Market Volatility Bulletin: Alternative Measures For Upcoming Volatility

Oct. 5, 2017

The Balance of Trade

Derivatives Strategy, trading, portfolio strategy, Educational Focus

The Balance of Trade

Summary

Four Fed speeches today, with special interest warranted for Jerome Powell.

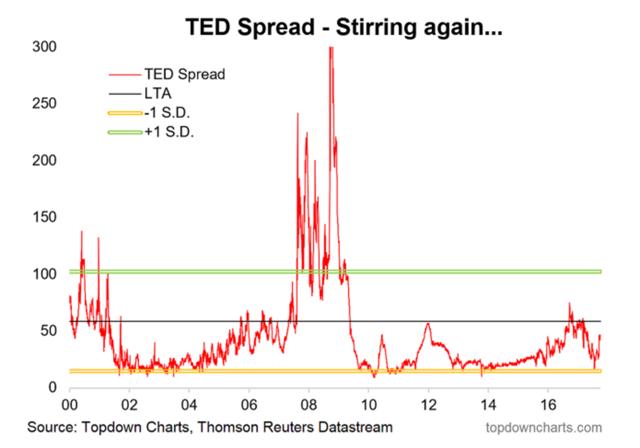

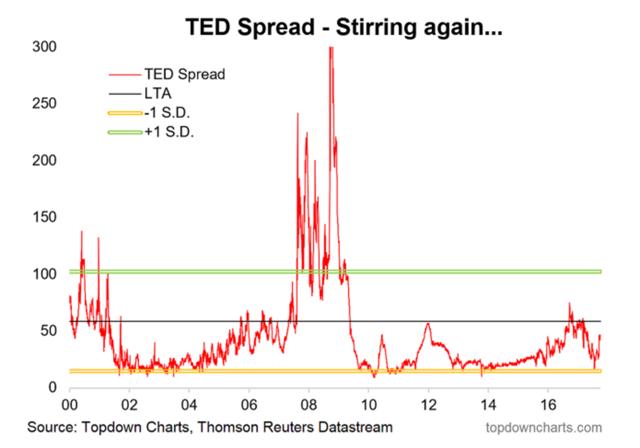

TED spreads are low, but seem to be turning around. Predictive for increases in volatility?

New strikes laid down on VX options, but the market isn't trading them yet: will liquidity dry up if VIX keeps grinding lower?

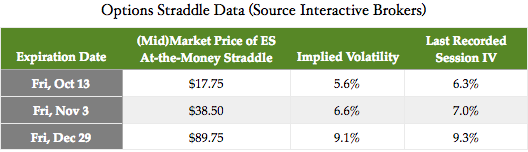

Monthly ATM ES options trading at 6.6.

Domestic equity indices ( DIA, SPY, QQQ) look to open little changed as pre-market futures are essentially flat. In addition, oil futures are seeing modest gains following yesterday's turbulence, whereas 10-year Treasury yields are on the decline.

Source: CNBC (7:24 ET)

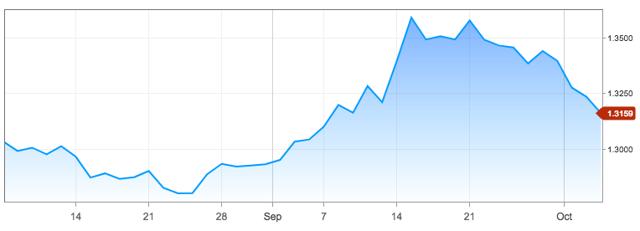

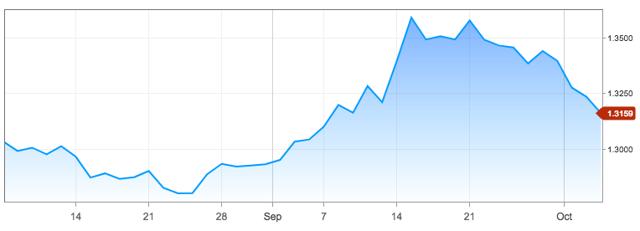

With the notable exception of the Yen, the dollar continues strengthening against most major currencies on strong data releases and potential tax cuts. The Pound ( FXB) has really taken a beating over the last couple weeks.

Source: CNBC - British Pound

Sterling appears to have peaked with PM May's Florence speech on September 21. The decline appears to be accelerating.

Gold futures are also moving upward, though their trend on the month is still overwhelmingly downward.

Things to look out for today include four Fed speeches, including one from Dr. Jerome Powell, the new front runner for Fed chair. We will also get data on international trade, jobless claims, and factory orders.

Tomorrow of course is the NFP jobs number. Consensus is for a mere 100,000 new jobs. What will be very interesting to see are the revisions, given the soft September NFP number and the collective downward revisions of about 40,000 from the prior two months.

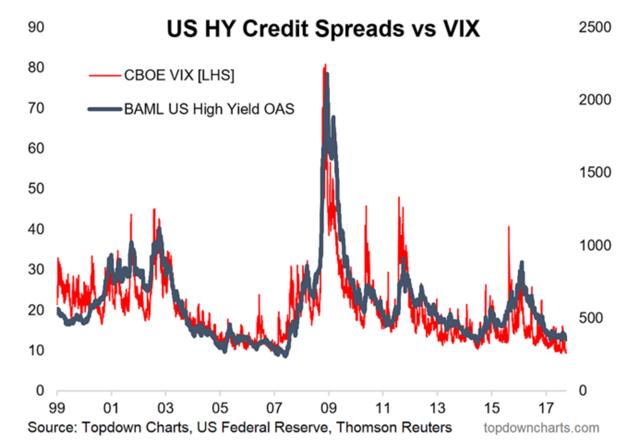

The main point of the article is that recent stirring in the TED Spread, in contrast to the VIX and High Yield credit spreads, is worth taking into consideration in relation to future volatility.

In the author's words:

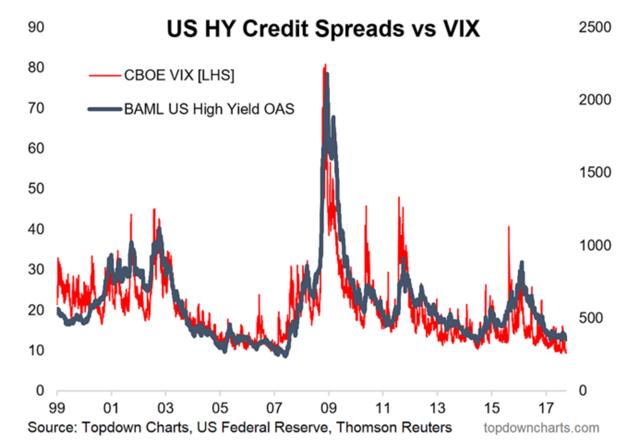

What makes the activity in the TED spread a little more interesting is how it stands in contrast to the very calm/complacent/confident readings of the CBOE VIX and US High Yield credit spreads. The mid-2000s period showed us just how long such complacency can last, and as long as the economy is doing fine and no risk events materialize, it can stay that way.

The following charts are provided for illustration:

The author does not argue that the TED spread is at this point a bearish indicator, but rather that the trend does appear to be moving higher and that the indicator is worth keeping an eye on.

We'd be interested to hear your thoughts on the matter. Do you agree that the stirring TED spread has indicative value at this point? If not, at what point do you think it would?

Thoughts on Volatility

Above is the F1-F2 VX futures contract. Consistent with contango, the spread is widening as we approach the Oct 18 th expiration of the front month. We believe this spread can widen out quite a bit further than what we're seeing, though perhaps it is time to take a breather until after the jobs release. If we get an extreme print tomorrow - higher or lower - we'd much rather be long the Oct than the Nov.

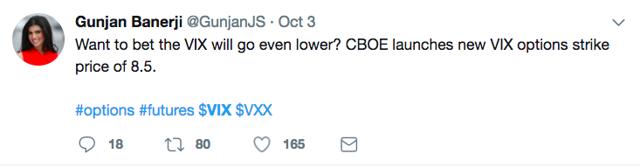

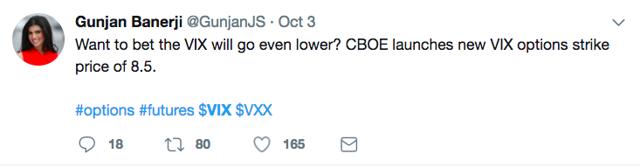

Yesterday we shared this rather interesting announcement:

We follow up today with the a rather interesting counterstatement:

While realized vol is sitting at deep lows (in the 3's on a very tight basis), and CBOE is making room in terms of VX strikes to go lower, so far the VX options market is not taking the bate.

