Intel Hints At Future Skylake Xeons As Enterprises Cool

October 24, 2016 Timothy Prickett Morgan

nextplatform.com

(Excerpt):

These thoughts are on our minds as we contemplate Intel’s financial figures for the third quarter, which by a lot of measures was a stellar one with sales of chips aimed at consumer and commercial PCs as well as devices aimed at the datacenter both showed good growth. But even as PCs showed more growth than perhaps many had expected, sales in the Data Center Group that is what The Next Platform is most interested in analyzing slowed yet again and now the goal of a sustained 15 percent annual growth rate is most certainly not being attained.

In the quarter ended on October 1, revenues were up 9.1 percent to $15.78 billion. With expenses held reasonably flat and $372 million in restructuring charges relating to the 12,000 layoffs that were announced back in April (about 11 percent of its workforce, which will cost around $2 billion in total), the rise in revenues were nonetheless able to boost net income at the company by 8.7 percent to $3.38 billion in the period. Intel had $5.8 billion in cash flow and was able to pay out $1.2 billion in dividends and buy back $457 million in its own stock, the latter of which helped boost its earnings per share metrics. Intel had just over $8 billion in cash and investments as the quarter came to a close, its cash hoard significantly reduced by the $16.7 billion deal to acquire FPGA maker Altera that was finalized earlier this year.

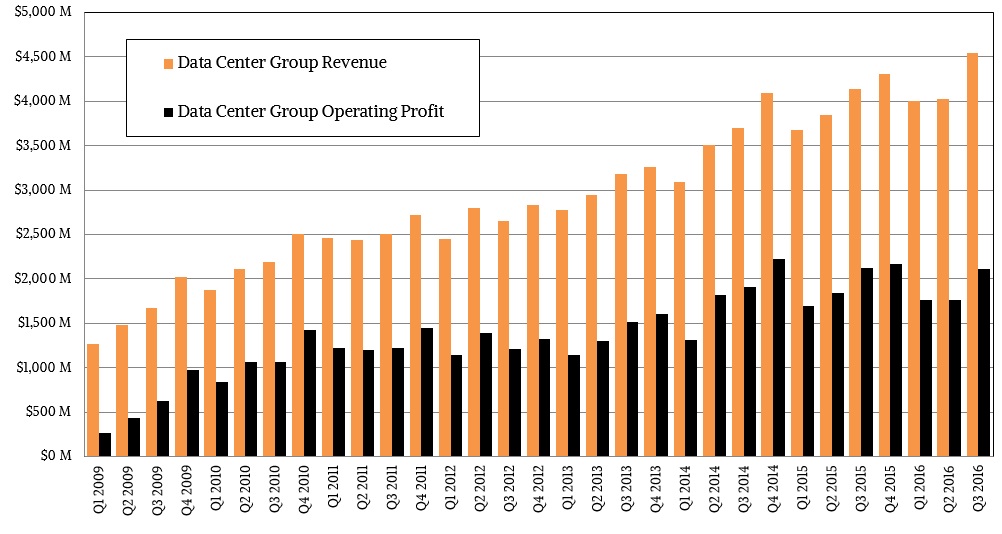

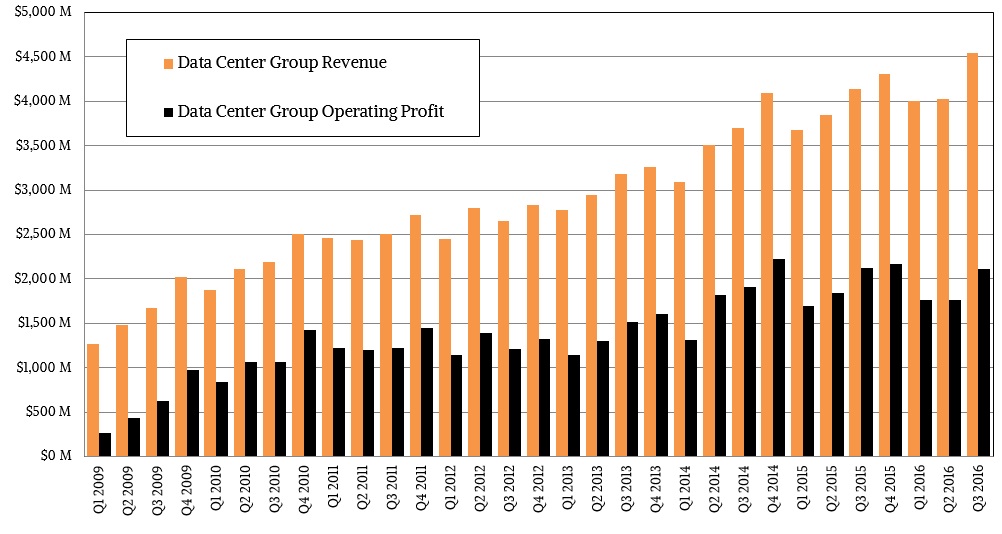

In the Data Center Group, which makes chips, chipsets, and motherboards for servers as well as processors for networking and storage devices, platform sales (meaning processors, chipsets, and motherboards) accounted for $4.16 billion, up 8 percent, and other products (such as software and interconnects) accounted for $378 million, up 33.4 percent. Add these up, and Data Center Group had $4.54 billion in overall sales, up 9.7 percent. But here is the caution. Operating income for Data Center Group was off just a tad under one percent, to $2.11 billion.

This chart makes it clear that Data Center Group in Intel’s second quarter did not grow along the normal pattern, essentially matching, at a macro level at least, what it did in the second quarter. It is still a very large and profitable business – in fact, we think Data Center Group has the largest pool of profits in the datacenter, as anything that can sustain between 45 percent and 50 percent operating margins must surely be.

But the interesting bit is that none of this was enough to make up for the fact that the server makers who sell gear to plain vanilla enterprises of all sizes pulled 3 percent less revenues than Intel had a year ago, and this enterprise segment is still apparently more than half of Intel’s Data Center Group revenues. Two years ago, Intel had been expecting for its enterprise business to resume growth, and then it was supposed to be flat, and now it is shrinking. We think there are a few forces at work here, but first and foremost, we think that some companies are shifting a portion of their workloads to the cloud, whether they use IaaS, PaaS, or SaaS services. We also think that many of their workloads are not growing as fast as Intel can deliver capacity with each successive generation of Xeon processors. This is not what is happening at hyperscalers and cloud builders, of course. They want as many cores as Intel can cram in a footprint at a given price and thermal envelope.

|