Nokia Q4 & FY 2014 ...

>> Nokia Ends 2014 on a High

Ray Le Maistre

Light Reading

1/29/2015

lightreading.com

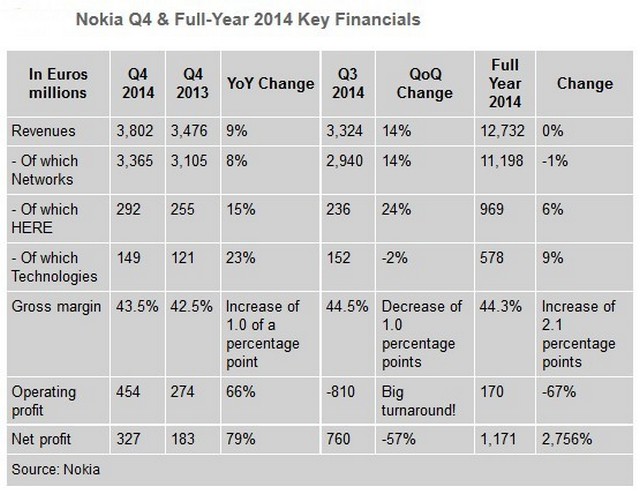

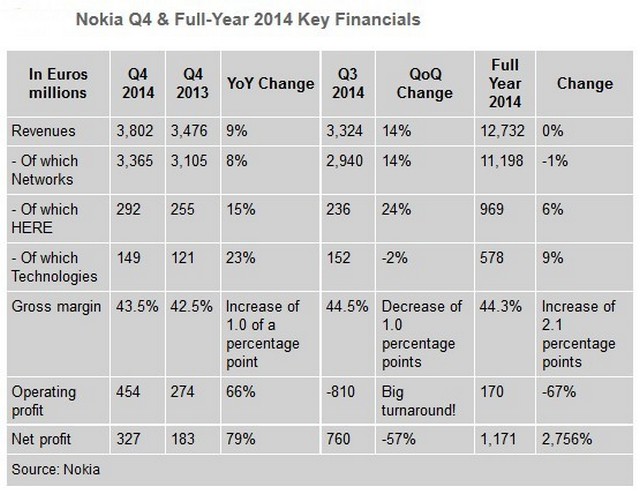

Nokia ended 2014 with a flourish, improving sales across all parts of its business, generating profits and predicting further growth in the coming year.

The vendor reported a year-on-year increase in fourth-quarter sales for all three business units -- Nokia Networks , HERE (mapping and location applications) and Technologies (intellectual property licensing) -- and even cited improving sales for its mobile broadband infrastructure business in North America, where rival Ericsson AB (Nasdaq: ERIC) experienced a sales downturn in the second half of 2014. (See Ericsson Feels US Capex Squeeze in Q4.)

Nokia expects revenues from all three units to increase in 2015, though it didn't provide any specifics.

Significantly for Nokia Corp. (NYSE: NOK), which has now stabilized under CEO Rajeev Suri following years of restructuring and the sale of its handsets business to Microsoft, the company is profitable, generating nearly €1.2 billion (US$1.36 billion) in net profit for the full year (though this was helped by a significant tax gain).

It even managed a full year's operating profit of €170 million ($192 million), despite a €1.2 billion goodwill impairment charge against its HERE unit in the third quarter of 2014. (See Nokia Reports Improved Sales, Margins in Q3 .)

The company ended 2014 with €5 billion ($5.65 billion) in net cash and other liquid assets, more than double the equivalent figure reported at the end of 2013.

"Looking ahead, while 2014 was a year of reinvention, we see 2015 as a year of execution," said Suri in Nokia's official financial statement issued early Thursday morning. "We are already moving fast, with HERE sharpening its strategic focus, Nokia Technologies accelerating its licensing and innovation activities, and Nokia Networks increasing its momentum in growth areas including virtualization and telco cloud. As we pursue these opportunities, we will not shy away from investing where we need to invest. But, we plan to always combine that with disciplined cost control and a focus on delivering ongoing productivity and quality improvements across the company. Overall, while we must remain focused on our execution, I believe that Nokia is well positioned to meet its goals for the year."

Nokia Networks had a particularly good end to the year, improving its fourth-quarter revenues by 8% year-on-year to €3.37 billion ($3.8 billion), with mobile broadband infrastructure accounting for 52% of sales and Global Services the remaining 48%. The company noted particularly strong demand for its packet core systems and reported a particularly strong quarter of infrastructure sales in North America, where 4G LTE demand resulted in a 95% year-on-year increase in sales. Notably, though, revenues were down year-on-year in China, despite the ongoing significant investments in 4G networks in that market.

The vendor ended the year with 162 commercial 4G LTE contracts.

Nokia ended the year with about 61,700 staff, about 6,400 more than a year earlier. Most of those employees work at Nokia Networks, which ended 2014 with a headcount of about 54,600, approximately 6,000 more than at the end of 2013.

Despite reporting a stable and profitable year, beating market expectations for the fourth quarter and forecasting growth for 2015, Nokia saw its share price dip by almost 5% to €6.81 in morning trading on the Helsinki exchange. # # #

- Eric L. - |