| | | Jesse

22 JANUARY 2015

Gold Daily and Silver Weekly Charts - Davos Man and High End Looting

"The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks."

John Dalberg Lord Acton

“When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.”

John Maynard Keynes

It was all about the ECB today. And do not think for a minute that this asset purchase program is designed to benefit the broader economy. It is a subsidy program for those who own financial paper and the Banks

Gold and silver were pushing higher against key resistance and a short term overbought condition on the word from Monsieur Draghi that the ECB will be handing over about a Trillion per year to misprice the risk in financial assets

This asset purchasing will not have much impact on the real economy, but it will inflate the price of paper assets, especially the kind of debt held with leverage by the wealthiest one percent, delivering profits in tax subsidized forms of income.

Gold is consolidating nicely, and as we showed intraday with the NAV premiums, the gold-silver ratio has dropped back down to 70, which although quite high is not as stratospheric as it has been. Even the premiums of the trusts and funds in precious metals have normalized a bit.

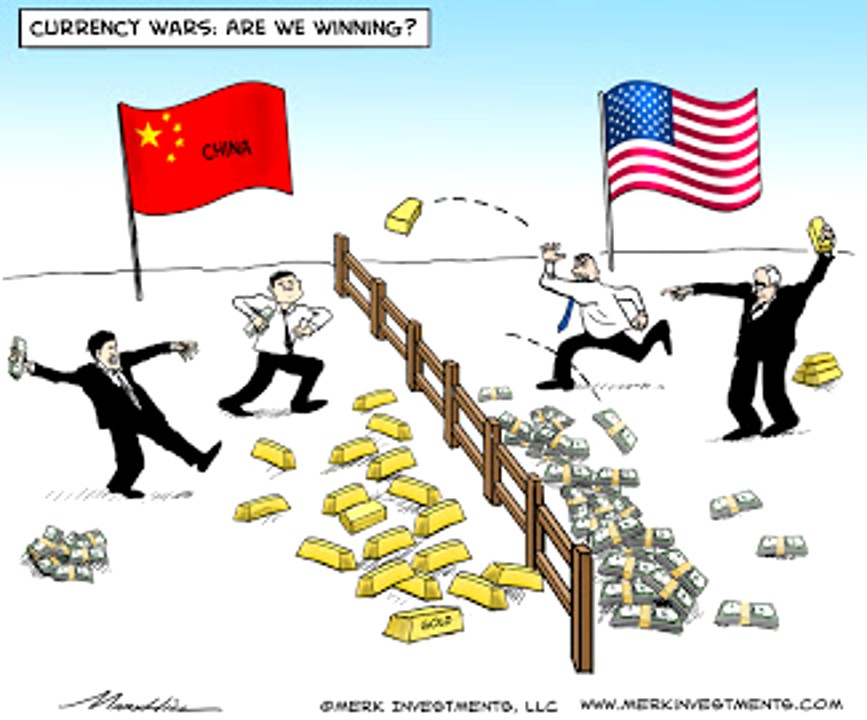

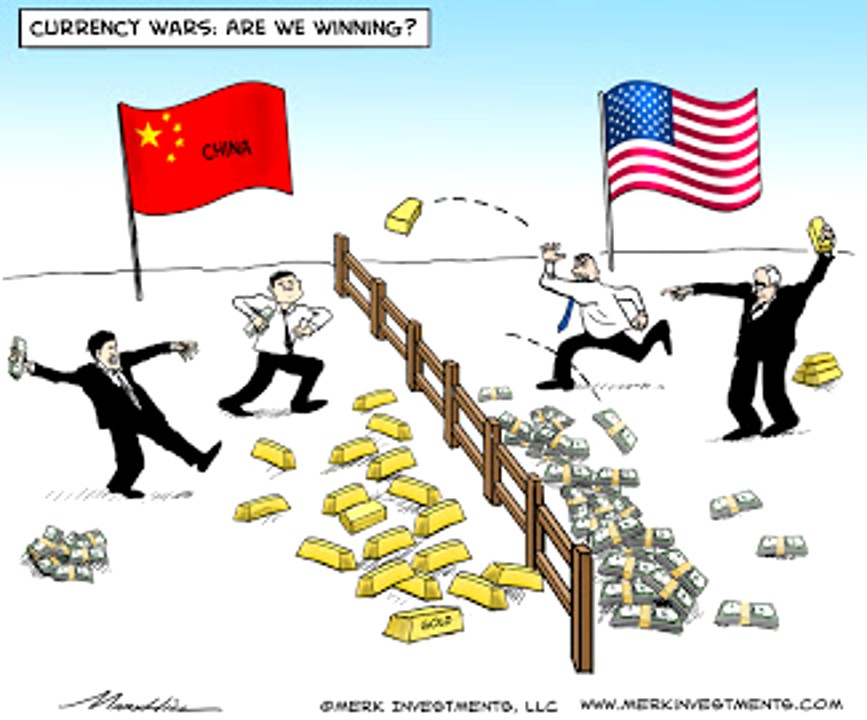

The strong dollar is good for importers and the Banks. And that is why most of the developed world, particularly Japan and Europe, are trying to devalue their currencies. But is hard to imagine how all of fiat price rigging is going to provide a benefit to the real economy. It starts to look more like high class looting from a distance

This is going to further taint genuine economic activity with financialisation, and make the task of prompting a recovery that is self-sustaining that much more difficult

The US financial sector will be benefitting enormously from this European QE, such are things these days with the global multinationals.

And as for the rest of the people, the vast majority? Time to lower your expectations, for you and your children. At least you will be given the privilege of voting for one of the candidates of their pre-selected choice next year.

Have a pleasant evening. |

|