The bull case for TRIL (from "Seeking Alpha")

Trillium Therapeutics: ASH Update And Looking Into 2018

Dec. 12, 2017 10:34 AM ET

|

3 comments

|

About: Trillium Therapeutics Inc. (TRIL)

Jonathan Faison

Summary

Shares are showing a bit of weakness after updated results for their TTI-627 program were presented.

Increased interest from key institutional investors bodes well.

Novel covalent EGFR inhibitor TTI-2341 is an overlooked asset that could overcome limitiations of its earlier generation predecessors.

I provide a recap of poster presentations for TTI-627 and my takeaways.

I wouldn`t be surprised to see a partnership or other value-adding transaction occur in the near to medium term.

Shares of Trillium Therapeutics ( TRIL) are showing a bit of weakness after updated results for their TTI-627 program were presented at the ASH (American Society of Hematology) annual meeting. Still, readers should keep in mind this comeback story has been very good to us since initiating coverage in mid-October.

TRIL data by YCharts TRIL data by YCharts

In my most recent update piece, I presented several reasons why I believed the story was getting better.

CD47 continues to be an attractive oncology target with preclinical efficacy established across a variety of indications and synergy with other immunotherapies likely. A recent indication of growing interest was the recent $75 million Series B Financing for Forty Seven Inc., led by Wellington Management Company with participation from existing investors (Clarus, Lightspeed Venture Partners, Sutter Hill Ventures and Google Ventures).

While Wall Street appeared to write off the stock in 2016 when two of five patients in the highest dose cohort of a phase 1 study experienced dose-limiting toxicity, additional data clarified that this transient thrombocytopenia often lessens after multiple infusions and was suggestive that there could be an opportunity to increase exposure to the study drug in patients after the initial dose.

Institutional participation was alive and well, for which I referenced the $30 million June financing as a positive development with significant positions owned by Growth Equity Opportunities V (9.9%) and Cormorant AM (5.66%). I also pointed out that Baker Brothers Advisors, Tekla Capital Management and NEA Management all own stakes as well.

What`s Happened Since

Institutional interest in the company`s recent private placement was encouraging. It consisted of 1,950,000 shares of common stock and 400,000 Series II non-voting convertible first preferred shares priced at $8.50 per share for total gross proceeds of $19.975 million.

I also liked what I saw in their new preclinical data for novel covalent EGFR inhibitor TTI-2341 pursuing opportunities in glioblastoma multiforme (GBM) and brain metastases of non-small cell lung cancer (NSCLC). The drug candidate showed potent activity against a broad range of EGFR variants such as disease-relevant mutants T790M and C797S. Importantly, it demonstrated the ability to penetrate the blood brain barrier and superior oral bioavailability compared to afatinib and osimertinib (greater than 20-fold higher free drug brain exposure compared to osimertinib). For a frame of reference, sales of Gilotrif (afatinib) are expected to hit around $700 million by 2022. TTI-2341 has significant potential even in this crowded field as it could overcome limits of poor penetration of the blood brain barrier and reduced activity against resistance-associated EGFR mutations.

In Monday`s ASH update the company provided several reasons for investors to remain hopeful into 2018 and beyond.

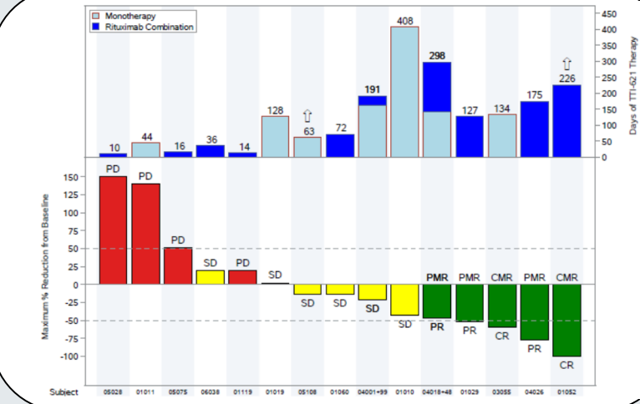

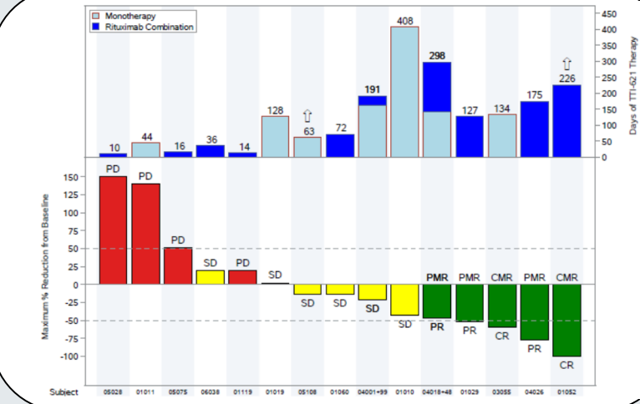

In a poster presentation for TTI-621, a summary was given from the study evaluating intravenous TTI-621 in patients with relapsed/refractory hematologic malignancies and those with diffuse large B-cell lymphoma (DLBCL). The most important takeaway for me was the fact that weekly infusions continued to be well tolerated, which along with results from the dose escalation portion should help alleviate at least some of the concerns Wall Street had (and the associated overhang on the stock price). When administered in combination with rituximab, objective responses occurred in 27% (5/18) DLBCL patients along with others demonstrating extended progression-free periods. Keep in mind these were patients that had already been heavily pretreated.

