EZchip-Mellanox Deal: The Go-Shop Period Is Over, Now What?

Dec. 17, 2015 1:33 PM ET | About: EZchip Semiconductor Limited (EZCH), MLNX

Disclosure: I am/we are long EZCH. (More...)

Summary:

- EZchip’s go-shop period ended with no offers better than Mellanox’s.

- After EZchip received no new proposals, Raging Capital’s argument seems weak.

- The deal is likely to be approved at the January shareholder meeting.

The $800M deal between EZchip (NASDAQ: EZCH) and Mellanox (NASDAQ: MLNX) passed another important milestone this week when the 30-day go-shop period Mellanox granted EZchip ended. The company and its designated investment banker, Barclays (NYSE: BCS), received no offers better than the original $25.5/share cash offer Mellanox made in September. The deal faces intense opposition from Raging Capital, which owns 7.5% of the company and is believed to lead a large group of individual investors. Raging Capital's opposition is backed by advisory firm Glass Lewis' recommendation to vote against the deal because it undervalues EZchip values significantly. On the other hand, most institutional shareholders support the deal, and they have received positive recommendations from advisory firms ISS (for U.S. institutional investors) and Entropy (for Israeli institutional investors) to accept the deal, which ISS says, "provides reasonable compensation for giving up the potential upside in a successful turnaround."

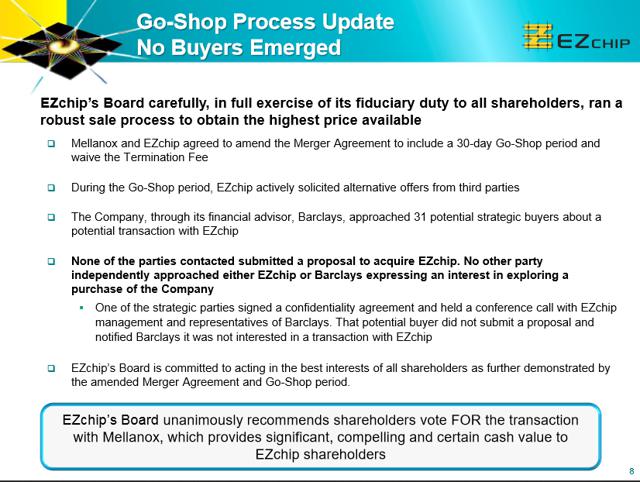

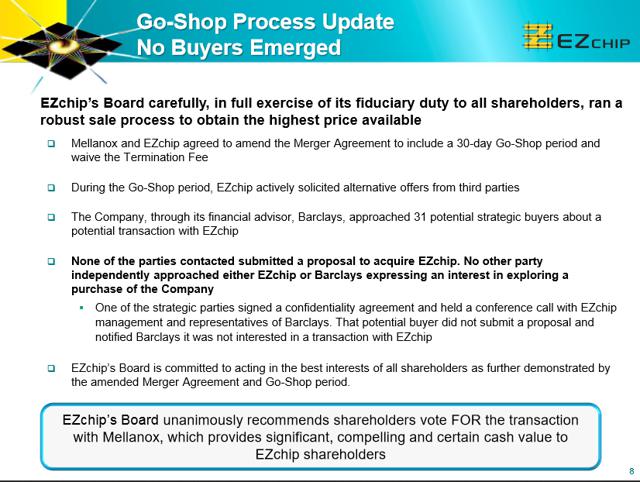

As shown below, EZchip provided some color during the go-shop process by proactively approaching 31 potential buyers who declined to offer superior proposals. No other company approached EZchip and showed interest in an acquisition.

(click to enlarge)

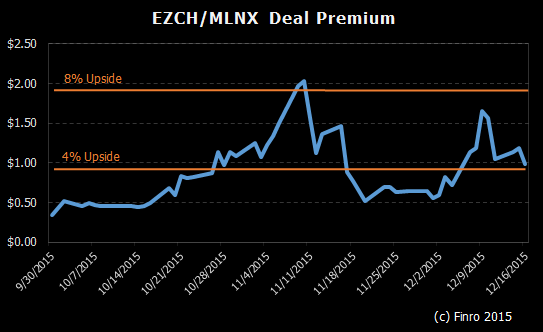

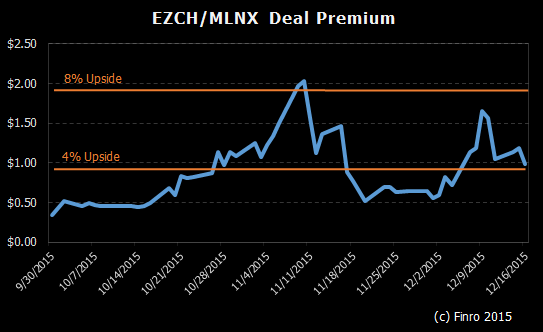

Raging Capital's intense opposition pushed EZchip and Mellanox to adjust their agreement and delay EZchip's shareholder vote for one month to allow EZchip and Barclays to look for a better offer than Mellanox's. As shown in the chart below, the deal premium reached its $2 peak one week before the previous EZchip shareholder meeting due to Raging Capital's vocal opposition.

Raging Capital's opposition is trying to increase the deal value to maximize EZchip's true value. However, because EZchip received negative responses during the go-shop period, I find it hard to believe that Mellanox will increase its offer when no other company is willing to pay more. In that sense, Mellanox cornered EZchip shareholders, which can either approve the current deal and benefit from the remaining upside or vote against the deal and strive to compete as an independent company in a very competitive market.

Raging Capital, on the other hand, claims that Eli Fruchter, EZchip's CEO, benefits from the current position EZchip is in because he wants to sell the company to Mellanox. In a press release, Raging Capital accused Mr. Fruchter of posting comments on a fee-based subscription forum in which he downplayed the company's future in order to make the deal look more attractive.

Even though Raging Capital's accusations are serious, I don't see how EZchip could get a better offer than Mellanox's $25.50/share in cash after the go-shop period ended the way it did. With the support from ISS and Entropy, most institutional investors will probably approve the deal, and the results of the go-shop period proved to many individual investors that they are getting a fair deal. I believe that at the January 19 meeting EZchip's shareholders will approve the transaction, passing another milestone toward completing the deal.

Additional disclosure: The information provided in this article is for informational purposes only and should not be regarded as investment advice or a recommendation regarding any particular security or course of action. This information is the writer's opinion about the companies mentioned in the article. Investors should conduct their due diligence and consult with a registered financial adviser before making any investment decision. Lior Ronen and Finro are not registered financial advisers and shall not have any liability for any damages of any kind whatsoever relating to this material. By accepting this material, you acknowledge, understand and accept the foregoing.

http://seekingalpha.com/article/3763096-ezchip-mellanox-deal-the-go-shop-period-is-over-now-what?auth_param=1v8u5:1b7600u:5ec7f390758399a1c9bc129aa634f4a4&uprof=45# |