Art, to your point about the current PPS, here is someone else pointing out that WDC is cheaper right now, on a PE basis, than it has ever been in its history. He doesn't actually *say* his target is $550, but I bet he is thinking it. ;-P

Link:https://seekingalpha.com/article/4172241-western-digital-cheapest-price-ever

Western Digital At Its Cheapest Price Ever

May 10, 2018 12:58 PM ET

| About: Western Digital Corporation (WDC)

by: Michael Turner

Michael Turner

Long/short equity, contrarian, event-driven, medium-term horizon

Summary

Despite a strong fundamental story, Western Digital's stock is at its lowest valuation in history (based on its PE ratio).

Investor fears over the cyclical nature of Western Digital's industry are overblown, and the stock represents fantastic future value.

The strong confluence of technical support at WDC's current price should limit any further downside.

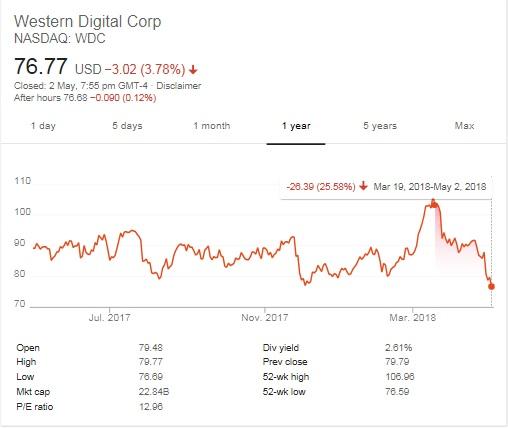

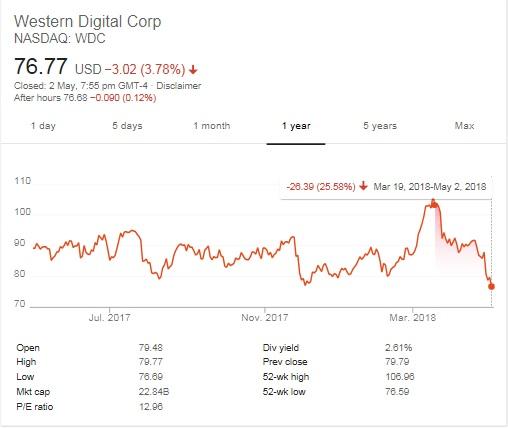

The StockWestern Digital (NYSE: WDC) is a leading provider of storage solutions, hard drives and Network Attached Storage devices for backup, sharing and storing the world's data. Despite a string of strong results over the past several quarters, Western Digital's stock has fallen over 25% since its March peak:

(Source: Google Finance) (Source: Google Finance)

As a result, it currently sits at its lowest forward price to earnings ratio ever:

(Source: Zacks)

Despite WDC's low valuation and the somewhat cyclical nature of its business, the future remains bright for both the company and its industry:

The number of connected devices worldwide is expected to grow from 9 billion today to upwards of 75 billion by 2025. This exponential growth will require robust storage infrastructures and purpose-built solutions that allow users to capture, preserve, access, and transform an ever-increasing diversity of data. The Western Digital platform is strategically positioned to play a key role in supporting these long-term growth trends.

(Western Digital Q3 2018 Results - Earnings Call Transcript - Seeking Alpha)

Q418 non-GAAP guidance is for revenue of $5 billion to $5.1 billion, with a gross margin of 41% to 42%. Operating expenses are expected to be between $840-$850 million (with interest/other expenses at approximately $100 million). Western Digital's effective tax rate will be between 5%-7%, resulting in non-GAAP EPS at between $3.40-$3.50. As a result, revenue growth for fiscal 2018 will exceed management's prior guidance, and margins (which were forecast to be below 38%) will now exceed 40% for the remainder of calendar 2018.

This strong performance leaves Western Digital's record low valuation as an opportunity for value investors to buy at record lows.

ChartingWestern Digital's chart also presents a strong argument for buying, as its price currently sits in a strong demand zone, which coincides with the 38.2% Fibonacci retracement level:

(Source: TradingView Charts/My own Technical Analysis) (Source: TradingView Charts/My own Technical Analysis)

Although sellers have been in control since March and have successfully pushed price below the 200-day MA (generally a strong bear signal), the strong confluence of technical support levels near WDC's current price, combined with the stocks current low valuation on fundamental metrics, should limit downside, and provides a strong entry point for long-term investors.

