Seeking Alpha article out this morning. Says WDC is undervalued. No kidding. Glad to see more and more people seeing it.

Link:https://seekingalpha.com/article/4155808-6-reasons-western-digital-20-percent-upside?ifp=0

6 Reasons Western Digital Has 20% More Upside

Mar.13.18 | About: Western Digital (WDC)

Chris Lau

Contrarian, event-driven, tech, oil & gas

Summary

Micron indirectly acted as a catalyst for markets to bid Western Digital stock to above $100.

Valuations are still very compelling, implying 20% more upside for investors.

Growth, strong balance sheet and relative undervaluations are some reasons to look at this hard disk supplier.

Ever since shares of Micron Technology ( MU) broke out past the $50 level and skyrocketed again when an analyst set a target price of over $100, tech investors are on the prowl for the next undervalued stock. Western Digital ( WDC) comes to mind. The hard drive manufacturer, which also broke out from the $80-$85 trading range, trades at above $100 but still has plenty more upside.

There are six reasons WDC stock could continue moving higher.

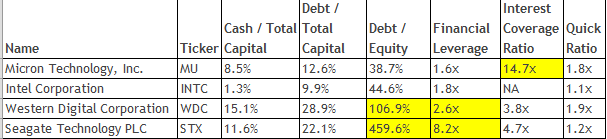

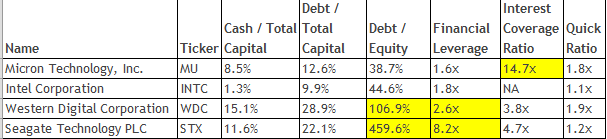

1) Western Digital’s Valuation Compared To SeagateAt a 7.88x forward P/E and 15.3x P/E, Western Digital is discounted compared to its competitor, Seagate Technology ( STX). Seagate is valued at a 12.3x forward P/E and a 27.4x P/E. The latter has a debt/equity profile of 4 times compared to the 1x debt/equity for Western Digital. The undervaluation in the hard drive maker did not make sense when the stock traded at $80 and still makes little sense at above $100/share.

Strong storage demand continues to act as a tailwind for the sector. Western Digital generated strong operating cash flow in its fiscal second quarter. Non-GAAP earnings topped $3.95 on revenue of $5.3 billion. Non-GAAP Gross margins of 43% were due to strong demand for enterprise storage and flash-based products.

STX data by YCharts STX data by YCharts

2) More Growth AheadStrong GDP growth worldwide is correlated to storage demand. Storage requirements in mobile, cloud, AI, and IoT (albeit AI and IoT are buzz words) are adding to the demand dynamics for storage. Investors may expect revenue growth not only in the U.S. markets but also in the EU and China. Although the seasonal strength of the holiday period in the last quarter probably gave the company unusually strong sales, the trend looks likely to continue. Client Devices, for example, will benefit from a product refresh this quarter. The company started shipping 3D flash-based embedded solutions but will realize higher sales in this period.

The Data Center Devices and Solutions saw demand for 10 terabyte and 12 terabyte storage units grow. The insatiable demand for storing videos, photos, and other multimedia data will result in continued pent-up demand. Expect Exabyte growth for 2018 surpassing 50 percent.

3) WDC Benefits From 3D FlashThe shift to 3D flash manufacturing led to better yields and therefore higher profitability for all storage manufacturers. Micron is in the middle phases of its own 3D XPoint technology. Despite “breaking up” with Intel ( INTC) in its development, the technical breakthrough in the 3D-based manufacture for storage and memory would justify higher valuations for WDC stock.

4) Solid Balance SheetWestern Digital ended Q2 with $6.4 billion in cash and equivalent securities and has $7.9 billion in liquidity when factoring in the $1.5 billion of undrawn revolver capacity. Another acquisition is unlikely, though one may be tempted into speculating that this would happen. After rumors of Intel buying Broadcom (NASDAQ: AVGO) circulated after the market close last Friday, any fantasy is possible.

Incidentally, Intel buying Broadcom would be a very bad idea and bad for Intel shareholders. $100 billion to buy Broadcom is cash Intel could better use investing in something else. In fact, Intel and Western Digital should both use their cash to increase their dividend and buy back shares. Neither company needs to get bigger by entering other markets. It needs to only grow market share within its existing markets.

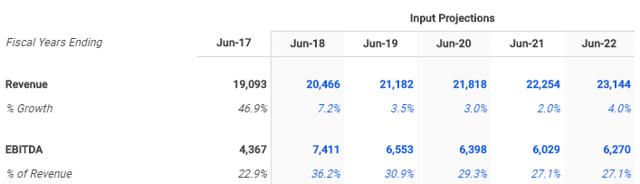

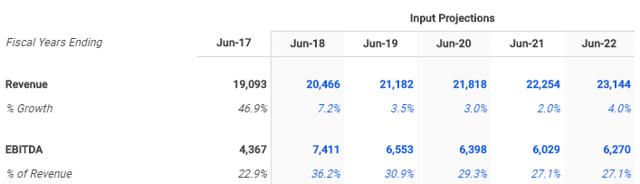

5) Price TargetPer finbox.io, the 5-year DCF Revenue Exit model is based on the basic philosophy that the fair value of a company is equal to the future cash flows of the company, discounted back to present value. Assuming revenue growth in the next 5 years in the range of 2 percent to 7.2%, with a dip in fiscal year 2021, Western Digital still has nearly 20% more upside.

Source: finbox.io (click on the link to change your assumptions)

Vote on this newly created forecast that the stock is worth $120:

Source: WhoTrades.com Source: WhoTrades.com

6) Related Companies

Source: finbox.io

****************************************************************************************************************************

UWG |

Source:

Source: