| | | seeking Alpha has stories of Tesla's doom and they are shut d

CHINA debt work out

Message 31345218

China has thrown in the towel on their debt and are going to have the global expertise banks

solve the Chinese debt bubble

Message 31349222

GE long term price charts as on today:

Message 31350136

strait from the www.treasury.gov site:

treasury.gov

1 year coupon yield is has gone from a coupon equivalent yield of 1.45% to 1.55% in 8 trading days...

90 day TBills up to 1.24% as of today. So the days of Free money are long gone.... and the key point is

that the Short term borrowing rates are so critical to all borrowers in ALL categories.

and Short term access to borrowing rates as it rises and the long end of the Yield curve stays Low... It

Burns up the profit making revenue centers of all banks, Insurance, Re Insurance, and all large companies that have lower term funding costs than what they can earn on the money longer out in time. It is

a draining of liquidity.. It is being felt all over the world and will result in a repricing of risk assets to lower

valuations.. ie. lower prices... this is why CALPERS is considering pruning asset allocation in equities

by 16%... the smart money is in distribution mode....

This is the 10 year weekly LIBOR 3 month rate..

LIBOR is being phased out in 2021 but is still in effect it is the absolutely lowest price for banks

Calpers Notes from today:

bloomberg.com

The California Public Employees’ Retirement System, the largest U.S. pension fund, is considering more than doubling its bond allocation to reduce risk and volatility as the stock bull market approaches nine years.

Calpers is looking at a menu of options for its fixed-income target ranging from the current 19 percent to as much as 44 percent, according to a presentation for a board workshop in Sacramento coming up Monday. Equities could be cut to as little as 34 percent from 50 percent. Stocks were the best-performing asset class in fiscal 2017, returning almost 20 percent.

“The markets have had a pretty good run and it’s possible Calpers staff is thinking this might be a good time to lock in some of the gains,” Keith Brainard, research director for the National Association of State Retirement Administrators, said in a phone interview.

Calpers oversaw $342.5 billion in assets as of Nov. 10, up about 13 percent this calendar year on a combination of returns and contributions from employees and taxpayers. The fund lost money in past bear markets, including about 25 percent in the 12 months through June 2009 and 7 percent in fiscal 2001.

-----------------------------------------------------------------------------------

Back To Tesla

My notes on Tesla and the part of the story of banking

Speed and reliability -- Rothschild's proved it is central to success

Message 31349178

Likelihood And Consequences Of A Tesla Credit Downgrade

Nov. 13, 2017 10:01 PM ET|24 comments| About: Tesla Motors (TSLA), Includes: HYG, JNK

seekingalpha.com

Summary

Tesla will probably be downgraded by one or both of the main credit rating agencies in the near future.

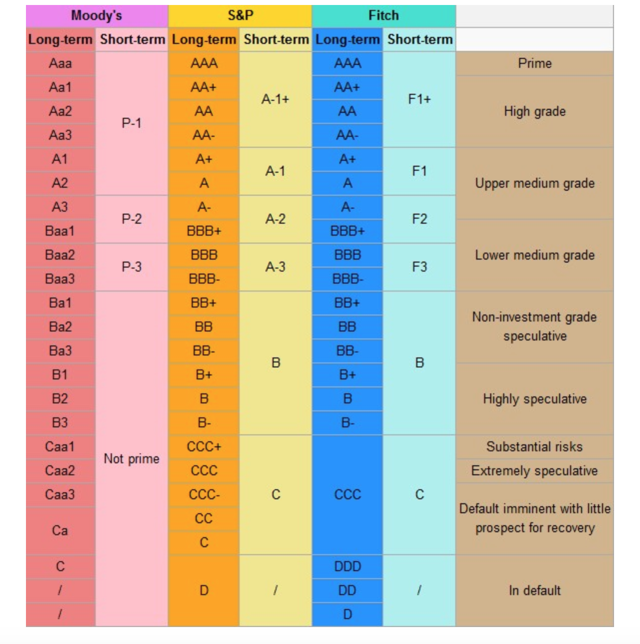

A downgrade will take its unsecured debt into the "C" rating range.

The company's access to new debt from the public bond markets will likely be insufficient to cover a significant proportion of its capital needs.

When Tesla (NASDAQ: TSLA) issued $1.8 billion of junk bonds in August, it sought and received ratings on the bonds from both Moody's and Standard & Poor's, the two largest credit rating agencies. The ratings of the bonds were:

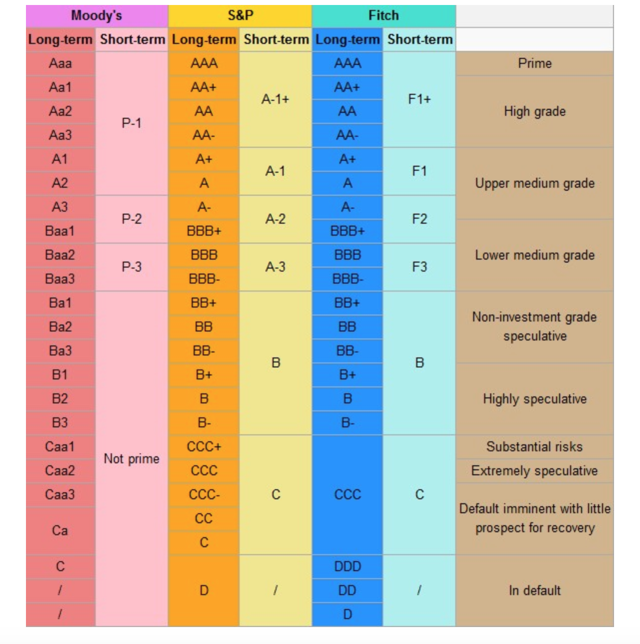

B3, with a stable outlook by Moody's (a newly assigned rating); andB-, with a negative outlook, by Standard & Poor's (a reaffirmation of a previously assigned rating).For those unfamiliar with credit ratings, here is a simple summary:

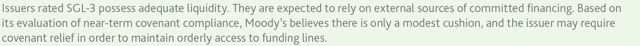

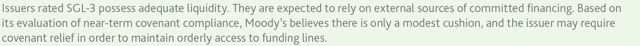

In addition, Moody's gave the company a rating with regard to its liquidity - speculative grade 3 or SGL-3, which Moody's defines as:

While most of the comments in this article are applicable to both agencies, I will concentrate on Moody's, which are more open and makes more information available to the public (through its website) than S&P, which restrict much information to subscribers. In particular, Moody's provided an informative press release when rating the bonds, on which this article will draw extensively. Note that Moody's gave a B2 rating to the Tesla "corporate family", while assigning a lower rating of B3 to the bonds, because the bonds, while technically senior obligations of Tesla, effectively rank junior to the $1.9 billion secured debt because of the extensive security interests given to the secured lenders. Since this article is looking at Tesla's ability to issue more junk bonds, the B3 rating is more relevant here.

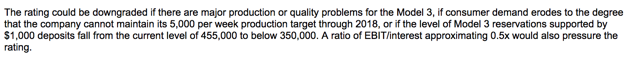

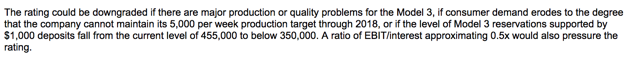

Will Tesla be downgraded?Moody's helpfully summarized the primary factors which might lead to a downgrade (or an upgrade). Those factors are:

Has the Model 3 had any major production or quality problems? If any readers have not been keeping up with current events, I recommend Montana Skeptic's excellent commentaries here and here. As for EBIT/Interest, Moody's hope that Tesla would earn enough before interest and taxes to pay half its interest bill looks very optimistic in the light of the recent 10-Q:

The ratio, which had been improving, has fallen dramatically, and that is despite the fact that only about six weeks of interest accrued on the junk bonds during the third quarter.

How about other factors supporting Moody's rating? It based the rating for Tesla on the expectation that:

"the launch, production ramp up, and market acceptance of the Model 3 will be successful enough to achieve approximately 300,000 unit sales during 2018 (a full-year sales rate averaging about 5,500 per week) with a gross margin approximating 25%"; and"Tesla's brand name, production facilities, and product lineup would have considerable value to another automotive OEM or technology firm targeting the electric vehicle and mobility markets".There seems little possibility that 300,000 units will be produced in 2018. Musk said on the Q3 conference call that he expects "to achieve a production rate of 5,000 Model 3 vehicles per week by late Q1 2018". Montana Skeptic's convincing argument here suggests that even if everything starts to function perfectly from now, Tesla only has capacity for 5,000 cars per week. As for the gross margin, even if we use the company's controversial definition of gross margin (those interested in the controversy should read here and here), it is now claiming only 18%, far from Moody's target. Finally, while I think all agree that there is value to an acquirer in the brand and in the product line-up (as well as in the deferred tax assets, as I have previously written), few acquirers are likely to assign much value to production facilities that have been so publicly shown not to work.

S&P is less forthcoming, simply stating that, "Negative outlook reflects Tesla's increased execution challenges over next 12 months, raising risks related to sustainability of capital structure". As discussed, above, the challenges have turned out to be show stoppers.

Based all of the above, I believe that a downgrade in the near future is highly likely. It seems the market agrees. Tesla's junk bonds now trade at a yield of 6.32%, a full percentage point above the August issue yield. A move of this magnitude generally presages a significant credit event, such as a down grade or a default. This move was not due to a general rise in junk bond yields. The price of the high-yield SPYDR, the SPDR Bloomberg Barclays High Yield Bond ETF (NYSEARCA: JNK), which is a useful proxy for the high yield market as a whole, was 36.77 at the close on 8/17/17, the day when Tesla's bonds were issued, and closed at 36.68 on 11/10/17. Despite the support from the company's retail fan base, the bond trades worse than the average B rated bond, as calculated by BAML's spread index.

