| | |

|

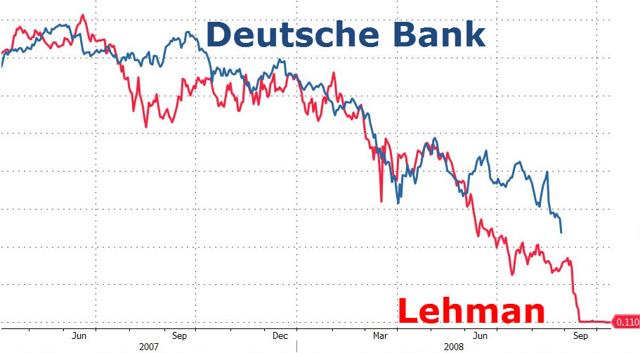

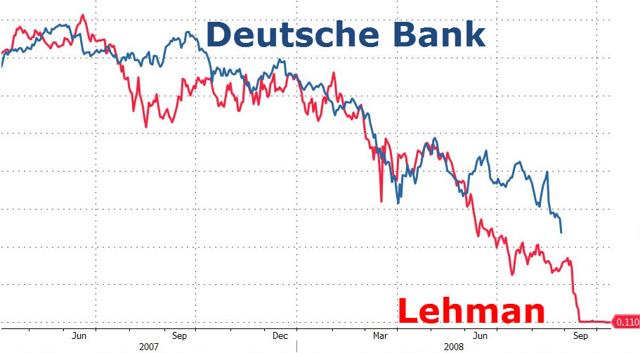

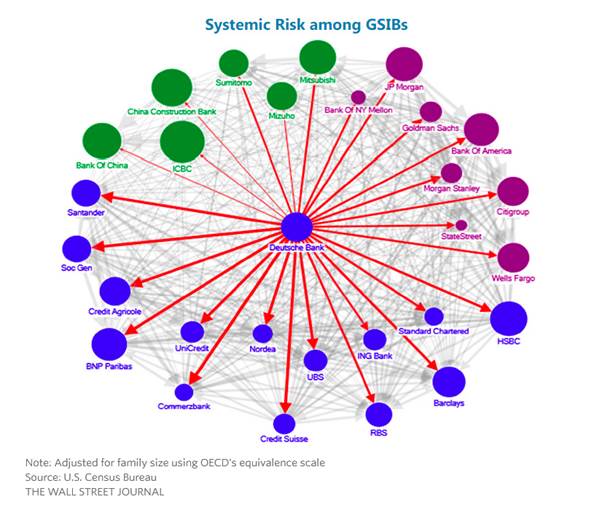

| | | the leverage on Deutsche Bank is around 40:1, but was "only" 31:1 for Lehman Brothers

It will be ironic if Deutsche Bank is responsible for blowing up the Euro Currency system

Deusche Bank is twenty times larger and more Critical to the Global Fiancial system than Lehman Brothers was.

Deusche Bank is the Worlds Largest Foreign Exchange Dealer in the World with a market share of 21 %. Foreign Exchange is the Worlds Largest Financial Market with over 5 Trillion dollars traded every day. The Derivative products the DB, JPM, GS Barclay's BAC, C, WFC are many more Trillion. The CDS, CDO, CLO's and other huger derivative products.

It dwarfs the puny puttering of the Market Capitalization of FB, AMZN, NFLX, AAPL, GOOGL.... and in fact the SPX.

The German Governent is about 10 times more solvent than the 178 Trillion unfunded liabilities of the US looking out to 2033. Japan The UK and the EU are similarly faced with unsustainable debt to GDP ratio's. When we come out of Negative Interest rates.

when evaluating the US stock market valuations on the basis of potential futures earnings or the metric of dividend yield relative to US ten year note yields puts an investor in the type of blinders that they use on race horses so they can not see 95% of what is going on at the race track and can only see to the racing stall which is where the horse belongs.

it is necessary in today's global Capital Markets and Speed of Light Global Capital flows to develop an understanding of a Holistic Approach where the impacts of these various related, FX, Debt, Fixed Income, Equity, Real Estate, Art and Collectibles all function in unision... much as our global ecosystem and the human body is made up of multiple components, which collectively provide us with our overall state of health and wellness.

Deutsche Bank AG (literally "German Bank"; pronounced ['d???t??? 'ba?k ?a?'ge?]) (  listen ( help· info)) is a German global banking and financial services company with its headquarters in the Deutsche Bank Twin Towers in Frankfurt. It has more than 100,000 employees in over 70 countries, and has a large presence in Europe, the Americas, Asia-Pacific and the emerging markets. In 2009, Deutsche Bank was the largest foreign exchangedealer in the world with a market share of 21 percent. [4] [5] The company is a component of the Euro Stoxx 50 stock market index. [6] listen ( help· info)) is a German global banking and financial services company with its headquarters in the Deutsche Bank Twin Towers in Frankfurt. It has more than 100,000 employees in over 70 countries, and has a large presence in Europe, the Americas, Asia-Pacific and the emerging markets. In 2009, Deutsche Bank was the largest foreign exchangedealer in the world with a market share of 21 percent. [4] [5] The company is a component of the Euro Stoxx 50 stock market index. [6]

The bank offers financial products and services for corporate and institutional clients along with private and business clients. Deutsche Bank’s core business is investment banking, which represents 50% of equity, 75% of leverage assets and 50% of profits. [7] Services include sales, trading, research and origination of debt and equity; mergers and acquisitions (M&A); risk management products, such as derivatives, corporate finance, wealth management, retail banking, fund management, and transaction banking. [8]

On 7 June 2015, the then co-CEOs, Juergen Fitschen and Anshu Jain, both offered their resignations [9] to the bank's supervisory board, which resignations were accepted. Anshu Jain's resignation took effect on 30 June 2015, but he provided consultancy to the bank until January 2016. Juergen Fitschen temporarily continued as joint CEO until 19 May 2016. The appointment of John Cryan as joint CEO was announced, effective 1 July 2015; he became sole CEO at the end of Juergen Fitschen's term.

In January 2014 Deutsche Bank reported a €1.2 billion ($1.6 billion) pre-tax loss for the fourth quarter of 2013. This came after analysts had predicted a profit of nearly €600 million, according to FactSet estimates. Revenues slipped by 16% versus the prior year. [10]

In January 2016, Deutsche Bank pre-announced a 2015 loss before income taxes of approximately EUR 6.1 billion and a net loss of approximately EUR 6.7 billion. [11] Following this announcement, a bank analyst at Citi declared: "We believe a capital increase now looks inevitable and see an equity shortfall of up to €7 billion, on the basis that Deutsche may be forced to book another €3 billion to €4 billion of litigation charges in 2016." [7]

According to the Scorpio Partnership Global Private Banking Benchmark 2014 [12] the company had US$384.1bn of assets under management, an increase of 13.7% on 2013. [12]

https://en.wikipedia.org/wiki/Deutsche_Bank

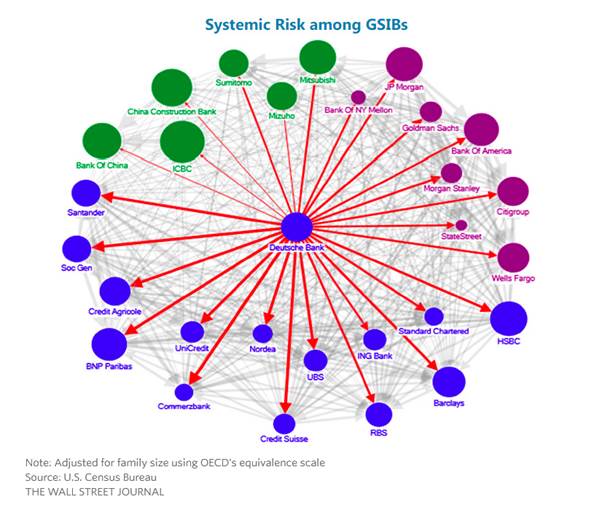

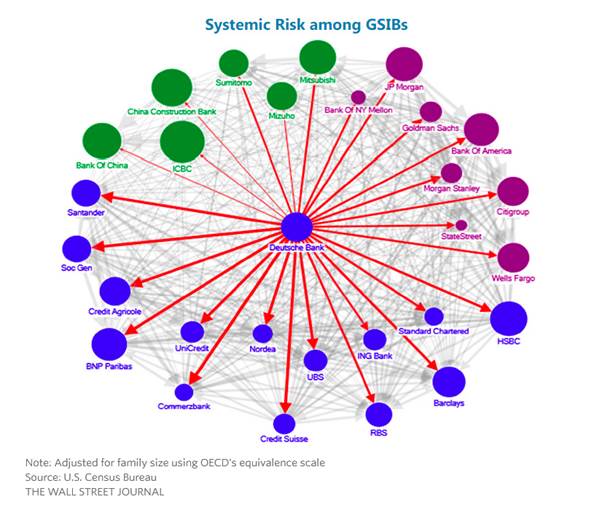

Study the vast and Massive interconnectedness of DB with all of the Large global banks and remember that Credit Suisse has problems as does GS ,WFC (which failed the recent US governemnt living will test) JPM

and of course, the Chinese Banking and Supremely Massive shadow banking system which teeters back and forth in a deflationary downdraft.

---------

and to end on an upbeat note right now with our abdundant liquidity the near term view for US stocks and financial assets is constructive with a real chance for a rush of money on the side to create a buying panic and higher stock prices and an uptick in the IPO and M and A areas.

we'll continue to monitor the market as it goes through it's never ending cyclical swings between Fear and Greed.

see how DB is making new all time lows very ominous.... as are many other major European banks.

Message 30658642

JJP

-------------------------------

| To: Chip McVickar who wrote (18322) | 7/13/2016 10:24:53 AM | | From: John P | 4 Recommendations Read Replies (1) of 18402 | | | The Financial System-Government Nexus: Source Of Economic Contagion

Jul. 12, 2016 10:38 AM ET

Kevin Wilson

Summary

The European banking crises of 2008 and 2012 were never fully resolved, and now a new crisis has begun that threatens to take down the system again.

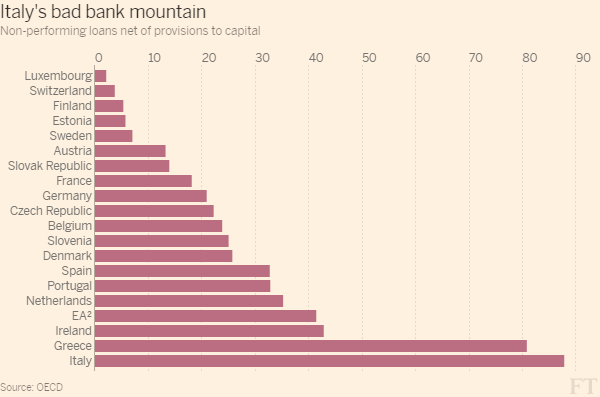

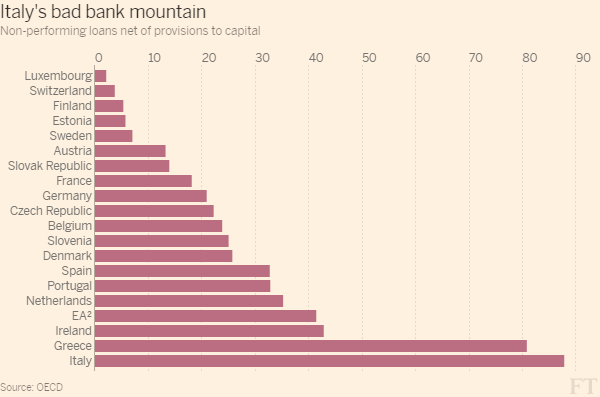

In spite of lessons supposedly learned in 2008, we observe many examples of "extend and pretend" loans and high leverage in Europe, with still-high NPLs to boot.

The powers-that-be still favor bailouts whenever needed, but do not favor meaningful reforms; this has permitted shadow banks and TBTF banks to continue their bad practices.

Banks and their shadow banking brothers haven't been exposed to true market discipline, so they live on as zombies, saved by the very interconnectedness that threatens the system.

Investors should stay defensive, holding bonds (TLT, BIV, IEF, BOND, AGG), defensive sector funds (USMV, SPLV), liquid alternatives (OTCRX, QLENX, QMNIX), and CEF hedge-like strategies (BXMX).

The Brexit vote has had some fairly impressive knock-on effects in Europe. One of the main market effects has been the huge sell-off in banking stocks throughout Europe (Charts 1 and 2). It certainly seems like Warren Buffett's dictum about the tide going out and letting us see who's swimming naked is in full operation here. There have been a number of authors who have noted that the European banking crises of 2008 and 2012 were never fully resolved. For example, Mehreen Khan has written in the Financial Times that many European economies and their respective banking systems did not ever recover from the 2008 crisis. Many eurozone banks continue to have very high non-performing loans (NPLs; cf. Chart 3).

Chart 1: The Demise of the Oldest Bank in the World

Source: businessinsider.com

Chart 2: The Shocking 2015-2016 Decline of DB Compared to Lehman Brothers

Source: zerohedge.com

Chart 3: Very High NPLs in More Than A Dozen EU Countries

Source: ft.com

The ECB is again allowing the deferral of risk weightings on sovereign debt, according to Rupert Hargreaves of the ValueWalk blog. This means that once again, eurozone banks can load up on relatively high-yielding Spanish and Portuguese debt using cheap funding from the ECB, all the while treating these somewhat doubtful securities as risk-free, and thus using them to cut their reserve requirements.(editorial note by JJP.... the spanish, Portuguese and Italian banks are loading their balance sheet with bogus bullshit junk loans and bonds, and it's being financed for free by the ECB.... which does not care about the zombie crap bogus investments and loans they are keeping alive because that is what the Central Bankers are doing since this crony crooked "capitalism" is enabling the "authorities" to get away with.

and we have 2 generations of investors that have been psychologically conditioned that there is no significant risk in risk assets...due to a childlike belief in Santa Claus .... ie our friendly Central Bankers who have guaranteed a "put" under stocks and risk asset prices.)

We also observe many examples of "extend and pretend" loan refinancing in many countries around the world, including the US and China. These accommodations, especially when they involve sovereign debt, are convenient in the short run, but they join governments and banks at the hip; there can be little doubt that they will eventually share the same fate.

This kind of thinking has gone so far now that even Greek debt is considered adequate collateral for ECB funding. ( LOL).... ( Ha Ha Ha) This allows Greek lenders to pledge junk-rated sovereign debt against ECB funding, according to Jana Randow and Nikos Chrysoloras of Bloomberg. The ECB is also apparently ready to allow senior tranches of hypothetical securitized Italian NPLs to be used as collateral for ECB funding, should that be needed. This is a fairly shocking replay of the kinds of things done by Bernanke's Federal Reserve during the height of the 2008 crisis. It is fair to say that we are again in a European banking crisis, and what happens next is critical to our economic health.

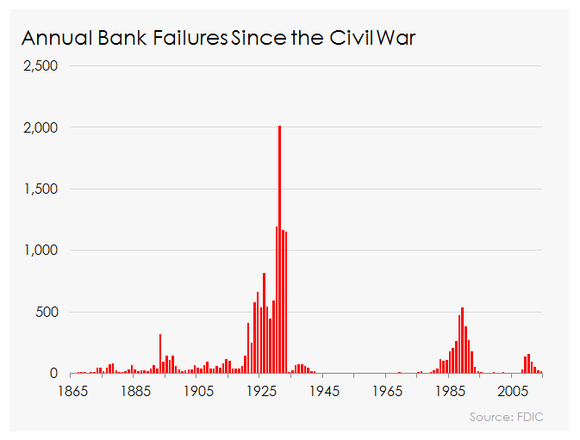

What is amazing to me is the fact that despite massive evidence of poor management and widespread, systematic law-breaking, very few banks in Europe are being allowed to fail. The same thing happened in the US during and since the 2008 crisis; indeed, hundreds of small banks failed, but very few big ones. Yet trillions of dollars were required to bail out or buy out large US banks in 2007-2009. Admittedly, many of the 2008 bailouts didn't even involve real banks, as the mostly unregulated shadow banking system allowed brokers, investment banks, and insurance companies to get in so much trouble that they ended up being bailed out (just like banks) by the Fed and the Treasury. This demonstrated a critical need for reform, but in essence little has actually been done to rein in shadow banking anywhere.

As I have stated elsewhere, no central bank seems inclined to actually follow the standards of Bagehot's (1873) Rule, i.e., to lend only to solvent banks, on good collateral, at a premium interest rate. By doing the opposite of Bagehot's Rule, first the Fed in 2008, and then the ECB in 2012, and now the ECB again in 2016, have essentially abandoned capitalism. Or rather, they have simply confirmed that their long-term negligent supervision of banks, their complete ignorance of shadow banking, and the variousunconstitutional measures they've undertaken to save TBTF banks in the last few years have together long since signaled the end of their support of capitalism. The fiscal authorities in every case seem not only to have backed up their respective central banks on this, they've actively promoted this undisciplined ad hoc decision-making process, at almost any cost. This is not a universal failing, as evidenced by what happened in Iceland over the last few years, but it is nearly so.

This ends up meaning that because of circumstances that tend to develop in a financial crisis, any thought of proper financial discipline or prudent action tends to be abandoned by the authorities in the name of expediency. There are no principles guiding the technocrats who make these decisions, except the support of the status quo. The principles of capitalism, on which our entire economic system is based, have thus been summarily tossed out in a series of crises for convenience alone. The result is that we are all more or less poorly led, and none of our financial problems (like failing banks) ever seem to get truly resolved in a permanent way.

If you think that this doesn't apply to America because our banks are so much stronger than European banks, I give you Fannie Mae ( OTCQB:FNMA) and Freddie Mac ( OTCQB:FMCC) and Ginnie Mae and Sallie Mae as counter-examples. My God, they are back to 98% LTV loans at Ginnie Mae again, and Fannie Mae is buying equally toxic mortgages! Student loan debt in the US has more than doubled since the crisis (to $1.35 trillion), and default rates on them are high and getting higher. The Fed's recent stress test, according to Rupert Hargreaves of the ValueWalk blog, allowed all 33 US banks to pass, but an alternative market crash scenario had the top six banks requiring another $376 billion of capital. This is not that much different (at the extremes) than the weakness in Europe, I'm afraid. Government is pushing the same agenda as before, not having learned anything at all.

This tendency of government to favor systemically important banks and GSEs and shadow banks (at any cost) also means, in my opinion, that without ever casting a vote, hundreds of millions of people on different continents have lost their right to a fair and equitable economic system. Such a system would have eventually (at least in crisis) weeded out poor managers and badly run companies through creative destruction, and ultimately protected the public from the asymmetric results of moral hazard in the banking/shadow banking industries. Instead, the worst managers and companies have been explicitly protected nearly everywhere.

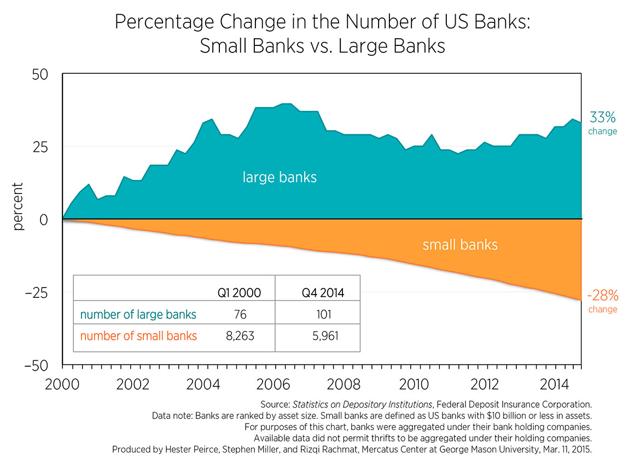

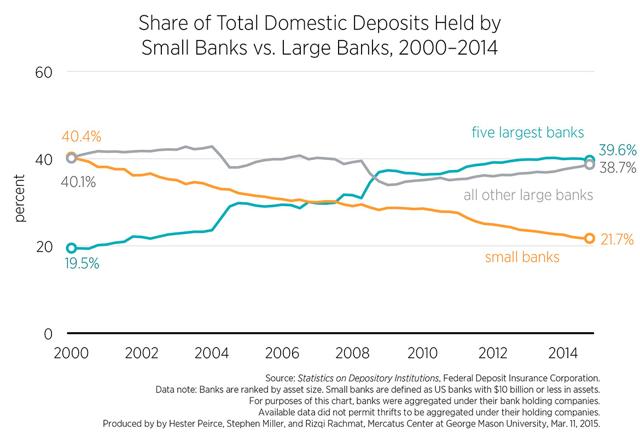

All anyone in the central banks or government can talk about is how to save these monsters yet again, not how to eliminate the threat. Sure, there were some reforms, but they were written by big bank lobbyists for the most part. If you're a small company or bank owner, the rules apply to you, and you are at risk for your mistakes, but if you're really huge, and somehow involved in finance, they don't, and you aren't. Of course, I realize that you can't just let big banks fail left and right, but we've had years and years to institute reforms, and in this we have failed in Europe, and mostly failed in the US.

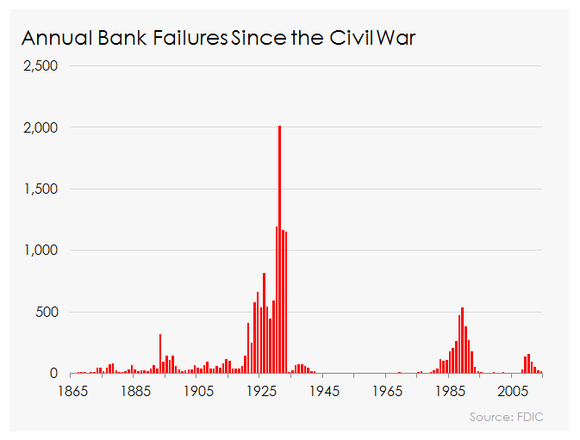

A great illustration of the modern dilemma can be seen in Chart 4, which shows a lower incidence of bank closures in the US in the Great Financial Crisis of 2007-2009 than was seen in the S&L Crisis of 1982-1990. This is in spite of the fact that the later crisis was orders of magnitude bigger than the earlier one. Of course, banks have been getting bigger for many years, so this may not be the best measure for capturing the banking problem. However, it is also the case that many non-banks were at the center of the troubles in 2008(Think AIG the 800 pound Insurance industry gorilla that was bankrupty 10 times over by having sold trillions of dollars of Credit Default Swaps that were worth nothing), and this may be the best explanation for the low number of bank closures: the crisis involved unregulated entities that are not captured in normal financial crisis statistics. This is the great danger that we still face around the world.

The same kinds of problems are of course very persistent in Europe, but banks are far more important in the capital markets there. The explanation for the persistence of banking problems in Europe is in part the tremendous amount of interconnectedness in the global system, as shown on Chart 5. This feature scared central banks and fiscal authorities into doing basically anything necessary to avoid presumed total systemic failure. Yet somehow this impulse didn't translate into taking action after 2008 to prevent this risk from ever happening again.

Chart 4: Asymmetric Distribution of Bank Failures Is Unrelated to Crisis Severity Since 1965

Source: FDIC; fool.com

Chart 5: Interconnectedness of Deutsche Bank (NYSE: DB)

Source: kitco.com; marketoracle.co.uk; wsj.com

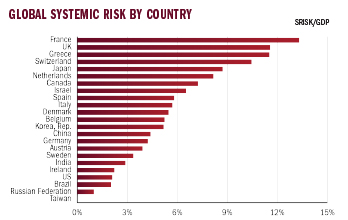

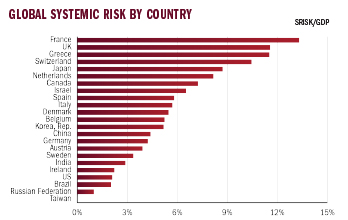

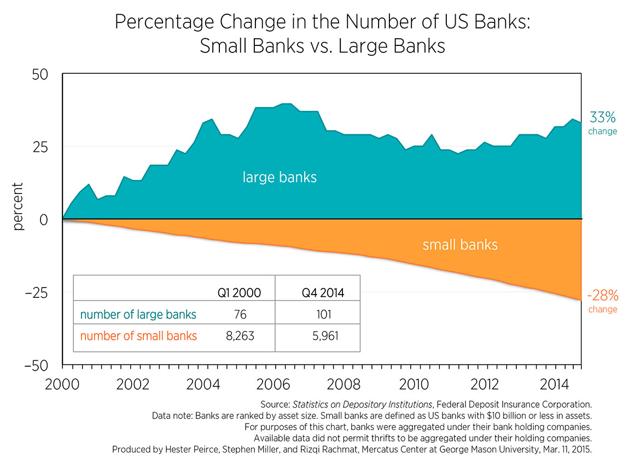

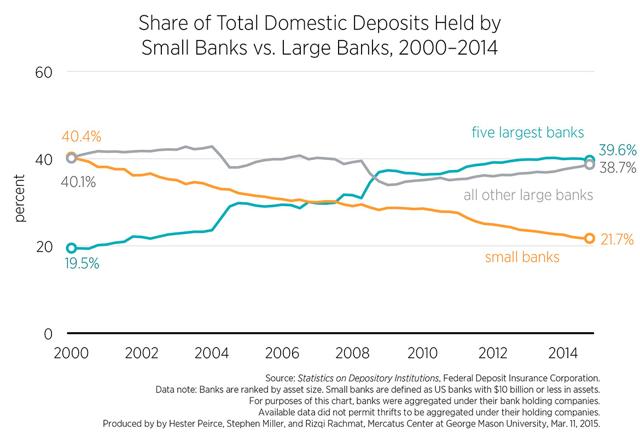

In consequence, global systemic risk is still elevated seven years after the initial crisis, according to Robert Engle and Matthew Richardson of the NYU Stern School of Business (2015). Their work involves estimates of systemic risk (SRISK) that can be aggregated up to country or regional levels (Chart 6). Thus, the banking systems in France, the UK, Greece, Switzerland, and Japan are still relatively large contributors to systemic risk. Reforms since 2008 were generally written in favor of big banks and at the expense of small ones in many places, although the Dodd-Frank legislation in the US seems especially egregious in this regard (Charts 7 and 8). This, plus the failure to fully recapitalize European banks and write off losses has left many giant banks in weak condition. Zombie mega banks are the result: they are neither dead nor alive, but just undead, and they can still cause a systemic crisis.

Chart 6: Engle & Richardson (2015) SRISK/GDP Estimates

Source: theclearinghouse.org

Chart 7: More Big Banks, Fewer Little Banks

Source: mercatus.org

Chart 8: Five Largest Banks Have 40% of Deposits

Source: mercatus.org

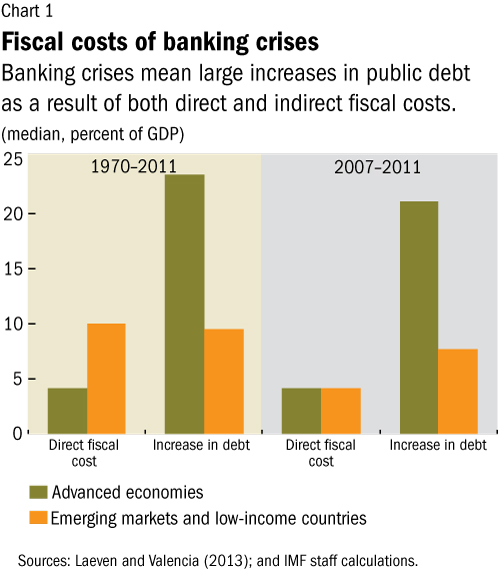

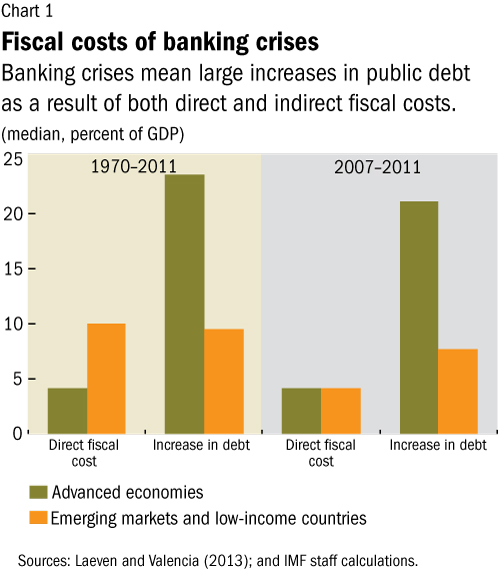

Given the absolutely appalling size of the banking crises in 2008, in 2012, and now again in 2016, and the "need" during each crisis to partially resolve it with government bailouts, the cost to the general public has been shocking in scale (Chart 9). As can be seen, if we just look at Europe and the US in 2007-2011, their combined estimated increase in debt was about 20% of GDP (about $2.76 trillion for the US and about $3.17 trillion for Europe), and direct costs were probably 4% of GDP ($552 billion for the US and about $633 billion for Europe), according to the IMF. The failure by banks, regulators and legislators to fully reform the banking system (and the shadow banking system) means that these kinds of costs are ongoing, and each new crisis (like the present one in Europe) has the potential to trigger a massive new fiscal cost that will hit the public yet again. Governments have already responded with money printing or debt monetization; it is hard to see how this can continue without markets and the public losing faith in the system at some point.

Chart 9: Huge Fiscal Costs of Financial Bailouts

Source: imf.org

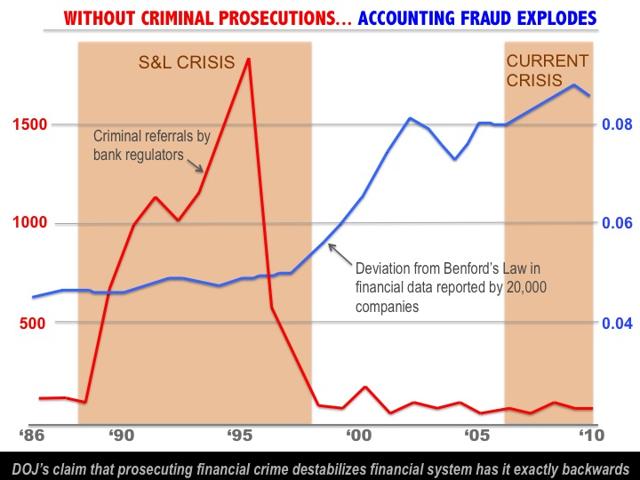

We are seeing strong signs of a populist rebellion in many countries right now. This kind of sentiment started in the aftermath of the Great Financial Crisis, when banks got bailed out after the greatest fraud in history, yet essentially no one went to jail for that fraud (except in Iceland and perhaps the UK). Of course, there are many other factors involved in the rise of populism, such as immigration policy, but the lack of punishment for the financial industry has probably become an issue with legs, and the new banking crisis will likely renew populist anger, as it already has in Italy. This will be awkward because it is a referendum year in Italy and an election year in the US, and there are elections in France and Germany next year.

