| | | Fiction, Meet Facts: The Unintended Consequences Of Central Bankers Gone Mad

Jul. 13, 2016 8:20 AM ET| About: SPDR S&P 500 Trust ETF (SPY), DIA, QQQ, IWM, Includes: TLT

The Heisenberg The Heisenberg

Ultra accommodative monetary policy comes with unintended consequences.

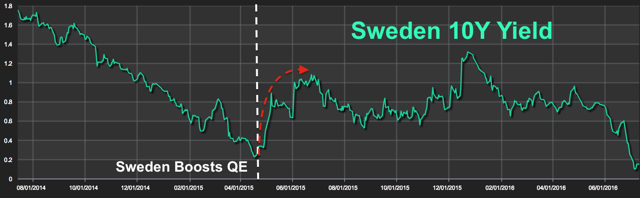

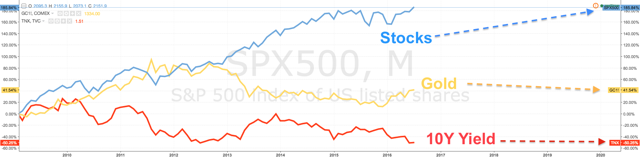

Let me give you a few examples. Have a look at what happened to Sweden when they expanded their asset purchase program last April:

Oops. QE is supposed to drive rates down, not up! So what happened there? Well, the market started pricing in a liquidity premium. That is, the Riksbank was sucking so much collateral out of the system, that the market began to worry about liquidity.

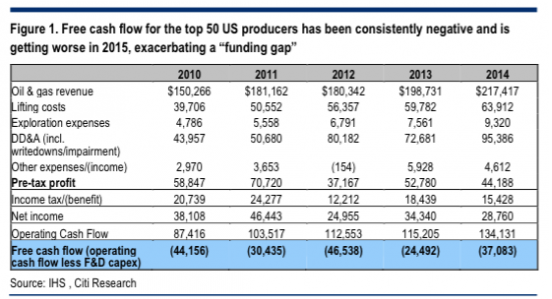

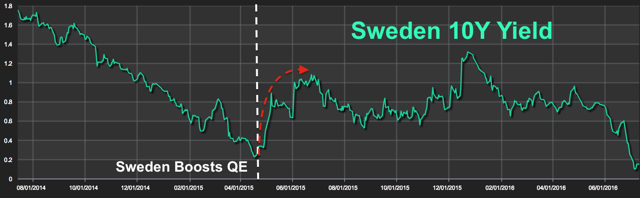

So that's country specific. More broadly, think about what ultra low rates and QE facilitate. Far from stoking inflation and growth, they actually encouragedeflation. The US shale space is the poster child for this dynamic. The entire complex should be out of business. Here, have a look:

(Table: Citi)

But, much to the chagrin of the Saudis, US production has generally lived to pump another day. Why? Simple: wide open capital markets. Here's Credit Suisse:

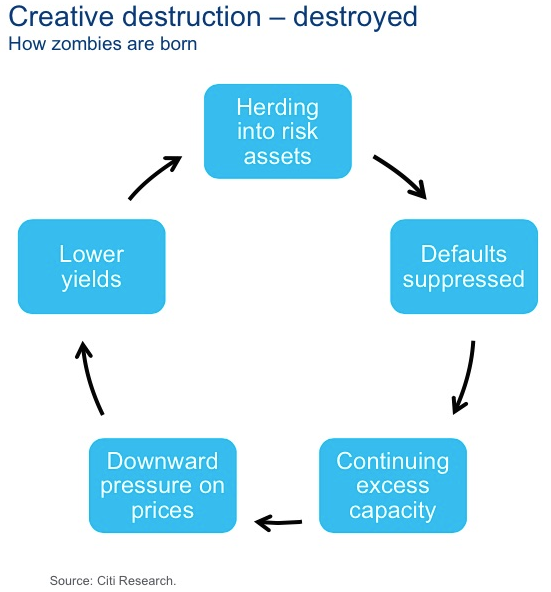

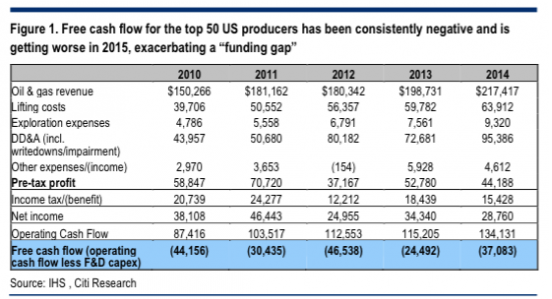

It encourages 'zombie' capitalism: QE keeps the cost of debt low, and thus the HURDLE RATE for corporates falls, too, increasing the risk that unprofitable projects are invested in.

