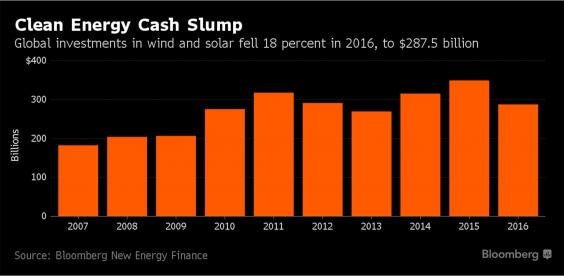

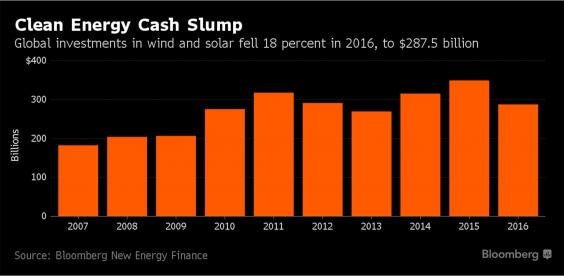

Global “clean” energy spending falls 18% in 2016

JANUARY 16, 2017

By Paul Homewood

independent.co.uk

It is not clear why Trump, only elected in November, or Brexit, which has not happened yet or had any impact at all on UK energy policies, have had any effect on global investment in renewable. But it is the failed Independent that we are talking about here!

Global investments in renewable power dropped the most on record in 2016 as demand in China and Japan faltered.

Worldwide spending on clean energy fell 18 percent from 2015’s record high to $287.5 billion, according to a report Thursday by Bloomberg New Energy Finance. It was the first decline since 2013 and comes as environmental policies face pressure from populist movements that have fuelled the rise of Donald Trump, the UK Independence Party and others.

[ This is baloney .... Trump's not in office and Brexit hasn't happened and neither of those things affect Chinese investment. Spending has fallen on its own for economic reasons. ]

Even as spending ebbs, the amount of wind and solar energy connected to power grids around the world continues to surge, gaining 19 percent in 2016, according to New Energy Finance. That’s in part because investors are getting more bang for their buck as competition and technological advances have dramatically reduced prices for photovoltaic panels and wind turbines.

Spending in China tumbled 26 percent to $87.8 billion from an all-time high in 2015. The slump comes as China’s electricity demand stagnates and the government reduces subsides for wind and solar power, lowering demand in a market accounting for about one-third of all global clean energy spending.

“China is really the driver of clean energy investment,” Abraham Louw, a New Energy Finance analyst, said in an interview. Spending in Japan slumped 43 percent to $22.8 billion.

independent.co.uk

With spending in the US also down by 7%, it is only Europe that is keeping the whole shebang on the road, enabled by massive subsidies.

This report gives the lie to repeated spin from the renewable lobby about how China has been ramping up investment in wind and solar.

The Independent tries to take comfort in investment this year:

Developers are forecast to build a record 134 gigawatts of wind and solar in 2017, as rising demand in India, the Middle East and South American offsets the slowdown in China, according to New Energy Finance. Yet competition is expected to continue driving down prices. While BNEF hasn’t completed its 2017 forecast, McCrone said investments this year appear likely to be on par with 2016 levels.

As ever, we are fed large looking numbers that most people don’t understand.

134GW, assuming a loading of 15%, would only produce 176TWh a year, or 0.7% of last year’s global electricity consumption.

Given that generation has been growing by more than that each year recently, renewable energy won’t even keep up with increasing demand

notalotofpeopleknowthat.wordpress.com |