Figure 2: Time on study and tumor response (source: ASH abstract) Figure 2: Time on study and tumor response (source: ASH abstract)

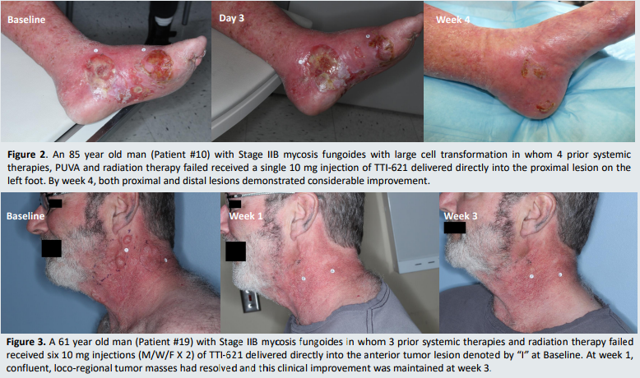

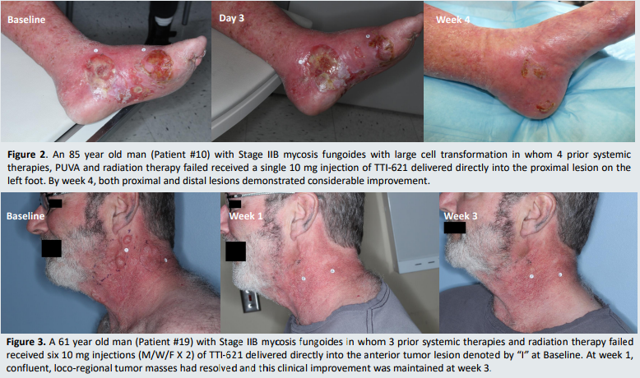

Their second poster was titled ¨A Single Direct Intratumoral Injection of TTI-621 (SIRPaFc) Induces Antitumor Activity in Patients with Relapsed/Refractory Mycosis Fungoides and Sezary Syndrome: Preliminary Findings Employing an Immune Checkpoint Inhibitor Blocking the CD47 "Do Not Eat" Signal.¨

Intratumoral injection of TTI-621 resulted in rapid reduction in CAILS scores (measures local lesion responses) in 90% (9/10) of mycosis fungoides patients. Additionally, in 3 of 3 patients a reduction in circulating leukemic Sezary cells was observed. Importantly, the injection was well tolerated with no dose-limiting toxicities. In sum, the data was encouraging and as a result patients continue to be enrolled.

Figure 3: Rapid tumor regression in mycosis fungoides (source: corporate presentation) Figure 3: Rapid tumor regression in mycosis fungoides (source: corporate presentation)

Trillium CEO Dr. Niclas Stiernholm had the following remarks to add (my emphasis in bold):

The regression of local tumor lesions observed in most CTCL patients treated with intratumoral TTI-621 monotherapy provides us with a rationale to initiate a sharply focused effort to characterize efficacy in this largely incurable disease, as well as other forms of T-cell lymphoma. Having completed the dose-escalation phase, we are now pursuing weekly dosing in the intratumoral trial with the goal of inducing systemic responses. In parallel, we continue to enroll a wide variety of T-cell lymphoma patients, including CTCL, into an expanded cohort in the intravenous TTI-621 trial. Notwithstanding the added level of complexity associated with developing combination therapies, the emerging signal in the DLBCL cohort is intriguing, especially since these patients have previously progressed after rituximab therapy. With growing evidence supporting the tolerability of dose intensification we are now able to assess whether increasing systemic exposure of TTI-621 leads to greater anti-tumor activity in patients, including those with T-cell malignancies.

For the third quarter the company reported cash and equivalents of $64.3 million, while net loss for the first nine months of the year totaled $34.4 million. This cash balance does not include $19.975 million received from the recent private placement.

Peering into 2018, I wouldn`t be surprised to see a partnership or other value-adding transaction occur. The progression of the program and opening of expansion cohorts could best be overseen by a partner with bigger pockets (or acquirer). Intratumoral TTI-621 definitely appears approvable and I look forward to continued updates here as well.

I believe the recent secondary financing also came as a result of increased clinical investment in expansion cohorts (and of course interest from institutional investors), both of which I consider to be promising signs. Matrix Capital now owns 16.5% of shares outstanding. We can expect an IND submission for TI-622 as well.

In Monday`s trading session - as I write this - the stock dipped to the $9 level but buyers quickly came back in (an encouraging sign). Perhaps expectations were overly high or this is simply a slight post conference sell off. Either way I believe at the end of 2018 this revaluation play will be trading at significantly higher levels than where we find ourselves today.

Trillium Therapeutics is a Buy.

Readers interested in the story who have done their due diligence should make an initial pilot purchase or add to their positions in the near term. I suggest adopting a "buy the dips" strategy as I believe ASH data should provide a decent floor for the stock price. This selection appears attractive into 2018 as a revaluation play.

After the recent financing, the risk of dilution appears to be off the table in the near term. I am further convinced after recent data that a partnership could be forthcoming, which would reduce the risk of dilution even more. However, in the absence of a partnership or other form of funding, capital markets will likely be accessed by the second half of 2018. Safety concerns, although less of an issue than before, are still significant and should be taken into consideration. Further, severe adverse safety events (including the possibility of a clinical hold) should be carefully considered prior to taking a position. Setbacks in ongoing and planned studies (both as a monotherapy and in combination) would negatively impact the stock price as well. Readers would also do well to keep tabs on progress by competition in the space.

Bladerunner |