semi_infinite: Thank you for bringing TRXC to my attention and after reading this, definitely stay away. Breathtaking, I've never come across anything like this. Sell TRXC and buy the gorilla ISRG or at least read: The Gorilla Game: Picking Winners in High Technology by Geoffrey A. Moore

seekingalpha.com

TransEnterix: What European Da Vinci Surgeons Say About The Senhance System

Nov. 14, 2017 11:46 AM ET

Summary

We have reached out to over 100 European surgeons who use the da Vinci surgical robot. The surgeons' opinions on the TransEnterix Senhance System were almost all negative.

TransEnterix has been aggressively marketing the Senhance System in Europe since late 2015 and hasn't sold one in Europe since February 2017. Has only sold two systems in total in Europe.

TransEnterix CEO Todd Pope has always been salesy and over-enthusiastic in the earnings calls. We believe his statements should be taken with a grain of salt.

Even if TransEnterix miraculously is able to make revenues of $100M in a year, it will still take a $30M+ net loss mainly because its gross margin is only 40%.

Our research overwhelmingly shows that the Senhance will not sell well in the US just like it has hardly sold any in Europe.

We believe TransEnterix ( TRXC) is one of the most overvalued stocks on Wall Street. Even in a realistic best case scenario for the company, the stock is still way overvalued. We recommend shorting shares, and with the company's large float and relatively large market cap, we think this is an easy short opportunity.

TransEnterix is a company that has been promoted and rallies hard on news which has made its executives and investment bankers wealthy but not most shareholders. For example, on stockpromoters.com here, it shows (free membership required) that TRXC has been promoted by investorideas.com, promotionstocksecrets.com, and BlueHorseShoestocks.com. TRXC rallied hard on when its Surgibot was expected to be approved by the FDA, but it got rejected. During that rally, the company sold many shares via an ATM (at the market) offering. Recently, it has rallied hard from its Senhance System being approved by the FDA on October 13, and again, the company sold many shares from its ATM.

It has only one product, a surgical robot called the Senhance System (formerly the ALF-X) that was created in 2008. Despite being such an old robot, TransEnterix has never reported upgrading the robot with a new model. Compare that to Intuitive Surgical’s ( ISRG) competing da Vinci robot which comes out with a new model every couple of years.

Senhance sales have been almost non-existent. When TransEnterix first acquired the Senhance in late 2015, the CEO, Todd Pope, said in earnings calls and presentations that the company was aggressively marketing the robot in Europe and there was “incredible enthusiasm”. Yet today, two years later, the company is lucky to sell one $1.5 million robot per quarter. It hasn’t sold a Senhance System in Europe since February 2017. The company says the sales cycle is 4-6 quarters, but the company is now well past that time frame since it started marketing the Senhance in late 2015. We believe we can safely say that the Senhance is a commercial flop as there have been many European hospitals and surgeons that have tested it and decided not to buy it.

As of 11/3/17, TRXC had 199.2 million shares outstanding. That puts its market cap at above $500M at $2.60 per share. That is a huge market cap for a company that struggles to make $2M in revenues per quarter. And even if the company does end up appealing to a certain niche crowd of laparoscopic surgeons and sells more robots to make just over $100M in revenues for a year, the company will still take a $30M+ loss. With only 40% gross margin for every $1.5M machine sold, it costs the company about $900k.

European Da Vinci Surgeons Have Overwhelmingly Negative Statements About The Senhance

To try and understand why the Senhance hasn’t been selling well in Europe, we interviewed European surgeons who use the da Vinci. We emailed between 100 and 200 European da Vinci surgeons. We had phone conversations with some surgeons, others just a brief email exchange. The following are some brief statements from the surgeons. Most of the following statements suggest that the Senhance will not sell well at all in the United States. It's unlikely that accomplished US surgeons will have a much different view than those in Europe. The only surgeon we spoke to that had a few positive things to say about the Senhance was Dr. Shahab Siddiqi, but he had negative things to say as well. The phone conversations we had with Dr. Shahab Siddiqi and Dr. Joachim Thuroff are transcribed and posted in the White Diamond Research Archives page here. The following are all of the surgeons with constructive responses who we reached out to:

Dr. Elmar Heinrich, An Austrian Robotic Surgeon For Many Years:

I experienced the Senhance at the UKE in Hamburg. At this step of the system no clinic with normal patient flow will buy the system since it is too complicated in the set up and conventional laparoscopy is easier to handle!

Anonymous Danish Surgeon:

As far as I‘m concerned, it‘s mainly the ergonomics. The hand pieces and the instruments (of the Senhance) behave exactly like traditional laparoscopic instruments. Most instruments are not wristed and the needle driver, although wristed, is very difficult to control.