So, what if Tesla does get downgraded?From Moody's B3, the next step down is to Caa1 (the S&P equivalent is from B- to CCC+). This move from the B range to the C range is significant.

Firstly, the debt is much more expensive. A recent (September) 8-year bond issue by a Caa1/CCC+ corporation (Golden Nugget, Inc.) priced at 8.75%, more than 3% higher than Tesla's August issue.

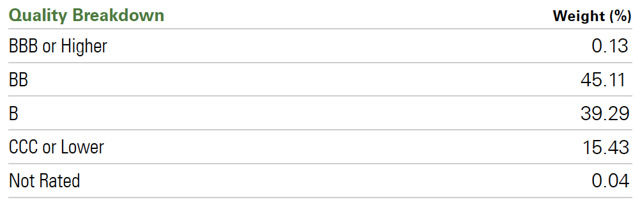

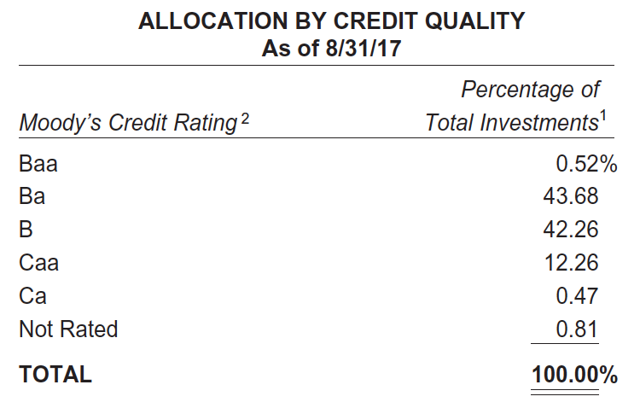

Secondly, there is much less capital. Most high yield indices and institutional high yield investors allocate much less capital to C range investments than to B range investments. According to peritusasset.com, the high yield bond market in the US has total issuance of approximately $1.6 trillion. Again according to Peritus, high yield issuance is running at about $29 billion monthly. While it is difficult to establish how much went to each rating level, an approximate amount may be found by looking at two of the largest high yield aggregators - JNK, which tracks the Bloomberg Barclays High Yield Very Liquid Index, and the iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA: HYG), which tracks the Markit iBoxx USD Liquid High Yield Index.

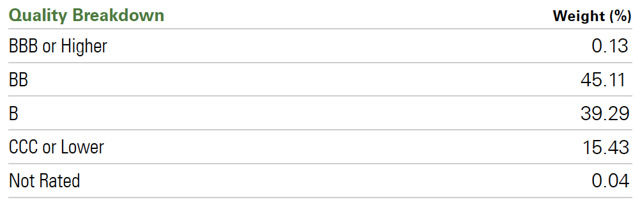

In the case of JNK, the allocation is...:

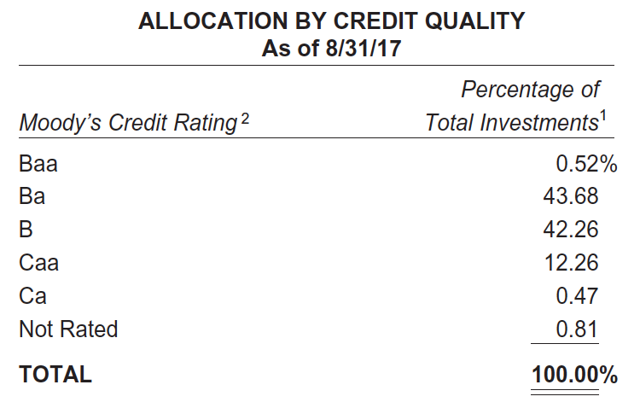

... while in the case of HYG, it is:

This suggests that the monthly pool of available capital for Caa/CCC issuance is around 12-15% of the $29 billion, thus around $3.5-4.4 billion, while the pool for B/B is $11.6-12.2 billion - almost 3 times larger. If Tesla, subsequent to a downgrade, sought to issue the same amount of bonds as it did in August, it would be soaking up approximately half the monthly available funds for the entire country - not a realistic prospect. And it seems likely, after the August experience, that the retail fan base will have discovered the unpleasant truth about low-rated junk bonds - you get much of the downside of the equity and none of the upside - so they will not be there to provide additional funds.

Persons more expert than I, notably Andreas Hopf here, EnerTuition here, Montana Skeptic here and Bill Cunningham here, have suggested that the company will need very large cash infusions within the next few months. Elon Musk better hope that investors are feeling generous, because the bond market is unlikely to be sympathetic.

So, in summary, equity investors who agree with the above experts that Tesla will need a lot more cash soon should consider that the cash will likely not be available from the debt markets. The best case is, therefore, that there will be another dilutive equity raise. The worst case is that equity is also unavailable, leading to a rapid collapse into default and bankruptcy. Debt investors should consider the likelihood that the junk bonds will trade down toward Caa1/CCC+ yields, which would probably require another 10% fall in the bonds' trading price.

Disclosure: I am/we are short TSLA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Short via puts. |

|