Q318 ResultsMacroeconomic conditions remained supportive in the quarter with Cloud Computing and Mobility serving as primary demand drivers. The positive third quarter dynamics included continued strong demand for our NAND flash products.

(CEO Steve Milligan, Western Digital Q3 2018 Results - Earnings Call Transcript - Seeking Alpha)

Revenue for the March quarter was $5 billion, increasing 8% y/y. Datacenter Devices and Solutions revenue increased 25% y/y to $1.7 billion, primarily due to strong demand for capacity enterprise hard drives. Client Devices revenue was $2.3 billion (essentially flat growth). Client Solutions revenue increased over 4% y/y to $1 billion, primarily driven by strength in the group's retail offerings.

Non-GAAP gross margins were 43.4%, up 410 basis points y/y. This was driven by significant growth in capacity enterprise products along with a higher mix of Flash revenue:

Aaron Rakers - Wells Fargo Securities LLC

...I'm curious on the gross margin kind of trajectory of the business. You guys now are talking about a 40%-plus gross margin. So the first question on that is, should we think about that as potentially raising the long-term sustainable target gross margin range? And then as we think about the mix of the business, particularly around the hard disk drive business, are you now seeing a gross margin in HDDs that is solidly above what the historical range had been? I think was past 27% to kind of 32% range.

Stephen D. Milligan - Western Digital Corp.

Yeah, so, Aaron, this is Steve. I'll take both questions. In terms of our long-term margin range, we continue to have the long-term margin range of 33% to 38%.

Of course, we will continue to look and evaluate whether or not that margin range should change, based upon our experience and what we see from a go-forward perspective; but for the time being, we're sticking with the 33% to 38%.

If you look at our hard drive margins – and obviously we don't disclose our Flash-based margins or our hard drive margins, but if you look – just to give a little bit of color, our hard drive margins for several quarters have been very, very stable. And without disclosing the specific number, if you look at this past quarter, driven almost entirely by mix. We actually saw a nice pickup in our hard drive margins and that was due to the strong demand that we saw from a capacity enterprise perspective. Obviously we'd like to see that continue, but we'll have other mix dynamics that will affect our business going forward. But very strong margins in the hard drive space this past quarter.

(Western Digital WDC Q3 2018 Results - Earnings Call Transcript - Seeking Alpha)

Non-GAAP operating expenses totaled $850 million. This included product development investments, improvements in go-to-market capabilities and IT transformation projects. An additional $157 million of interest expense for the March quarter will lower the effective interest rate on Western Digital's debt.

Non-GAAP net income was $1.1 billion ($3.63 EPS), an increase of 52% y/y. This resulted in $3.3 billion in operating cash flow (an increase of 34%). Dividend distributions totaled $148 million for the year, and management declared a dividend of $0.50 per share. $155 million worth of shares were purchased as part of management's buyback program. Capital restructuring activities decreased total debt by $825 million during the quarter to approximately $11.4 billion.

A legal stoush between Western Digital and Toshiba was also recently resolved:

Western Digital finally closed the book on the legal challenge to Toshiba's sale of Toshiba Memory Corp ("TMC") to a consortium led by Bain Capital Private Equity. WDC's priority was to protect the SanDisk JVs with TMC, ensure the long-term success of the JV, and guarantee long-term access to NAND supply. And that' exactly what they accomplished with by settlement of the legal challenges with Toshiba. As a result, the stock is currently quoted up $3 in pre-market trade.

( Source)

Q318's performance was strong, and management has a strong history of beating earnings consensus over the past 9 quarters:

Date

Period Ending

Estimate

Reported

Surprise

% Surprise

| 4/26/2018 | 3/2018 | $3.31 | $3.63 | +0.32

| +9.67%

| | 1/25/2018 | 12/2017 | $3.81 | $3.95 | +0.14

| +3.67%

| | 10/26/2017 | 9/2017 | $3.30 | $3.56 | +0.26

| +7.88%

| | 7/27/2017 | 6/2017 | $2.83 | $2.93 | +0.10

| +3.53%

| | 4/27/2017 | 3/2017 | $2.16 | $2.39 | +0.23

| +10.65%

| | 1/25/2017 | 12/2016 | $2.06 | $2.30 | +0.24

| +11.65%

| | 10/26/2016 | 9/2016 | $1.05 | $1.18 | +0.13

| +12.38%

| | 7/28/2016 | 6/2016 | $0.72 | $0.79 | +0.07

| +9.72%

| | 4/28/2016 | 3/2016 | $1.25 | $1.21 | -0.04

| -3.20%

| | 1/28/2016 | 12/2015 | $1.53 | $1.60 | +0.07

| +4.58%

|

(Source: Optionslam)

This consistently strong performance defies the market's pessimistic attitude towards the companies' future prospects.

