Tesla spells out why markets are failing battery storage, big and small

By Giles Parkinson on 14 February 2018

Tesla Energy has used the success of its newly installed big battery in South Australia to highlight how batteries – both big and small – are disadvantaged by Australia’s out-of-date electricity market rules.

In a submission to the Australian Energy Market Commission’s Reliability Frameworks Review, Tesla highlights the market barriers that could impede the development and performance of installation like big battery at Hornsdale, or its newly-announced world’s biggest “virtual power plant”.

The Hornsdale Power Reserve, the world’s biggest lithium ion battery at 100MW/129MWh, has been operating since early December. Already, it has won over many doubters with its speed and versatility and ability to puncture some of the major pricing events hitting consumers.

But Tesla says the current structure of the market does not properly value its service – perhaps not surprising given that speed and versatility that has not been seen before, as we highlighted here: Speed of Tesla big battery leaves rule-makers struggling to catch up.

Tesla is not a lone voice on this, even if the opening of the Tesla big battery at Hornsdale makes it the most prominent. Battery storage developers all point out that the considerable value propositions of batteries storage are simply not recognised by a market designed to reward coal and gas.

Tesla illustrates two main areas where that occurs.

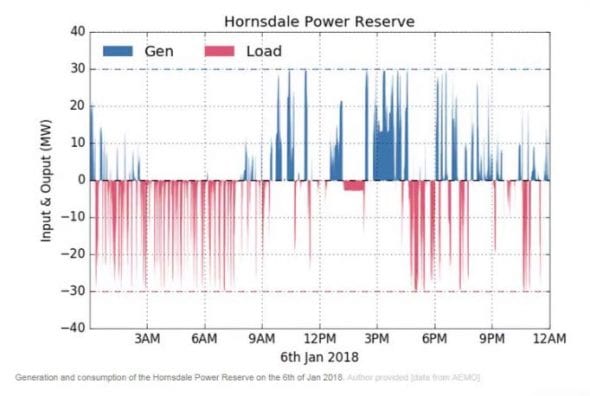

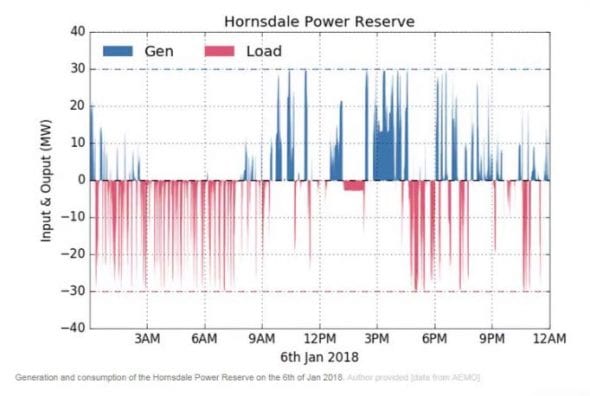

One is its ability to respond to “contingency” events on the National Electricity Market, such as its rapid response to the December 14 trip of a unit of the huge Loy Yang A brown coal generator in Victoria.

Tesla responded to that outage in a matter of milliseconds, faster than the coal units specifically contracted to provide the contingency response (called upon when frequency falls below 49.8Hz).

“As demonstrated in the charts above – the Hornsdale Power Reserve can respond rapidly within existing market parameters,” the submission says.

“However, the true value of this rapid response is not fully recognised. The fastest contingency FCAS market is six seconds, while the Tesla Powerpack response time is <200ms (milliseconds).”

It wants to see a market for fast frequency response that recognises the value of batteries (and presumably other inverter-based technologies) to fill that void, in much the same way that settlement periods are being reduced from 30 minutes to 5 minutes.

“Ultimately ensuring the appropriate mix of reliability and security in the market should be based on appropriately compensating flexible capacity that can provide both energy and system security services.”

Tesla also cites the flexibility in the battery – rapid changes in charging and discharging in response to market needs and price signals – but says it is disadvantaged by current rules.

These rules force it to register as both a generator and market load to provide both charging and discharging services.

Tesla says this results in a more conservative approach to bidding because it has to estimate whether a charge or discharge service is likely to be more valuable to the market within a given dispatch period.

A more efficient system would allow it to be able to submit a single dispatch bid for both generation and load services, and allow the market would determine whether charging or discharging provides the greatest market value for a given dispatch period.

For that reason, Tesla suggests a distinct market participant classification for BESS assets that will allow for single dispatch bids for both generation and load services, and alternative mechanisms such as a capacity market for flexible generation.

Tesla also wants changes to facilitate more distributed energy, combining rooftop solar an battery storage of the type it proposes in what is being hailed as the world’s biggest virtual power plant, 250MW of solar and 650MWh of storage located in some 50,000 different homes.

It notes Bloomberg New Energy Finance predicts more than 3GW of battery storage will be installed in homes and businesses by 2030.

“This represents an asset base of fully controllable generation and customer load that can provide critical reliability in a changing market,” it says.

“The existing market framework is not, however, well set up to extract energy, FCAS or demand response services from these assets, without the involvement of a retailer.”

It wants such virtual power plants to be able to provide “behind the meter” wholesale market demand response, and network support services, but says issues with categorisation, metering, and a better understanding of the technology need to be addressed.

Tesla said market reform was key to ensuring sufficient flexible capacity, and also voiced support for AEMO’s plan to establish renewable energy zones and to highlight the relevant infrastructure requirements necessary to ensure energy security and reliability as the generation mix changes.

reneweconomy.com.au |