Hi Bob,

I love the way that Chip is still out there watching us as are many of the old timers on SI.... so many

people lurk..... they do not comment ... but I get PM's from them.

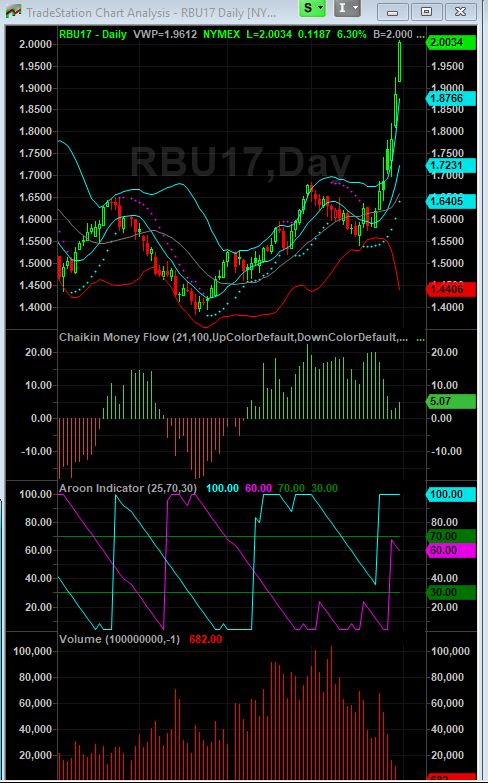

yes I am scaling out as we reached the $2.00 level..... this position worked out fine.

Message 31239578

| To: richardred who wrote (19802) | 8/28/2017 12:16:14 AM | | From: John P | 3 Recommendations Read Replies (1) of 19827 | | | Hi Richard, this is a black swan.... get long september and october gasoline..... the EUR/USD is going higher.... looks like the Yen is going higher against the USD.... and that's because we have a flight to safety....

This is an inflationary event .... of much bigger magnitude than is priced into the market.

BHP, very bullish AA very bullish.....

The next few days are going to be very very interesting..........

John |

Sept and Oct Gasoline has been the 10 bagger of this year..... wow there are a lot of people up trading the Sept contract I the spread was wide on the matrix and I put a few offers to sell and the buyers came out and scooped them up.

It's an pretty amazingly easy market to liquidate in at 3 AM... Nothing like Sunday night.... god that was nothing like the liquidity and spreads on Sunday night....

here is my post from GZ's thread.......

Hi GZ,

I moved into Sept Gasoline and October Gasoline on Sunday night...... I have to admit we were up all night scared at the thinness of the market and the huge swings... but we just put on the Big Game

position on..... and I was looking at it on Tuesday and was like wow...and then I'm watching it tonight..

The position is up 13% on the futures..... you have to have a futures account to understand what 13% on margin means.... it's up 13% on the total value of the size of the position and of course there is massive margin on futures.

the 3 day move in Gasoline has been the biggest move of the year....... It was as good as the round trip in the SPX futures the Night last summer when the Brexit vote became know and the futures went limit down

during the night only to turn around and explode to the upside the following day....... that was a short the

spoos at 6 PM cover midnight and go long....

and amazing... as my boss and mentor John Rice (a native New Yorker, as am I) at Citibank in Sydney

would always tell me, the market always gives you a second chance.

and sure enough the exact same thing happened the night that DJT was elected.... the heavy selling started around 7 PM and so you shorted the SPX until it went limit down and then covered at midnight.......

It was like Deja Vu...... and it's not the dark pools and the Insurance and Pension funds and algo's doing those moves either it's like it was back in 1900 and the 1920's when "Reminisces of a stock operator" was

written

Here is the 60 minute Sept Gasoline chart..... Oct is similar not as powerful of a % increase..... interestingly,

the e - mini gasoline contract stopped trading as the market became to volatile.... the exchange must have shelved it for the moment due to the dramatic volatility increase.

the daily chart.... on Sept NG..... and there are not 9 levels of dark pool players and Insurance companies, and index fund in this position..... it's not the algo's trading this market..... It's just good old fashioned Knowing the lay of the land and what all those refineries closing would do.and when one has spent as many years working with the energy service sector companies....... heck I went and totally filled my Toyota Sequoia up on Saturday night.... because I'm frugal and I'm getting my gas while it's cheap, i went out at 11 pm on Friday night to beat the price increase... but there was traffic and so I was making the rounds on Saturday and filled it to the brim as I was stopping by a couple of Sports bars between 6 and 7 PM to scope out the Mayweather McGregor fight..........

That what I love the big game..... like when we had the fund and Natural Gas was at 3.40 and had broken out to new all time high and all signals were go for a massive bull market... back in August of 2000 and you and I were on the phone 5 or 6 times and we put on 1 contract around 3.43 another around 3.45 another around 3.46..... and those were the big contracts $10,000 ..... we would be making $30,000 for each $1.00 it rose...

back then it was easy, Nat Gas always had it's peak in Dec in the winter traded down into April.... a high

in July...with summer A/C season. I knew we had a big move coming... just like with the Sept and Oct Gasoline this week.... a no brainer.... we had Oct contracts and were would roll those to Dec and sell by

the mid Dec.... and NG went all the way to $10.00 .

that position of 3 contracts was good for a profit of about $200,000.... the size of the entire fund. we would have been up 200% on the $100,000 K with the futures firm and we had 100K in JPM in 2 year notes.... so we had ample reserves for a margin call or even to reload if needed.

even breaking even trading around the other markets that was the 10 bagger. And then someone.... who was not me ( and we were the only authorized traders on the account) went and wrote covered calls on the position... just as it was taking off. And as the implied volatility increased dramatically the cost of calls went up big time.... but we were not long NG calls we were short...... so that capped the position at nearly nothing.

