| | | This is a very incisive report that the author is making available for free while he is recovering from an illness.

wallstreetexaminer.com

Meanwhile, one indicator to keep an eye on is the level of bank lending to finance securities holdings. That weekly data correlates directly with the prices of US Treasuries. It has pulled back in recent weeks and is threatening its f 52 week moving average. A trend break there, could signal a bear market in Treasuries, or at least a significant intermediate term rise in yields, which has already begun. Ironically, that would attract even more capital flows into the US. 3/2/16 Why does capital flow from Europe to the US as fast as Super Mario can print it? This is so simple, even a caveman would get it, but unfortunately, put 12 central bankers in a room and they lock the door to keep reality out. Capital flows to the US because Europe has negative interest rates (NIRP) and the US has positive interest rates. Big investors, speculators, businesses, and securities dealers all have the option of where to send and keep their money, and if Europe is stupid enough to tax them for keeping cash there, then by god, they’ll just move it somewhere else. They’ll move it to where it’s safe, and where they can still earn a positive return, however, minuscule. That dear friends, means the good old US of A, land of the free and home of the half point, which, by the way will be heading higher soon. As crazy as I think the Fed is, they are beacons of sanity in the delusional world of central bankers. Insanity is relative, and in this case, that relative dose of sanity is probably just enough for the Fed to recognize that positive rates in the US help to keep our Ponzi growing as long as Europe and Japan are negative. And if the Fed raises rates, those flows to the US will grow even more. It’s not quite quantitative easing. It’s really more of a quantitative expropriation.

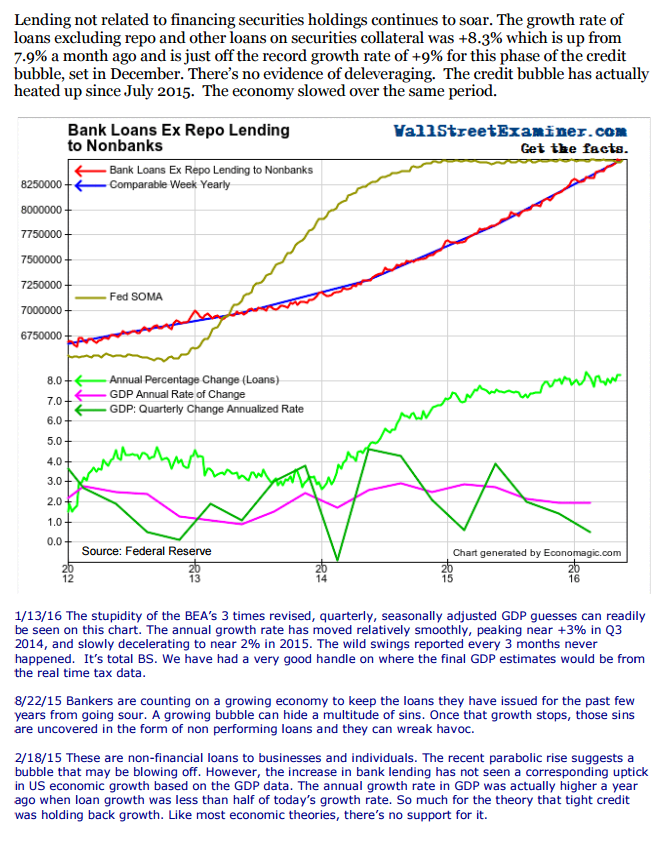

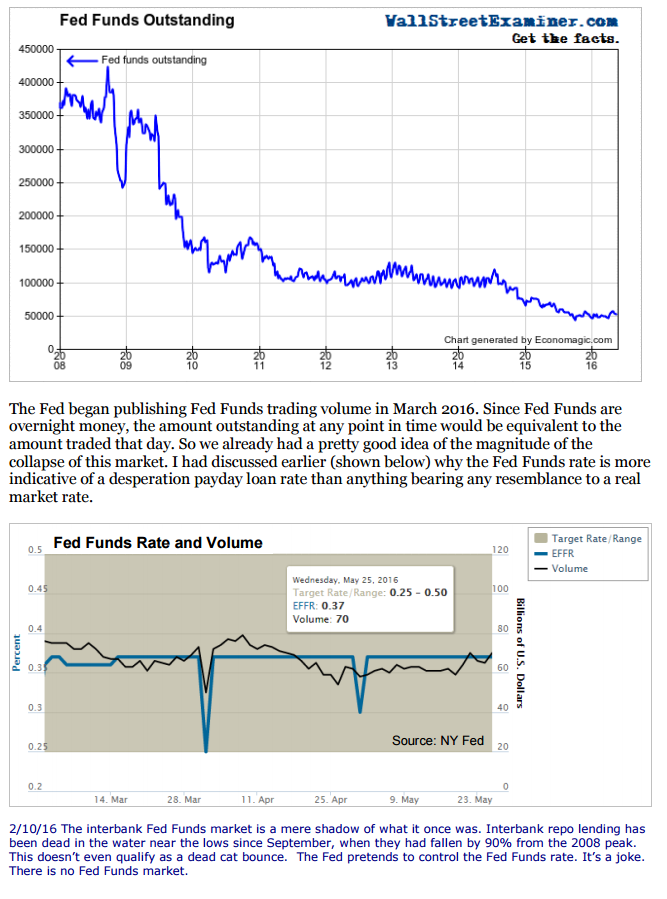

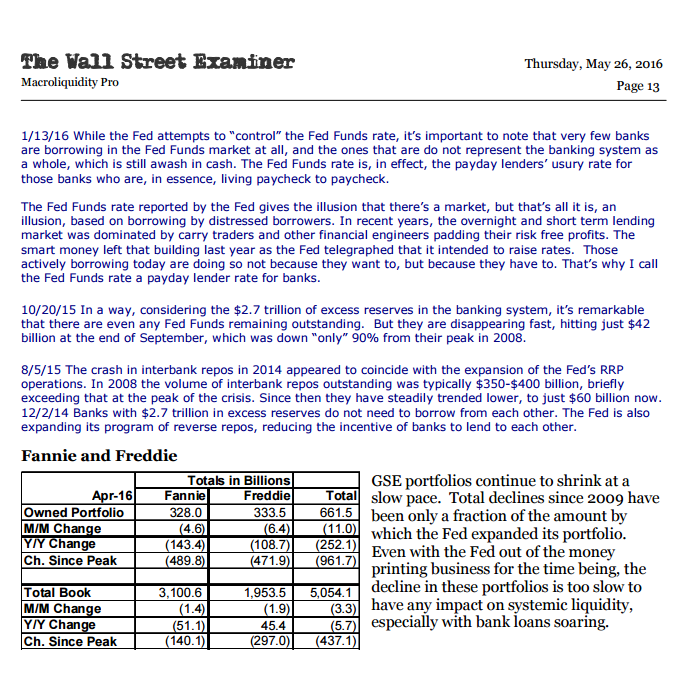

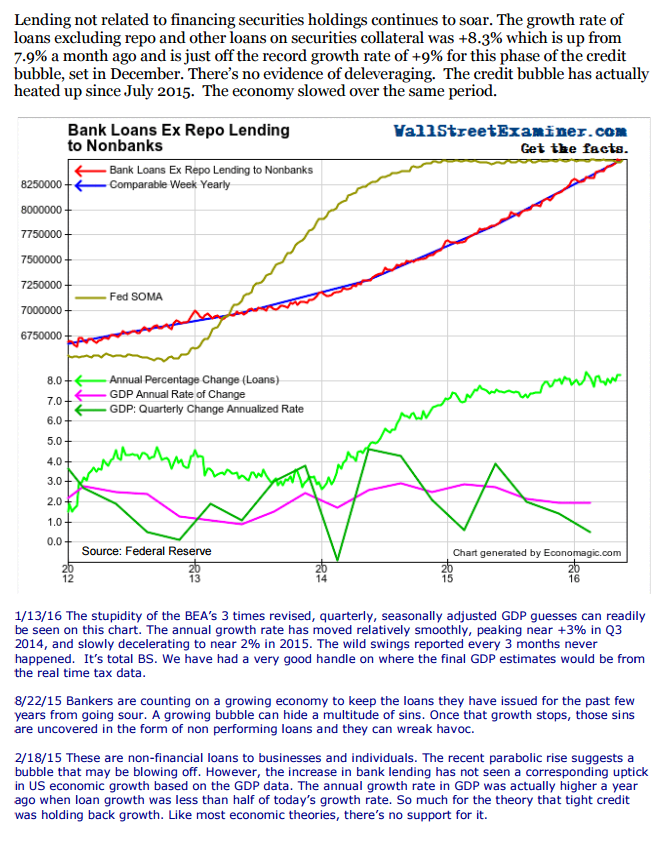

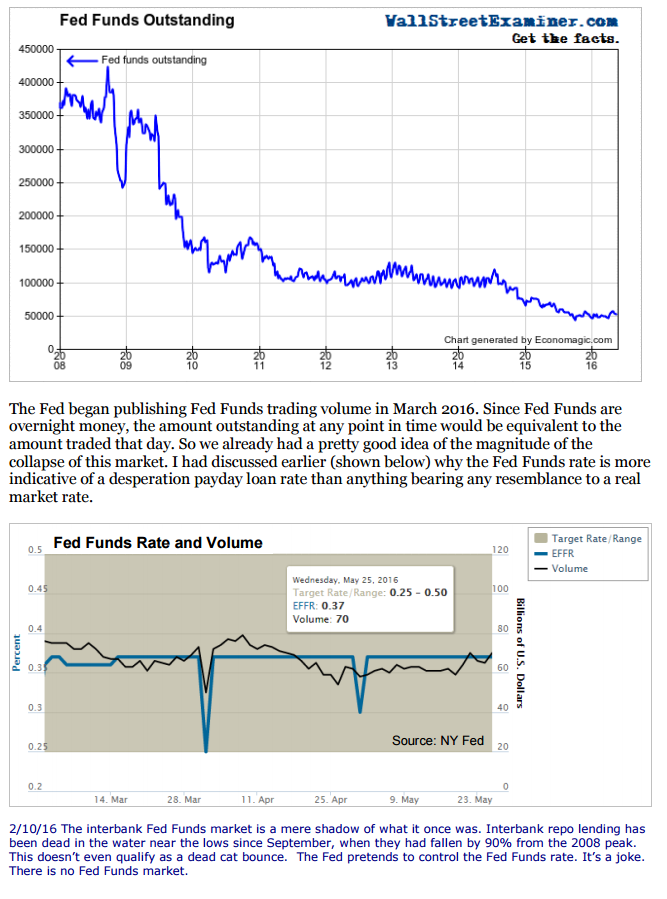

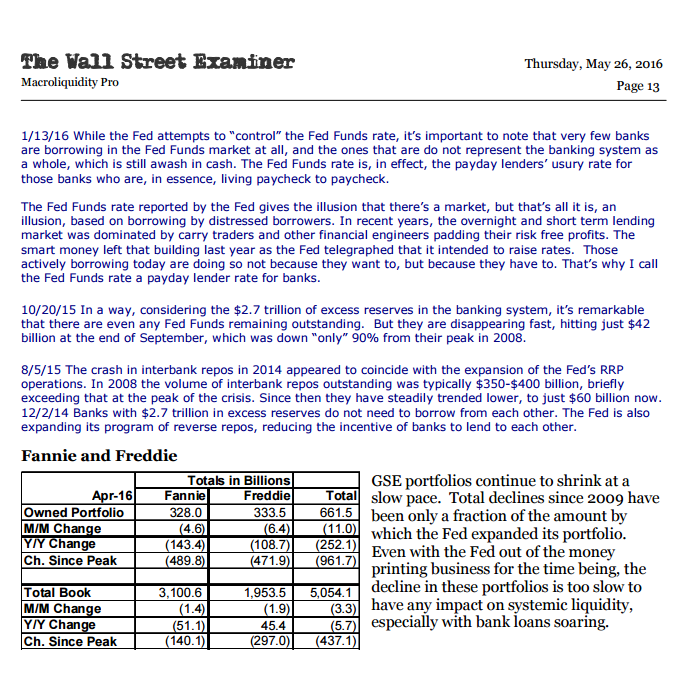

The result is a combination of NIRPitrage and QuanThe ECB and the BoJ do the quantitative easing, then the Fed pays just a little more for it, and the cash comes flowing across the sea in massive waves.titative Expropriation. 1/13/16 Interbank Fed Funds lending continues to be virtually non-existent, down 90% from 2008 peak levels as the Fed continues to promote the myth that it has raised rates. Most banks are still so loaded with cash that they have zero need to enter the overnight funding markets. The banks who are borrowing are the distressed exception. With all the excess cash in the system, those banks who need to borrow in the Fed Funds market are like households who borrow from payday lenders. They borrow because they have no other choice. This is hardly indicative of the market as a whole, where there is no bank borrowing. In spite of the Fed’s balance sheet being flat, bank loans are soaring. This excludes loans to finance securities, which have been flat. Isn’t it strange that credit to business and individuals is soaring and GDP growth is slowing? Based on the latest official release, GDP growth is down to around 2% from 3% in 2014, and the real time tax data that we track suggests that real growth is now less than 1%. According to economists, credit growth and economic growth go hand in hand. According to reality it doesn’t, and in fact, too much credit apparently is associated with slow or no growth. As we know from our experience of a decade ago, extremely rapid credit growth leads to extremely rapid, and devastating, correction. Unfortunately, bankers are always the last to learn that lesson and since there’s been no moral rectification of the last credit bubble, we’re having another one in rapid succession moral hazard at pillar of salt proportions. This one is now on the doorstep of correction. Given that it has metastasized to a much greater degree than the last one, the end result is likely to be far more damaging, especially since the world’s central banks have used up their monetary trickery and their credibility in bringing us to this point. Even if they tried to stop a collapse by printing more money, it’s doubtful that enough players have enough faith in them to buy into the con one more time.

definitely some good reading in the report.

-------

JP |

|