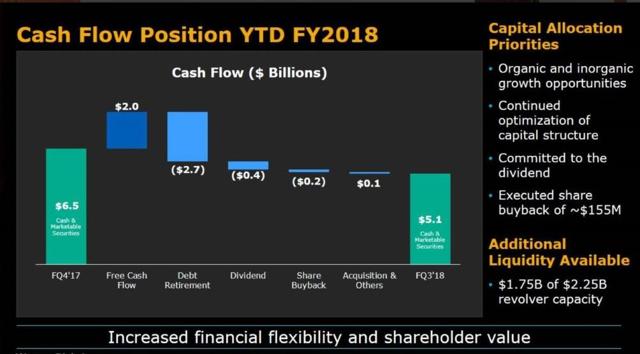

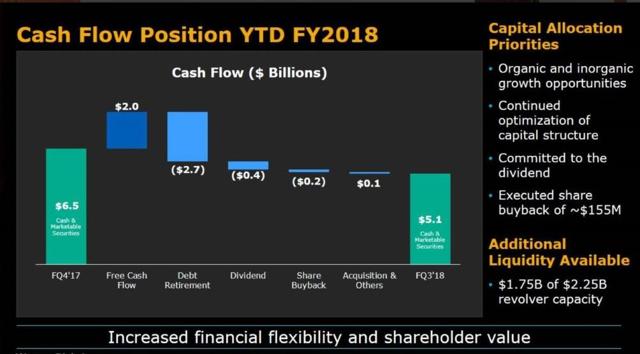

Capital Management (Source: Western Digital Q318 Earnings Calls Slides - Seeking Alpha) (Source: Western Digital Q318 Earnings Calls Slides - Seeking Alpha)

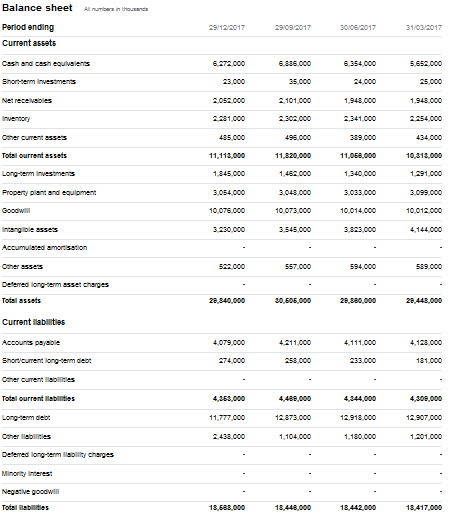

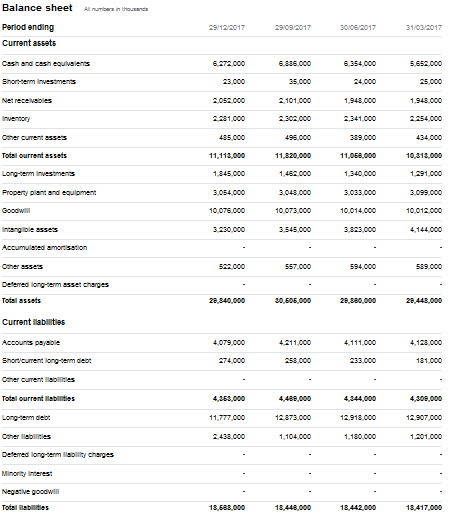

Management has been focusing on decreasing debt and hedging against rate rises on existing debt, while also executing share buybacks. With over $6 billion dollars in cash and under $12 billion in debt, Western Digital's strong balance sheet will enable the company to withstand any industry-wide downturn and continue investing in its future, alleviating the risk of any cyclical downturns in the near future:

(Source: Yahoo Finance) (Source: Yahoo Finance)

Western Digital's dividend yield (at its current price) is >2.5%, and due to the company's strong capital management it will remain stable into the future.

ConclusionDespite a strong fundamental story, Western Digital's stock is at its lowest valuation in history due to investor fears over the future of the cyclical data storage industry. While margins in the industry are expected to stabilise over the long term, I do not see these headwinds having any material effect on the company or the value of its shares. As such, the stock represents fantastic value as the future remains bright for both the company and its industry.

Disclosure: I am/we are long WDC. |

(Source:

(Source:

(Source:

(Source:  (Source:

(Source:  (Source:

(Source: