'Super Cycle' is ending for chips....

Naturally, I am sure most of us hope he is wrong.

Link: seekingalpha.com

5 Warning Signs The Memory Super Cycle Is Ending

Feb. 20, 2018 6:22 PM ET

Robert Castellano

Chipmakers, solar, macro, research analyst

The Information Network

Summary

While favorable DRAM and NAND supply-demand dynamics have resulted in robust earnings and stock prices for memory manufacturers, several events are bringing about a significant change.

Increased capacity, lowered prices, and new Chinese memory fabs are and will continue to stem the tide of memory price increases that grew 76% in 2017.

There's a direct correlation between selling prices of memory chips and stock prices of memory companies.

Back on November 26, 2017, Morgan Stanley analyst Shawn Kim cut memory leader Samsung Electronics ( OTC:SSNLF) to Equal Weight from Overweight and trimmed its price target by 3.4%. According to the report:

"We see downside risk as NAND prices have started to reverse in 4Q17. Meanwhile, visibility on DRAM supply-demand dynamics has reduced beyond 1Q18."

Morgan Stanley cautioned that the memory chip sector's so-called "super cycle" is close to peaking.

Coincidently, Morgan Stanley analyst Katy Huberty cut her rating on Western Digital ( WDC) to equal weight from overweight based on an expectation that prices of NAND flash-memory chips are peaking and could fall as much as 15%, starting in the first quarter.

Fast forward to 2018 and I see three warning signs that this super cycle is ending.

