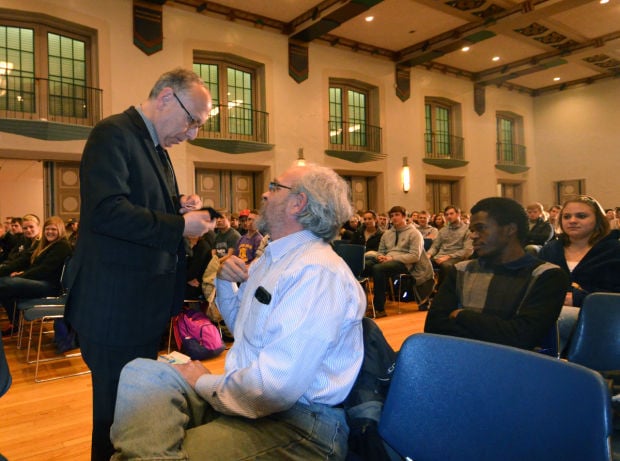

Sam Antar, who was convicted of fraud in a family business in New York, talks with UNI faculty and business students in early November in a program designed to teach them how to recognize white-collar crime.

2014-11-23T19:45:00Z 2014-11-24T04:48:00Z Ex-fraudster warns UNI business students about white-collar crimeJIM OFFNER jim.offner@wcfcourier.com Waterloo Cedar Falls Courier

15 hours ago • By Jim Offner

Jim Offner

jim.offner@wcfcourier.com

Follow @CourierJimO

(0) Comments

CEDAR FALLS | Sam Antar says white-collar criminals don’t carry guns.

They’re not needed.

In many cases, all they require is a smile, Antar told business students and faculty Nov. 10 at the University of Northern Iowa.

“You’d think they’re a nice guy,” he said when asked about the modus operandi of fraudsters. “You can’t be a liar if you’re a creep. One of the things I teach students is white-collar crime is a crime of persuasion. If you’re creepy, you can’t lie to somebody. You have to be likeable.”

Antar spoke from experience. He was chief financial officer of Crazy Eddie’s, an electronics retailer in New York, New Jersey and Connecticut that was implicated in securities fraud in the 1980s. The business’s cash-skimming scheme and securities fraud case cost investors nearly $150 million. Antar’s cousin, Eddie, the founder and majority owner of Crazy Eddie’s, was referred to as the “Darth Vader of capitalism” by one-time U.S. Attorney and Secretary of Homeland Security Michael Chertoff.

Sam Antar, a former CPA and now a convicted felon, currently advises federal and state law enforcement agencies, performs forensic accounting services, and speaks at universities, government agencies, and professional organizations on the subject of white-collar crime.

The Huffington Post recently named him as one of the 25 most feared financial reporters in the U.S.

“You can steal more with a smile than with a gun,” he said. “The most effective white-collar criminals are charming, guys you can have a beer with, guys you can discuss football, sex or politics with. They are people you like you’re more likely to trust.”

Many in the audience likely were familiar with the scenario if they followed stories about the downfall of Cedar Falls-based commodity futures trader Peregrine Financial Group in 2012 and the subsequent imprisonment for its CEO, Russell Wasendorf Sr. Wasendorf was convicted and sentenced to 50 years in federal prison for having orchestrated a fraudulent scheme that lasted two decades and cost PFG investors an estimated $215 million.

The fraud uncovered at PFG fit the classic mold of feeding on people’s hope, Antar said.

“Hope for most people is like heroin,” Antar said.

It’s also “an exploitable weakness,” because it lesson’s a person’s skepticism, he said.

“Often, as white collar criminals, we prey on people’s hope; hope defines everything we do,” Antar said. “When I was committing crime, we used to joke around that people live on hope. It’s not a joke.”

Antar was asked about traits fraudsters have in common.

“The trait of the criminal is I committed my crimes because I could,” Antar said, noting that he stopped was that he “got caught.”

“I knew it was wrong and I didn’t care,” he said. “It was arrogance.”

It’s more important to discuss the traits fraud victims share.

“What makes you into a good, law-abiding, ethical human being makes you into easier prey because, as a moral and ethical human being, you place limitations on your behavior that I as a criminal don’t put upon myself,” Antar said. “The more ethical you are, the more decent and moral you are and the easier for me as a criminal to take advantage of you and possibly defraud you. You have to accept upon yourself that there will be always criminals taking advantage of decent people because of their decency.”

There is hope that fraud will diminish because rules in the 2009 financial regulatory overhaul known as Dodd-Frank, now provides payments for corporate “whistleblowers” to step forward with evidence they may have that can thwart fraudulent activities, Antar said.

“If you tip off the SEC (U.S. Securities and Exchange Commission), and it prosecutes a case, the SEC will give you 30 percent of what it collects over $1 million,” Antar said.

It’s an important tool, Antar said.

“Only about 3-4 percent of white-collar crimes are uncovered by external auditors, and about 25 percent are discovered by internal audits, but 43 percent are found by tippers,” he said. “The hardest category for people to find out about financial crimes is not people working compliance at a company and it certainly isn’t the government, because they usually come in after the fact. The biggest factor is tippers, and they’re not altruistic.”

Most whistleblowers fall under the “3-X” category: ex-lovers, ex-business associates and ex-employees, Antar said.

“With Dodd-Frank, it gives people not only motivation for revenge but an economic incentive to rat out crimes,” he said. “As a criminal, I wasn’t afraid of my auditors or regulators. I was most afraid of one thing – rats. Economic incentive to rats, or tippers or whistleblowers. That’s a good thing. The criminal’s biggest enemy is informants.” |