Seeking Alpha article I came across that compares WDC and Seagate. The author does present a good case. Doesn't make sense that WDC is so undervalued. If WDC was given a 12X multiple of EPS right now, the stock would be in the $140's.

Link: seekingalpha.com

Western Digital: Lagging Behind Seagate For No Good Reason

Jan.23.18 | About: Seagate Technology (STX)

Gary Alexander

Software and cloud, high-growth technologies, IPOs

Summary

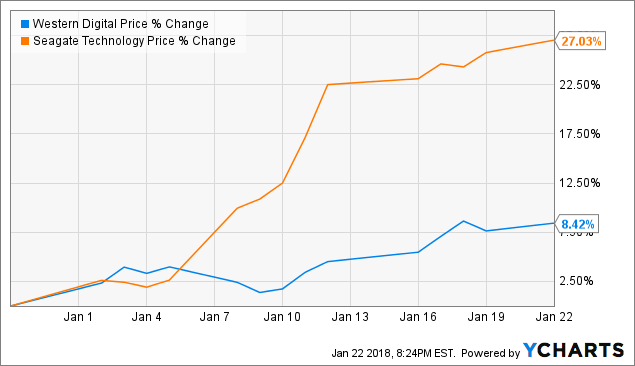

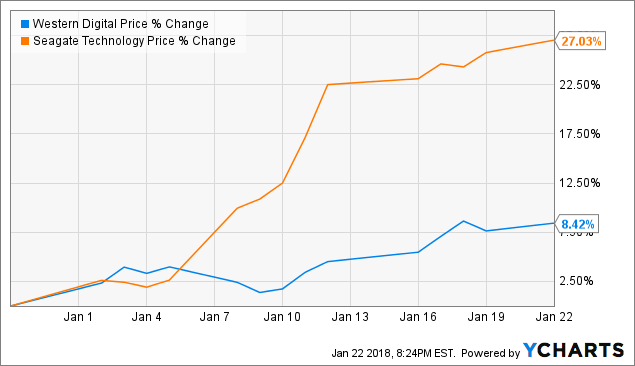

Since the beginning of 2018, Seagate's performance has outstripped Western Digital by nearly 20%.

Seagate's pre-release of Q2 results, bolstered by strength in the HDD market, but this strength should carry over into Western Digital as well.

Western Digital has a near-identical business mix to Seagate and is an even larger player in the HDD market than Seagate is.

Seagate's rumored investment in the Ripple cryptocurrency only adds a couple points to its outperformance.

Western Digital will report earnings on January 25; with HDD strong, an earnings beat is virtually guaranteed and the company will catch up to Seagate.

The market has two main players in the hard disk drive (HDD) arena: Western Digital (NASDAQ: WDC) and Seagate Technology (NASDAQ: STX). Despite these stocks historically moving rather close in tandem with each other - as they both occupy a near carbon-copy of each other's businesses - their performance has diverged rather noticeably in the first month of 2018.

As seen in the chart below, Seagate is up 27% since the start of this year - making it one of the best-performing stocks in the S&P 500 - while Western Digital, while still posting above-index returns, has lagged far behind its cousin. The central thesis of this article is that while there are some company-specific forces at play that are pushing Seagate up (specifically, its investment in Ripple), it's not enough to justify its outperformance relative to Western Digital. With Seagate hinting at strength in the HDD market that should also be a great tailwind to Western Digital, the latter will likely see a meaningful jump as it catches up to Seagate in the near term, creating a buying opportunity before Western Digital's January 25 earnings call.

WDC data by YCharts

Investors have had a rocky relationship with the HDD space over the past several years - most argue that the technology is dying out in favor of NAND flash-based memory, which doesn't come with the magnetic spinners that make HDD memory so clunky and slow. Yet, HDD has seen a bit of a resurgence in 2017, as greater use cases for data-at-rest and the explosion of data volumes in general have made a compelling case for buying hard drives for non-critical workloads, instead of their much more expensive NAND counterparts.

And it's not like the HDD players are oblivious to changes in market norms, either. Both Western Digital and Seagate have made inroads into NAND flash, with Western Digital just recently settling a long dispute with Toshiba over coveted NAND supply.

With these two businesses so similar, there's no reason why Seagate should be racing so substantially ahead of Western Digital: most of the lift in the stock is due to industry-wide factors.

