Blog

Forces Driving Semi Mergers & Acquisitions

Part 2 in series

Walden Rhines, Chairman & CEO, Mentor Graphics

6/8/2016 10:30 AM EDT

0 comments post a comment 0 comments post a comment

NO RATINGS

LOGIN TO RATE

inShare3

The driving force for consolidation is typically the efficiencies achieved through economies of scale with larger volume. Not so with the semiconductor industry.

As discussed in my last column, the semiconductor industry entered uncharted territory in 2015 with a wave of major mergers. After more than 60 years of deconsolidation, the industry made the first material steps toward consolidation. For many, this appears to be the inevitable maturation of an industry in which growth rates have slowed and further increases in return on investment depend upon the efficiencies of consolidation rather than upon growth.

The driving force for consolidation is typically the efficiencies achieved through economies of scale with larger volume. In most industries, manufacturing economies of scale are the most important. This is true for the integrated device manufacturers, or IDMs, of the semiconductor industry as well. However, these IDMs constitute a continuously shrinking share of the semiconductor industry and now consist mostly of memory producers, several very large IDMs like Intel and Samsung, and process-differentiated companies that produce analog, mixed-signal, RF and power semiconductors.

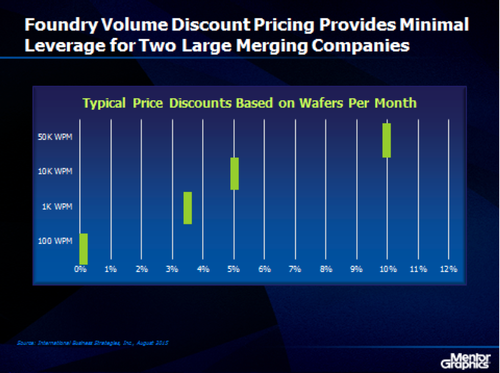

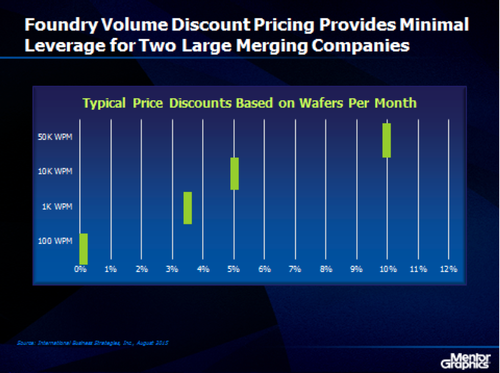

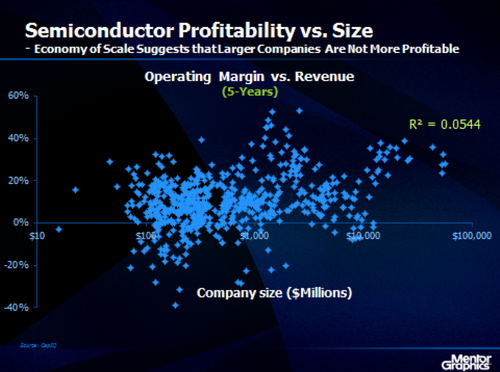

Thirty percent of the semiconductor industry is now fabless. Manufacturing economies of scale generated by the merger of fabless companies are limited (Figure 1). If two large semiconductor companies merge, the volume discounts they receive from the wafer foundries, as well as from the assembly and test subcontractors, are not greatly different. The additional volume achieved through merger likely adds only modest additional discounts.

Figure 1

Click here for larger image

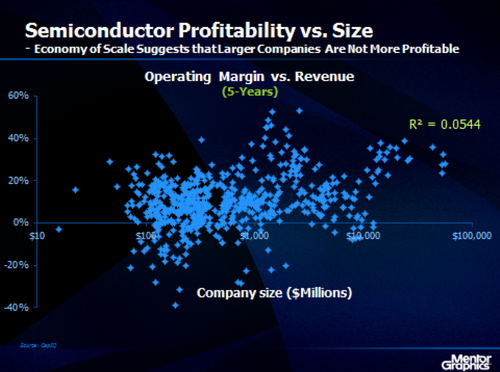

Of course, manufacturing costs are only part of the volume-sensitive benefit of mergers. The cost benefits of a merger, often referred to as synergies, include many other types of economies of scale. One would expect to see a correlation of these cost benefits with size of semiconductor companies. What is remarkable is that such a correlation doesn’t appear to exist (Figure 2).

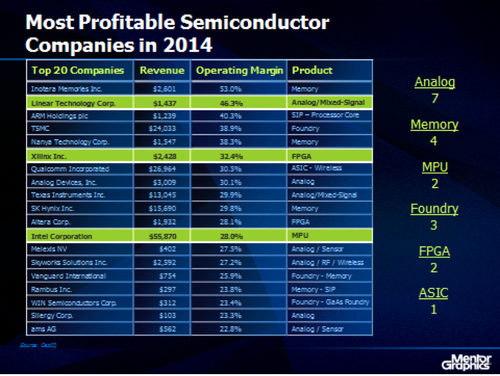

Figure 2

Click here for larger image

A look at data from the top 130 public semiconductor companies over a period of five years (Figure 2) shows no relationship between size and profitability. A linear regression coefficient of 0.0544 suggests no correlation at all.

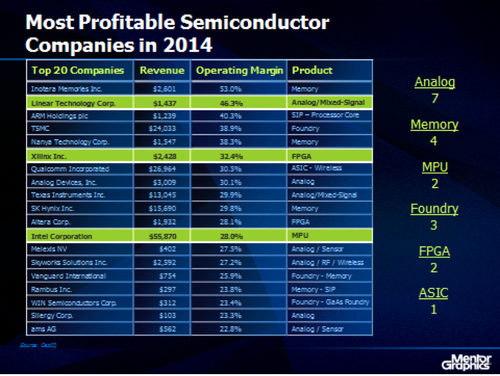

Comparison of the most profitable semiconductor companies seems to support this same conclusion (Figure 3). The largest semiconductor company, Intel, had a very respectable operating profit of 28% in 2014 on $56B of revenue. But Linear Technology, with only $1.4B of revenue achieved a 46.3% operating profit and Xilinx, with $2.4B of revenue, achieved a 32% operating profit. You might think that operating profit is dependent upon the sector in which a company operates but the top 20 most profitable companies in 2014 cover most of the range of possibilities — with analog (7), memory (4), microprocessor (2), foundry (3), FPGA (2) and ASIC (1).

It appears that economies of scale are of limited importance in the motivation for consolidation. As a result, semiconductor companies rarely try to achieve the benefits of volume when a particular sector of the industry matures. We saw this in the wireless industry when most of the market share leaders in wireless baseband chips actually shut down their businesses rather than sell them as the market consolidated. TI was the leader in baseband chips and, like Broadcom, ST Micro, Marvell and more, found no buyers as the market commoditized. Others, like Qualcomm, HiSilicon, Mediatek and Spreadtrum showed a willingness to hang with it as prices declined. Even those who were able to sell what remained of their declining wireless chip businesses, like NXP, were not acquired by a consolidating leader.

Figure 3

Click here for larger image

Data seem to argue that the current consolidation of the semiconductor industry is not driven primarily by the desire to achieve economies of scale. In the next article (part 3 in the series), we’ll look at other motivating factors driving semiconductor mergers and acquisitions.

Walden C. Rhines is Chairman and CEO of Mentor Graphics. His last article, "Semiconductor Merger Mania: A Change from Historical Norms," was published May 19, 2016.

|

0 comments

0 comments