I know there is a thread where you go on and on about a 10 or 12 K swing we had in the EUR/JPY cross.

but that was nickels and dimes..... I never responded to it at the time... but the folks like Chip were sending me PM's and calling and commenting how you were sending out a daily email on what the fund was doing

that is not practical . and Even thought the NDX and COMP started the autumn collapse on Sept 1st, 2000

Message 14290707

| To: IndexTrader who wrote (2730) | 8/28/2000 11:56:12 PM | | From: John P | Read Replies (3) of 19826 | | | I'm started an aggressive cash raising campaign today

and that means selling parts of everything from JNPR, VRSN,

SDLI, MRVC, FLEX, FLSH, MEAD, ITWO, EXDS, AMD, SSTI, some

SIMG, that I just bought recently @ 26. and several other

positions. this time period in the next week or so is the

mirror opposite to me of the april 14-17th lows and the may

25th 2000 lows in the nasd.

I bought some NEM and HM in my low commission account.

It's getting hard to find a gold stock to buy through an

actual broker due to the commission...that in and of itself

may mean something -ng-

Not interested in selling energy at this juncture, only

tech and value plays that have moved up.

Japan looks ok for the premier stocks like SNE.

John |

and I rang the bell with all my

reasons why I was getting out of all kinds of tech, net and bubble stocks...... we did not short a market that

was going in one direction.........

Message 14305230

| To: Stoctrash who wrote (2732) | 8/30/2000 11:10:41 PM | | From: John P | Read Replies (9) of 19826 | | | Hi Fred, my bearish concerns, are that

1) Sept is a very bad month historically for equities.

2) the VIX is getting down to the levels of significant

tops.

3) energy prices are through the roof, especially for

heating oil and Natural gas.

heating oil was at .50 cents last year during this week.

prices eventually got close to a dollar by Jan 2000.

this year in august prices are @ 1.00 and could be going

to 2.50 by Jan.

NG is making new highs daily and could have a still

significant move ahead of it.

4) the Sept OPEC meeting may generate some very harsh

language from the OPEC countries, specifically how is

it that the US has not had an energy policy for this

past decade. This is clearly the biggest failing of

the Clinton administration. Al Gore's solution is that

he welcomes higher energy prices to get the people of the

US to conserve. These higher energy price cripple

marginal consumer spending.

the anti-market rhetoric that will come to pass from these

price hikes will be very negative for the market.

The EMLX air pocket may be an early feel for the fall

version of the April airpocket of april 4th.

the inverted yield curve and the rise in energy prices have

as Ed Hyman has pointed out lead to an economic recession

every time we have had this large of a jump in

energy prices, and the inverted yield curve has worked

86% of the time since 1960.

growth equities are not priced for this.

the year after a presidential election is a down year, why

not jump the gun.

I have a few more concerns, such as the many stocks that

are going up week after week but the momentum

makes them look prime for a nice sharp sept decline.

FLEX is a textbook example on a daily bar chart.

there are a few concerns not yet mentioned but this

is why I'm raising cash.

I remember telling the piffer why I got out of ESPI and PANL

(yep I was playing all those with them back then)

and other stocks and said that I was going to my

highest quality stocks at the start of March.

I think we still have a week or so to play with and we

could try to move higher into Sept. 7-8th, but

this is prime fall selling season for me.

John |

| |

but the fund beat it's benchmark which was the NASDAQ Comp back in 2000, as it was all internet, B2B and tech stocks all the time back then.... as the fund went down less than the SPX and the COMP. like a 16% haircut.... I probably should have left it going longer than we did ......... As the Managing GP it was a little disingenuous that we were supposed to be a trend riding fund and there was such a style drift from what you were commenting was your strong suit playing trending markets.

Now you are wise like us all and we realize that selling trading systems, advisory services... and value added services of forecasting is a business that is always there tomorrow, next week, next month, next year.

The 10 bagger's are always out there.......

Sunday evening we moved into Sept and Oct Gasoline....

Message 31239841

| To: richardred who wrote (19802) | 8/28/2017 12:16:14 AM | | From: John P | 3 Recommendations Read Replies (1) of 19826 | | | Hi Richard, this is a black swan.... get long september and october gasoline..... the EUR/USD is going higher.... looks like the Yen is going higher against the USD.... and that's because we have a flight to safety....

This is an inflationary event .... of much bigger magnitude than is priced into the market.

BHP, very bullish AA very bullish.....

The next few days are going to be very very interesting..........

John |

I notice Chip McVicker up in Boston... gave me a recommendation on that pretty quick.

So now that I have written so much on Gasoline it's probably time to scale out of it. the Sept contract is

closing today and I am closing 80% of the position as I right..... the work is done.......

I've got the bullish Natural Gas posts from the late summer ... and I mentioned it was time to sell in Dec of 2000 ...not going to bother to get those...... this stuff is all for the book....... or the movie or something 21st

century.... that we don't yet know we will be doing in 2 years.!!!

All the best, I would do it again in a NY minute..... it was through Bob Furman's interest in the fund and us both living in the Woodlands that I met Bob and his wife back in 2000 and it's turned into a great friendship,

as has ours .... and just about everyone who was connected with that particular fund......

It was Bullrider's idea to do a fund with you in the first place and then he had some reservations about the

situation..... I talked with him on the phone and on SI PM....... just talked with him this past month......

when we had those SPX 3 month trading contests in 1999 there was the one guy who was monitoring everyone's posts to look for edits in the 15 minute window....... I managed to win one of those contests,

because I figured out we were in an Elliott wave contracting triangle......

All the best

John |