We argue that it's just a matter of time. The fact is that the volatility market here is eschewing the notion that the VIX can fall much further.

But if realized volatility stays in the range that it currently inhabits, there's no way in our mind we don't pull lower on VIX.

Indeed, we are starting to wonder if there is a theoretical VIX level where volume in the VX options contracts dries up. Here's our question:

Is there a combo of (LevelofRealizedVol, LevelofVIX) where neither the buyer nor the seller wants to play? Low levels of realized vols not only make buyers potentially complacent: they can frustrate them as "sure bets" just fail to pay off. Meanwhile, perhaps there are levels of VIX below which sellers simply see too much risk of a sudden and giant move higher. Let's face it, we've really not been down at these levels for very long.

We wonder what your view is. Of course in theory this is a market and there's a price where the quantity demanded equals quantity supplied. Got it. But do the actual combos of volatility that we're seeing have the potential to slow down volume on VX options?

One last point, to be clear: we wouldn't think of this as happening overnight. Probably it would take a few weeks.

Finally, while it's an interesting question, we do not ask it as a pure theoretical. We are genuinely interested as to what kind of impact such a phenomenon could have on liquidity and price action.

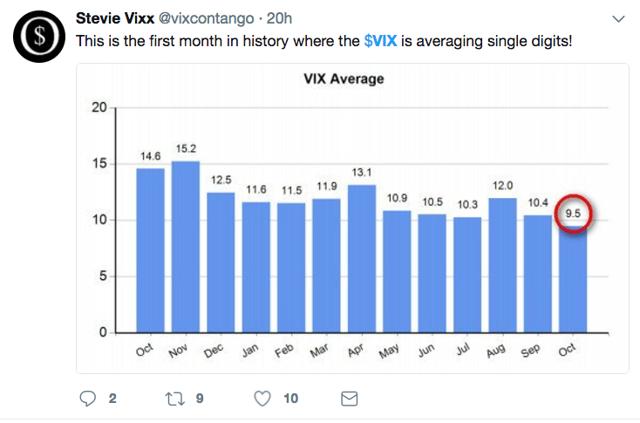

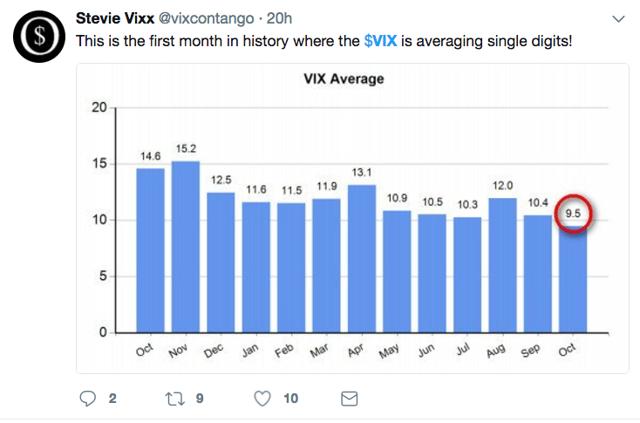

We have seen a few tweets, posts and visuals like this. And it is interesting, but remember that we've only had 3 trading days thus far; a typical trading month has 20-24, depending on Holidays, length of month, week days, etc. These kinds of graphics are meant more for fun trivia for sharing with your friends at vol-parties, not for using as a basis of decisions. The more extreme levels VIX takes, the more careful you are going to need to be about having trivia crowd the news feeds.

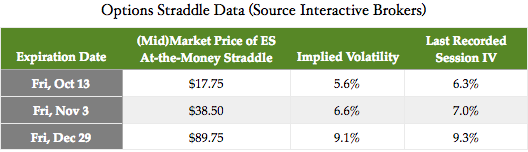

We thought that organic vol on at-the-money ES may well break through the lows we witnessed back in July. But we've got to say we are surprised by the speed with which it broke down.

These levels are truly extraordinary. We're going to be rolling the "quarterly" contract next Monday; that contract sits at 9.5 presently. Could we see an eight-handle on the Dec quarterly by tomorrow? Given the sudden fall-off that we've just witnessed, it appears entirely so.

We must say here that being a vol seller looks less and less tenable. It isn't any one factor: high S&P, low VIX, low realized vol. We'll grant that there is maybe some theta to gain in being an option seller. But selling volatility begins to look very dicey.

Slowly scaling into a long position on vol looks far more defensible at these levels. |