American's moving less and inventory at record lows

One of the dirty perceptions put out there is that home buyers stay put in their homes for many decades counting their days until the mortgage burning party arrives. The real estate pitch is always built around longevity. Think about your future kids, dogs, and the ability to paint your walls hot pink. In reality however, the average home owner was staying put for roughly 6 to 7 years before the housing market went off the edge. Many current owners are staying put because they still want those juicy peak prices and many were underwater. Others are staying put because they leveraged the daylights out of their properties. The latest figures show that current owners are staying put for longer because of the economy and this has had a big impact on the available inventory on the market. This is why those in the market to buy today are largely relegated to competing for crap shacks in areas where schools are subpar and construction is shoddy. There is an odd sort of capitulation going on today. It is speculation masqueraded as prudence. Even though momentum has stalled as smart investor money pulled back in 2013 and 2014, you have some ready to dive in just because “you only, live once” as if this was reason enough to plunk down a crazy amount of cash for house that looks like it belongs in a Hooverville. But for most of the country, real estate is priced to move. So why is inventory so low?

Inventory and being stuck

When the housing market is moving along a predictable path, you have a steady amount of buying and selling. For each home that is sold, you are likely to have a buyer moving in and a current owner moving into another property. Two transactions versus the massive amount of one-off transactions conducted by investors. You had 7,000,000+ completed foreclosures since the crisis hit where many people moved into rentals and big investors bought a property to rent out. A one-off transaction. This also explain the massive decline in the homeownership rate.

If we look at current inventory of existing homes for sale they are at a pathetically low level:

During the bad years of the crisis, we had something like 3.8 million existing homes for sale on the market. Today we are closer to 2 million. With investors chasing yield and supply shrinking, prices got pushed up and we saw this hit strongly in 2013 and 2014. But this wasn’t driven by massive sales volume or your traditional channel of typical home buyers. This was largely done by a low rate environment, investors, and low inventory.

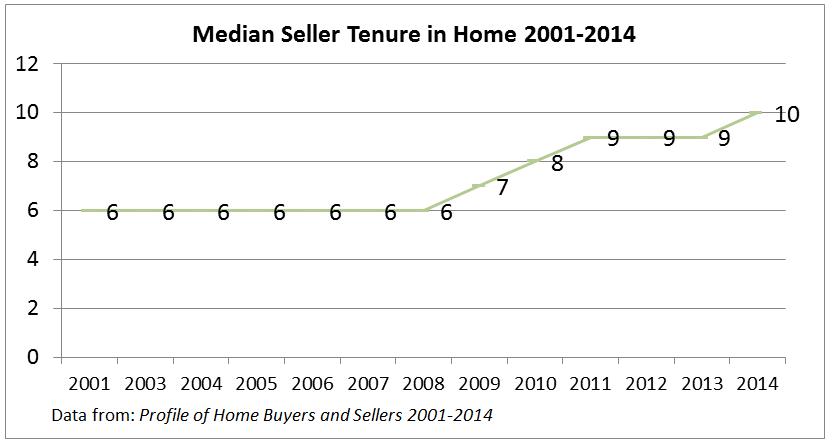

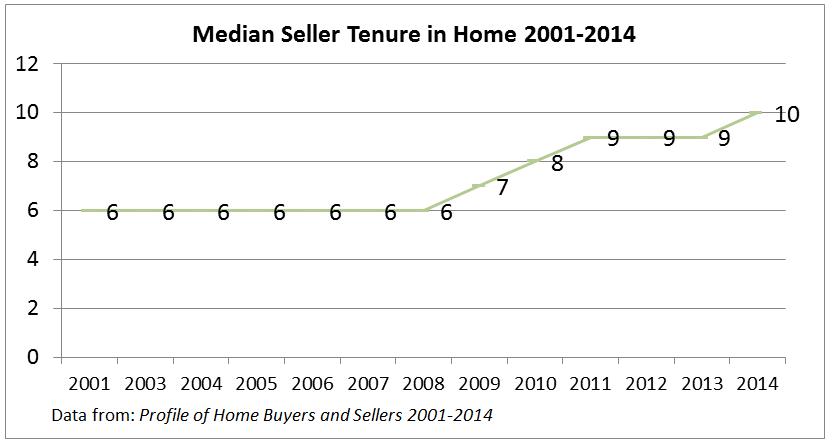

This brings us to our next figure that shows many current owners are staying put longer:

The idea of staying put is virtually a myth when it comes to homeownership. This might have been the case for previous generations but for current owners many are moving on a shorter timescale and are eagerly chasing their property ladder fantasies. This is why we have many older Americans chomping down on Purina Dog Chow while still paying off a mortgage or HELOC. I find it interesting that the National Association of Realtors is trying to encourage more volume since this is where their money comes from:

“(NAR) The underlying economic conditions for vehicle sales and home sales are the roughly same. Homes, however, have other special factors. Namely, the housing market crash had put a sizable number of homeowners in an underwater status and a good portion of them did not want to bother with the frustrating short-sale process. They have been waiting for home value to turn higher. Well, home values have been turning for the better, up 25 percent over the past 3 years on average. Therefore, there are likely pent-up sellers who had to wait in a better position to make the next move in 2015.”

In other words, more supply should be hitting the market. But will regular buyers come back in droves to fill the void left by investors? Younger buyers are not in great shape to pick up the slack and we are seeing this with many kids moving back home with their parents.

The market seems largely stuck. The national median home price is $208,000. That is certainly a reasonable amount and with very low mortgage rates, you would expect more buyers to be out on the hunt. But as we discussed, 6 out of 10 Millennials prefer renting over buying and this would be your next target audience to take the baton from the aging baby boomers. This is where the clash also occurs. Baby boomers seem to assume that their offspring have the same desire to own property as they do and that this applies to everyone. That isn’t always the case and also, desire and incomes don’t always align.

The fact that inventory is so low and current owners are staying put longer simply speaks to the lingering impacts of the housing bust.

http://www.doctorhousingbubble.com/exisiting-housing-inventory-and-average-stay-for-home-owner/#more-7954 |