Time to buy farmland?

bloomberg.com

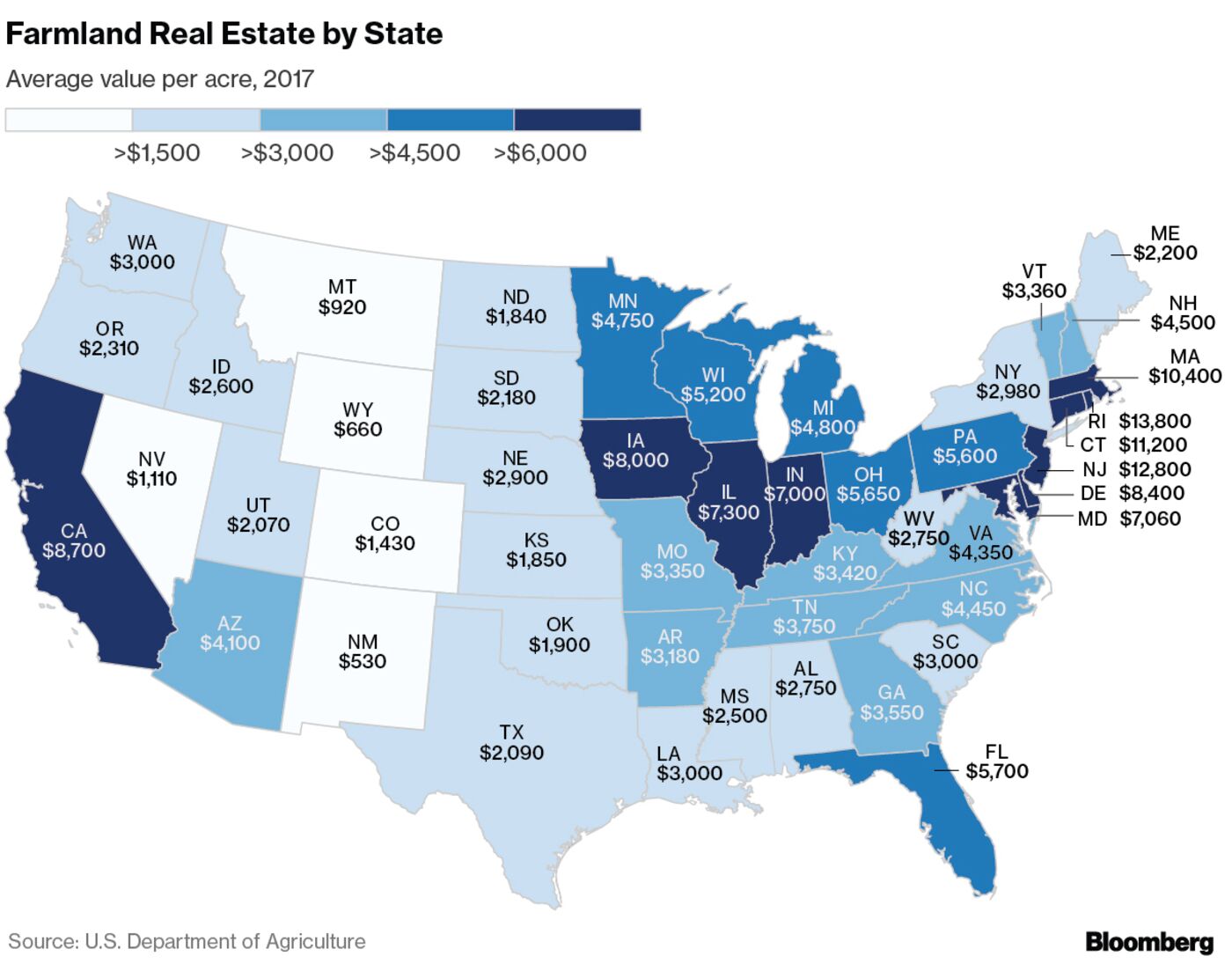

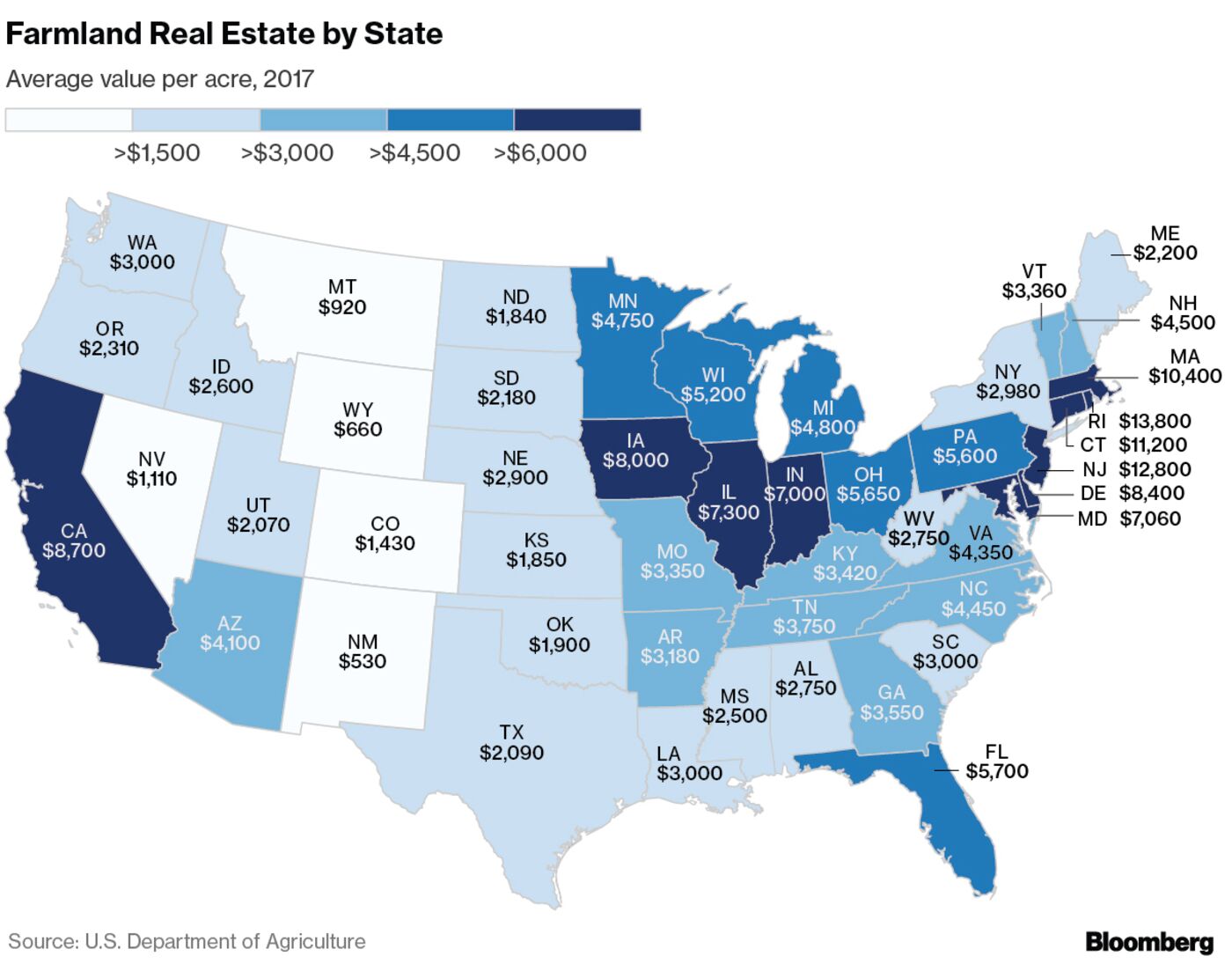

Ready to quit the city, buy a farm and live out your rural fantasy? Bargains can be found in South Dakota, but you better move quickly in California, which is getting pricey.

Average farmland values nationwide have risen 2.3 percent to $3,080 an acre so far in 2017, according to an annual report released Thursday by the U.S. Department of Agriculture. That gain, which erases last year’s decline of $10 an acre, is mostly due to increases in the value of buildings and land put into non-agricultural uses.

State-by-state, however, the picture is varied.

"What region you’re in and what commodities you produce matter," said Dan Kowalski, director of research at CoBank, an agricultural lending cooperative based in Greenwood Village, Colorado.

California, the biggest U.S. agricultural producer and home to high-value crops such as almonds and avocados, saw the largest gain in land values, an increase of 10 percent to $8,700 an acre. The end of a multi-year droughtthere may have brought confidence back into farmland buying, Kowalski said. |