| | | The Bank Review Three Months After Brexit - Part 2

Greg Schnell | September 23, 2016 at 01:11 PM

This is a continuation of the article: " The Bank Review Three Months After Brexit" Click on the link to read it first.

In hindsight, Brexit injected fear into the market and the market has rallied hard for three months. Let's zoom in on some of the banks close to the issue.

HSBC is one of the world's largest banks residing in the UK. With an SCTR ranking of 86.7, it is in the top quartile for large-cap price performance now. We can see the highs of $49 and $48 in 2013 and 2014 have created a ceiling for the stock but this level is a long way away from the current price. HSBC really jumped off the 4-year lows. As the stock is at a major resistance level, this is an important test for the stock. So far the stock broke out to a new high above $38.24 but then failed to hold it. That is not a positive.

Barclay's PLC (BCS) broke to 6-year lows with Brexit. Since then, it rallied along with the rest of the market. However, the stock is still trapped below the 40 WMA and there is a lot of wide-ranging, volatile weekly bars around the $9.00 level. The SCTR is 20.3 so this mega-cap is still one of the poorer performers in the large-cap space. The volume has a space-needle appearance through Brexit as it went ballistic and almost doubled anything seen since the financial crisis. The momentum is still well below zero on the MACD. For me, this really needs to stay above the $8.25 blue level.

Royal Bank of Scotland (RBS) is another large UK bank. The chart can best be described as abysmal at the Brexit low. However, this stock continues to look very weak. With the SCTR at 1.2, RBS has some of the worst price performance in the entire large-cap arena. Keep in mind, this is not just banks we are using for the SCTR calculation. This compares to the entire large-cap space with all nine sectors. RBS made highs back in 2014 and lost support in August 2015 when the US banking stocks were topping out. At this point, the stock is technically in free fall below $6. On this bounce, it was unable to hold above the $5.36 low. Gulp. This is an important time for the British-based banks. The MACD looks flat because of the size of the 2008 crash, but it is rolling over. You can click on these charts and shorten the period to a few years to get a better look.

Germany's largest bank, Deutsche Bank AG (DB) is not looking great. The SCTR ranking is 0.6, putting it in the worst 1% of the large caps. The cliff drop in 2007-2009 looks proportional to the rest of the chart, so I left it in. Earlier this year, Deutsche Bank AG took out the 2009 lows and Brexit Friday marked the lowest weekly close on the chart. Now we have tested the Brexit low twice and this week we made a marginally lower low. Yes, new 20 year lows on the US ticker symbol for this German bank. Notice the volume going ballistic on multiple weeks including this week.

The chart below is still for Deutsche Bank AG (DB) but I have zoomed in on the last 3 years. A very negative MACD has not given a fresh new sell signal by crossing the signal line, but does it matter? This chart is top left to bottom right. Not exactly the definition of an uptrend. This continued pressure on the Brexit low is very concerning. The volume candle is huge this week and highlights the vulnerability of this chart.

From Switzerland, we have Credit Suisse (CS). This makes the Matterhorn look like no big deal. The SCTR has improved to 33 from a level of 1 on the Brexit low. The momentum was very negative but now it has set up positive divergence. However, the stock is hitting resistance at the 40 WMA and there is a major resistance level at $15. This is where we would expect a rally to fail. The stock is around 50% of last years final high.

Looking closer to Club Med is a Spanish Bank, Santander (SAN). The SCTR of 31 is well of the Brexit low of 3 but this still suggests a weak stock. The Brexit price was a fresh 7 year low. While some rally is expected in concert with the thrust across the markets, this stock is still making lower highs and lower lows. The MACD is already below zero for momentum. We'll see if it can get into positive territory.

Let's head over to the home of Euro 2016 and look at a French bank. BNP Paribas (BNPQY). With an SCTR of 54, we have a stock that is right around the middle of the pack. The stock had its lowest weekly close in 3 years on Brexit Friday. A series of lower lows and lower highs suggests a test of $14 could be coming, but there is some positive divergence showing on the MACD. At the Brexit low, the sell signal on the MACD looked like the direction would be lower. With this rally, some of the technicals have improved slightly, but this would need to start making higher highs and at least one higher low before we could get excited. Another positive is the break above the 40 WMA.

Credit Agricole (CRARY) is below. The SCTR has rallied to 28 so this is an improvement from the Brexit low. The stock had the lowest weekly close in three years on Brexit. There is support around $4.50 but this looks tentative. The MACD is making higher highs so that is an improvement.

