I think many of us are aware of bitcoin and the wild west carnival barker speculative nature of the BitCoin market.

Although, the underlying block chain transaction technology should go on to have a very long life.

A number of weeks ago the capital inflows coming out of China seemed to be the primary driver of BitCoin's value. The Mount Gox scandal out of Japan, certainly hurt Bitcoin a couple of years ago.

I think most of us here have "bought in" that Bitcoin in a very wild speculative bubble.

be interesting to see how it plays outs. My main question / (possible prediction) is why won't we see at least 3 more Mount Gox type of market maker blow ups in Bitcoin over the next several years?

John

------------------------------------------------------------------

Bitcoin And Gold Revisited

May 10, 2017 7:59 AM ET|

The price of silver which has declined for sixteen out of seventeen sessions from $18.725 on April 17 to $16.06 on May 9 weighed heavily on the price of gold. The yellow metal moved from highs of $1297.50 on the same day that silver made its highs to lows of $1214.30 on Tuesday, May 09. The two most commonly traded precious metals have declined from recent highs despite a weak dollar that is trading below the 100 level on the dollar index futures contract.

Aside from the divergence with the weaker dollar, gold has suffered from a rising stock market and renewed confidence. The fear and uncertainty of recent months have dissipated dramatically in markets. The VIX, the volatility index for the stock market has dropped to under 10 in a sign that investor confidence is high. The election of a pro-European Union candidate as President of France caused equity markets from Paris to New York to move higher. With fear and uncertainty taking a backseat to confidence, investors and traders exited long positions in gold and silver over recent weeks, and the prices of the precious metals moved lower.

Gold and silver are both commodities, as they are metals, and they have long and storied histories as currencies or means of exchange. The two precious metals have been around as foreign exchange instruments for a lot longer than any currencies traded today. In fact, the Bible mentions gold and silver's role as money and archeological evidence points to their use as a store of wealth for many thousands of years. The prices of the precious metals tend to reflect stability or instability in the global economy. Last year, the metals hit highs after the unexpected result of the of the Brexit referendum. Gold and silver are often alternative assets compared with currencies during times when confidence in foreign exchange instruments declines. Last week, while gold and silver were moving lower, another alternative currency that is less than one decade old climbed to an all-time high. The price of Bitcoin traded to almost $1750 this week, and as gold hit its most recent low of $1214.30 per ounce on Tuesday, May 9, the cryptocurrency continued to make new highs.

A divergent week for the two alternative currencies

I wrote a piece about the Winklevoss twins and their failed effort to get a Bitcoin ETF product through the spider web of U.S. regulation in March. Meanwhile, I had been writing about the comparative performance of the cryptocurrency and gold periodically. The last piece was last December, and on December 28 I wrote, " One of the reasons that the price of Bitcoin has taken off like a rocket ship, more than doubling since last year at this time, is that the market is so small and thin. With only 21 million Bitcoins and a total market capitalization of $19.5 billion the potential for more gains, assuming there are no more Mount Gox type issues, means that there could be a lot more upside for the cryptocurrency in 2017." The trend has continued, and while both gold and Bitcoin are higher so far in 2017, the performance of the cryptocurrency has left gold in the dust.  Source: CQG Source: CQG

As the weekly chart of COMEX gold futures highlights, the yellow metal closed 2016 at the $1152 per ounce level. On April 17, gold reached its highest level so far this year at $1297.50 per ounce. At the highs, the precious commodity was 12.6% higher. As of May 9 a correction that has gripped most commodities caused gold to drop to lows of $1214.30. At that level, the metal was still around 5.4% higher on the year.

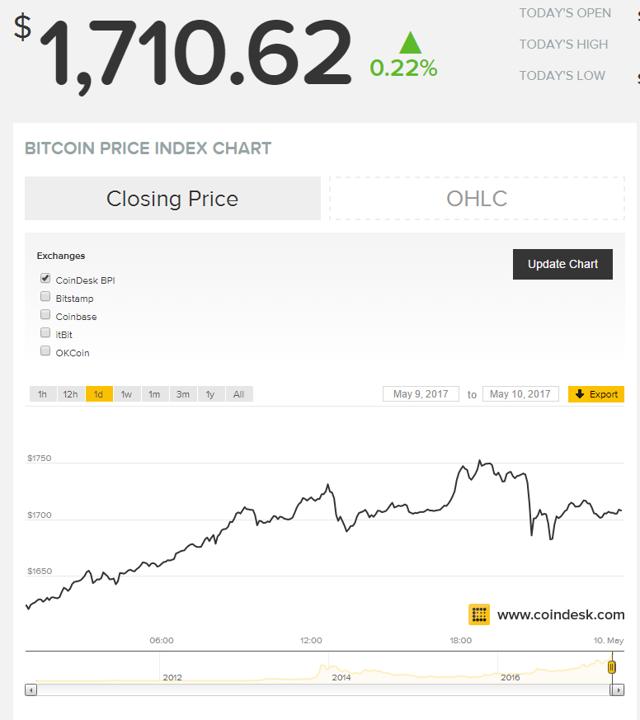

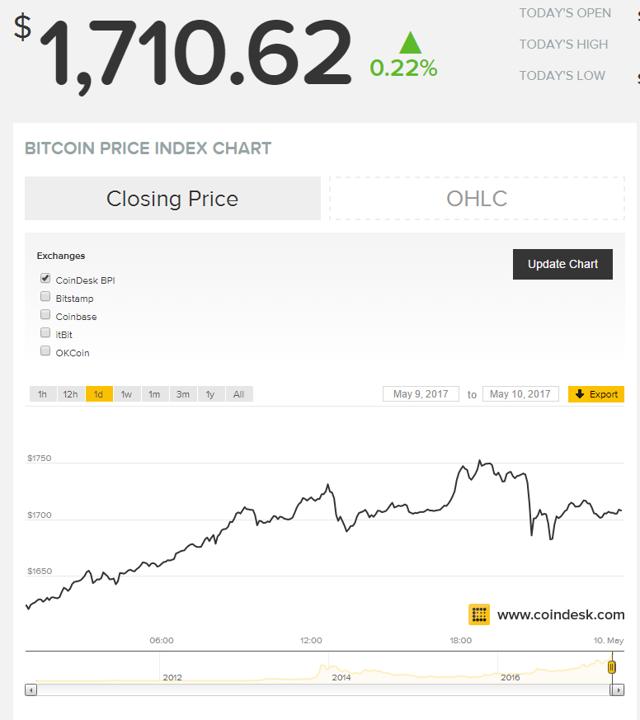

Meanwhile, the performance of Bitcoin has been nothing short of spectacular.  Source: http://www.coindesk.com/price/ Source: http://www.coindesk.com/price/

When I wrote the article in December 2016, the price of Bitcoin was at just under $930. As of May 9, Bitcoin was trading at just over $1710 up from $956 at the end of 2016, an increase of 78.9%. Bitcoin has blown gold away so far in 2017.

The computer age and the cyber currency

I have to admit; it takes me longer each year to catch up to technology. I only recently stopped buying stamps and now pay my bills each month using bill pay the electronic payment system. I am always a few iPhones behind the times. Each time I learn a new technology, I wonder why it took me so long to come onboard.

I recently bought a new home. The home is new construction, and it came with a complete suite of everything that constitutes a "smart" home. The alarm system, lights, doors, and even the pool operate through my iPhone. The technology saves a tremendous amount of time each day, and it makes my life a lot easier.

I think back to my college days and the many hours spent sitting in the library to research assignments. Today, students can accomplish the same task, with many more resources at their disposal using nothing more than a smartphone. Technology is amazing.