And here's the classic graphic from Citi's Matt King:

(Chart: Citi)

Now, more than ever, we should be cognizant of the unintended consequences of central planning gone wild. As stocks will attest to, we're about to witness the implementation of ' helicopter money' in Japan.

In other words: the monetization end-game draws nigh. As we enter the final phase of the greatest (or "worst", depending on how you're inclined to look at it) experiment in the history of economics, Deutsche Bank has taken a look back at things and decided that this may not have been such a great idea after all.

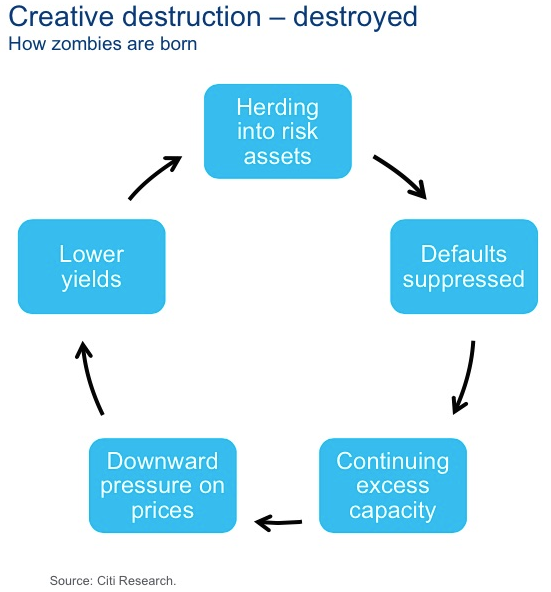

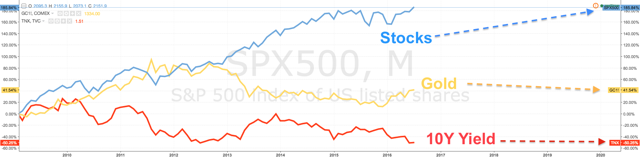

"Do low rates stimulate growth?," the bank asks, in a note out Tuesday. Below, find facts versus fiction. Note the equities (NYSEARCA: SPY) versus fixed income (NYSEARCA: TLT) allocation point:

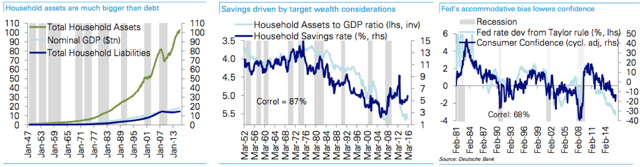

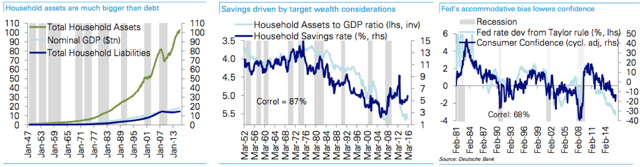

Premise: Low rates subsidize borrowing costs for households, freeing up resources for consumption. Fact: The tax on the other side of the balance sheet is much larger. Household sectors are large net creditors and hold more cash and fixed income assets than they have debt. Low rates therefore represent a sizable net tax (2.7% of GDP in the US) that is negative for spending and growth;Premise: Low rates encourage front-loading of spending and lower savings. Fact: Lower rates force households to save more (1% of GDP) to meet wealth and retirement income targets, lowering spending;Premise: Lower rates encourage a reallocation into riskier assets like equities, with wealth effects that are positive for growth; Fact: Falling rates encourage the reverse, with a record over-allocation in this cycle to fixed income (+$750bn) at the expense of equities (-$1.7trn);Premise: Lower rates support particular industries such as housing.Fact: They do so at the expense of other industries, such as the Financials, with an ambiguous impact on overall growth;Premise: Central banks' accommodative bias is positive for confidence. Fact: Repeated easing and pushing out of rate normalization has provided a negative signal and significantly reduced confidence.

And here are a few of the accompanying visuals (out of respect for the original, I won't include them all):

(Charts: Deutsche Bank)

This isn't going to end well folks. It really isn't. And that's not me being hyperbolic. As I've said time and again, I'm no permabear. I have long-term holdings just like anyone else that benefit when risk assets hit record highs.

But the average investor doesn't seem to understand how far policymakers have plunged into the great unknown. There's no telling what happens next. But what we do know is this:

Find me a bargain there.

We're walking further and further into the monetary Twilight Zone with the unintended consequences conspiring to plunge the world into secular stagnation and we're embarking on this ill-advised adventure with every asset class trading rich.

There's no room for error. Anywhere. The life of your portfolio is in their hands...

seekingalpha.com |

|