The camera is controlled by the surgeon’s eyes which maybe in the future offers an advantage, but so far, the system reacts rather slow.

The actual system, to my opinion, does not offer an advantage over state of the art 3D laparoscopic surgery and the ergonomics of the current Da Vinci are by far superior to the Transenterix system.

Dr. Shahab Siddiqi:

We were offered the same price, 1.5 million for the da Vinci Xi, and the Senhance was the same price. I was surprised at the price they were asking, and the level of development. The Xi is way beyond the S and the Si, yet it is the same price as the Senhance.

It feels to me, that the Senhance is a good option, but it’s still not there yet. It has potential, and one of the good things it does, is the pivot points.

Dr. Ruud Bekkers:

I have not worked with the Senhance system yet so my experience as such is limited.

My impression of the video on the website is in comparison with DaVinci:

1. the instruments have less degrees of freedom, it looks like laparoscopic instruments put in a robot arm.

2. The robot arms are rather short so placing and avoiding collision may be difficult, especially if the area in the abdomen where the operation takes place is larger.

3. I am not sure how the camera system operates, I presume it is 3-D, but how does the surgeon operate this.

Dr. Joachim W. Thuroff:

All of the instruments are wristed with the da Vinci. If the needle drivers and so on are not wristed, then that would be a major disadvantage obviously, because this is one of the main advantages of the da Vinci, that you have working ergonomics that are very good and effective.

Dr. Evangelos Liatsikos:

I am not familiar with the Transenterix device. They never contacted me even though I am the Chairman of the European Section of Urotechnology (ESUT). I do not see great enthusiasm among my colleagues for their product.

Angus McIndoe, Gynaecology Consultant:

I hadn’t heard about this TransEnteric robot until your email. I think no-one much in the UK has heard about it. I think cost is a huge issue in the UK so depending upon the costs, with better marketing the robot may sell better.

Despite Aggressive Marketing, European Sales of The Senhance System Has Been Almost Non-existent

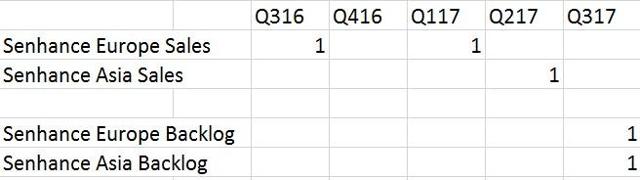

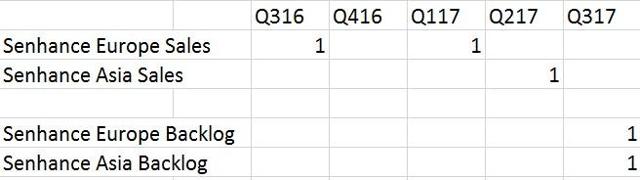

TransEnterix acquired the Senhance (formerly ALF-X) robot in September 2015. According to TransEnterix management, the company immediately began aggressively showing it to surgeons. The company says the sales cycle for a surgical robot is between 4-6 quarters. It has now been over 8 quarters, so the company is well past this stated sales cycle. The following are the Senhance sales and backlog the company has accomplished so far in each quarter:

Each of the sales of the Senhance is about $1.5M or euros. COGS per Senhance is about $900k, so that leaves $600K in gross profit. That’s an astonishingly low amount of profit for a $500M market cap company.

As shown above, TransEnterix has only sold three Senhance robots so far. It should also be noted that the first sale in Q316 was to a research and teaching hospital in Italy called the Milan. They were already using and experimenting with the robot before TransEnterix acquired it.

The company didn’t make any sales in Q317, but did report two robots pending a sale. We advise investors not to count those backlog orders as sales. For most technology companies with big ticket items, backlog doesn’t end up being a sale the majority of the time. Prospective customers constantly change their mind, and aspects of their business change that might make a purchase not seem like a good idea anymore. Unless TransEnterix had taken a deposit for these backlog orders, which was not stated by the company, they are not guaranteed sales.

Ever since TransEnterix acquired the Senhance surgical robot, originally called the ALF-X, the company has had high expectations for future sales. Looking back at previous earnings calls, TransEnterix CEO, Todd Pope, was very excited and optimistic about upcoming European sales. Our comments are after the earnings call quotes.

From TRXC Q415 earnings call on 3/10/16:

Todd Pope said:

Some of our top highlights were, one, we acquired the ALF-X Surgical Robotic System in the back half of 2015.

So the confirmation is that we received going through this integration finalization, first, the market interest for ALF-X is very high.

So we now had a very short amount of time have 23 employees, focused exclusively ALF-X commercialization and support.

Now our marketing efforts on the next page Slide 13, we immediately after acquisition in the Q4, we went for a pretty aggressive digital and print marketing campaign. We wanted to get the word out that this platform of ALF-X was in the hands of TransEnterix. We were able to contact over 5,000 surgeons and hospital administrators across the EU and the Middle East and we really let them know about the transaction…It has generated 100s of high-quality leads and we've been following up with those and that's what's created our early pipeline.

As far as our commercial ramp on 19, we're going to continue to put significant resources behind ALF-X.

Stifel analyst Rick Wise said:

You described ALF-X reception was overwhelmingly positive, you clearly have made tremendous progress in a short time in terms of building the initial commercial infrastructure.

All of the above talk by Mr. Pope about aggressive marketing was stated in early 2016, and said "the market interest for ALF-X is very high". We’re well past the 4-6 quarter sales cycle since then, and the company has almost zero sales to show for all the marketing work it has done in 2016.

From the Q116 earnings call on 5/10/16.

Todd Pope:

With that said, I’d like to provide you an update on ALF-X. We gave our team an aggressive goal to sell a system in the Q1. Even though, we haven’t closed that initial sale, we continue to expand our pipeline and our confidence continues to be emboldened through our interactions with customers.

On the commercialization front, we’ve added three additional direct sales people, since our March 3 call, these new hires will start between now and June 30. And this will bring our total direct sales team to nine people. Across most of Europe, the on-boarding process can take several months, once a physician is accepted.

10 new hospitals have participated in at least one full hands-on training event, since our last call. We also highlighted in our last call, the importance of our demonstration and training capability and our plans to expand our capability with the new training site in the second quarter remain on track.

More aggressive marketing talk by Mr. Pope, and “emboldened confidence” that didn’t lead to any sales. He also mentions 10 hospitals participating in their training event; apparently, that also didn’t lead to sales.

From the Q216 earnings call on 8/5/16.

Todd Pope:

You know we just kind of alerted you to some of those statistics. We’ve had 59 surgeons from 21 hospitals complete visits in the Q2 to get a hands-on demonstration of the device. So, when you start thinking about that’s more than just a sales presentation, and as you project that out four to six quarters, I think you can see some meaningful productivity from the pipeline four quarters out as the first half of next year end and then beyond it just grows from there.

Again, Mr. Pope was clearly wrong in his Senhance sales expectations. So, why do investors trust his expectations now?

Mr. Pope continued talking a big game in the Q317 earnings call. That was after the Senhance got approved in the US on 10/13/17.

From the Q317 earnings call on 11/9/17

Todd Pope:

I'm also pleased to report that we've recently received an order for a system in Europe, which we expect to deliver in the fourth quarter, and we are optimistic about the potential of other opportunities that we are tracking.

This is a backlog order. Unless the company received a deposit, then it may not translate into a sale.

On these visits, surgeons have had the opportunity to participate in preclinical labs and to observe live surgery, while helping the company hone our U.S. value proposition. As a result, we are optimistic that we'll have our first U.S. sale by the end of the year.

This kind of optimistic talk is same as when TransEnterix acquired the ALF-X. It expected to get a sale in Q116, but that didn’t happen.

Rick Wise

But you're obviously more clearly starting to have visible success in Europe.

“Visible success in Europe”, how so? It didn’t make any sales last quarter or this quarter and hasn’t sold a Senhance in Europe since February.

It Is Clear That Most Surgeons Do Not Like The Senhance, And There Is No Sales Momentum

From our conversations with surgeons, and evidence of almost zero sales, it’s clear that the Senhance is not a popular product. The Senhance is a functional robot, and surgeons can use it, which is why it was approved by the FDA. It seems to appeal the most to laparoscopic GYN surgeons, but Dr. Joachim Thuroff said that he goes to many events featuring GYN surgeons, and nobody has told him about it.

There are many better options out there, like the da Vinci, or state of the art 3D laparoscopy, like from Olympus Europe. Here is a video about 3D laparoscopy from Olympus Europe made in 2013. There are other surgical robots that are expected to come on the market soon. This was mentioned in our conversation with Dr. Thuroff, who does da Vinci surgeries at the University of Mannheim in Germany. He said:

I get quite around on medical meetings of our societies, and there has been no mention of the company (TransEnterix) or show on the company because everybody would have discussed it, but that is not the case. I know that some companies are in the process to come to market with new developments like Olympus and I know another Japanese company has a robot but they did not present so far in Germany.”

Dr. Thuroff shared a lot of knowledge about robotic surgery and the da Vinci which we include the full conversation in our archives.

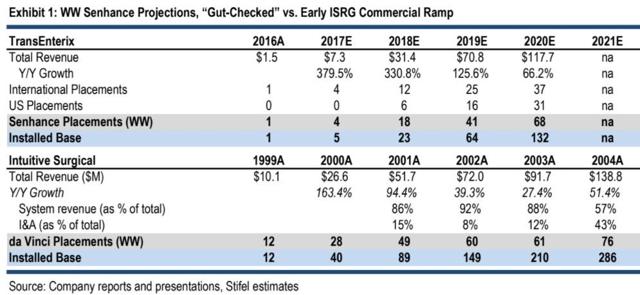

TransEnterix Income Statement Estimates And Comparison To Intuitive SurgicalStifel Nicolas, TransEnterix’s lead investment banker, has a $4 price target on the stock. With the current 199.2M shares outstanding, that’s a whopping $800M market cap. Some TransEnterix bulls say that it could become the next Intuitive Surgical. Stifel makes the comparison in a report.

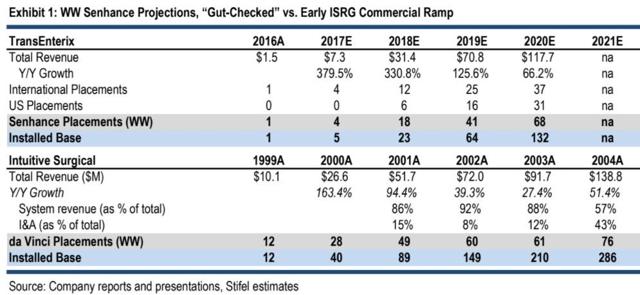

However, the flaw in this thinking is today’s period of surgical robots is different from 2000. In 2000, Intuitive Surgical was establishing a proof of concept for surgical robots. In general, once a first mover starts an industry, it takes a few years for that industry to become mainstream. However, today, it is already proven that surgical robots provide a valuable benefit to surgeons, and it is mainstream. Therefore, if a new entrant is better and/or cheaper than the da Vinci, then it shouldn’t take long for sales to ramp up. But sales aren’t ramping up for the Senhance. Also, when the da Vinci was first created, it had no competition, so that made sales easier. The Senhance is in direct competition with the da Vinci. For these reasons, comparing the Senhance today to the da Vinci back in 2000 is like comparing apples to oranges. The following is a comparison of the two companies' early robot sales years by Stifel:

The above comparison says a lot about TransEnterix and the Senhance slow sales ramp. The da Vinci got FDA approved in the year 2000. Intuitive Surgical immediately started selling the da Vinci in that year, selling 28 robots. It didn’t need the four to six quarter sales cycle that TransEnterix management claims it needs to make a sale. With such a slow start, it’s quite a leap of faith by Stifel to assume TransEnterix will go from $7.3M in revenues in 2017 to $117.7M in 2020.

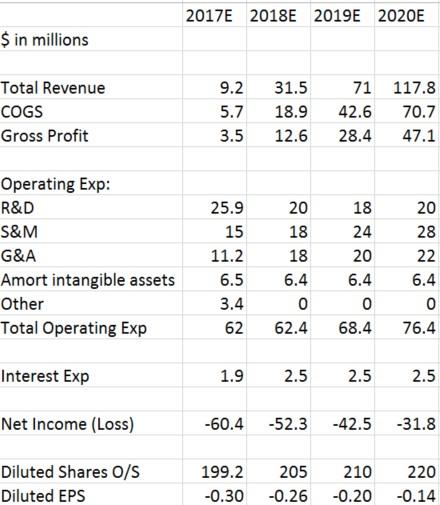

Stifel gives TRXC a $4 price target, which is 7x EV/2020E revs. We believe Stifel’s revenue expectations are extremely unrealistic, given TransEnterix sales so far. What’s also interesting to note and very bearish for TRXC longs is the company still would have an estimated $31.8M loss for the year if it made $117.7M in sales. That’s mainly because the gross margin on Senhance sales is only 40%.