Whenever I write on Bitcoin, I get so many comments pro and con about the cryptocurrency. The comments range from believers to total nonbelievers. The former are younger and accustomed to and hungry for technological advance. The doubters and those who dismiss the concept of Bitcoin are older and seem to dread technology as almost an evil. Many of the traditional gold bugs, who often make an excellent case for owning the yellow metal, are not believers in Bitcoin and until sometime in 2016 I counted myself among them. However, I came around and realized that fighting the technology was a mistake. Each day I incorporate technology into my daily life, I realize that the concept of cryptocurrency is ingenious and dismissing constitutes a tragic mistake.

Gold is old school

Gold is probably the oldest investment vehicle on earth. The yellow metal has an amazing history, and each ounce of gold ever produced still exists today. Gold is timeless, and humans cannot own gold, they can just borrow the metal for as long as they live and then it finds its way into the hands of another temporary holder. While some call gold a barbarous relic of the past, it is a multifaceted asset. Gold is one of the most liquidly traded commodities; it is a financial instrument held as a foreign currency asset by central banks around the world. While people do not wear stocks, bonds, currencies or other mainstream assets to adorn themselves, golden jewelry is commonplace. Gold has a luster like few other substances on earth, and for that reason, it has mesmerized humans for thousands of years. Gold is a store of value and a symbol of wealth. Gold is the ultimate old school asset.

Bitcoin is now rich man's gold, for now

For most of my career, another precious metal had the nickname, rich man's gold. Platinum is more than ten times rarer than gold. Platinum is more expensive to product than the yellow metal because it occurs deeper in the crust of the earth. Platinum has a higher density and melting point than gold increasing its utility as an industrial metal. Platinum, the industrial precious metal, has more applications than gold on a per ounce produced basis.

Platinum has a long history of trading at a premium to gold. In 2008, platinum was more than $1200 more expensive than the yellow metal. However, since 2014, gold has been more expensive than platinum, and last year it was trading at a $360 premium, an all-time high for gold and low for platinum. On May 9, an ounce of platinum was trading at around $315 below the price of an ounce of gold. It is hard to call platinum rich man's gold today; perhaps that title needs to go to Bitcoin.

The cryptocurrency will continue to gain in stature because it is an asset that embraces technological advances in that it is easy to store and transfer. More importantly, it is one of the few assets that transcend government control and manipulation in a world where people are becoming more concerned about government intervention in their lives. As wealth increases in closed economies like China, the upside for cryptocurrencies like bitcoin is enormous.

Is Bitcoin the real thing or a shell game?

The Mount Gox scandal set Bitcoin back many steps, but since then it has made incredible gains. Aside from Bitcoin itself, Blockchain technology that underlies the accounting system for the cryptocurrency has unique and critical applications across many, if not most businesses around the world. Regulators in the United States, like the Commodities Futures Trading Commission's Acting Chairman J. Christopher Giancarlo, have embraced blockchain as one of the most significant innovations in modern time for controlling transaction flows.

I always get many comments, and I will likely get them in response to this piece, that Bitcoin is a shell game, a Ponzi scheme and a fraud that will eventually blow up and leave holders of the cryptocurrency crying in their empty computer wallets. However, it would be foolish to ignore the incredible price action and benefits of blockchain technology. Gold has value because people ascribe worth to the metal. Bitcoin has value because of the same reason . I am quite sure that the concept is here to stay and Bitcoin's performance since I began writing about it last year continues to blow gold away. The trend continues, and these days, with Bitcoin trading at a $490 premium to gold (and rising), the asset is not only as good as gold; it is the embodiment of rich person's gold. I have a feeling that it will not be long before central banks acquiesce and begin to hold Bitcoin as part of their reserve assets.

Each Wednesday I provide subscribers with a detailed report on the major commodity sectors covering over 30 individual commodity markets, most of which trade on U.S. futures markets. The report will give an up, down or neutral call on these markets for the coming week and will outline the technical and fundamental state of each market. At times, I will make recommendations for risk positions in the ETF and ETN markets as well as in commodity equities and related options. You can sign up for The Hecht Commodity Report on the Seeking Alpha Marketplace page. Additionally, check out my website for more information about commodities.

seekingalpha.com |