| | | China Debt Today---- Welcome to The China Debt, Shadow Banking, Wealth Management Product Nexus

How corporate defaults could have much wider consequences.

(read post I am responding too)

by Tracy Alloway

April 21, 2016 — 8:20 AM EDT

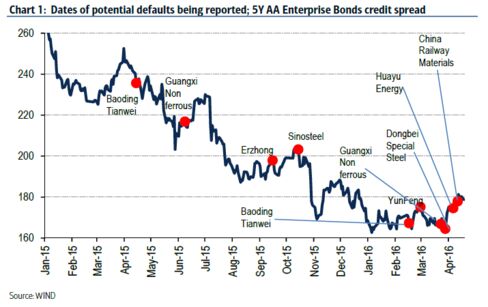

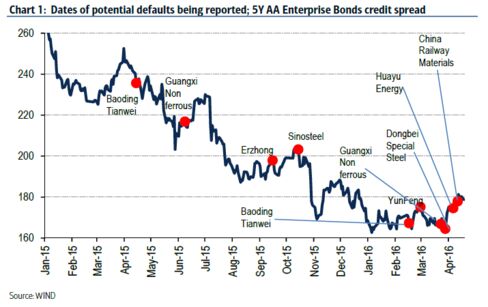

Here's a growing list to further excite China bears this Thursday: Baoding Tianwei Group Co., China National Erzhong Group, Sinosteel Co., China Coal Huayun and China Railway Materials Co., Guangxi Nonferrous Metal Group, Greenland Holdings Corp.'s Yun Feng unit, and Dongbei Special Steel Group Ltd.

These are the eight state-owned enterprises (SEOs) that have run into some sort of repayment problem this year, exacerbating already heightened concerns over the future of China's debt-fueled economy. It's a point picked up with some aplomb by Bank of America Merrill Lynch's China strategists on Wednesday, who argue that SEO-issued debt could eventually come to destabilize a much wider slew of China's investment landscape.

At issue is the degree to which the debt issued by China's SEOs has infiltrated the country's wider financial system, as well as the complex interplay of motives that has come to characterize its various stakeholders.

ource: BofAML

EOs that overindulged on debt may actually be keen to default on their bonds, while government officials may be loath to bail them out entirely. Meanwhile, banks will likely want to suppress defaults in the SEO space through potentially any means possible including, perhaps, pushing losses onto investors who have purchased the debt through wealth management products (WMPs).

Indeed, the wildcard in this already tangled web of financial players may prove to be in the so-called shadow banking system, where smaller investors have long been gorging on WMPs that promise juicy yields. Unsurprisingly, perhaps, some of those high returns may have been generated through the buying of—and application of leverage to—SOE-issued bonds.

"The way that WMPs are sold in China has led many buyers to believe that these products are essentially term deposits. As a result, if financial institutions decide to pass on some of the default losses to these buyers, they may stop buying en masse, essentially generating a 'bank' run in the shadow-banking sector," the BofAML analysts, led by David Cui, write in their research.

Indeed, there are some early signs of this dynamic at play already, with at least one bank reportedly taking money raised from WMPs to cover a defaulting bond, according to BofAML. The repeated use of such tactics may well represent a breaking of an implicit promise embedded in the products, they warn.

"For years, bond buyers believed that bonds issued by any government-related entity, including SOEs and [local government financing vehicles], were bullet-proof," the BofAML analysts conclude

"If this perceived 'implicit' guarantee is broken, at a minimum, credit spreads would widen sharply and, at the worst, panic selling could develop, generating a negative spiral. Moreover, contagion risk could be high: if this 'promise' is broken, will the market still believe in perceived government guarantees elsewhere, including those on [renminbi], the A-share market or housing prices?"

http://www.bloomberg.com/news/articles/2016-04-21/welcome-to-the-china-debt-shadow-banking-wealth-management-product-nexus

|

|