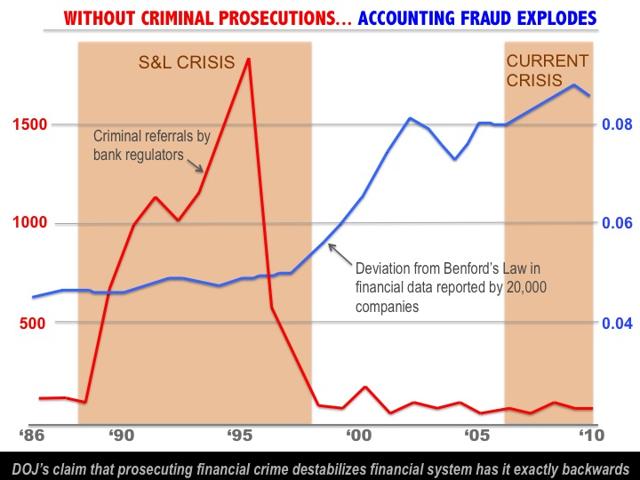

Chart 10 below suggests that the lack of prosecutions since 1998 has actually encouraged accounting fraud, here defined as the violation of Benford's Law (which is a forensic accounting identity that predicts the frequency of specific numbers that should occur in normal accounting data). Jo Craven McGinty ofThe Wall Street Journal has pointed out that the Enron fraud was readily visible on a Benford's Law diagram, and there is still popular anger about that incident many years later.

What is the real justification then for letting the greatest fraud in history go unpunished? There must be a political explanation, but it must also be a pretty weak one. Anyway, the public outrage over 2008 here in the US, and 2012-2016 in Europe, is palpable and growing larger. This is a cancer on the body politic that will not be helped by another financial crisis and bailout in Europe.

Chart 10: Accounting Fraud Encouraged By Lack of Prosecutions

Source: reficultnias.org

CONCLUSION:

The series of financial crises and bailout actions by central banks and the fiscal authorities in recent years may very well be the biggest policy mistakes that have ever occurred since the 1930s. I don't necessarily expect the end of capitalism to come from this,but I do expect a lot of trouble, and our political cohesion will continue to be tested.

What central bankers have done, with the full acquiescence of unprincipled and/or clueless politicians of all stripes, is to serially violate the rules of capitalism and the laws of their respective jurisdictions, all in order to preserve the status quo for very poorly run major banks and speculative shadow banks. Much of this is due to the deferral of problems until a crisis forces action. Now, of course, there's nothing new in who gets to pay for such a mess; it is always and has always been the public. But at least in the Great Depression (the last time such a huge crisis occurred) most bad banks were actually closed (cf. Chart 4 above). We now have allowed the unregulated speculators in the shadow banking world and the TBTF banking sector to effectively control our destiny, without ever voting to give them that power.

Indeed, our elected representatives may be in gross dereliction of their duty in not reining these bad bankers and speculators in, but the legal and financial systems in place were originally set up for actual capitalism, and have been maintained as such under a body of law that dates back to the 1930s. No one has openly proposed or voted for the mess we see now in so many countries. It has happened because the entire regulatory and political apparatus of the state, of many states in fact, has been captured by the big financial interests; it has also happened because of human error, something that will always be there. Slowly but surely, the original safeguards on the system have been repealed or set aside for convenience, financial engineering has been deemed useful rather than destructive, and the common sense and probity that used to dominate our system are mostly gone.

Our so-called reforms have done little to diminish the power of shadow bankers and TBTF banks to generate catastrophes. Even where we do have some regulatory control, such as in the case of actual banks, we have sometimes given bigger banks nearly unlimited room to profit from moral hazard. That is less a case in the US than it was, but it is still very much the case in Europe. For crying out loud, the leverage on Deutsche Bank is around 40:1, but was "only" 31:1 for Lehman Brothers, according to Chris Vermeulen at thestreet.com. How can the supposedly sane and prudent Germans have allowed this to go on? The answer must be the same as it was in the case of Lehman Brothers: no one is minding the store.

As for trades, I am not convinced that the recent equity rally means anything at all. The currency and bond markets are telling the real story here, as well as the banking indexes in equity markets. Investors should stay defensive unless a real, confirmed breakout of 3% or more above the old 2015 highs occurs, holding intermediate to long Treasuries: the iShares 20+ Year Treasury Bond ETF (NYSEARCA: TLT), the iShares 7-10 Year Treasury Bond ETF (NYSEARCA: IEF), the Vanguard Intermediate-Term Bond Fund (NYSEARCA: BIV), the PIMCO Total Return ETF (NYSEARCA: BOND), and the iShares Core Total U.S. Bond Market ETF (NYSEARCA: AGG). Also, defensive sector funds like the PowerShares S&P 500 Low Volatility Portfolio ETF (NYSEARCA: SPLV), the iShares MSCI USA Minimum Volatility ETF (NYSEARCA: USMV); also some liquid alternatives like the Otter Creek Long/Short Opportunity Fund (MUTF: OTCRX), the AQR Long-Short Equity Fund N (MUTF: QLENX), or the AQR Equity Market Neutral Fund (MUTF: QMNIX); and even some sophisticated hedge-like Closed-End Fund strategies like the Nuveen S&P 500 Buy-Write Income Fund (NYSE: BXMX).

Disclosure: I am/we are long BIV, BOND, OTCRX, QLENX, QMNIX, BXMX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks or other securities mentioned or recommended. This post is illustrative and educational and is not a specific recommendation or an offer of products or services. Past performance is not an indicator of future performance.

