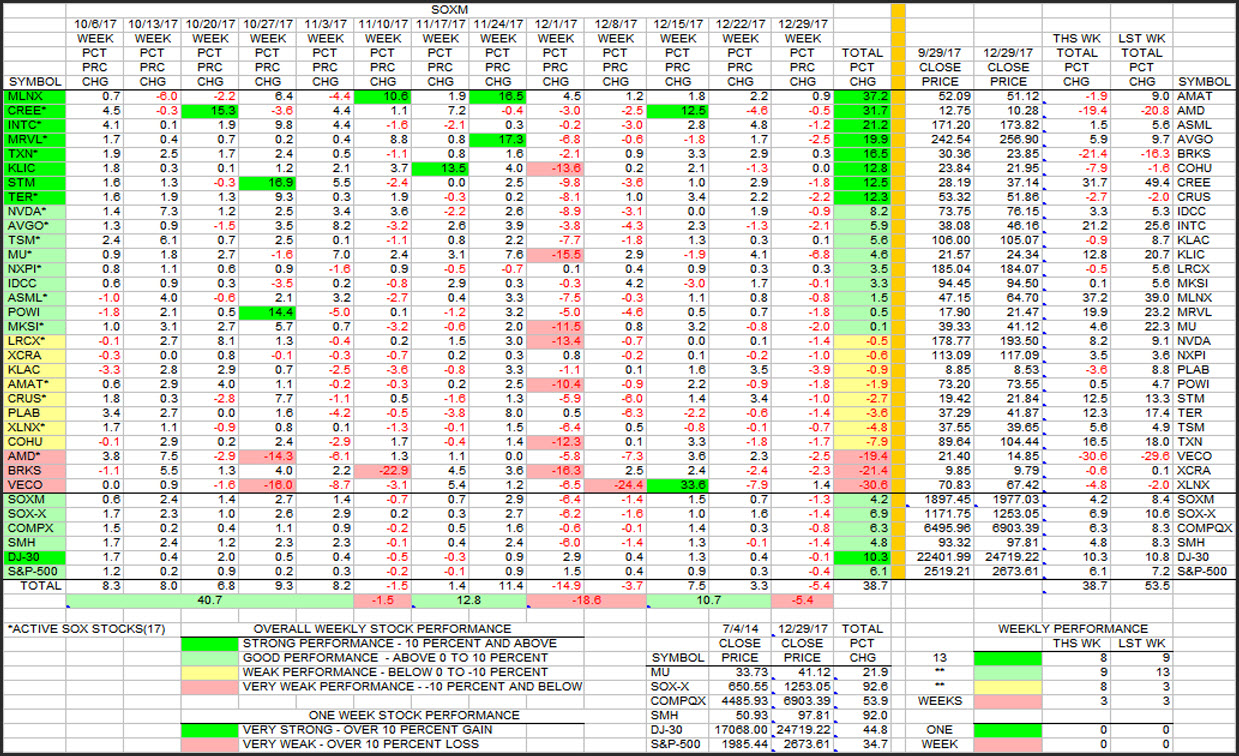

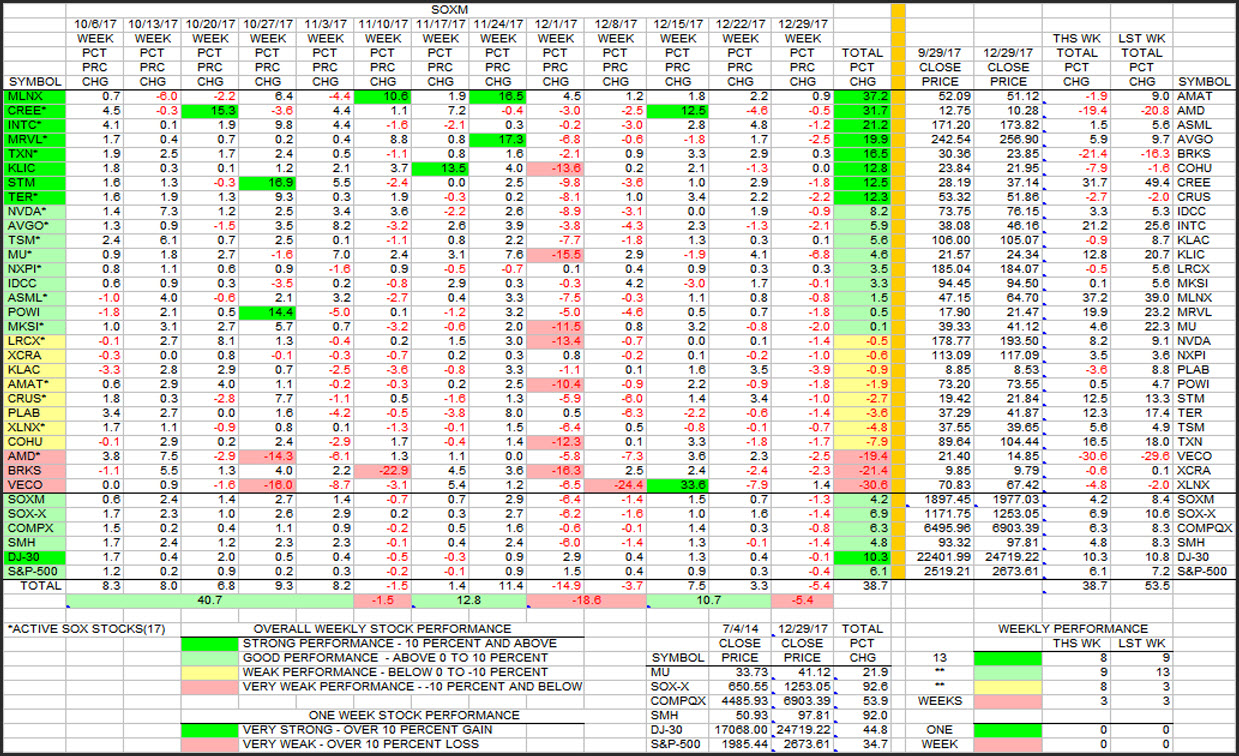

This is the weekly update of the 13 week rolling quarter for the SOXM stocks and major indices in actual and percent terms. This is a special week in that it is the final calendar quarter for 2017 finishing out the year.

With a good green week rolling off to the left and replaced with a red week on the right, the bottom line number of 53.5 last week went to 38.7 this week.

Looking at the bottom line, the 5 weeks on the left total 40.7, but the last 8 weeks total to -2.0. A real break point occurred the week ending 11/3. During the last 2 months the bottom line performance has been essentially "flat". INTC has done well for the 13 weeks, up +21.2%. The DOW is up +10.3%, the highest of any index. Micron is up +4.6% for the period, but LRCX, KLAC, and AMAT are all in the yellow.

Looking at the small table at the bottom from 7/4/14 to now, a period of essentially 2 and 1/2 years, the DOW is up about +45%, the NASDAQ up about +54%, the semi indices up over +90%, and Micron up about +22%.

|