Article from last week that is bullish on WDC.

Link: seekingalpha.com

Western Digital: In A Bull/Bear Tug-Of-War, Bulls Will Win

Jan.26.18 | About: Western Digital (WDC)

Michael Fitzsimmons

Renewable energy, oil & gas, dividend investing, gold

Summary

Western had a wild day of trading before its earnings were released after the bell on Thursday.

As I expected, the EPS report was a beat on both the top and bottom line.

Yet investors don't appear to be convinced and are left thinking the stock is going to breakout (big) one way or the other (up or down?).

So I take a look at the bull and bear case in this article.

Bottom line: I reiterate my 2018 price target of $115.

Western Digital's ( WDC) stock took a wild and volatile ride on earnings report Thursday. The stock traded as high as $89.81 shortly after the open (up almost $3) and dove to under $84 (down almost $3) after the close on the earnings release. The stock subsequently recovered its after hours loss on upbeat comment during the conference call:

Source: Google Finance Source: Google Finance

The big swings in the stock price came on strong volume of 7.2 million shares - 75% above normal.

Bull-and-Bear Tug Of WarThe dramatic stock moves suggest a very nervous investor base. Indeed, TheStreet.com recently suggested investors just flip a coin to determine which way WDC might go. The analysis was mostly technical with the conclusion apparently being buy if it gets to $95 and sell if it breaks $76.72. I find that rather useless technical mumbo jumbo considering the stock just swung $3/share around $87 in a single day of trading practically in the middle of TheStreet.com's technical buy/sell points.

The Bears SayThe bears believe WDC will have continue to have integration issues with its SanDisk and Hitachi Global Storage Technology ("HGST") acquisitions, as well as fallout from financially strained JV partner Toshiba. Bears point out that the hard disk drive market is eroding and still is responsible for a large portion of WDC's total revenue.

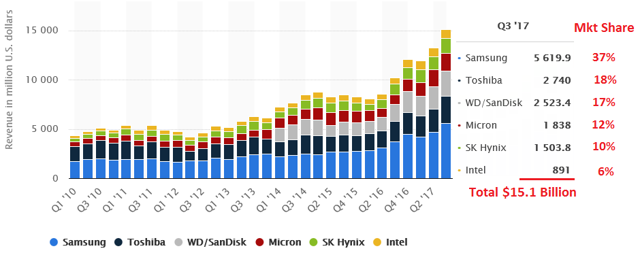

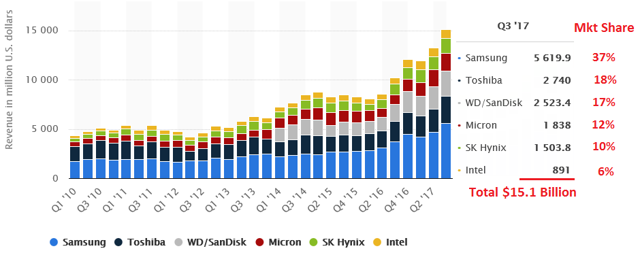

Meantime, bears seem to think the good times are ending for WDC's growth engine: the cyclical NAND flash market. NAND has been a cash cow for Western since the SanDisk acquisition due to very strong pricing. But bears think the solid state disk ("SSD") market is much more competitive than the three-horse HDD market - the main competitor in HDDs being only Seagate Technology ( STX) and Toshiba. But in NAND flash, Samsung ( OTC:SSNLF) is a strong competitor in NAND flash and has roughly twice the market share of WDC (see graphic below).

The Bulls SayThe bulls say that integration of WDC's acquisitions is going well, and that strong NAND pricing since the SanDisk deal has enabled WDC to be ahead of schedule in terms of its balance sheet improvement and debt reduction efforts. And while the settlement with Toshiba ended up with no clear "winner", WDC not only protected its interest in the JV, but secured access to the next generation of NAND flash technology and extended the JVs to 2029 (see my Seeking Alpha piece WDC Secures Next-Gen NAND Supply and Extends Toshiba JVs Out To 2029).

The bulls also say that the sun is not yet setting on the HDD market and that it is still the lowest cost-per-bit solution in any high capacity relatively non-critical application - that is, access time is not the number one concern, cost is. This is true for large-scale vendors in the cloud and enterprise market segments. As a result, hyperscale enterprise storage demand for HDDs (and SDDs as well) will continue to grow with the massive amount of digital data required by applications - both old and new. Meantime, advances in HDD technology (like heat-assisted magnetic recording for instance) should support HDD competitiveness over SSDs in terms of cost/bit.

Source: Statistica (Mkt Share % by the author) Source: Statistica (Mkt Share % by the author)

Meantime, bulls also point out that WDC has an excellent slice (17%) of total global branded NAND flash revenue. And that it is not only the market share WDC holds, but the overall growth rate of NAND flash revenue (see graphic above). In addition, WDC's transition to the latest NAND technology (i.e. cheaper to manufacture on a per bit basis) is coming just as the market perceives that NAND flash prices may fall.

The bulls also say that, post the Toshiba settlement, WDC reiterated its FY18 full-year adjusted earnings guidance of $13/share. At today's after hours close ($86.50), that represents a forward P/E=6.6. Note the average S&P 500 P/E is currently 26.5, 4x that of WDC. Meantime, WDC also pays a $2 annual dividend, which is good for 2.3%.

Those are the major bull and bear arguments. But what is real is channel checks and earnings. Let's take a look.

HDD Market IndicatorsA day before the earnings were released, Barron's reported that Nidec, the maker of motors that powers HDDs, said the HDD market in the quarter ending in December was 103 million units globally. That was 1 million more than Susquehanna analyst Mehdi Hosseini had anticipated. Going forward, Nidec sees 92 million units in the March quarter - higher than Hosseini’s 90-million unit estimate.

In addition, Hosseini said he “does not see any excess hard disk drive inventory,” which he finds “encouraging."

Q2FY 18 Earnings (released 1/25/2018)The Q2FY EPS report was a big beat - by $40 million on the top line and $0.16/share on the bottom line. Revenue was a record $5.3 billion and, excluding charges, adjusted earnings came in at $3.95/share. The company generated $1.2 billion of CFO during the quarter and ended with $6.3 billion in cash - up from $4.9 billion in the prior year quarter. Gross margins were a very strong 43.2% (compared to 36.7% in Q2FY17 - which proves favorable integration progress is being accomplished).

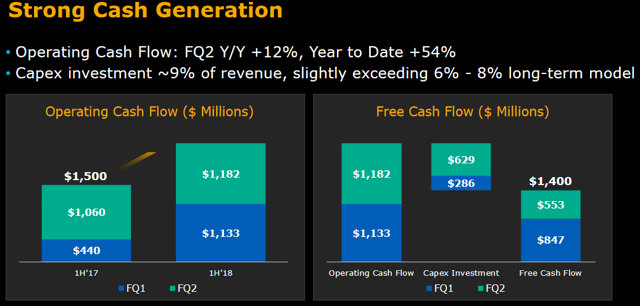

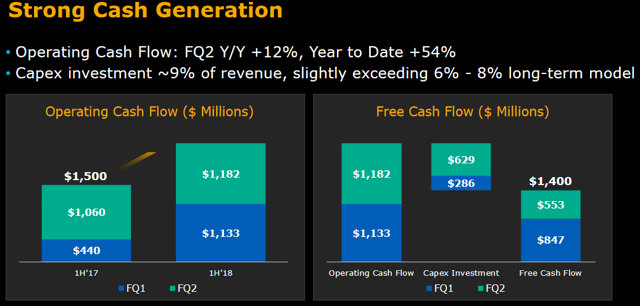

The company generated over a half-billion dollars of free cash flow during the quarter:

Source: Q2 presentation. Source: Q2 presentation.

Net debt has been reduced by about $500 million over the past year.

Comments on the conference call regarding the macro environment were positive:

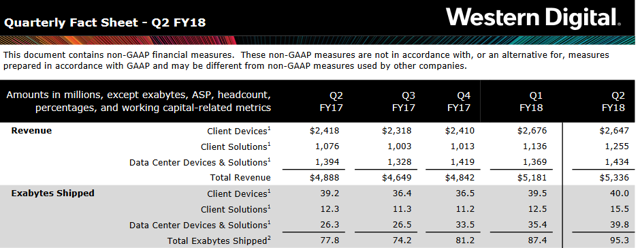

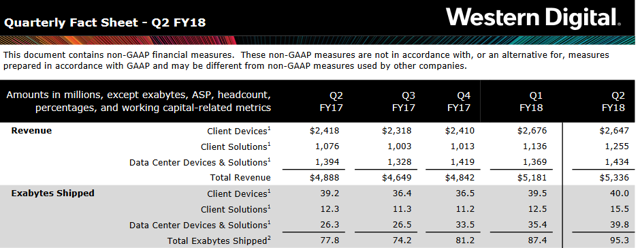

Growth in digital data remains unabated.There is significant growth in data center cap-ex.The flash market is stable.WDC had revenue growth across all revenue categories.Total exabytes shipped were 95.3, up 9% sequentially from the previous quarter and up 23% yoy:

Source: Quarterly Fact Sheet Source: Quarterly Fact Sheet

The news on NAND flash was all positive:

BiCS3 mix: >90% of total 3D Flash bits.Began manufacturing of BiCS4 - the company's 96 layer technology - and samples have been sent out. Meaningful output in 2H of C2018.

As Barron's summed it up after the conference call, comments by WDC's CEO indicate that "all's well with flash". For the full year, CFO Mark Long said revenue should be toward the high end of the company's targeted range of 4%-8%. EPS for the full year is now expected to be in a range of $13.50 to $14. That is stronger than what the Street has been modeling ($13.36).

Summary & ConclusionEverything about WDC's Q2FY18 support the stock moving higher. Gross margins expanded, revenue grew across the board, the NAND flash outlook is favorable, and CFO and free cash flow generation continue to be impressive. Interest expense continues to drop as the company efforts to restructure its debt load has been successful.

Bottom line: I am a bull. I reiterate my 2018 price target of $115/share.

Disclosure: I am/we are long WDC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an engineer, not a qualified investment advisor. While the information and data presented in my articles are obtained from company documents and/or sources believed to be reliable, they have not been independently verified. Therefore, I cannot guarantee its accuracy. I advise investors conduct their own research and/or consult a qualified investment advisor. I explicitly disclaim any liability that may arise from investment decisions you make based on my articles. Thanks for reading and I wish you much success with your investments.

**********************************************************************************************************************

UWG |

Source:

Source:  Source:

Source:  Source:

Source:  Source:

Source: