Well, sndk1000, the board has shifted to more meaningful content and away from snarky remarks. Feel free to join in. Use the article below as exemplary of what we like to see here when we are awake.

Worth noting, this author calculates the debt restructuring adds about $1.25/share to EPS. That alone would account for the PPS increase.

Article I found today: seekingalpha.com

Western Digital: Investment Thesis Still Bullish

Mar. 6.18 | About: Western Digital (WDC)

Michael Fitzsimmons

Renewable energy, oil & gas, dividend investing, gold

Summary

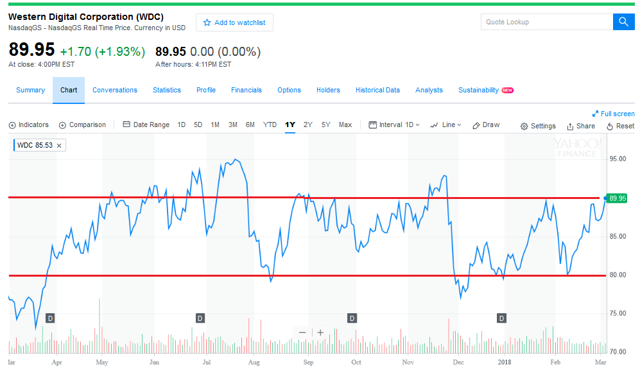

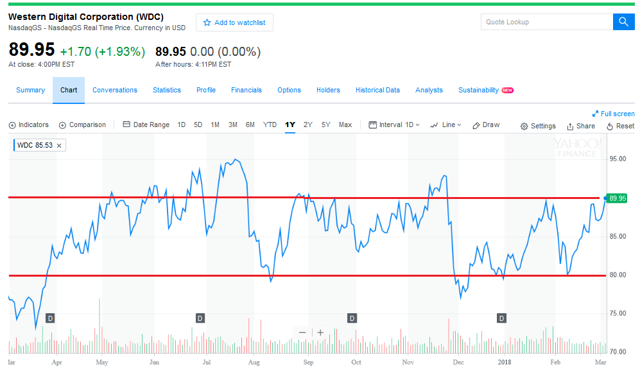

Western Digital continues to trade in a $80-$90 range despite the excellent quarterly report delivered in late January.

Yet the bullish thesis remains intact: Growing demand for digital data storage, rising cash flow, and the third largest share of the global NAND market.

Meanwhile, the company has restructured debt at much more favorable terms, saving a whopping $1.25/share in estimated interest expense.

I reiterate my buy recommendation and $115 price target based on management hitting, and likely exceeding, its FY18 adjusted earnings guidance of $13/share.

Western Digital ( WDC) continues to hang in its $80-$90 trading range despite continued forward momentum in reducing interest expense while growing cash flow and earnings. Fundamentally, in the latest quarterly report ( Q2FY18), global demand for its HDD and non-volatile NAND memory solutions was robust: Total exabytes shipped rose 22% yoy. EPS rose 75% yoy and the company generated over $2.3 billion in six-month cash flow from operations, up from CFO of $1.5 billion in the year earlier period (+53%). Gross margins were a strong 43%.

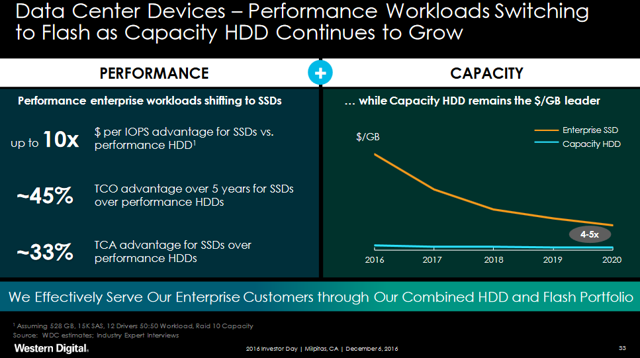

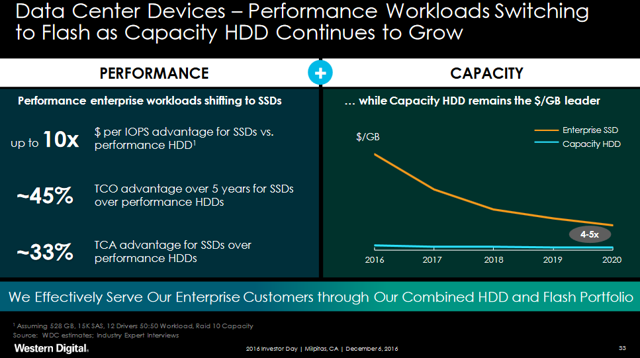

In the last quarter, HDD revenue fell compared to the prior year, but was up sharply over the previous quarter as average selling prices improved. This reflected a higher percentage of HDDs being deployed in the enterprise market. WDC has an excellent product line to address this market including the helium-filled 10TB and 12TB drives. Meanwhile, HDDs continue to provide a 4-5x cost advantage ($/GB) over SSDs in a data center market:

Source: WDC December Presentation Source: WDC December Presentation

In the NAND segment, revenue grew over 20% annually in Q2 driven by the 64-layer 3D NAND product line. The company is currently in the process of rolling out its 96-layer 3D NAND products. As a result, the company is well positioned for the transition from HDD to NAND flash in the notebook and desktop markets. Unlike its main rival - Seagate Technology ( STX), WDC is not watching its core HDD market share melt away without any recourse.

WDC is moving its long-term HDD memory customers in the PC space over to its non-volatile SSD solutions. And this is the prime competitive advantage WDC currently has over Seagate: WDC owns the third-largest share of the global NAND market behind Samsung ( OTC:SSNLF) and just behind JV partner Toshiba. Currently, Seagate is shipping no NAND product whatsoever.

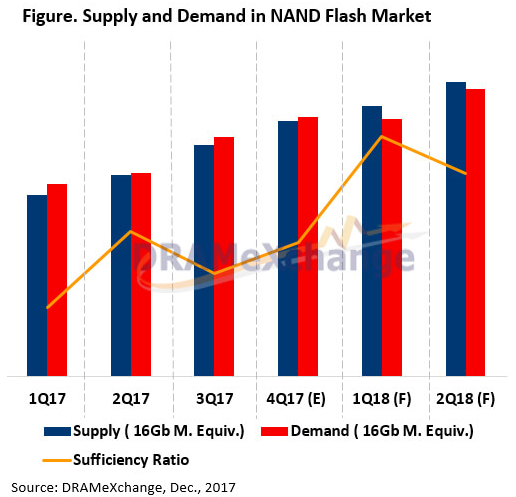

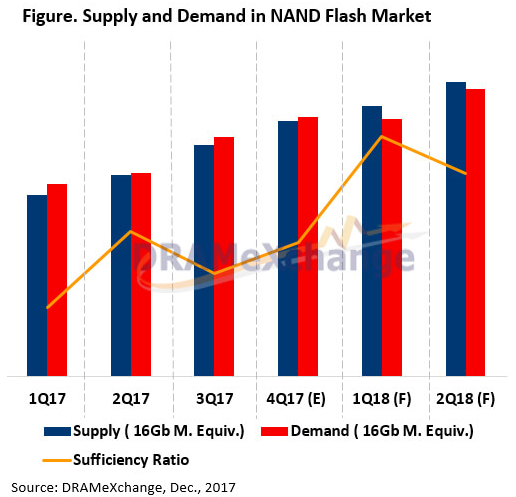

That said, industry analysts would not be surprised to see a slight pullback in NAND prices in Q1 this year - typically a seasonally weak period for the industry:

Source: EPS News Source: EPS News

Note that 2018 Q1/Q2 supply/demand estimates are in stark contrast to the very bullish under-supply seen in the first half of 2017. As a result, the first half results may come in a bit weak and surprise some investors. However, demand is expected to gather steam in the second half of the year.

Debt RestructuringMeanwhile, management continues to take advantage of its excellent 2017 financial performance to restructure the debt load at much more favorable terms. Just last week the company announced it had redeemed a large portion of its expensive debt:

- all of its senior unsecured notes due 2024 (10.5%)

- all of its senior secured notes due 2023 (7.375%)

The redemptions were accomplished with cash on hand as well as proceeds from previously announced offerings:

- $2.3 billion in aggregate for 4.750% senior notes due 2026.

- $1.0 billion in aggregate for 1.50% convertible senior notes due 2024.

- The proceeds of its previously announced new $5.022 billion term loan A-1 facility maturing in 2023, reflecting a $1.0 billion increase over its previous term loan A facility.

As you can from the summary, the newly issued senior notes were issued at less than half the expense of the previous notes. Accordingly, management said:

As a result of these financing transactions, based on the current capital structure and a current LIBOR rate of 1.67%, the company expects to reduce its GAAP annual interest expense to approximately $435 million to $440 million, compared to $808 million in the last 12 months ended Dec. 29, 2017.

At the mid-point of guidance, that reduces the company's expected annual interest expense by ~$370 million (54%). With 296 million diluted shares outstanding at the end of the most recent quarter, the savings on debt restructuring alone equate to an estimated $1.25/share.

Summary And ConclusionThe only possible reasons for WDC to still be trading in the $80-$90 range is because either:

- Investors don't believe WDC will meet management's $13/share adjusted earnings guidance for FYF18 or

- investors believe memory storage demand and/or prices for WDC's products will lag in 2018 and the business is headed for cyclical decline.

So far, neither appears to be the case. And while I'm sure management had already baked in the significant debt restructuring savings into its FY18 guidance, there's no doubt they have now achieved those savings and continue to execute according to plan. As a result, I reiterate my $115 PT and buy rating on WDC. In addition, the $0.50 quarterly dividend means the stock currently yields ~2.2%. If you are not convinced yet - and don't want to buy WDC at the top of its $80-$90 range (see graph below), which is where it stands today, you may want to wait and see if it makes another round trip back down to $80.

However, I suspect WDC is going to break out to the upside sooner rather than later. After all, if management meets its $13/share in adjusted EPS this year, that corresponds to a forward P/E of only 7. Considering the average S&P 500 stock currently has a P/E=25 and likely not growing cash flow and earnings at near WDC's torrid pace, WDC is highly undervalued. And that's true even at the top of its $80-$90 trading range.

|

Source:

Source: