| | | the leverage on Deutsche Bank is around 40:1, but was "only" 31:1 for Lehman Brothers

Deusche Bank is twenty times larger and more Critical to the Global Fiancial system than Lehman Brothers was.

Deusche Bank is the Worlds Largest Foreign Exchange Dealer in the World with a market share of 21 %. Foreign Exchange is the Worlds Largest Financial Market with over 5 Trillion dollars traded every day. The Derivative products the DB, JPM, GS Barclay's BAC, C, WFC are many more Trillion. The CDS, CDO, CLO's and other huger derivative products.

It dwarfs the puny puttering of the Market Capitalization of FB, AMZN, NFLX, AAPL, GOOGL.... and in fact the SPX.

The German Governent is about 10 times more solvent than the 178 Trillion unfunded liabilities of the US looking out to 2033. Japan The UK and the EU are similarly faced with unsustainable debt to GDP ratio's. When we come out of Negative Interest rates.

when evaluating the US stock market valuations on the basis of potential futures earnings or the metric of dividend yield relative to US ten year note yields puts an investor in the type of blinders that they use on race horses so they can not see 95% of what is going on at the race track and can only see to the racing stall which is where the horse belongs.

it is necessary in today's global Capital Markets and Speed of Light Global Capital flows to develop an understanding of a Holistic Approach where the impacts of these various related, FX, Debt, Fixed Income, Equity, Real Estate, Art and Collectibles all function in unision... much as our global ecosystem and the human body is made up of multiple components, which collectively provide us with our overall state of health and wellness.

Deutsche Bank AG (literally "German Bank"; pronounced ['d???t??? 'ba?k ?a?'ge?]) (  listen ( help· info)) is a German global banking and financial services company with its headquarters in the Deutsche Bank Twin Towers in Frankfurt. It has more than 100,000 employees in over 70 countries, and has a large presence in Europe, the Americas, Asia-Pacific and the emerging markets. In 2009, Deutsche Bank was the largest foreign exchangedealer in the world with a market share of 21 percent. [4] [5] The company is a component of the Euro Stoxx 50 stock market index. [6] listen ( help· info)) is a German global banking and financial services company with its headquarters in the Deutsche Bank Twin Towers in Frankfurt. It has more than 100,000 employees in over 70 countries, and has a large presence in Europe, the Americas, Asia-Pacific and the emerging markets. In 2009, Deutsche Bank was the largest foreign exchangedealer in the world with a market share of 21 percent. [4] [5] The company is a component of the Euro Stoxx 50 stock market index. [6]

The bank offers financial products and services for corporate and institutional clients along with private and business clients. Deutsche Bank’s core business is investment banking, which represents 50% of equity, 75% of leverage assets and 50% of profits. [7] Services include sales, trading, research and origination of debt and equity; mergers and acquisitions (M&A); risk management products, such as derivatives, corporate finance, wealth management, retail banking, fund management, and transaction banking. [8]

On 7 June 2015, the then co-CEOs, Juergen Fitschen and Anshu Jain, both offered their resignations [9] to the bank's supervisory board, which resignations were accepted. Anshu Jain's resignation took effect on 30 June 2015, but he provided consultancy to the bank until January 2016. Juergen Fitschen temporarily continued as joint CEO until 19 May 2016. The appointment of John Cryan as joint CEO was announced, effective 1 July 2015; he became sole CEO at the end of Juergen Fitschen's term.

In January 2014 Deutsche Bank reported a €1.2 billion ($1.6 billion) pre-tax loss for the fourth quarter of 2013. This came after analysts had predicted a profit of nearly €600 million, according to FactSet estimates. Revenues slipped by 16% versus the prior year. [10]

In January 2016, Deutsche Bank pre-announced a 2015 loss before income taxes of approximately EUR 6.1 billion and a net loss of approximately EUR 6.7 billion. [11] Following this announcement, a bank analyst at Citi declared: "We believe a capital increase now looks inevitable and see an equity shortfall of up to €7 billion, on the basis that Deutsche may be forced to book another €3 billion to €4 billion of litigation charges in 2016." [7]

According to the Scorpio Partnership Global Private Banking Benchmark 2014 [12] the company had US$384.1bn of assets under management, an increase of 13.7% on 2013. [12]

https://en.wikipedia.org/wiki/Deutsche_Bank

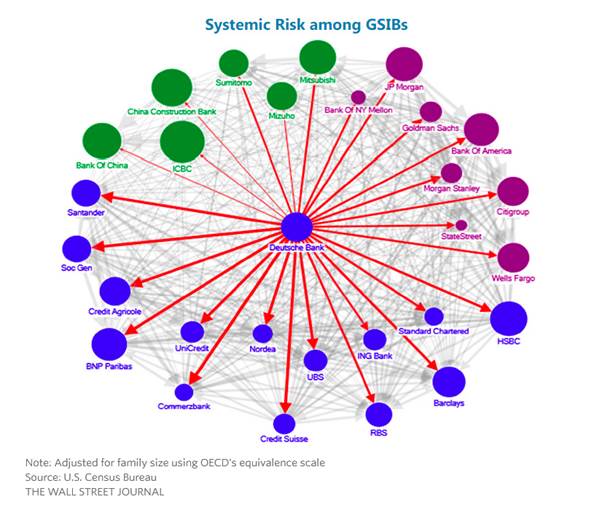

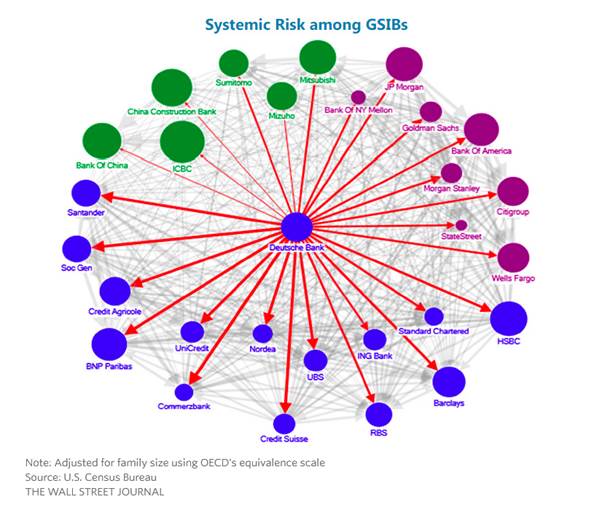

Study the vast and Massive interconnectedness of DB with all of the Large global banks and remember that Credit Suisse has problems as does GS ,WFC (which failed the recent US governemnt living will test) JPM

and of course, the Chinese Banking and Supremely Massive shadow banking system which teeters back and forth in a deflationary downdraft.

---------

and to end on an upbeat note right now with our abdundant liquidity the near term view for US stocks and financial assets is constructive with a real chance for a rush of money on the side to create a buying panic and higher stock prices and an uptick in the IPO and M and A areas.

we'll continue to monitor the market as it goes through it's never ending cyclical swings between Fear and Greed.

see how DB is making new all time lows very ominous.... as are many other major European banks.

JJP |

|