Strategic Metals (SMD-V)

Doug Eaton is now the president of Strategic Metals. (SMD-V) The company has some 120 wholly-owned projects in the Yukon. They have six joint ventures and have royalty interests in six more projects. They have an embarrassment of riches including over $20 million in cash and over $33 million in shares of other companies as of last Friday. They have a market cap of $54 million and have $53 million in tangible assets. There isn’t what you might call a lot of risk in buying the shares at this price.

But Strategic Metals has one giant problem. No one has ever heard of them even though they are the biggest landowners in the Yukon and are run by the guy who used to stable Sargent Preston’s horse when he was a child. Doug Eaton practically invented the Yukon.

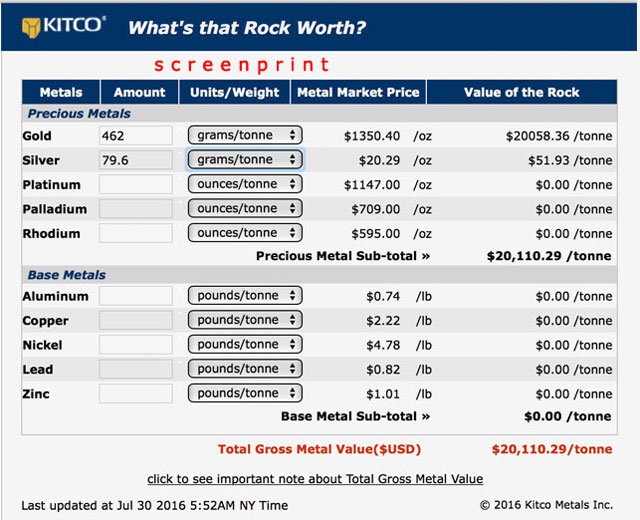

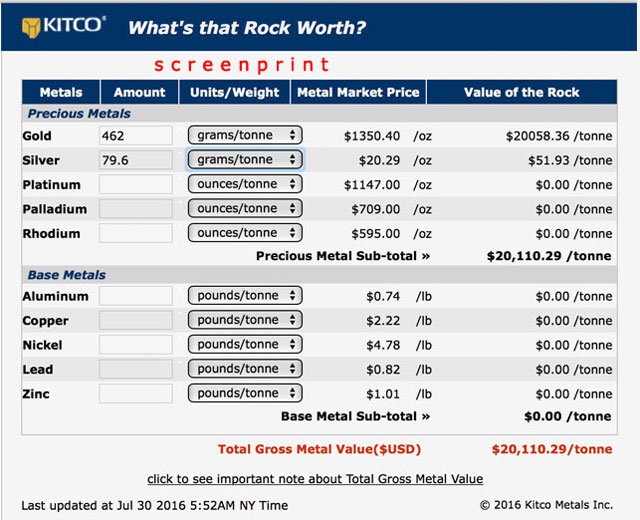

On Thursday last Strategic Metals released a press release talking about their Hartless Joe project. The highest-grade chip sample was 462 grams gold and 79.6 grams silver over .40 meters. I plugged those values into the Kitco program that generates value of metals in rocks and was astounded. Could $20,000 rock be possible?

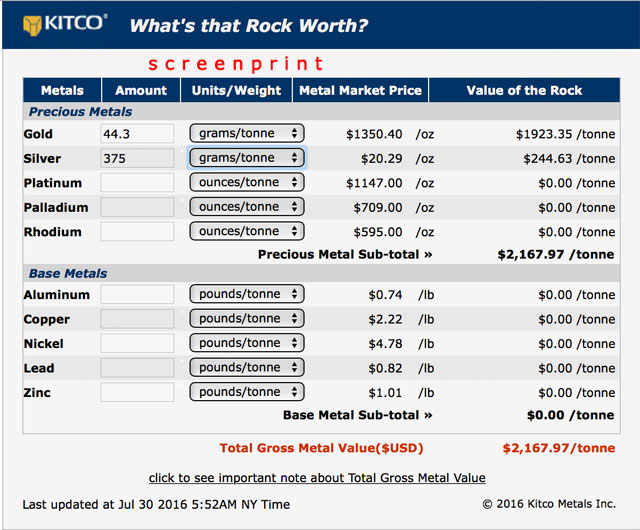

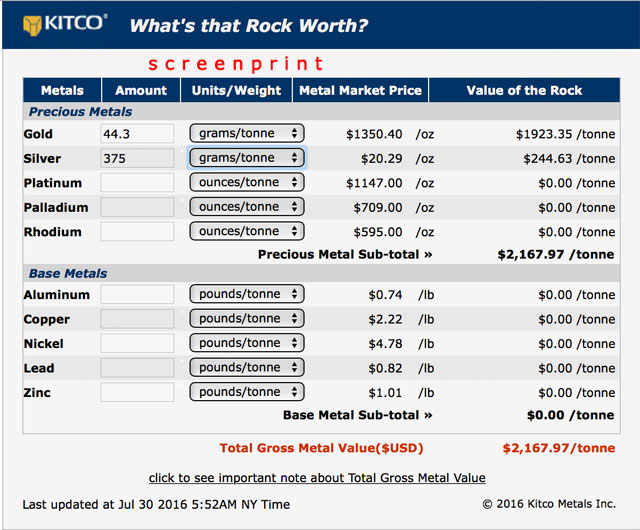

For those skeptics in the crowd who want to point out that the sample was only .4 of a meter, I will point out that while perfectly true, it’s also perfectly meaningless because while .4 of a meter isn’t particularly minable, 2.10 meters is. Another chip sample taken from the King zone showed 44.3 grams gold and 375 grams silver over 2.1 meters and that’s a bonanza value of $2,167 of rock.

Remember when I said that Strategic Metals has one giant problem of being way below the radar? Well, on Friday after the press release came out, the stock went down a penny. Sigh.

Chip samples are pretty meaningless. They give a company a sniff of what might be around but by themselves, they are meaningless. The real valuable data comes from the truth detector, the diamond drill. So while Hartless Joe is showing some interesting signs of life, we need to wait all the way to August when drilling is scheduled to commence at Hartless Joe.

Doug Eaton believes the project is similar to Eskay Creek. That’s both true and not true. Eskay Creek was a high-grade VMS deposit with hole 109 showing 5 ounces gold. Hartless Joe appears to be a high-grade epithermal gold/silver deposit. VMS deposits are almost always rich but epithermal deposits can range from meaningless to bonanza. 15 ounce gold over .4 of a meter is beyond bonanza grade.

Strategic Metals is an interesting company for a whole bunch of reasons. While many stocks are up 500% this year Strategic have barely budged being up only about 100% from January. That’s good for you. The company is near riskless, holding cash and shares equal to their market cap. I don’t expect that to last long. And ignoring the other 119 properties they have available to option, Hartless Joe doesn’t seem all that heartless. Hartless Joe seems like it might be a home run out of the park and only the drill results will tell the tale.

Doug Eaton is beyond just a lifesaver. He has more knowledge of the Yukon than anyone in Canada. I think their idea of spending a little of their own money this year at Hartless Joe is brilliant. Now all they need is some drill results that match the chip samples and someone to tell the tale.

When I talked to Doug a month ago and learned that they had cash and shares equal to their market cap, I immediately bought some shares. SMD is an advertiser. Their website is well done and as is pretty unusual in the industry, it’s actually up to date. I encourage any potential share buyers to do their own due diligence.

###

Strategic Metals Ltd

SMD-V $.63 (Jul 29, 2016)

SMDZF-OTCQX 86.8 million shares

Bob Moriarty

President: 321gold

Read in full 321gold.com |