The value of Seagate's Ripple investment isn't substantial enough to account for the performance gapSeagate is up for two main reasons since the start of the year, which is what we'll focus on in this article. The company has been a major news hub as it 1) announced preliminary results on January 8 that resoundingly beat analyst expectations, and 2) an earth-shaking Seeking Alpha article, posted on this very site, suggested that Seagate may own up to 4% of the crypto company Ripple, with a current valuation that makes it one of the largest private unicorns.

The central focus of this article is simple: Seagate's crypto associations, if properly valued, only contribute to a few points of the stock's outperformance; second, extracting this crypto-related upside, its HDD-driven gains should translate into Western Digital as well. With Western Digital due to report earnings on January 25, it's virtually guaranteed to report numbers to the upside as few investors have baked in the HDD strength read-through from Seagate's preliminary report.

First, let's put a rough target on the value of Seagate's Ripple investment. The Ripple cryptocurrency XRP, at the time of writing, is trading at $1.34, giving it a market cap of $52 billion. Ripple owns ~60% of XRP's market cap ($31.2 billion), and recent analyst notes claim Seagate's stake in Ripple to be between 2-3%, stemming from Seagate's participation in Ripple's $55 million Series B round in 2016. It wasn't the lead investor; a Japanese investment company called SBI Investment was.

Assuming the midpoint of 2.5% of analyst assumptions, we can estimate Seagate's Ripple-related value at $780 million - we can be generous and round this up to an even $1 billion. With Seagate's current market cap at $15.2 billion, this implies that Ripple is responsible for, at the most, 6% of Seagate's rise.

And note that assuming this $1 billion value-add for Ripple is already a contentious assumption, within the past year, Ripple's value has fluctuated from a low of <$0.01 to a high of >$3. Maybe investors are banking on Ripple's value soaring in Bitcoin-style fashion to account for more a jump in Seagate, but that's an extremely speculative call that few investors are likely to make.

HDD tailwinds account for the restSeagate is beating Western Digital by ~19% since the start of this year; in theory, after netting out the Ripple value, this leaves ~13% in HDD-related gains that Western Digital should be sharing in.

In its January 8 press release, Seagate reported that it expects $2.9 billion of revenue in Q2, representing 10% sequential growth over Q1 revenues of $2.632 billion.

Note that we're focusing on sequential growth here (instead of y/y growth, which is roughly flat) because Seagate had originally guided to 3-5% in sequential growth (producing a negative y/y comp). This is a 5-point beat to the high end of Seagate's guidance - which, considering HDD is thought of as a "dead" space, is truly impressive.

Seagate attributes its upside performance entirely to HDD:

"The strength in the Company’s revenue and gross margin for the quarter was driven primarily by better-than-expected demand for the Company’s HDD mass-storage solutions portfolio and operational execution"

In theory, this should play well for Western Digital as well as Seagate. After all, Western Digital has a 5-point market share lead over Seagate in HDD. Though the only possible explanation for Western Digital's failure to catch up would be if it lost market share to Seagate, this isn't too likely of an outcome, as the two companies' market shares have held steady over a long period of time. More than likely, the growth in HDD was evenly distributed across the industry.

Western Digital hasn't touched its guidance since December. The consensus analyst average revenue target for Western Digital is $5.3 billion, right in line with Western Digital's own guidance. If Seagate saw upside in HDD during the holiday season after Western Digital set its guidance (on December 12), it's likely to carry over into upside for Western Digital as well. Note that hard drives have a lot of consumer end-uses, such as in PCs and gaming, so a surprise holiday bump is very much within the realm of possibility.

Valuation and key takeawaysOf course, we shouldn't be looking at these two stocks' valuations in an aquarium: it could very well be that they are both expensive. Just because one is up more than the other, doesn't necessarily mean that either is good value.

It turns out, however, that this is not the case. Both Western Digital and Seagate trade at forward P/E multiples that are substantially below market averages (partially due to investors' fear that the memory super-cycle is coming to an end). With the S&P 500 at ~18-19x forward P/E, either of these stocks is a superb value buy.

And Western Digital, at just 6.4x forward P/E, is substantially cheaper than Seagate - trading at more than twice its valuation. If Seagate were below Western Digital's valuation and its recent rally was just a catch-up, then it wouldn't be a major buy signal for Western Digital. But as it turns out, not only was Western Digital always the undervalued play, but the spread has widened even further.

WDC PE Ratio (Forward) data by YChartsThe key sound bite from this article: Western Digital has a lot of catching up to do. If investors like Seagate this much, they should be throwing at least a little bit more love onto Western Digital. Western Digital's earnings, coming up on January 25, are very likely to be an upside catalyst to support its catch-up rally.

Disclosure: I am/we are long WDC.

**************************************************************************************

UWG |