The Industrial and Commerical Bank of China (IDCBY) is the largest state-owned bank in China. We don't track an SCTR for this stock. The price has rallied to the middle of the 5-year range. The rally was impressive, but this still does not look like a great stock to invest in. I am slightly more impressed as the MACD is above zero which is not the case with most of the Eurozone banks.

Lastly, I'll finish in Japan. Mitsubishi UFJ Financial Group (MTU) is the fourth largest bank in the world. With an SCTR of 77.3, it has one of the best SCTR scores we have seen. It is also creating a series of higher highs and higher lows. It is currently above the orange support / resistance line and has found support on the 40 WMA. The MACD is right around the zero level so we will be watching to see if it can actually get some positive momentum going.

The bottom line:

These charts are bouncing off the Brexit low. Many of them have hit some form of resistance. A few are above the resistance level. What is concerning are the RBS, CS and DB charts. Making a new low on the DB chart is really not encouraging.

No banker will hold up an exit sign on their stock, but collectively as a group, these stocks are a continuing area of potential global risk. Only a few had an SCTR above 50.

Feel free to pass this article on to friends and family. Feel free to comment below. If you would like to receive future articles by email, click on the Yes button below. I do roughly one-two articles a week from each blog ( Commodities Countdown, The Canadian Technician, Don't Ignore This Chart) so you need to subscribe to each one individually. I also do a couple of webinars each week and you can view those live or in our webinar archives.

If you are looking for someone to tell you when to be cautious, this is still the time. That does not mean sell everything. It does mean make sure you are only in the strongest stocks to support your dividends and minimize downside risk.

--------------------------------------

| To: John P who wrote (18331) | 7/18/2016 2:32:58 AM | | From: John P | 4 Recommendations Read Replies (1) of 18402 | | |

Charting The Epic Collapse Of The World's Most Systemically Dangerous Bank

by Tyler Durden

Jul 9, 2016 8:15 PM

154

SHARES

Twitter Facebook Reddit

It’s been almost 10 years in the making, but the fate of one of Europe’s most important financial institutions appears to be sealed.

After a hard-hitting sequence of scandals, poor decisions, and unfortunate events, Visual Capitalist's Jeff Desjardins notes that Frankfurt-based Deutsche Bank shares are now down -48% on the year to $12.60, which is a record-setting low.

Even more stunning is the long-term view of the German institution’s downward spiral.

With a modest $15.8 billion in market capitalization, shares of the 147-year-old company now trade for a paltry 8% of its peak price in May 2007.

Courtesy of: Visual Capitalist

THE BEGINNING OF THE ENDIf the deaths of Lehman Brothers and Bear Stearns were quick and painless, the coming demise of Deutsche Bank has been long, drawn out, and painful.

In recent times, Deutsche Bank’s investment banking division has been among the largest in the world, comparable in size to Goldman Sachs, JP Morgan, Bank of America, and Citigroup. However, unlike those other names, Deutsche Bank has been walking wounded since the Financial Crisis, and the German bank has never been able to fully recover.

It’s ironic, because in 2009, the company’s CEO Josef Ackermann boldly proclaimed that Deutsche Bank had plenty of capital, and that it was weathering the crisis better than its competitors.

It turned out, however, that the bank was actually hiding $12 billion in losses to avoid a government bailout. Meanwhile, much of the money the bank did make during this turbulent time in the markets stemmed from the manipulation of Libor rates. Those “wins” were short-lived, since the eventual fine to end the Libor probe would be a record-setting $2.5 billion.

The bank finally had to admit that it actually needed more capital.

In 2013, it raised €3 billion with a rights issue, claiming that no additional funds would be needed. Then in 2014 the bank head-scratchingly proceeded to raise €1.5 billion, and after that, another €8 billion.

A SERIES OF UNFORTUNATE EVENTSIn recent years, Deutsche Bank has desperately been trying to reinvent itself.

Having gone through multiple CEOs since the Financial Crisis, the latest attempt at reinvention involves a massive overhaul of operations and staff announced by co-CEO John Cryan in October 2015. The bank is now in the process of cutting 9,000 employees and ceasing operations in 10 countries. This is where our timeline of Deutsche Bank’s most recent woes begins – and the last six months, in particular, have been fast and furious.

Deutsche Bank started the year by announcing a record-setting loss in 2015 of €6.8 billion.

Cryan went on an immediate PR binge, proclaiming that the bank was “rock solid”. German Finance Minister Wolfgang Schäuble even went out of his way to say he had “no concerns” about Deutsche Bank.

