I agree with this guy.

Link: 4140393-western-digital-unfairly-sold-strong-quarter

Western Digital: Unfairly Sold On Strong Quarter

Jan. 26, 2018 5:55 AM ET

|

8 comments

|

About: Western Digital Corporation (WDC)

Gary Alexander

Software and cloud, high-growth technologies, IPOs

Summary

Western Digital reported strong Q2 earnings that beat analyst consensus on both the top and bottom line.

The company also increased its guidance from the view given in December. It raised its EPS guidance to $13.50-14, implying a 6.3x forward P/E at current trading levels.

Despite strong earnings, the stock fell in after-hours trading for apparently no reason.

Western Digital remains one of the most undervalued stocks in the semiconductor industry.

Over the past few months, it seems that Western Digital (NYSE: WDC) remains a stock that investors love to hate. It's true that Western Digital has had its fair share of issues over the past year, but it is more or less resolved: the Toshiba ( OTCPK:TOSYY) dispute has been settled, giving Western Digital a steady pipeline of flash supply; its core hard drive business is showing surprise strength, a trend confirmed by rival Seagate (NASDAQ: STX); and a strong earnings quarter/guidance release has confirmed a strong year ahead for the company. So why is the stock trading down after-hours on the back of a solid quarter?

WDC Price data by YCharts WDC Price data by YCharts

To be fair, Western Digital quickly recovered the majority of the post-earnings selloff that triggered immediately after its release. But after already trading behind Seagate's valuation, and after buoyant results across the industry from the likes of SK Hynix ( OTC:HXSCF), there's no reason Western Digital should be trading down. In all fairness, it should be trading up towards the $90s.

The post-earnings selloff, in my view, presents a strategic buying opportunity into a company that has long been undervalued. Memory trends look stable heading into 2018, and most industry observers share the opinion that the cycle won't start turning sour until sometime in 2019. Trading at a P/E of just ~6x (based on the company's fresh FY18 EPS view of $13.50-14), and with financials that are showing consistent top-line growth along with earnings expansion, Western Digital seems to be a deal that's too good to pass up.

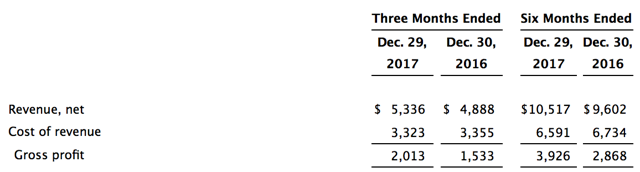

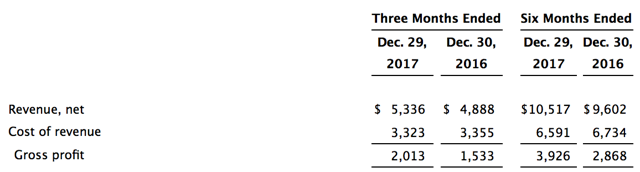

Q2 results and guidance download: full steam aheadWestern Digital generated $5.34 billion in revenues in Q2, up 9% y/y. In its guidance given in mid-December, the company guided to $5.3 billion in revenues, and analysts were expecting exactly $5.3 billion, or 8% growth.

Figure 1. Western Digital Q2 revenues

Clearly evidenced by strong, near-double-digit revenue growth, end-customer demand for Western Digital memory products is holding up well. There are plenty of drivers to support elevated demand for both flash and hard drive memory. On the consumer side, think cryptocurrency and games with ultrahigh-quality graphics - all creations of recent years. Storage of this content often falls upon hard drives, resurrecting demand in what was once thought to be a dead product. On the enterprise side, an increasing number of corporates are hoarding data and treating it as a critical business asset - necessitating large purchases of both flash and hard drive memory products for critical and non-critical data, respectively. While it's true that demand is shifting from older HDD technology into more expensive flash, many businesses are still opting to put non-critical data that doesn't need continuous refreshing or access into cheaper hard drives that they can buy in bulk.

It might be in the company's gross profit that investors smelled a little bit of trouble. The company's $2.0 billion of gross profit implies a 37.7% GAAP gross margin relative to the company's guidance for 38-39% margins. This may signal that the pricing squeeze on memory products has come to an end, and that chipmakers will race each other to the bottom as supply floods the market (similar to airlines' price wars), but all the evidence from competitors and industry analysts suggest otherwise. Gartner, in particular, released a recent research report that predicts revenues for the memory industry will still continue in its current growth pattern through 2018, with pricing only falling off in the back end of the year and going into 2019.

It's also important to note that gross margin is still up significantly from 31.3% in 2Q17. Margins are finicky, and especially in the hardware space they can see some quarter-to-quarter fluctuation, but the key takeaway should still be the margin expansion from 2Q17 to 2Q18.

Driven by top-line growth as well as by gross margin expansion, Western Digital's GAAP operating income also soared in the quarter to $955 million (an 18% margin), up more than 2x from $545 million (11% margin) from the prior-year quarter. For all the talk about Western Digital operating a "dying" hard drive business, the growth in profitability is difficult to argue with.

Net income in the quarter is noisy due to a $1.6 billion tax-related accounting charge due to the passage of the Trump tax bill, but the company's pro forma EPS (backing out tax charges and other non-cash items) of $3.95 still grew a resounding 72% y/y over $2.30 in 2Q17 and was a 16c (4%) beat over analyst consensus of $3.79.

Guidance was another key highlight of the quarter, though the views offered by Q3 and full-year guidance seem to take a different narrative. For Q3, Western Digital called for $4.9 billion in revenues (+5% y/y), whereas analysts - as compiled by Yahoo Finance - were expecting, on average, $4.94 billion (+6% y/y). For the full year, the company is sticking to its previously issued guidance of "high end of 4% to 8% growth," while it nudged up its pro forma EPS guidance to $13.50-14.00, up from a vague prior guidance of "exceeding $13."

Analysts were only calling for $13.42 for FY18. In my view, the raise in full-year earnings outlook is far more important than a one-point miss on Q3 revenue targets - especially when Western Digital has a consistent streak of earnings beats for the past seven quarters.

Key takeawaysWas Western Digital's quarter perfect and flawless? No, one could hardly say that. The slight (and I do mean slight: a measly 30bps) shortfall in gross margins certainly wasn't welcome news, nor was the slight miss to consensus Q3 targets.

But on the whole, Western Digital's Q2 release had a lot more positives packed in than the sole two negatives above. This is a business that is firmly defending its turf in both flash and HDD memory, and industry conditions are still widely expected by multiple research firms to be favorable through the end of 2018, making Western Digital's raised FY18 targets highly attainable.

With shares currently hovering around $85, Western Digital trades at 6.2x its FY18 EPS guidance midpoint of $13.75. Typically businesses that trade at these single-digit P/E ratios are bargain basement stocks - not ones that are showing 9% revenue growth and a near doubling of operating income.

Western Digital is far from being the most rock-solid fundamental company in the markets, but at a single-digit earnings multiple, it's well worth the risk - especially with the rest of the market being as expensive as it is. Time generally exerts a correcting force on stock valuations, and Western Digital is best scooped up now before investors crowd into the trade.

Disclosure: I am/we are long WDC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. |