worth a look.. Note long both WDC and Toshiba

The Toshiba Memory Sale Is Dead - Western Digital Will Benefit

Dec. 1, 2017 12:01 PM ET

|

About: Toshiba Corp. (TOSBF), WDC, Includes: AAPL, HXSCF, JPM, MU, QLC, SPA, STX, UBS

JP Research

Long/short equity, Growth, long-term horizon, macro

(733 followers)

Summary

Toshiba's latest capital raise is a game changer - a Toshiba Memory sale doesn't make financial sense anymore.

WDC still holds significant legal and IP leverage.

Expect legal and delisting risks to de-escalate.

WDC's stock is pricing in an irrational discount - great time to accumulate in the high 70s.

Toshiba also looks attractively priced - accumulate.

"Everything will be okay in the end. If it's not okay, it's not the end" - John Lennon

Event related plays have always been fascinating to me for the simple reason that they have not happened yet. With acquisition related plays for instance, conventional thinking tends to point toward a binary black/ white outcome - sell or no sell. But it's really the grey that swings the P/L. And I think this is looking to be the case in the latest inning of the Toshiba Memory saga.

Only two months ago, some here were proclaiming a done deal - that Toshiba ( OTCPK:TOSBF) would sell its memory unit to Bain and that would be that. Not so, in my view. As things have panned out, Toshiba has repeatedly cited contingency plans, hidden a contractual escape clause, announced a JPY600bn capital raise (diluting its shareholder base to the tune of 35%) along with a number of asset disposals which will allow it to forego a sale entirely. The numbers support this view - Toshiba is likely to stay put and remain listed regardless.

Assuming this scenario prevails, a non-sale (binary black/ white outcome) will have zero accretion to Western Digital's ( WDC) financials. There is grey though - should it return the multiple back to historical levels (~11x), this equates to $143 (~77% upside) on solid fundamentals.

Meanwhile, Toshiba at these levels still prices in some degree of delisting risk which seems out of the question at this point, while a non-sale event (~81% upside) has not been priced in at all by the market.

Recent dips in both stocks are great opportunities to accumulate.

Key UpdatesSince my last update, we've seen a major swing in the balance of negotiating power away from Western Digital ( WDC) toward Toshiba ( OTCPK:TOSBF). This has kept WDC range bound around the mid-80s to low 90s (before the recent dip back to the 70s) as a deal with Bain was announced.

Below is a (lengthy) timeline of events since my September update.

Date

| Event

| 6th Sept

| Toshiba reaches no agreement at board meeting on Western Digital's revised offer to acquire Toshiba Memory

| 7th Sept

| Reports surface that Toshiba faces mounting pressure from banks and government to reach a deal concerning sale of flash memory unit

| 11th Sept

| Toshiba receives revised bid of JPY 2.4tn for flash memory unit from Bain Capital consortium

| 13th Sept*

| Toshiba signs MoU with Bain Capital-led group to open talks over Toshiba Memory sale; aim to sign contract by late September

| 19th Sept

| Reports of the Japanese government seeking a capital injection into Toshiba as bail-out plans emerge

| 20th Sept

| Western Digital consortium proposes new concession plan, INCJ to invest JPY 500bn

| 20th Sept*

| Toshiba decides to sell memory chip unit to the Bain Capital consortium; Toshiba to hold reported 40.1% stake in consortium

| 21st Sept

| SanDisk files additional arbitration request with ICC on flash-memory JVs with Toshiba

| 26th Sept

| Toshiba Memory bidder Western Digital provides details on legal process related to JVs with Toshiba

| 27th Sept

| Further delays reported - Apple ( AAPL) seeks increase its memory product supply as a condition, Hynix intends to acquire a 15% future stake

| 28th Sept*

| Toshiba Memory share transfer agreement to sell 100% stake to Bain Capital consortium "concluded"; IPO planned within 2-3 years post deal

| 29th Sept

| INCJ reconsiders future investment in Toshiba Memory despite decision making rights to be granted

| 10th Oct

| Western Digital posts Q&As on issues over JVs with Toshiba

| 11th Oct*

| Toshiba shares to be removed from Tokyo bourse's on-alert list, opens funding options

| 11th Oct*

| Toshiba board approves additional investment of JPY 110bn for Fab 6 equipment at Yokkaichi plant

| 13th Oct

| Toshiba Memory, Bain Capital seek quick solution to Western Digital litigation

| 16th Oct

| Reports emerge that Toshiba Memory could receive additional investments of more than JPY 1tn by Bain Capital-led consortium until listing

| 19th Oct

| Bain Capital considers direct investment if Toshiba Memory deal doesn't complete by 31 March

| 19th Oct

| Securities Commission begins investigation into the accounting processes involving Toshiba's huge losses at its US nuclear power business

| 24th Oct*

| Toshiba gains shareholder approval for Toshiba Memory sale; CEO says contingency plan under consideration

| 27th Oct

| Arbitration court ruling expected in the first part of 2018

| 10th Nov

| Toshiba mulls share placement, public offering to raise JPY 600 bn

| 10th Nov

| Toshiba CFO - Toshiba mulling measures to improve financial conditionsother than memory chip business sale

| 10th Nov

| MOFCOM yet to initiate formal review; reports emerge of Unigroup's opposition, will drag review process

| 14th Nov

| Toshiba, Western Digital begin talks to settle legal tussle over memory chip business sale

| 16th Nov

| Western Digital CEO seeks to solve problems with Toshiba through "reconciliation"

| 19th Nov

| Toshiba announces JPY 600bn capital raise via share placement to cover payment for Westinghouse project

| 20th Nov*

| Toshiba and Western Digital end talks for investment in semiconductor production at JV with no agreement

| 30th Nov*

| Toshiba seeking JPY 120bn in damages from Western Digital in Tokyo District Court over attempts to block Toshiba Memory sale

|

(* denotes key Memory sale events/ announcements, Bold denotes indications of a failed FY3/18 sale close)

My high level takeaways from the Toshiba Memory event timeline are as follows - 1) Toshiba was never going to make the FY3/18 deadline, 2) But the capital raise completely mitigates delisting risk, and 3) Hence, WDC loses some negotiating leverage in the form of Toshiba's time constraints.

Sounds bad on paper but digging deeper, a non-sale actually benefits WDC and should lift the overhang on its multiple. As I'll delve into later on, WDC's current legal/ negotiating leverage is misunderstood and the market is irrationally penalizing shares. The 6% dip presents a compelling opportunity to accumulate heavily discounted WDC shares at ~6.2x FY2018E PE (assuming $13.00 FY18E consensus EPS).

Clarifying Western Digital's Legal LeverageAs I've reiterated numerous times in my prior articles, Western Digital's legal case is watertight. My position on this has only gotten stronger as the courtroom battles grow in volume and intensify. As recent history will show, Sandisk/ Western Digital has ultimately won the courtroom battle not once, not twice but on every occasion both parties have had a legal dispute.

Date

| Ruling

| In favor of?

| July 11

| The Superior Court of California granted SanDisk's request for a temporary restraining order ("TRO") prohibiting Toshiba

| WDC

| July 19

| Toshiba appeals TRO. However, after reviewing SanDisk's legal brief, the Court of Appeal summarily dissolved its temporary stay, thereby reinstating the TRO.

| WDC

| July 28

| The Superior Court of California entered a stipulated order preventing Toshiba from closing any transfer of its Flash JV interests without providing at least 14 days advance notice to SanDisk.

Note: the decision was a win for WDC because 1) it preserved the arbitration process and 2) Toshiba implicitly accepted the Superior Court of California's jurisdiction over it by accepting this order.

| WDC

| August 14

| The Superior Court of California granted SanDisk a preliminary injunction enjoining Toshiba from preventing certain employees from accessing shared databases and networks regarding the three NAND flash-memory JVs operated with SanDisk and from refusing to ship certain engineering wafers and samples.

| WDC

| September 8

| As the Superior Court of California concluded that it can exercise jurisdiction over Toshiba and TMC, the Superior Court of California entered a final order denying Toshiba's "motion to quash."

Note: Toshiba had disputed jurisdiction but by accepting the July 28th ruling, the denial was inevitable.

| WDC

|

If the legal proof isn't enough, consider the number of occasions when Toshiba has tried to coerce Western Digital into waiving its consent rights or wiggle its way out of its legal bind.

Date

| Event

| December 4 (2016)

| Toshiba drafts an "Undertaking" where both parties would waive their consent rights. WDC, upon learning of Toshiba's intentions to sell its memory unit, objects and no agreement is reached.

| April 1 (2017)

| Following its failed attempts to circumvent WDC's consent rights, Toshiba instead transfers the JV interests to a newly created affiliate on April 1 ( "Toshiba Memory")..

| June 2 (2017)

| Toshiba reversed its prior move, reverting its NAND JV assets back to the parent company from the subsidiary Toshiba Memory Corporation ("TMC") after WDC threatens an "event of default", allowing them to purchase TMC for <$1bn (~95% discount).

| Early July (2017)

| Toshiba now claims Flash Ventures is merely a financing vehicle and has no claim over the land, facilities, IP, R&D, etc. However, Sandisk designs approximately half of the NAND chips manufactured and has 2x the patent filings TMC has in the US.

| July 28

| Toshiba accepts California jurisdiction (and by extension the consent rights stipulated in the JV agreements governed by California law) by agreeing to stipulated order preventing it from closing any transfer of its Flash JV interests without providing at least 14 days advance notice to SanDisk. Attempts to challenge jurisdiction is subsequently shot down in Sept 8th ruling.

|

The latest attempt to battle it out on home ground (Tokyo) instead seems pointless - there are no exceptions in the anti-transfer provision in the Master Agreements, which are governed by California law. Additionally, Toshiba has already implicitly accepted California jurisdiction post the Superior Court of California's July 28th ruling and then in the Sept 8 ruling, when the Superior Court of California explicitly stated that it had jurisdiction.

Now that the three person arbitration panel (approved in late Oct) is approved, we're heading into a full arbitration tribunal process which could take ~2 years for full resolution. As I'll elaborate later on, delisting risk is now moot, removing the time constraint on Toshiba. But closing the Bain deal will not only remain a challenge but it will also mean foregoing significant upside for Toshiba.

In the meantime, Western Digital will file for injunctive relief to block the sale process with a decision expected in 1H '18.

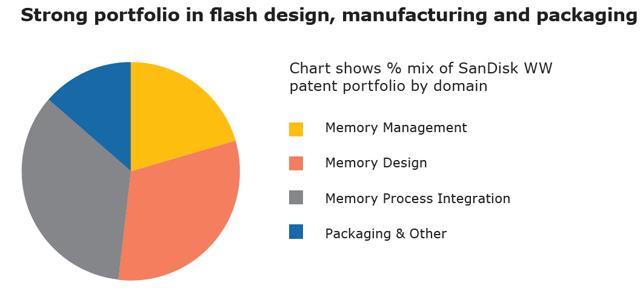

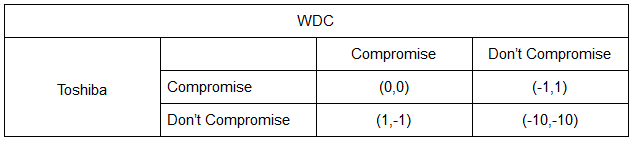

Clarifying Western Digital's IP LeverageIn early October, Western Digital published a fascinating 9 page Q&A document clarifying its position in the Toshiba Memory saga. Of note, it clarified a key misconception Toshiba has been spreading around IP contribution in the Western Digital-Toshiba JV.

Per the Q&A:

"The SanDisk IP portfolio was a key motivating factor in forming the JVs... SanDisk has more seminal patents in semiconductor memory than anyone else. More than 50% of SanDisk's patent portfolio is related to flash design and manufacturing…. SanDisk has more than 4,000 U.S. flash-related patents, about twice the number of TMC's U.S. patents."

(Source: Western Digital Q&A)

Remember the fuss Toshiba made about JV access when Western Digital asserted its contract rights? Here's a quote (one of many) from Toshiba's legal team:

"If Western Digital refuses, Toshiba Memory Company will have no choice but to protect its intellectual property rights by suspending Western Digital employees' access to all TMC facilities, networks and databases"

And here's a quick refresher of the Toshiba database access case:

Event

| Date

| Outcome

| WDC Database Access Blocked

| 28th June

| Toshiba blocked the ability of WDC to access certain databases

| TRO Motion Filed

| 6th July

| WDC filed a motion seeking a temporary restraining order (TRO) against Toshiba's blocking of information access

| TRO Granted

| 11th July

| Court granted WDC a TRO prohibiting Toshiba from, among other things, preventing certain employees from accessing shared databases and servers

| Toshiba Clarification of TRO

| 12th July

| Toshiba does not have to provide access to information owned exclusively by Toshiba but does have to provide WDC with JV information

| Temporary Stay of the TRO Issued

| 19th July

| Court of Appeal issued a temporary stay of the TRO on Toshiba's database shutdown to WDC

| Toshiba's Temporary Stay of the TRO Declined

| 3rd August

| California Court of Appeal denies Toshiba's request to stay the TRO prohibiting Toshiba's lockout

| Preliminary Injunction Granted Against Toshiba

| 14th August

| Prevents Toshiba restricting shared databases and networks and from refusing to ship certain engineering wafers and samples

|

Note the reiteration of IP rights by Toshiba's legal team to paint the impression that WDC (and by implication, Sandisk) was a mere tag along while Toshiba did the heavy lifting i.e. design, development etc. The reality, as Western Digital stated in its Q&A report, is that SanDisk/WDC had twiceToshiba Memory's US patents with over half of those related to Flash design and manufacturing. The swift and absolute manner of WDC's legal win (WDC's TRO was granted within 5 days) is testament to its IP contribution.

IP leverage is a big deal because it gives Western Digital significant leverage in Fab 6 negotiations. Recall that Toshiba had effectively threatened a unilateral investment in Fab 6, cutting off WDC's supply from the facility. Supply disruption from Fab 6 extends to 2029 and would on paper, prove a key obstacle in its ability to meet bit target growth rate of 35-45% for 2019.

But for all of Toshiba's posturing, the reality is that Toshiba cannot proceed with manufacturing 3D NAND Flash without Western Digital/ Sandisk's IP.

Per WDC's Q&A report:

"SanDisk designs approximately half of all the NAND chips that are manufactured in the JVs. SanDisk has been responsible for breakthrough design and system innovations that have resulted in advancements such as Multi level cell (MLC), Three-level cell (TLC) and Quad level cell (QLC) technologies, among others."

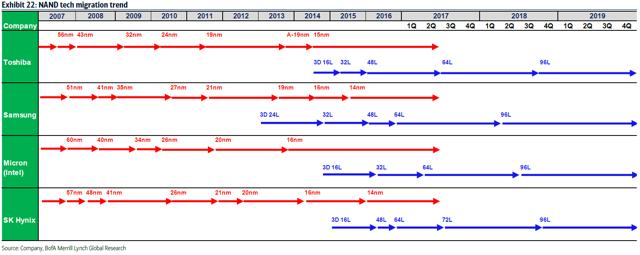

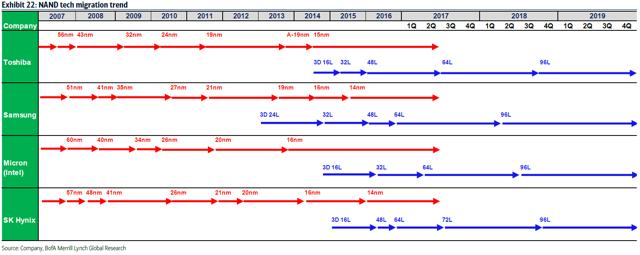

WDC/Toshiba is in the midst of a crucial transition from 64-Layer (BiCS3) to subsequent 96-Layer (BiCS4) 3D NAND and IP-related disruptions would set them back considerably in the 3D NAND race.

If that isn't enough of a hindrance, their contractual agreement definitely will be. Per WDC, " Toshiba is contractually prohibited from working with other companies to manufacture BiCS or other NAND flash memory being developed or manufactured in the SanDisk-Toshiba JVs." If that isn't enough of a hindrance, their contractual agreement definitely will be. Per WDC, " Toshiba is contractually prohibited from working with other companies to manufacture BiCS or other NAND flash memory being developed or manufactured in the SanDisk-Toshiba JVs."

To me, that's about as clear cut as it gets. WDC's IP leverage through Sandisk is very solid and threats of a unilateral investment in Fab 6 are most likely posturing on Toshiba's part to coerce Western Digital into giving up their consent rights.

From a legal perspective, Sandisk's IP contribution strengthens its case for injunctive relief as 1) SK Hynix ( OTC:HXSCF) has a checkered history with respect to IP theft and 2) Seagate ( STX) is a direct competitor - potential IP leaks and a larger SSD presence will threaten WDC's competitive advantage.

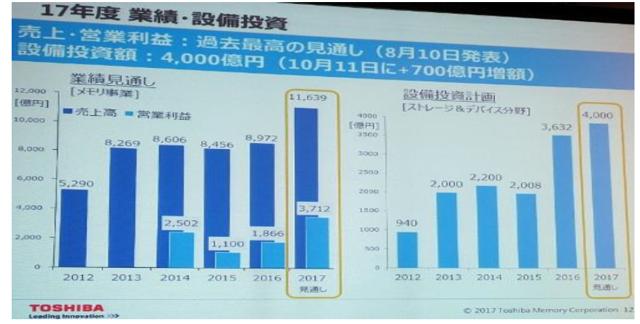

Diving into Toshiba's Crown JewelIn late October, we got our first insight into Toshiba Memory's post Bain business strategies (they had stopped releasing these earnings following a suspension during the aftermath of the Toshiba accounting scandal).

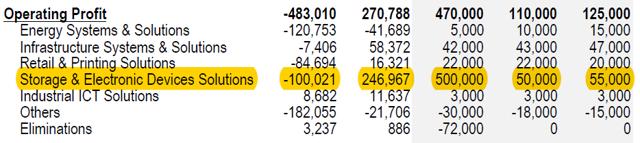

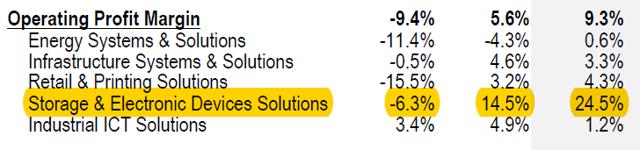

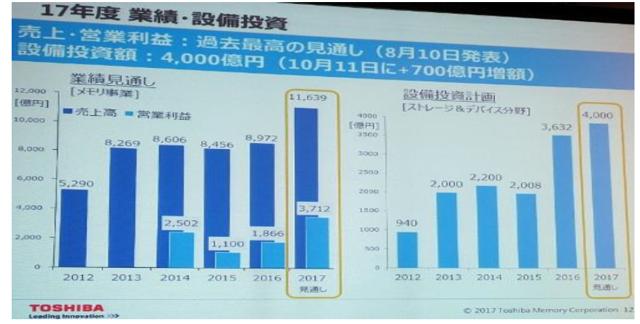

The financials were astonishing. Revenues were guided up ~30% for CY2017 while operating profit were on track to double (+99% YoY) at ~32% OP margin. Toshiba Memory expects revenue of JPY1.16tn, operating profit of JPY371bn, and will spend capex of JPY400bn (prior capex was ~JPY200bn) for the year.

(Source: Toshiba) (Source: Toshiba)

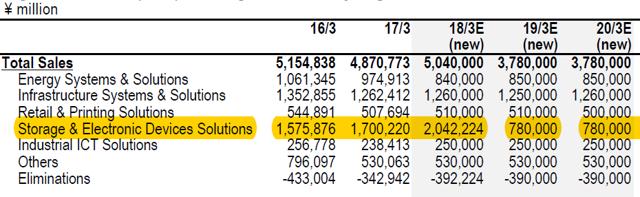

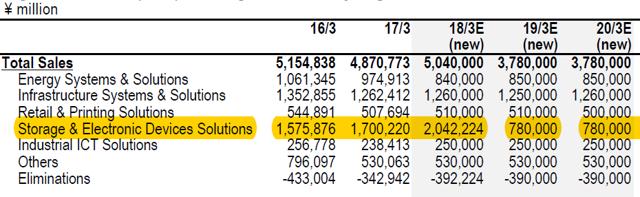

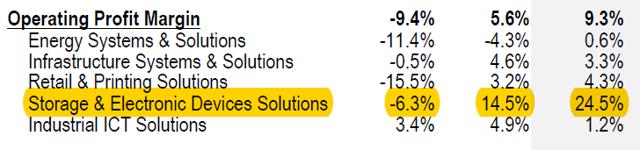

Just to put the memory performance into perspective, let's start with a breakdown of Toshiba's revenue - ~35% of total revenue comes from the storage & electronic devices segment (its biggest driver) while its other segments trail slightly in scale.

(Source: JPM) (Source: JPM)

But none of its ancillary businesses actually generate much profit. In FY2017, the storage and electronic devices unit contributed 91% of the company's operating profit. The only other profitable business - industrial ICT was barely breaking even.

(Source: JPM) (Source: JPM)

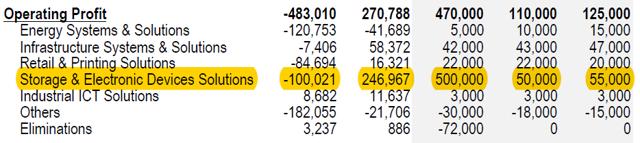

Applying what Toshiba disclosed about TMC - 32% OP margins, JPY371.2bn OP, it's quite clear that the memory business is carrying the entire company on its own. Minus the JPY371bn contribution to OP, FY17 would have been another severe loss making year for Toshiba and a delisting would have been a given.

(Source: JPM) (Source: JPM)

The JPY600bn LifelineThe removal of Toshiba shares from the TSE's on-alert list was a key event for one key reason - it opened up equity funding options for the company. Realizing the inevitability of a Bain deal falling short of the FY3/18 target, Toshiba management moved to "Plan B" - a JPY600bn capital raise. This would be raised through the issuance of new shares.

The indicative price will be ~¥262.8 (4.8% below 30 November close) with issuance of 2,283.1 million new shares - i.e. boosting the share count by 54% and diluting existing shareholders by ~35%.

Shares Issued ('m)

| Current Shares Outstanding ('m)

| Dilution (%)

| 2,283.1

| 4,238

| 35

|

Issue Price (JPY)

| Current Price (JPY)

| Discount (%)

| 262.8

| 276

| 4.8

|

(Source: Author Estimates)

The capital raise will be completed on 5 December, providing net proceeds after fees of ¥574bn. The funds will be used to make full payment of company guarantees related to WEC (specifically the Vogtle and V.C.Summer AP1000 nuclear projects).

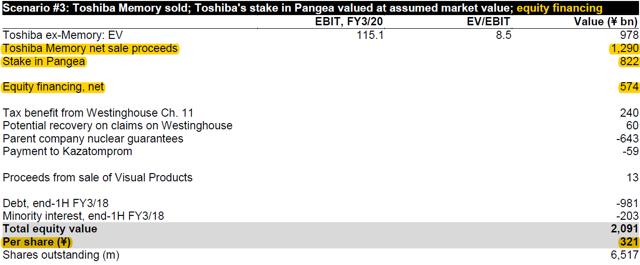

In the context of delisting, the JPY600bn lifeline is a game changer. In fact, subsequently selling the business now and obtaining a surplus equity position looks a lot less appealing given 1) "new" Toshiba post memory sale will have little if any earnings power and 2) current valuations at JPY2tn actually undervalues the memory unit's earning potential.

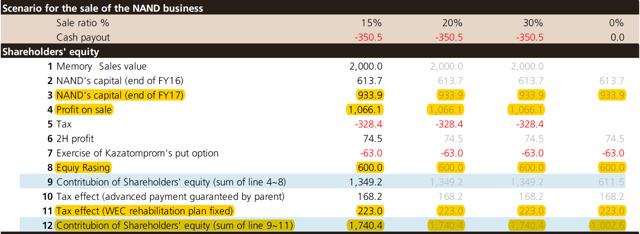

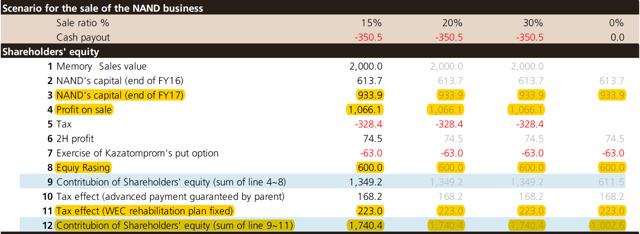

With the additional JPY600bn on the books, Toshiba will have its share of options. Here's an illustrative table mapping out how easily Toshiba can now turn its negative equity position positive.

(Source: UBS) (Source: UBS)

Notice that of all the possible memory unit sale scenarios, Toshiba's equity position remains in positive territory regardless - even if the sale completely fell through. The reason for this sudden shift is threefold - 1) the JPY600bn capital raise boosts June 2017's ~ -JPY619bn equity position virtually into positive territory already, 2) by settling WEC related obligations to creditors, Toshiba would be able to obtain the right vis-a-vis Westinghouse to demand reimbursement of the amount paid by Toshiba, and 3) this then leads to a scenario where Toshiba can then sell its claims, including reimbursement, against WEC and interest held by it related to WEC to a third party and realize tax benefits accordingly.

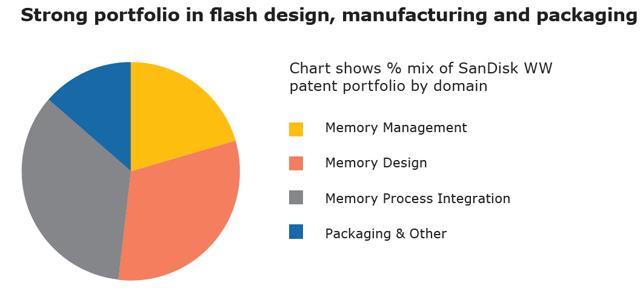

The Toshiba Memory Sale and Put OptionThis brings us to the sale of Toshiba's memory unit to the Bain consortium. Contrary to what most think, this deal is far from done. In fact, I think the JPY600bn raise has altered things so materially, it doesn't make financial sense for Toshiba to proceed with the sale any longer.

And even if it does, the March deadline is long gone. A June close would seem far more realistic.

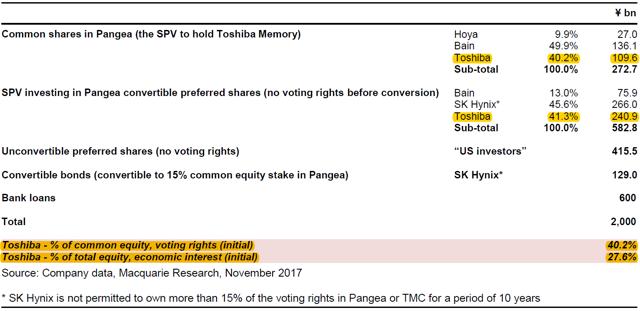

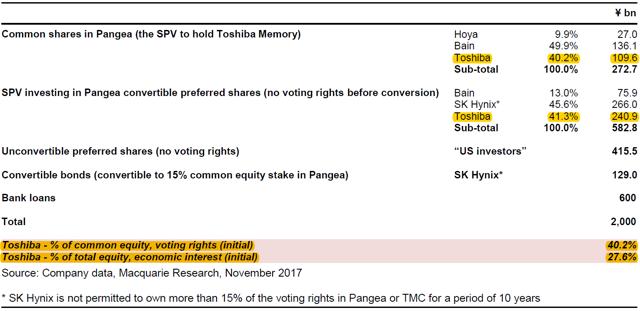

As things stand, Toshiba will invest ~JPY350bn in the Pangea SPV (set up for Toshiba's memory unit acquisition) and retain a large 40% common equity interest, although economic interest will be sub 30% (~27.6% est). The presence of Hynix (IP theft) and Seagate (direct competitor) will not sit well with Western Digital - expect this to be a key point of contention at arbitration and WDC's filing for injunctive relief.

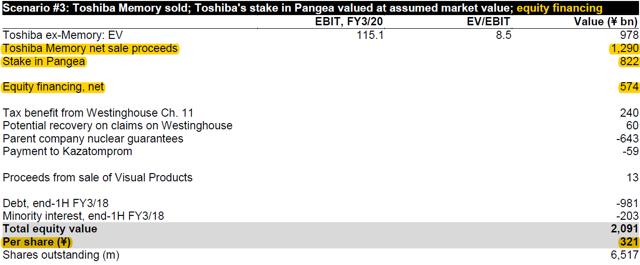

Keeping a portion of Toshiba Memory on the books and earning affiliate income contributions from TMC will support earnings going forward and presents some good upside (~16%) if current NAND supply/demand dynamics do not drastically falter. Keeping a portion of Toshiba Memory on the books and earning affiliate income contributions from TMC will support earnings going forward and presents some good upside (~16%) if current NAND supply/demand dynamics do not drastically falter.

