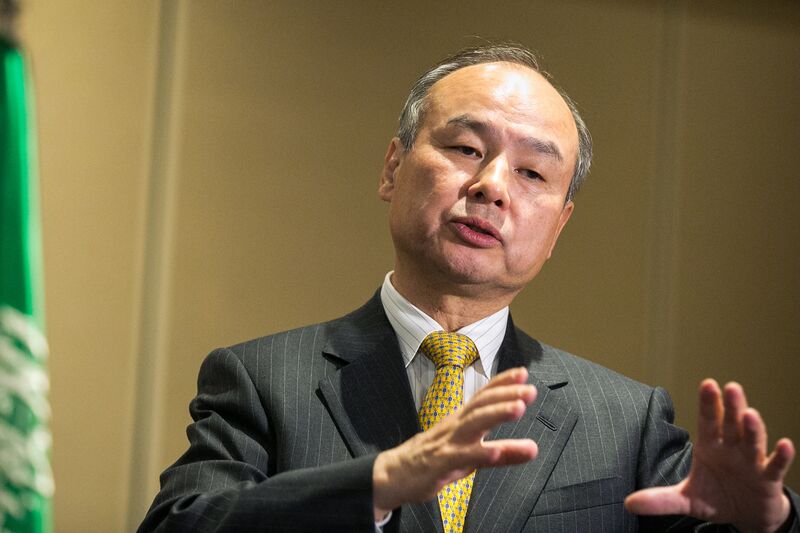

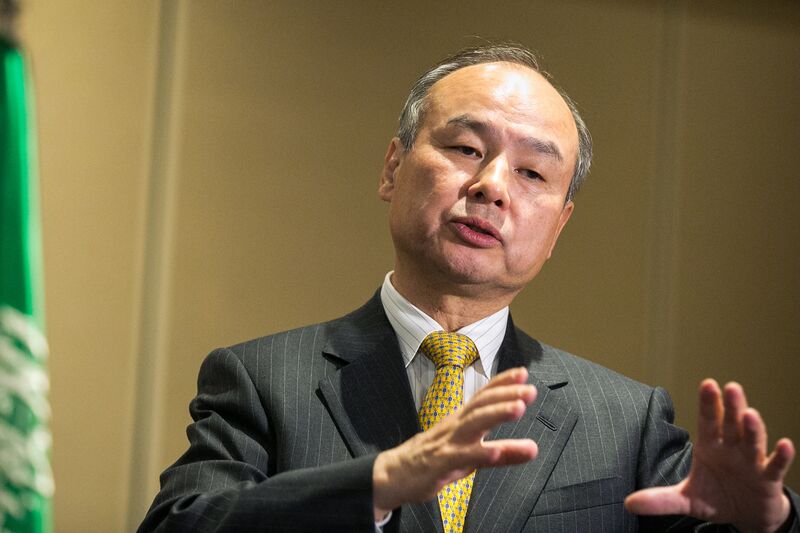

A Sprint-T-Mobile deal is back on the table:

Make Masa an Offer He Can't Refuse

The SoftBank founder needs to deleverage. He'll be flexible in Sprint/T-Mobile merger talks.

By Shuli Ren

Bloomberg

April 11, 2018

Photographer: Jeenah Moon/Bloomberg

---------------------------------------------------

It's a good time to be facing Masayoshi Son across the negotiating table. The SoftBank Group Corp. founder will be a lot more accommodating this time.

Sprint Corp. and T-Mobile US Inc. have restarted talks about a potential deal, five months after efforts to combine two of the biggest U.S. wireless providers fell apart, Bloomberg News reported, citing people familiar with the matter. SoftBank shares rose the most since January on Wednesday.

Son is starting to run out of cash, and junk-rated Sprint is just one of SoftBank's endless debt pits. After a buying spree lasting years, the Japanese company had amassed total liabilities of $130 billion at the end of 2017, of which $37 billion came from Sprint. That puts it in the same league as Venezuela, which owes somewhere between $100 billion and $150 billion.

On a call to discuss December quarter earnings, Son insisted SoftBank's ratio of net interest-bearing debt to Ebitda was at a still "healthy" 2.8 times and the internet conglomerate could raise that to 3.5 times. Even that would mean room for only a further $7.9 billion of debt. In a low-rate environment, SoftBank still managed to incur $4.5 billion of interest payments last year.

Selling more debt may not be straightforward. Appetite for SoftBank's high-yield notes has waned. One issue is that the Federal Reserve is poised to raise rates at least three times this year. More importantly, as I wrote last month, Asian private banks that enthusiastically bought into SoftBank's dollar securities last year felt betrayed and burned after the company offered sweeteners to holders of its 2015 notes at the expense of newer investors.

The 10-year 5.125 percent note is down 4.5 percent from September's issue date -- and don't forget, investors' actual losses are much bigger because these bonds can get up to 80 percent financing.

Meanwhile, the company's 29 percent stake in Alibaba Group Holding Ltd., which in theory is worth over $130 billion -- $48 billion more than SoftBank's entire market cap -- isn't easy to unload. It doesn't own the liquid American depository shares listed in New York, but "registrable securities" that lay claim to Alibaba's Cayman Islands-based holding company.

SoftBank would need Alibaba's approval to sell its interest in the open market. Given that shares of Tencent Holdings Ltd. have yet to recover after major shareholder Naspers Ltd. offloaded a mere 2 percent stake last month, it's unlikely Alibaba founder Jack Ma will agree.

Crowded Trade

SoftBank would need Alibaba's approval to sell its shares in the company, the most overweighted globally by active fund managers

So it's no surprise that SoftBank is using its Alibaba shares as collateral to raise $8 billion in margin loans. Stock for such jumbo-sized shareholder advances may be valued at just 50 cents on the dollar. In other words, SoftBank may have put up $16 billion worth of Alibaba shares to raise these funds. That's not an efficient use of assets. As for conventional loans, SoftBank has become too big for comfort for Japanese banks.

SoftBank is also hoping to raise cash by listing its domestic telecom business. But it remains to be seen how much enthusiasm the public will have. Investors buy into cash cows for stable income, but SoftBank has already stripped 350 billion yen ($3.3 billion) from the telco's balance sheet as payment for using the parent's trademark.

You get the picture. Son needs to deleverage, and he's sure to play nice.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

To contact the author of this story:

Shuli Ren in Hong Kong at sren38@bloomberg.net

To contact the editor responsible for this story:

Matthew Brooker at mbrooker1@bloomberg.net

bloomberg.com |