Hi Jim,

This article covers it quite well:

EBITDA to net debt is 5.7x.Is The Dividend Safe?

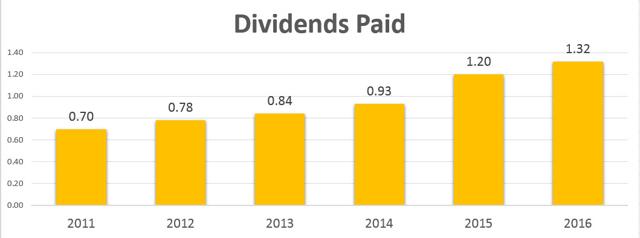

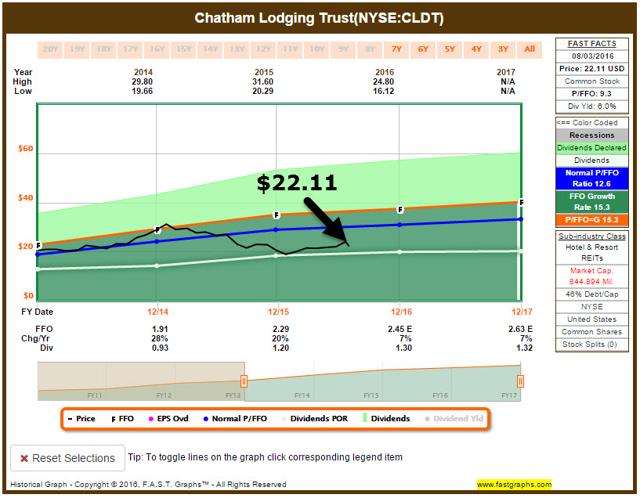

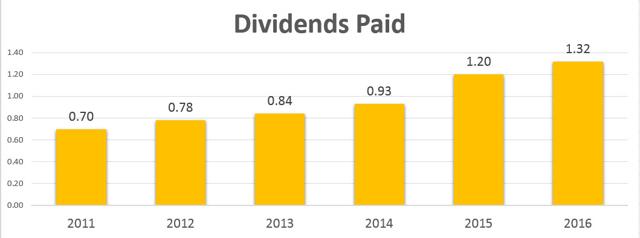

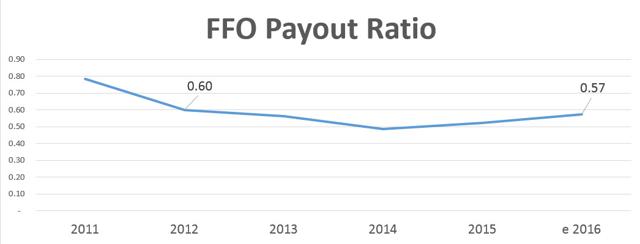

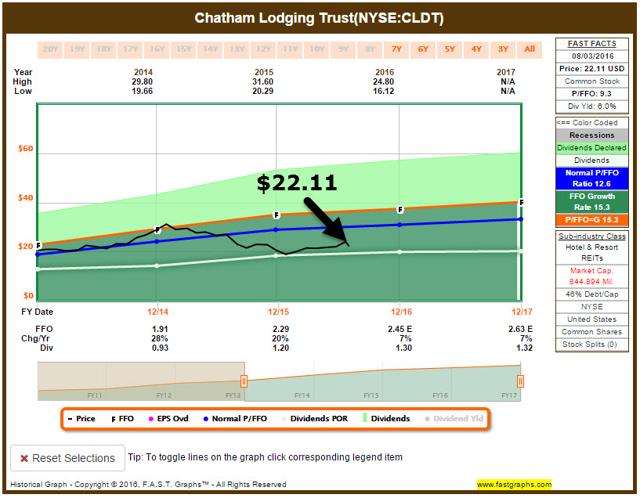

CLDT's monthly dividend of $0.11/share or $1.32 on an annualized basis, which equates to a 6.0% current dividend. Since the company went public in 2011, it has paid and increased dividends annually.

Click to enlarge Click to enlarge

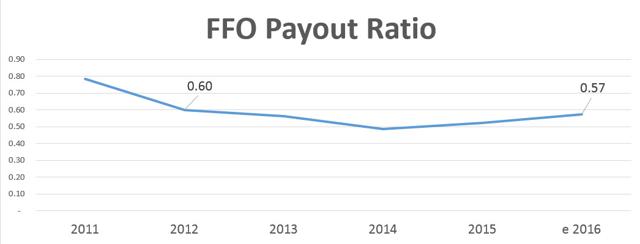

CLDT's payout ratio is safe and it appears that the company is not in jeopardy of a dividend cut.

Click to enlarge Click to enlarge

The Conundrum With Chatham

Today, I had quite a few emails from readers and subscribers asking whether or not I was going to modify my recommendation. I had heard there were one or two downgrades - all tied to the negative sentiment and slowdown in corporate business travel.

After digging deeper into the numbers, I became fixated on the economic drivers more so than CLDT's fundamental metrics.

The good news for CLDT is that occupancy is not down, the company has been able to maintain occupancy year over year at a very high occupancy rate of 86%. The real takeaway with CLDT is that in the second quarter the company produced ADR of $164 (and an occupancy rate of 86%).

So the problem with CLDT is not occupancy, it is that the company was not able to drive a meaningful increase in ADR due primarily to the following reasons.

New supply in gateway urban markets lower GDP growth which is impacting business travel.

Business travel trends have been soft in 2016 and that trend is likely to continue for the balance of 2016. GDP growth has been moderate at best as corporate profits are mixed and this ultimately restricts corporate travel.

Click to enlarge Click to enlarge

What are the catalysts?

That's a tough question. Overall, the biggest driver for the Chatham shareholder is GDP growth. When the economy picks up steam, hotel profits will follow.

I don't see any near-term catalysts. This stock is tied directly to the economy, so it will be difficult to forecast returns until there is a return to normalcy relative to corporate business spending.

In short, I wish I had a better answer. CLDT does have some room to manage margins and the dividend is safe. I am NOT downgrading shares at this time; however, I am taking a more cautious approach as I watch how CLDT focuses on asset management over the next few quarters.

There are many forces that could drive shares up or down, and given the political environment we are in right now, I think it's important to maintain error on the side of caution. CLDT is one of two Lodging REITs that we have a BUY rating on and we will continue to monitor the stock and wish for better GDP results.

Longer term, we believe there is upside to holding shares in Chatham. This is a value play and I believe as the business climate improves Chatham is well positioned to benefit from its core limited-service focus.

The greatest risk in my view centers on general economic conditions in the US., specifically concerning business and recreational travel, overall economic growth, consumer confidence, enplanement levels, GDP and employment growth, and demand. These risks are much harder to quantify, but if you are tempted by the yield and discounted price, it may be time to check into Chatham.

Click to enlarge Click to enlarge

The price is discounted 35% from recent highs - it has a value and the dividend is safe at 7.0%.

That's huge these days.

I have a long term view if I'm lucky enough o buy the stock in a 16.00 to 19,00 price range. so far I've sold the 20.00 puts at 1.30 and 1.35 next sale will be 1.50 or a buy in February @ 18.50 and yields of 7.14%.

Hoping to get 1.50 on the 17.50s - that would be touching the past previous low @ 16.12 back on jan 15th |

Click to enlarge

Click to enlarge Click to enlarge

Click to enlarge Click to enlarge

Click to enlarge Click to enlarge

Click to enlarge