Follow this author and get email alerts

Follow Kevin Wilson

About this article:Expand

Recommended for you: |

Mind The Gap

Macro Bruin • Jul. 12, 2016 5:30 PM ET

|

|

The REIT Big Bang

Chris DeMuth Jr. • Jul. 11, 2016 1:54 PM ET

|

|

Greater Fools Storm The Casino

David Stockman • Jul. 13, 2016 4:33 AM ET

|

|

'Get To Da Choppa!': Helicopter Money Cometh

The Heisenberg • Jul. 12, 2016 8:30 AM ET

|

Comments (4)

Track new comments

Salmo trutta

Comments (5642) | + Follow | Send Message

"A great illustration of the modern dilemma can be seen in Chart 4, which shows a lower incidence of bank closures in the US in the Great Financial Crisis of 2007-2009 than was seen in the S & L Crisis of 1982-1990"

-------------------

During the S&L crisis 1,043 out of the 3,234 savings and loan associations (non-banks), in the United States failed from 1986 to 1995: the FSLIC closed or otherwise resolved 296 institutions from 1986 to 1989 and the RTC closed or otherwise resolved 747 institutions from 1989 to 1995.

The S&L crisis, and ensuing recession, was caused by the DIDMCA of March 31st 1980.

The GR's recession was exacerbated by the payment of interest on excess reserves, IBDDs.

Sheila Bair can be congratulated for protecting the banks from the impending GR (in 2006 increasing the staff in the Division of Resolutions and Receiverships, instituted Congressional approval of charging a bank premium on risk profiles in Nov. 2006, and successfully defended against implementing Basel II reforms (which would have lowered the capital requirements for U.S. banks). And Dodd-Frank legislation made some of these changes permanent.

12 Jul 2016, 11:15 AM Report Abuse Reply0 Like

Matt Carpenter , Contributor

Comments (752) | + Follow | Send Message

Nice work. In the US, both liberal and conservative politicians find Tbtf odious, and yet little has been done to remedy the problem.

12 Jul 2016, 01:22 PM Report Abuse Reply0 Like

18shanti

Comments (35) | + Follow | Send Message

Thanks to the author for an excellent article explaining in detail the real economic situation.

The author suggests that investors should stay defensive unless a real, confirmed breakout of 3% or more above the old 2015 highs occurs.

For SPX, old 2015 high was 2134. breakout of 3% = 64 points will bring SPX to 2198 which can be rounded up to 2200.

The author suggests investors stay defensive below SPX close at 2200.

Any suggestions about the new portfolio IF SPX closes above 2200?

12 Jul 2016, 02:06 PM Report Abuse Reply0 Like

susan58

Comments (325) | + Follow | Send Message

"Given the absolutely appalling size of the banking crises in 2008, in 2012, and now again in 2016, and the 'need' during each crisis to partially resolve it with government bailouts, the cost to the general public has been shocking in scale (Chart 9)."

Other than the deleterious effects on savers of ultra-low rates, what are the other costs to the general public that are tangible and can be quantified? We know that whenever the Federal Reserve bails out banks, that causes the Fed's balance sheet to grow, but does the growth of the Federal Reserve's balance sheet affect the general public? If so, how? Does the growth of the Fed's balance sheet increase the national debt? If so, how does it do that and will the general public be liable for the debt?

Message 30658578

seekingalpha.com

JP |

---------------------------

| To: CrashDavis who wrote (18342) | 7/20/2016 2:00:25 PM | | From: John P | 3 Recommendations of 18402 | | | Hi Crash and Bob.... Yes Deutsche Bank is the 800 pound gorilla in German banking.... they have been very active in the derivatives market as well as the FX and bond markets dating bank to their purchase of Bankers Trust in the late 1990's.

Banker's Trust an earlier 20th century creation by banker JP Morgan and his colleagues always was very agressive in novel derivative, trading and FX products. BT supplied the FED with it's first Head... Benjamin Strong.

BT

was one of the big 5 or 6 big NY city institutional owners of the FED.

History[ edit]

Bankers Trust logo c. 1919

In 1903 a group of New York national banks formed trust company Bankers Trust to provide trust services to customers of state and national banks throughout the country on the premise that it would not lure commercial bank customers away. In addition to offering the usual trust and commercial banking functions, it also acted as a "bankers' bank" by holding the reserves of other banks and trust companies and loaning them money when they needed additional reserves due to unexpected withdrawals. Bankers Trust Company was incorporated on March 24, 1903, with an initial capital of $1.5 million. Despite technically having numerous stockholders, the voting power was held by three associates of J.P. Morgan. Thus, it was widely viewed as a Morgan company. J. P. Morgan himself held a controlling interest, and Edmund C. Converse, a steel manufacturer turned financier and then president of Liberty National Bank, was chosen to serve as Bankers Trust's first president.

Bankers Trust quickly grew to be the second largest U.S. trust company and a dominant Wall Street institution. During the Panic of 1907, Bankers Trust worked closely with J.P. Morgan to help avoid a general financial collapse by lending money to sound banks. In 1911 it acquired the Mercantile Trust Company and a year later the Manhattan Trust Company. In 1914 Converse resigned to become president of Astor Trust Company, another Morgan company. He was succeeded by his son-in-law Benjamin Strong Jr.. Strong served as president for less than a year, leaving Bankers Trust to become the first governor of the Federal Reserve Bank of New York after helping to establish the Federal Reserve System. In October 1917 the company became a member of the Federal Reserve system.

In 1980, Bankers Trust exited retail banking under the direction of its CEO, Alfred Brittain III. The bank attempted to sell its credit portfolio and branches to Bank of Montreal; however, the deal was not completed due to a disagreement over BankAmercard (Visa). Bank of Montreal wanted to include BankAmercard in the terms of sale, but Bankers Trust did not want to sell the new credit card program licensed from Bank of America due to its profitable future. Eventually, Bankers Trust sold 89 branches to five banks including Republic National Bank of New York. Republic National Bank of New York expanded its branch network to 32 with the opening of a new branch in Manhattan's World Trade Center and the acquisition of a dozen Bankers Trust Company branches—ten in Manhattan, one in the Bronx, and one in Brooklyn. [1]

Bankers Trust became a leader in the nascent derivatives business under the management of Charlie Sanford, who succeeded Alfred Brittain III, in the early 1990s. Having de-emphasized traditional loans in favor of trading, the bank became an acknowledged leader in risk management. Lacking the boardroom contacts of its larger rivals, notably J. P. Morgan, BT attempted to make a virtue of necessity by specializing in trading and in product innovation.

The company shied away from using market data distribution products from companies such as Reuters, instead choosing to develop its own systems in-house. A small development team based in London created BIDDS (Broadgate Information Data Distribution System) which included the Montage front-end package that traders used to obtain data from data feeds and broker screens.

In early 1994, despite all its prowess in managing the risks in the trading room, the bank suffered irreparable reputational damage when some complex derivative transactions caused large losses for major corporate clients. Two of these - Gibson Greetings and Procter & Gamble (P&G) - successfully sued BT, asserting that they had not been informed of, or (in the latter case), had been unable to understand the risks involved.

BT Alex. Brown logo in use between 1997 and 1999 following its acquisition of Alex. Brown & Sons

In 1997, Bankers Trust acquired Alex. Brown & Sons, founded in 1800 and a public corporation since 1986, in an attempt to grow its investment banking business.

The bank suffered major losses in the summer of 1998.

Shortly before the Deutsche Bank acquisition in November 1998, BT pleaded guilty to institutional fraud due to the failure of certain members of senior management to escheat abandoned property to the State of New York and other states. Rather than turn over to the states funds from dormant customer accounts and uncashed dividend and interest checks as required by law, certain of the bank's senior executives credited this money as income and moved it to its operating account.

Bruce J. Kingdon, the head of the bank's Corporate Trust and Agency group spearheaded the fraud and (in 2001) entered into a guilty plea in the US District Court for the Southern District of New York and was sentenced to community service. Certain of his subordinates were thereafter barred forever by the SEC from working in the securities markets.

With the Bank's guilty plea in the escheatment lawsuit, and thereafter its status as a convicted felon, it became ineligible to transact business with most municipalities and many companies which are prohibited from transacting business with felons. Consequently, the acquisition by Deutsche Bank was a godsend to the bank's shareholders, who avoided losing their entire investments.[ citation needed]

In November 1998, Deutsche Bank agreed to purchase Bankers Trust for $10.1 billion; [2] the purchase was finalized on June 4, 1999. CEO Frank N. Newman received $55 million in severance. [3]

Deutsche Bank sold the Bankers Trust Australian division to the Principal Financial Group in 1999 who, in turn, sold the Investment Banking Business to Macquarie Group in June 1999 and the asset management division to Westpac on October 31, 2002. [4] This organisation now uses the name BT Financial Group.

Deutsche Bank announced on November 5, 2002 that it would sell The Trust and Custody division of Bankers Trust to State Street Corporation. The sale finalized in February 2003. [5]

Controversies[ edit]In 1995, litigation by two major corporate clients against Bankers Trust shed light on the market for over-the-counter derivatives. Bankers Trust employees were found to have repeatedly provided customers with incorrect valuations of their derivative exposures. [6]The head of the US Commodity Futures Trading Commission (CFTC) during this time was later interviewed by Frontline in October 2009: "The only way the CFTC found out about the Bankers Trust fraud was because Procter & Gamble, and others, filed suit. There was no record keeping requirement imposed on participants in the market. There was no reporting. We had no information." - Brooksley Born, US CFTC Chair, 1996-'99. [7]

Several Bankers Trust brokers were caught on tape remarking that their client [Gibson Greetings and P&G, respectively] would not be able to understand what they were doing in reference to derivatives contracts sold in 1993. As part of their legal case against Bankers Trust, Procter & Gamble (P&G) "discovered secret telephone recordings between brokers at Bankers Trust, where 'one employee described the business as 'a wet dream,' ... another Bankers Trust employee said, '...we set 'em up.'" [7] The bank's row with P&G made the front page of major US magazines during 1995. On October 16, 1995, the US magazine BusinessWeek published a cover story that P&G was pursuing racketeering charges against Bankers Trust: "The key evidence: some 6,500 tape recordings." [8]

Both the magnitude of losses and the litigation by well-known companies caused market regulators to intervene. Concerns motivated by the particular Bankers Trust case eventually extended to the OTC derivatives market in general. The US CFTC embarked on a failed attempt to take over part of the bank regulators' role in regulating the OTC derivatives market in the late 1990s. The thesis of an October 20, 2009, broadcast of the PBS television magazine Frontline, Early Warnings of the Economic Meltdown, was that the failure of Congress to allow CFTC a role in regulating derivatives was a key element eventually leading to the financial crisis of 2007–2010.

Notable former employees[ edit]Business[ edit] Joaquin Avila - managing director of the Carlyle Group Jeff Bezos - chief executive officer of Amazon.com Greg Coffey - hedge fund manager Chris Corrigan - private investor and former CEO of Patrick Corporation Henry P. Davison - banker Brady Dougan - chief executive officer of Credit Suisse Richard Farleigh - private investor John Key - Current New Zealand Prime Minister and investment banker Herbert L. Pratt - director of BT from 1917–38, and head of Standard Oil Company of New York Sally Shelton-Colby - banker and diplomat Benjamin Strong, Jr. - Secretary (1904-1909), Vice-President (1909-1913), President (1913-1914), then first head of New York Federal Reserve (1914-1928) Nassim Taleb - author and financial mathematician Albert H. Wiggin - president of Chase National Bank Robert G. Wilmers - Chief Executive Officer and Chairman of M&T BankOther[ edit] Maxim Dlugy - Chess International Grandmaster Jack H. Jacobs - Medal of Honor recipient Charlie Rose - Television reporter

DB was founded as an FX specialist bank and has been involved in numerous dubious activities such as the LIBOR setting scandal, the CDO market implosion and several earlier bumps in it's ROAD.

1870–1919[ edit]Deutsche Bank was founded in Berlin in 1870 as a specialist bank for foreign trade. [13] The bank's statute was adopted on 22 January 1870, and on 10 March 1870 the Prussian government granted it a banking licence. The statute laid great stress on foreign business:

The object of the company is to transact banking business of all kinds, in particular to promote and facilitate trade relations between Germany, other European countries and overseas markets. [14]

Three of the founders were Georg Siemens whose father's cousin had founded Siemens and Halske, Adelbert Delbrück and L. Bamberger. [15] Previous to the founding of Deutsche Bank, German importers and exporters were dependent upon English and French banking institutions in the world markets—a serious handicap in that German bills were almost unknown in international commerce, generally disliked and subject to a higher rate of discount than English or French bills. [16]

They are absolutely in the too big 2 fail category.... and also will be at ground zero when we see ECB interest rates rise and/ or a generalized collapse or run on the Eur.

JP |

| |

|

|

|