Robots in Finance Bring New Risks to Stability, Regulators Warn

By Silla Brush

Bloomberg

November 1, 2017

-- Financial Stability Board issues paper on AI, machine learning

-- Firms are rapidly adopting artificial intelligence, FSB says

Robots Are Coming for Jobs on Wall Street

___________________________________

Banks and hedge funds that rely on artificial intelligence threaten to inject risks into the financial system that could exacerbate a future crisis, according to global regulators.

The financial industry’s rush to adopt AI raises the potential that firms will become overly dependent on technologies that herd them toward the same view of risks and could “amplify financial shocks,” according to a study published on Wednesday by the Financial Stability Board, a panel of regulators that includes the U.S. Federal Reserve and European Central Bank.

“AI and machine learning applications show substantial promise if their specific risks are properly managed,” the FSB said in a report that called for additional monitoring and testing of robotic technologies designed to lessen human involvement. “Taken as a group, universal banks’ vulnerability to systemic shocks may grow if they increasingly depend on similar algorithms or data streams.”

The FSB, headed by Bank of England Governor Mark Carney, said that many of the technologies are being designed and tested in a period of low volatility in financial markets, and, as a result, “may not suggest optimal actions in a significant economic downturn or in a financial crisis.”

Artificial intelligence is a branch of computer science that aims to imbue machines with aspects of reasoning. The term now includes machine learning, which is the ability for computers to learn by ingesting data, and natural language processing -- the ability to read or produce text.

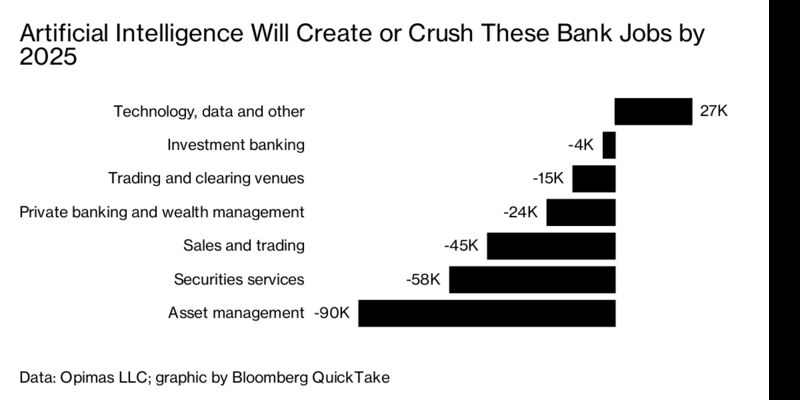

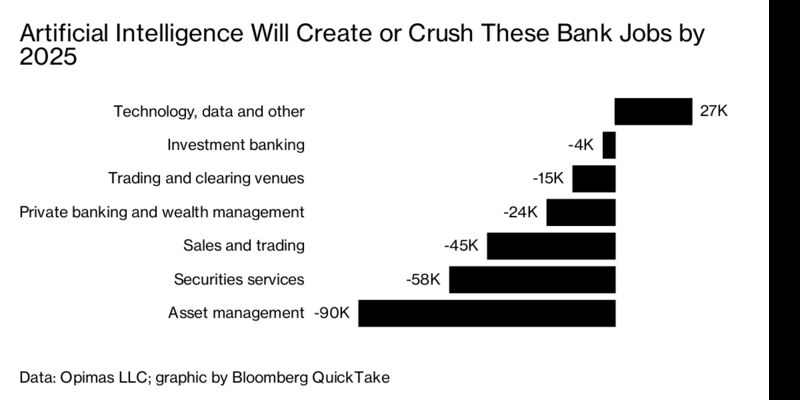

The world’s biggest banks and hedge funds are embracing the tools, driven by the availability of major new sources of data that can be analyzed quickly with computer power and at the same time a desire to cut costs and employment levels. Management consultant Opimas LLC estimated in March that AI would result in a cut of 230,000 workers at financial firms worldwide by 2025, with the hardest hit being 90,000 people in asset management.

Firms are using AI and machine learning to assess the credit quality of borrowers, price insurance contracts, automate interactions with clients and estimate the risk of trading positions, the FSB said. Hedge funds relying purely on AI and machine learning technologies are growing rapidly and have about $10 billion in assets under management, the FSB said, citing an estimate from a unnamed financial firm.

The FSB said technology’s potential to cut costs and drive new profits is even creating an “arms race” among firms to demonstrate their use of AI.

In the process, firms may be relying on a small number of third-party technological developers and services. If those were to fail, the effect would ripple across the wider financial system and contribute to major disruptions at large financial firms at the same time.

“These risks may become more important in the future if AI and machine learning are used for ‘mission-critical’ applications of financial institutions,” the FSB said. “Moreover, advanced optimization techniques and predictable patterns in the behavior of automated trading strategies could be used by insiders or by cyber-criminals to manipulate market prices.”

— With assistance by Edward Robinson

bloomberg.com |