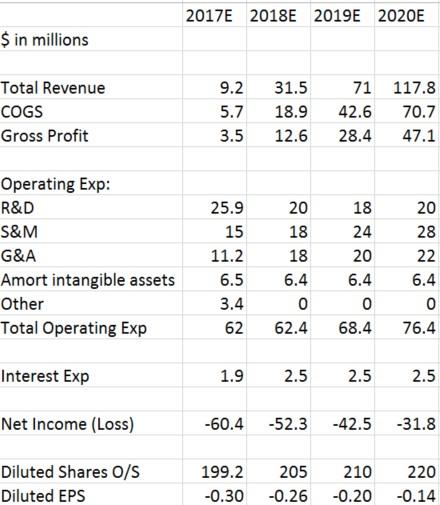

These are TransEnterix income statement estimates following Stifel Nicolas’ model:

As shown in the above estimates, if TransEnterix makes $117.7M in revenues in 2020, it will still have a net loss of $31.8M for the year. For TransEnterix to just break even for the year, it would have to make over $200M in revenues, which would require selling over 100 Senhance robots. Given all of the information we have presented in this report, we don’t see how anyone could realistically think that’s possible for the company.

We give TRXC a $0.75 price target. The company reported $100M in cash, so a $50M EV is an appropriate value today, given the company’s cash burn. We believe it’s likely that TransEnterix will never gain market penetration with its surgical robot, and once that’s clear to the market, the stock will drift towards $0 and eventually become delisted from the AMEX.

Said Dr. Thuroff:

Intuitive Surgical uses their monopoly situation very well, that’s OK, but if there’s an equally good machine available at a lower price, not only the purchase price, but disposables, then people would be willing to look into it.

As stated by Dr. Shahab Siddiqi, the price his hospital was offered for the new da Vinci and the Senhance was the same. But the money to be saved would be from disposables.

Said Dr. Siddiqi:

If they were half the price, that’s different. But to come in at the same price as the da Vinci and saying that your cheaper in the long run is a difficult statement to make to someone I think.

It’s clear that it is not an equally good machine as the da Vinci, and hospitals so far have not purchased the Senhance to save money on disposables.

Meager Sales Of Senhance Suggest TransEnterix Is Not Gaining MomentumTransEnterix has so far had no momentum with its Senhance sales, being that its last sale of the Senhance was in February 2017. We conversed with many European surgeons who are obviously industry experts to get their feedback on the Senhance technology, and it came back almost unanimously negative. Based on that evidence, we doubt that the Senhance will make a positive upswing in Europe anytime soon.

What makes things worse for TransEnterix is the Senhance is a robotic device developed in 2008. Unlike drugs, technology devices can constantly be tweaked and improved on at a rapid pace, and customers expect them to be. The da Vinci robot is constantly being upgraded, the new da Vinci X just got approved in Europe and the US in 2017. 2008 is the year the first iPhone came out. Compare the 2008 iPhone with the new iPhone today, and the differences would be astounding.

TransEnterix doesn’t have the budget to revamp the Senhance and fix the negative issues that the surgeons bring up in this article. In its latest earnings call, the company reported a cash balance of $100M, but it needs that money for marketing and running the company, data collection, FDA fees, etc. The Senhance sold today is the same version that came out in 2008 (then called the ALF-X). Other than small superficial changes, like in July, TransEnterix announced the new capability of the Senhance to use smaller instruments, the Senhance has not been upgraded. That could be why the Danish surgeon we quoted said:

The camera is controlled by the surgeon’s eyes which maybe in the future offers an advantage, but so far, the system reacts rather slow.

Even The Best Case Scenario Does Not Justify TransEnterix Current Market Cap Of $500 MillionBoth the realistic best and worst case scenarios for the future of TransEnterix suggest a strong sell of the stock. Looking at both scenarios:

The worst case scenario:

The Senhance sales continue at the rate they have been in Europe in the US as well. The robot just appeals to the occasional quirky surgeon, probably a GYN surgeon, who isn't thrilled with the da Vinci and wants to try something different. But the vast majority of surgeons prefer the da Vinci, cutting edge 3D laparoscopy, or other new laparoscopic robot coming to market. TransEnterix continues to sell one or two per year in each of Europe, Asia, and the United States. The company will run low on money within one year, at which point, the stock will be trading below $1 as investors lose hope, and they will have to do another ATM offering. We believe more or less, this is the most likely scenario for the company.

The best case scenario:

The Senhance develops a following of laparoscopic surgeons who like its features and low disposable costs. After a few years, the company is able to sell 10-20 Senhance robots per quarter and ramps up sales similar to the Stifel Nicolas estimates shown in this report. Even then, the company will still have losses of $20-50M per year for many years to come, possibly never making a profit. The company needs to sell at minimum 100 Senhance in a year to break even. And certainly, the company will need to have another major dilution in about a year, adding millions more shares to its current 199.2 million shares outstanding.

We don’t see any realistic way a long-term shareholder of TransEnterix will come out ahead in the long run, even if sales have a big uptick. However, its executives and investment banks will continue making money at hopeful shareholders' expense.

Please see our disclaimer here.

Disclosure: I am/we are short TRXC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. |