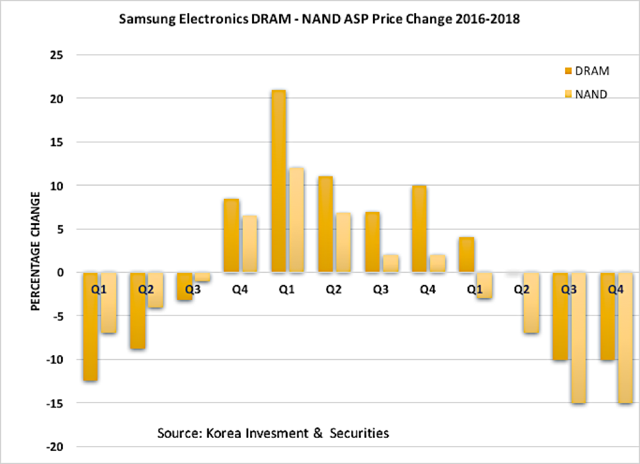

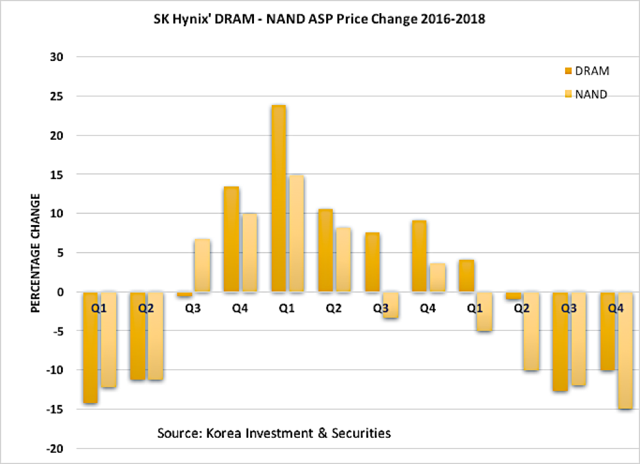

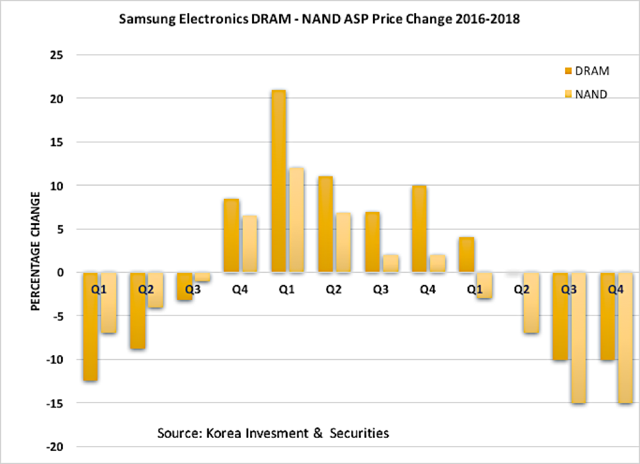

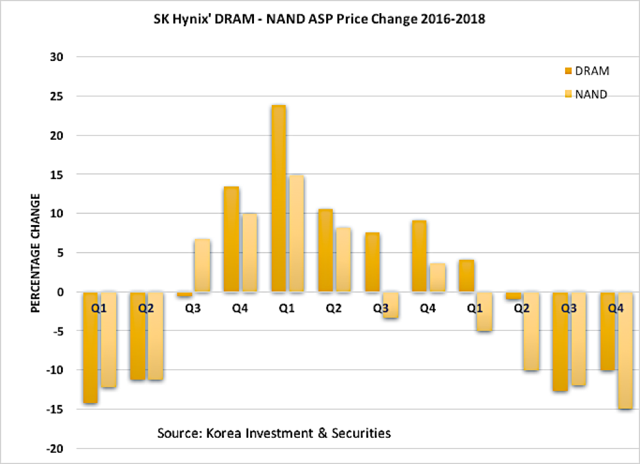

First, the percentage changes of average selling prices (ASPs) of NAND and DRAM have been dropping and are forecast to continue to drop. Below are charts that I’ve compiled illustrating historic and forecasted changes in ASP for Samsung Electronics (chart 1) and SK Hynix (Chart 2).

Second, China's National Development and Reform Commission (NDRC) and South Korea's Samsung Electronics Co Ltd signed a memorandum of understanding for further cooperation on semiconductors, state media China Daily reported on February 6, 2018. The article notes that it was a report by DRAMeXchange stated that rising prices in the DRAM market prompted the NDRC to approach Samsung.

Third, Samsung has decided to take on additional capacity in 2018 to limit the profit growth of its main rivals and to raise the entry barriers against potential Chinese competitors. A new DRAM line will be set up within a section of the second floor of Samsung’s facility in Pyeongtaek, South Korea. The original plan was to have that entire floor devoted to NAND Flash fabrication, but the recent decline in NAND Flash prices compelled Samsung to make the change.

DRAMexchange is projecting that DRAM bit supply will grow by 22.5 percent in 2018, up from about 19.5 percent in 2017. The firm had predicted as recently as September that DRAM bit supply would grow by 19.6 percent next year.

DRAMeXchange forecasts that DRAM revenue will grow 30% in 2018, but that's down from 76% in 2017.

Fourth, the new memory fabs under construction in China will eventually become a reality, perhaps as early as late 2019. I noted in an October 3, 2017, Seeking Alpha article entitled "Does Micron Need To Build A New Production Fab Like All Its Competitors?"

"Couple that with three new fabs being built in China, and construction scheduling is accelerating. Fijian's Jinhua Integrated Circuit plant is slated to finish the construction of its key plant structure in October this year. Wuhan-based YMTC is investing a total of US$24 billion in building three large-sized 3D NAND flash manufacturing plants. It’s No. 1 plant is set for an official run in 2018, with a monthly production capacity of 300,000 wafers. Finally, Hefei-based Rui-Li IC is actively placing orders with suppliers for a variety of DRAM manufacturing equipment and is expected to take delivery of the first batch of advanced lithography machines by the end of 2017."

Apple ( AAPL) has announced that it's in talks to buy storage chips from Yangtze Memory Technologies, a move that would mark the iPhone maker’s first buy from a Chinese memory chipmaker.

Currently, Apple buys NAND flash memory chips for its iPhones from Toshiba of Japan, Western Digital of the U.S., SK Hynix and Samsung Electronics of South Korea.

Here’s the interesting thing. I noted in a January 11, 2018, Seeking Alpha article entitled “Intel's Split Is Really Bad News For Micron Technology,” which was met with a great deal of denial by Micron ( MU) longs, that Intel ( INTC) may form a joint development with China's Tsinghua Unigroup, a company that tried to buy Micron a few years ago.

So just what is Yangtze Memory Technologies (YMTC) that Apple is in conversation with for NAND? Just so happens that Tsinghua Unigroup owns 51.04 percent of YMTC, while the other 48.96 percent of YMTC is owned by China's National Integrated Circuit Industry Investment Fund, the Hubei IC Industry Investment Fund, and the Hubei Science and Technology Investment Group.

Fifth, Apple will cut iPhone X production by “half” this quarter because of sluggish iPhone X sales due to consumer price resistance (so much for the $2,000 iPhone anticipated in a few years). Why does this matter? It's the world's biggest consumer of these chips, taking roughly 15% of overall global demand of 160 million gigabytes in 2017, according to Sean Yang, an analyst at Shanghai-based research company CINNO. The reduction in iPhone X production means less memory chips consumer, accelerating the slowing in changes in ASPs in NAND and DRAM.

Investor TakeawayAll these five factors will result in a reduction in increases in ASPs of memory chips as supply-demand dynamics change. The surge in stocks for memory companies in 2017 was due to tight supply and high demand. As supply increases, the rampant increases in average selling prices we saw in 2017 will slow. Forecasts show that ASPs of NAND already have started dropping and ASPs of DRAM will begin in mid 2018.

Because of the correlation in memory chip pricing and stock pricing, a correction in memory stocks is anticipated |