Stocks Plunge, Trump Trade Dies, Fed 'Doesn't Care'

Mar. 21, 2017 4:25 PM ET|

The Heisenberg

Summary

Ok, so Tuesday was bad.

This is probably a good time to talk about drawdown risk.

It's also a good time to think really, really hard about where we stand on the reflation narrative because if you're following along, you know it just cracked.

Oh, and the Fed told you on Twitter that it "doesn't care about the stock market." Literally.

Well, in light of the - how should I put this - "steep" intraday decline in equities (NYSEARCA: SPY), I think now is as good a time as any to talk a bit about drawdown risk.

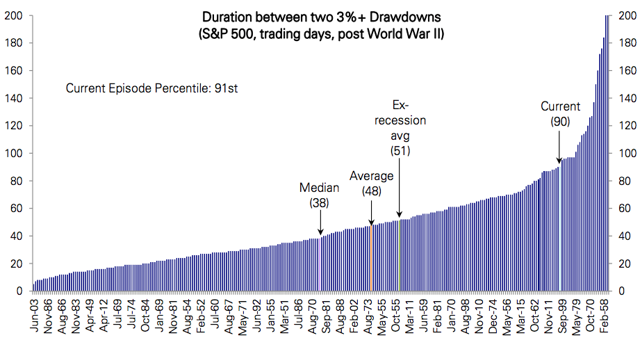

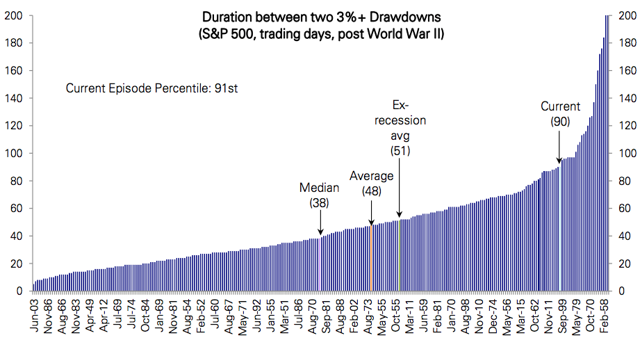

To be sure, it's been one spectacular ride that's left us in the 91st percentile versus history with regard to the gap between 3%+ pullbacks.

(Source: Deutsche Bank)

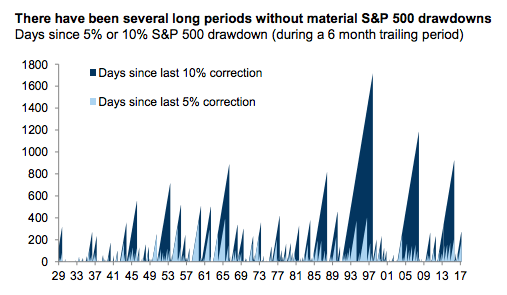

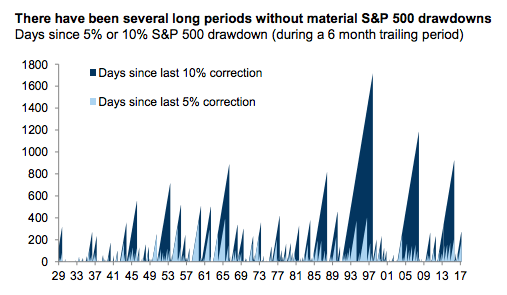

But on the flip side, Goldman reminds us that depending on how one chooses to look at things, the current streak isn't really all that anomalous.

(Source: Bus Goldman)

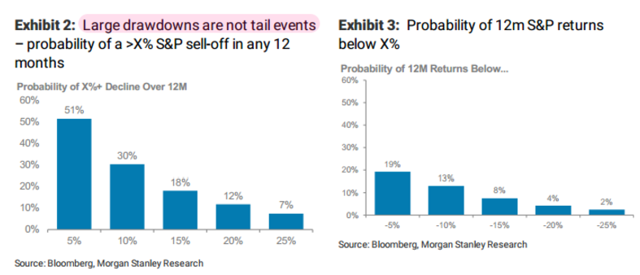

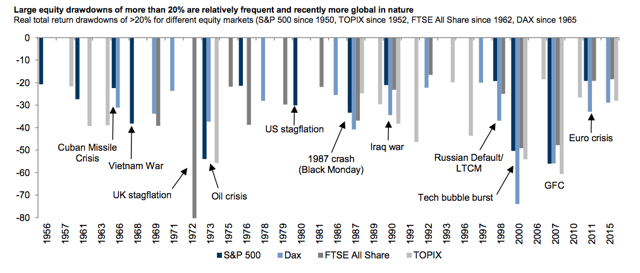

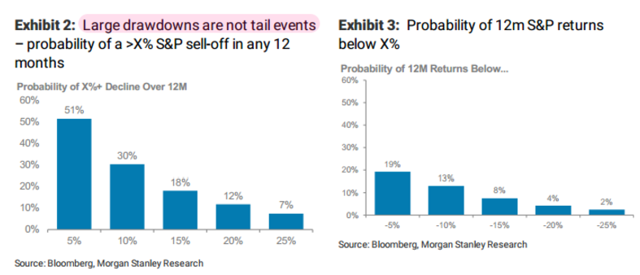

Of course, neither are large drawdowns - anomalous that is.

