Business Loan Delinquencies Spike to Lehman Moment Levelby Wolf Richter • May 19, 2016

A leading indicator of big trouble.This could not have come at a more perfect time, with the Fed once again flip-flopping about raising rates. After appearing to wipe rate hikes off the table earlier this year, the Fed put them back on the table, perhaps as soon as June, according to the Fed minutes. A coterie of Fed heads was paraded in front of the media today and yesterday to make sure everyone got that point, pending further flip-flopping.

Drowned out by this hullabaloo, the Board of Governors of the Federal Reserve released its delinquency and charge-off data for all commercial banks in the first quarter – very sobering data.

So here a few nuggets.

Consumer loans and credit card loans have been hanging in there so far. Credit card delinquencies rose in the second half of 2015, but in Q1 2016, they ticked down a little. And mortgage delinquencies are low and falling. When home prices are soaring, no one defaults for long; you can sell the home and pay off your mortgage. Mortgage delinquencies rise after home prices have been falling for a while. They’re a lagging indicator.

But on the business side, delinquencies are spiking!

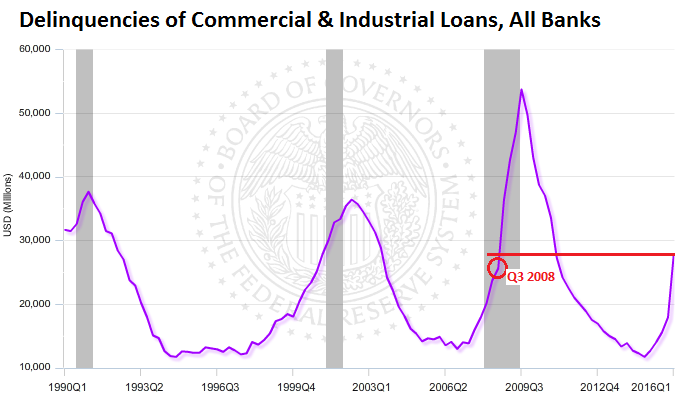

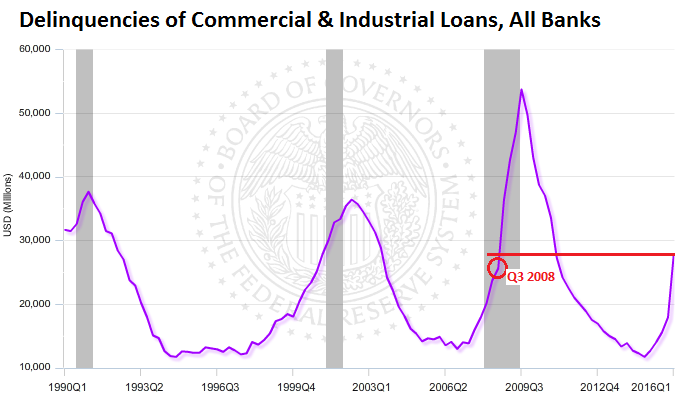

Delinquencies of commercial and industrial loans at all banks, after hitting a low point in Q4 2014 of $11.7 billion, have begun to balloon (they’re delinquent when they’re 30 days or more past due). Initially, this was due to the oil & gas fiasco, but increasingly it’s due to trouble in many other sectors, including retail.

Between Q4 2014 and Q1 2016, delinquencies spiked 137% to $27.8 billion. They’re halfway toward to the all-time peak during the Financial Crisis in Q3 2009 of $53.7 billion. And they’re higher than they’d been in Q3 2008, just as Lehman Brothers had its moment.

Note how, in this chart by the Board of Governors of the Fed, delinquencies of C&I loans start rising before recessions (shaded areas). I added the red marks to point out where we stand in relationship to the Lehman moment:

Business loan delinquencies are a leading indicator of big economic trouble. They begin to rise at the end of the credit cycle, on loans that were made in good times by over-eager loan officers with the encouragement of the Fed. But suddenly, the weight of this debt poses a major problem for borrowers whose sales, instead of soaring as projected during good times, may be shrinking, and whose expenses may be rising, and there’s no money left to service the loan.

wolfstreet.com |