"IMO the market is trying to decide between hyper-deflation and hyper-inflation..."

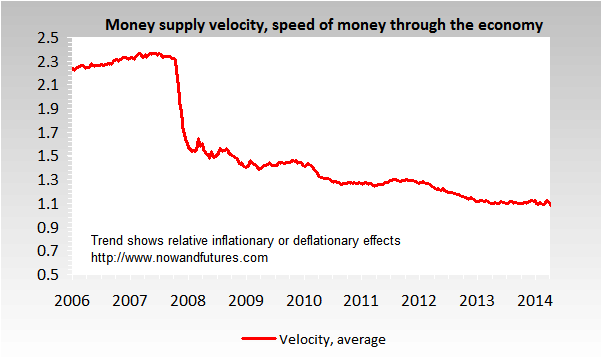

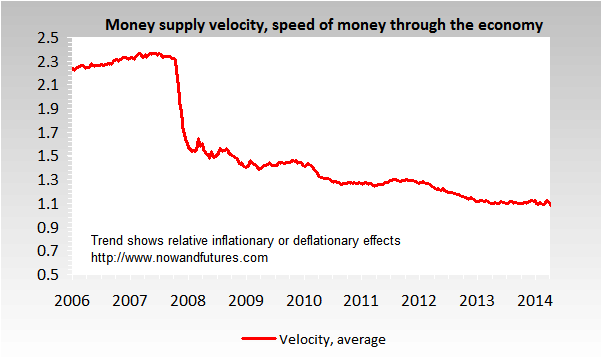

I can't see that the market is at all anticipating hyper-inflation at this time. I say that because the precious metals best associated with an increasing "velocity of money" (aka, speed of money), platinum and other PGEs, continue their out-of-sinc relationship to gold and silver, and in the longest such event in history, by far.

As an increasing speed of money is within the definition of inflation, we don't have it even on the horizon (for now).

The above chart is a bit out of date, but data would suggest the present picture isn't any better, looking at an even wider distances between average gold/silver prices v. PGEs.

Deflation and/or hyper-deflation are possible, but I think we will see "stagflation", perhaps even an extended period of it first. This means, of course, a lot of things will get more expensive, but jobs and standards of living will suffer. Meanwhile, those best positioned for this will make a killing.

Just how I see things now, but everything is subject to change.

VP in AZ |