If you think back to a few weeks ago, Morgan Stanley reminded us that what we might generally think of as "tail events" aren't actually tail events. To wit (my highlights):

We often hear "a large sell-off is unlikely, based on the levels of 'X'". We decided to test that: A 15%+ correction for the S&P 500 within 12 months occurred around ~20% of the time when a wide variety of indicators were at the same levels they are now. That's close to average, but higher than options markets imply.

Don't forget, the probability of a 15%+ drawdown over ANY 12-month period is 18%: We think investors underestimate the unconditional probability of a major drawdown (defined here as a 15%+ decline from current prices within a year).

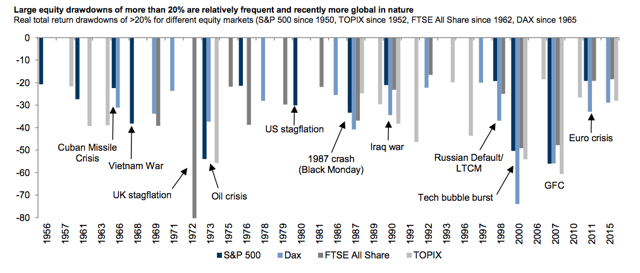

Of course, the problem - and I've talked about this before - is that diversification is harder to come by these days. You can see this by simply glancing at the clustering in the following chart...

(Source: Business Goldman)

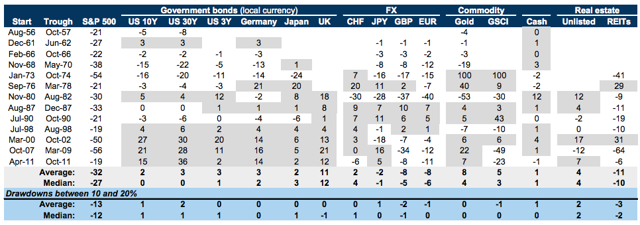

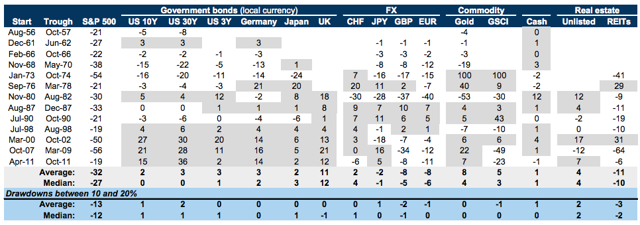

...or, if you want to look beyond equities, you can scrutinize the following cross-asset return table:

(Source: Goldman)

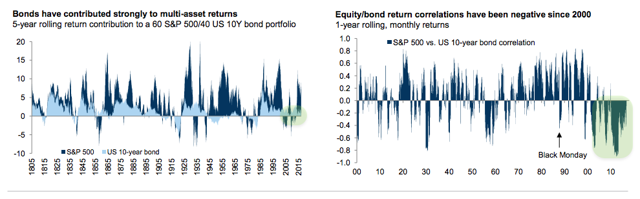

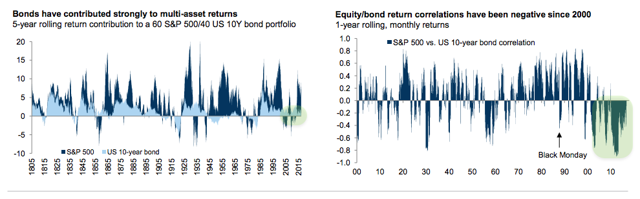

One thing you'll note in that table is that since the late 90s, bonds have provided a cushion during equity drawdowns. This is the virtuous negative stock-bond return correlation that I've talked so much about and that readers finally seem to have conceded is actually just as big a deal as I said it was months ago. Here's some useful historical context:

(Source: Goldman)

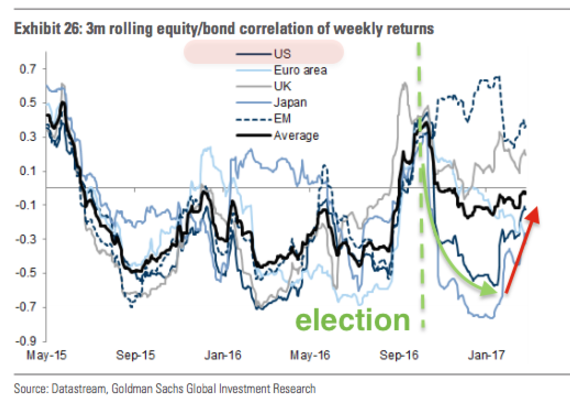

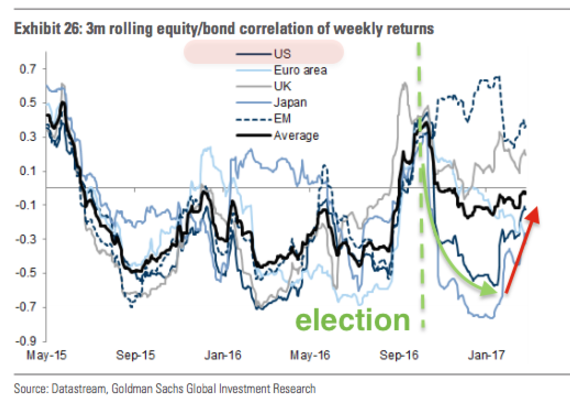

As noted over at HR on Monday, that correlation was in jeopardy last September, but moved sharply negative following Trump's election. However, it has recently been heading back towards positive territory, catalyzed first by stocks and bonds weakening in tandem heading into the Fed hike, and then by stocks and bonds moving higher together post-hike.

Here's what that looks like in terms of correlation:

(Source: Goldman, my additions)

On Monday, as equities sold off, the negative correlation was restored as Treasuries (NYSEARCA: TLT) rallied further:

Ok, good news, right? That is, we're getting diversification from bonds in a stock market rout.

Well, yes. But here's the problem. There are a whole lot of people out there who believe the Fed was unnerved by what it saw last week in terms of stocks rallying post-hike and the dollar dropping like a rock. That eased financial conditions markedly and essentially turned a rate hike into a rate cut. Today's action represents the reflation narrative (you know, the "Trump trade") simply rolling over and dying. Bond yields are falling, the dollar is dropping, and equities are plunging.

The 10 is at 2.43-ish. That's off the YTD lows, but remember what happened the last time yields fell and stocks were looking wobbly? Let me remind you:

Put simply, the Fed saved the reflation narrative by jawboning yields higher, and Trump saved the equity rally by sounding presidential in his first speech to Congress.

I'm not entirely sure the Fed is going to stand by and let yields continue to fall this time around either. And while it may not be overly concerned about the dollar right now (despite the fact that it's plunging), what its very well might be concerned with is this:

If bund yields continue to climb on reduced French election risk while Treasury yields continue to sink (i.e.US-German rate differentials if continue to compress), then that could send the dollar sharply lower from here.

Now that could mean one of two things. If things were to suddenly revert to some semblance of normalcy, the weaker dollar could buoy inflation and commodities. However, if the greenback continues to serve as the third leg of the reflation trinity (higher yields, higher dollar, higher stocks), then a further decline is going to be bad news for equities.

If you're following along, you can probably anticipate the next point. If the Fed moves to jawbone yields and the dollar back up, you'd better hope stocks are prepared to handle it. That is, you'd better hope that stock-bond return correlation doesn't continue to move towards positive territory.

The takeaway: I think this is a damned if you do, damned if you don't moment for equities. I cannot imagine things going well if lower yields (exacerbated by short covering on that massive Treasury short) send a risk-off signal and the dollar continues to tank. Alternatively, I am by no means sure that stocks are prepared to handle a Fed that suddenly steps in to reinforce a hawkish message just as the market wobbles.

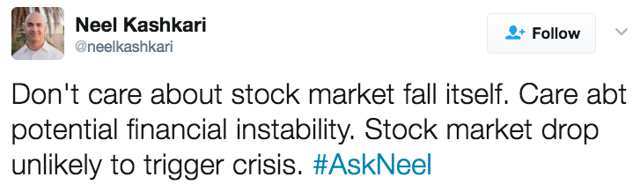

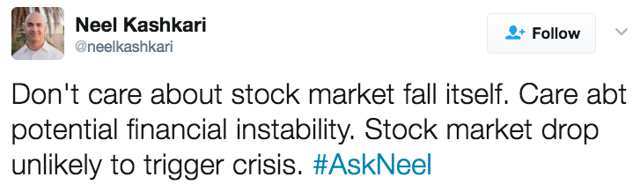

Oh, and to all the folks still long stocks, Neel Kashkari does not have your back:

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

seekingalpha.com

( the comments both bull / bear / neutral are well worth a read... there were 72 when is started this post, now 79........ so sleuths can read through them..... JJP) |