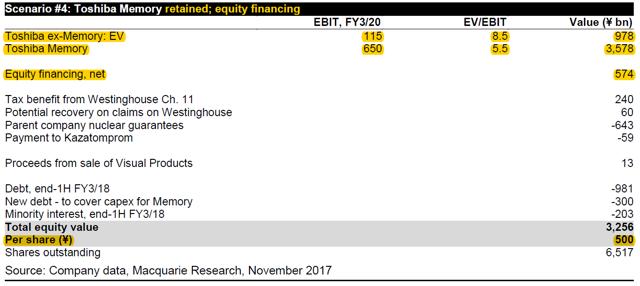

But here's where it starts to get interesting - if Toshiba retained 100% of its memory unit, applying Micron's ( MU) ~5.5x EV/ EBIT multiple would yield ~81% upside from current levels. But here's where it starts to get interesting - if Toshiba retained 100% of its memory unit, applying Micron's ( MU) ~5.5x EV/ EBIT multiple would yield ~81% upside from current levels.

Toshiba, it would seem, agrees with a no sale scenario. Looking through Toshiba Memory's Share Purchase Agreement (SPA) indicates no penalty at all if Toshiba were to terminate the deal. In fact, Toshiba can terminate the agreement in the (likely) event that the transfer of Toshiba Memory shares is not completed by 31 March 2018. A contractual escape clause for the seller, while buyers have to wait until June to terminate (JPY10bn penalty if they do). Toshiba, it would seem, agrees with a no sale scenario. Looking through Toshiba Memory's Share Purchase Agreement (SPA) indicates no penalty at all if Toshiba were to terminate the deal. In fact, Toshiba can terminate the agreement in the (likely) event that the transfer of Toshiba Memory shares is not completed by 31 March 2018. A contractual escape clause for the seller, while buyers have to wait until June to terminate (JPY10bn penalty if they do).

Toshiba also discloses required antitrust approvals from the following key jurisdictions - Brazil, China, the European Union, Japan, Korea, Mexico, Philippines, Taiwan, Turkey, and the United States. If getting all those approvals within the next 3-4 months wasn't tough enough, Tsinghua's objection to the TMC sale will make MOFCOM the key hurdle in a process already running severely short of time.

Couple that with a potential WDC injunction and the government's (INCJ/DBJ) reluctance to participate upfront, and you have a deal just waiting to fall through.

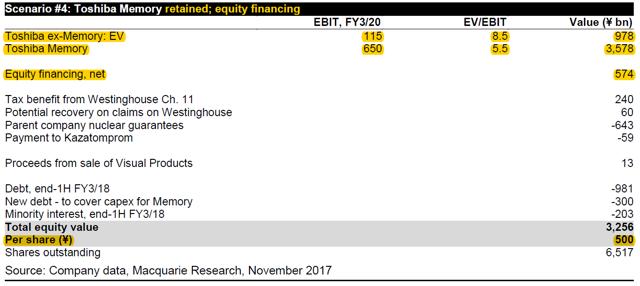

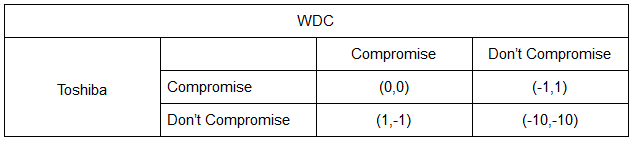

To Be the Yielder or the AggressorIf a deal does indeed collapse or drastically change in form, I expect we'll see a move towards settlement between both parties. I think game theory is a particularly useful way to frame how negotiations have gone so far. Consider the diagram below.

With an impending memory unit sale, neither WDC nor Toshiba is incentivized to compromise as the outcome is binary - one wins and the other loses. But if neither side compromises, we arrive at the worst possible outcome, and this seems to be what WDC is pricing in at the moment.

But take the memory unit sale out of the equation and the situation changes dramatically. Without a sale, there is simply nothing to compromise on. We simply move back to the status quo (0,0) set of outcomes where both parties are now incentivized to compromise given their legal bind to one another and the lack of financial incentive at hand.

Final CallAssuming this scenario prevails, a non-sale (binary black/ white outcome) will have zero accretion to Western Digital's financials. There is grey though - should it return the multiple back to historical levels (~11x), this equates to $143 (~77% upside) on solid fundamentals.

Meanwhile, Toshiba at these levels still prices in some degree of delisting risk which seems out of the question at this point, while a non-sale event (~81% upside) has not been priced in at all by the market.

Recent dips in both stocks are great opportunities to accumulate.

Disclosure: I am/we are long WDC, TOSBF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. |