Translation: things are in full-on crisis mode.

In the following weeks, here’s what happened:

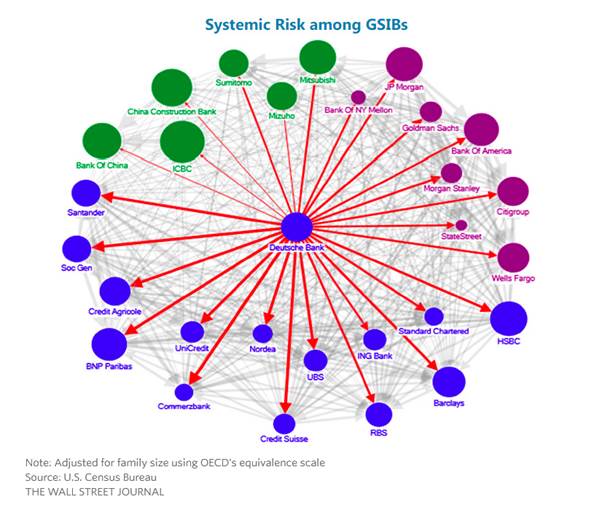

May 16, 2016: Berenberg Bank warns that DB’s woes may be “insurmountable”, noting that DB is more than 40x levered.June 2, 2016: Two ex-DB employees are charged in ongoing U.S. Libor probe for rigging interest rates. Meanwhile, the UK’s Financial Conduct Authority says there are at least 29 DB employees involved in the scandal.June 23, 2016: Brexit decision hits DB hard. The bank is the largest European bank in London and receives 19% of its revenues from the UK.June 29, 2016: IMF issues statement that “DB appears to be the most important net contributor to systematic risks”.June 30, 2016: Federal Reserve announces that DB fails Fed stress test in US, due to “poor risk management and financial planning”.Doesn’t sound “rock solid”, does it?

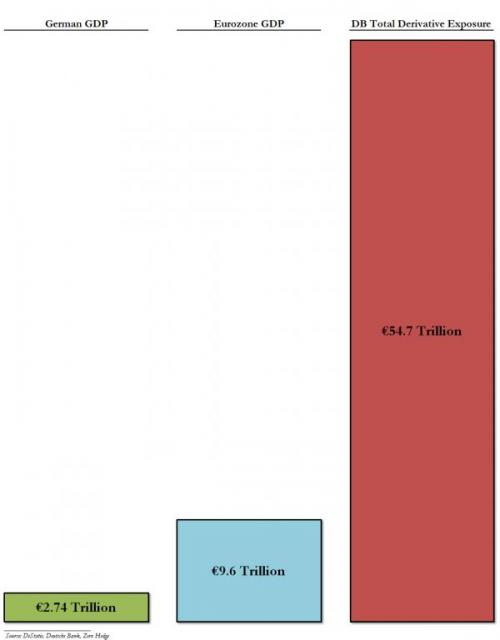

Now the real question: what happens to Deutsche Bank’s derivative book, which has a notional value of €52 trillion, if the bank is insolvent?

Source: Visual Capitalist |

| |

Message 30654786

--------------------------------------

|

| |

(editorial note by JJP DB, CS,RBS, LYG, UBS.... WFC all have some balance sheet problems... The Chinese Banks are very very likely in much poorer condition than their charts indicate.... We have Already had a structural rise in LIBOR and Janet Yellen and her CB counterparts have been trying to keep the bubble going with very Low rates however the Bond Markets from Japan to Europe to the US at least from the long end of hte curve saying that a change Maybe coming at us much faster than realized. JJP)

http://stockcharts.com/articles/commodities/2016/09/the-bank-review-three-months-after-brexit---part-2.html

------------------------------------

| To: John P who wrote (18330) | 7/13/2016 11:08:26 AM | | From: John P | 5 Recommendations Read Replies (1) of 18402 | | | the leverage on Deutsche Bank is around 40:1, but was "only" 31:1 for Lehman Brothers

Deusche Bank is twenty times larger and more Critical to the Global Fiancial system than Lehman Brothers was.

Deusche Bank is the Worlds Largest Foreign Exchange Dealer in the World with a market share of 21 %. Foreign Exchange is the Worlds Largest Financial Market with over 5 Trillion dollars traded every day. The Derivative products the DB, JPM, GS Barclay's BAC, C, WFC are many more Trillion. The CDS, CDO, CLO's and other huger derivative products.

It dwarfs the puny puttering of the Market Capitalization of FB, AMZN, NFLX, AAPL, GOOGL.... and in fact the SPX.

The German Governent is about 10 times more solvent than the 178 Trillion unfunded liabilities of the US looking out to 2033. Japan The UK and the EU are similarly faced with unsustainable debt to GDP ratio's. When we come out of Negative Interest rates.

when evaluating the US stock market valuations on the basis of potential futures earnings or the metric of dividend yield relative to US ten year note yields puts an investor in the type of blinders that they use on race horses so they can not see 95% of what is going on at the race track and can only see to the racing stall which is where the horse belongs.

it is necessary in today's global Capital Markets and Speed of Light Global Capital flows to develop an understanding of a Holistic Approach where the impacts of these various related, FX, Debt, Fixed Income, Equity, Real Estate, Art and Collectibles all function in unision... much as our global ecosystem and the human body is made up of multiple components, which collectively provide us with our overall state of health and wellness.

Deutsche Bank AG (literally "German Bank"; pronounced ['d???t??? 'ba?k ?a?'ge?]) (  listen ( help· info)) is a German global banking and financial services company with its headquarters in the Deutsche Bank Twin Towers in Frankfurt. It has more than 100,000 employees in over 70 countries, and has a large presence in Europe, the Americas, Asia-Pacific and the emerging markets. In 2009, Deutsche Bank was the largest foreign exchangedealer in the world with a market share of 21 percent. [4] [5] The company is a component of the Euro Stoxx 50 stock market index. [6] listen ( help· info)) is a German global banking and financial services company with its headquarters in the Deutsche Bank Twin Towers in Frankfurt. It has more than 100,000 employees in over 70 countries, and has a large presence in Europe, the Americas, Asia-Pacific and the emerging markets. In 2009, Deutsche Bank was the largest foreign exchangedealer in the world with a market share of 21 percent. [4] [5] The company is a component of the Euro Stoxx 50 stock market index. [6]

The bank offers financial products and services for corporate and institutional clients along with private and business clients. Deutsche Bank’s core business is investment banking, which represents 50% of equity, 75% of leverage assets and 50% of profits. [7] Services include sales, trading, research and origination of debt and equity; mergers and acquisitions (M&A); risk management products, such as derivatives, corporate finance, wealth management, retail banking, fund management, and transaction banking. [8]

On 7 June 2015, the then co-CEOs, Juergen Fitschen and Anshu Jain, both offered their resignations [9] to the bank's supervisory board, which resignations were accepted. Anshu Jain's resignation took effect on 30 June 2015, but he provided consultancy to the bank until January 2016. Juergen Fitschen temporarily continued as joint CEO until 19 May 2016. The appointment of John Cryan as joint CEO was announced, effective 1 July 2015; he became sole CEO at the end of Juergen Fitschen's term.

In January 2014 Deutsche Bank reported a €1.2 billion ($1.6 billion) pre-tax loss for the fourth quarter of 2013. This came after analysts had predicted a profit of nearly €600 million, according to FactSet estimates. Revenues slipped by 16% versus the prior year. [10]

In January 2016, Deutsche Bank pre-announced a 2015 loss before income taxes of approximately EUR 6.1 billion and a net loss of approximately EUR 6.7 billion. [11] Following this announcement, a bank analyst at Citi declared: "We believe a capital increase now looks inevitable and see an equity shortfall of up to €7 billion, on the basis that Deutsche may be forced to book another €3 billion to €4 billion of litigation charges in 2016." [7]

According to the Scorpio Partnership Global Private Banking Benchmark 2014 [12] the company had US$384.1bn of assets under management, an increase of 13.7% on 2013. [12]

https://en.wikipedia.org/wiki/Deutsche_Bank

Study the vast and Massive interconnections of DB with all of the Large global banks and remember that Credit Suisse has problems as does GS ,WFC (which failed the recent US government living will test) JPM

and of course, the Chinese Banking and Supremely Massive shadow banking system which teeters back and forth in a deflationary downdraft.

---------

and to end on an upbeat note right now with our abdundant liquidity the near term view for US stocks and financial assets is constructive with a real chance for a rush of money on the side to create a buying panic and higher stock prices and an uptick in the IPO and M and A areas.

we'll continue to monitor the market as it goes through it's never ending cyclical swings between Fear and Greed.

see how DB is making new all time lows very ominous.... as are many other major European banks.

JJP |

|

|