This guy has a pretty good analysis of the state of affairs at WDC.

Link: seekingalpha.com

Western Digital: Back Where We Have Been Before

May 11, 2018 10:07 AM ET

About: Western Digital Corporation (WDC)

by: Daniel Schönberger

Daniel Schönberger

Value, long-term horizon, dividend investing, Growth

Summary

- Although there are many explanations why Western Digital Corporation cannot continue its upward trend, technical analysis might provide the simple answer.

- Fundamental risks are the high interest rates and maybe the debt levels as well as Western Digital being a cyclical company.

- But megatrends like artificial intelligence, the Internet of things and the resulting growing demand for storage capacity should ensure at least moderate growth for Western Digital.

- Western Digital is still undervalued and currently oversold and hence a clear buy at current prices.

Western Digital Corporation (NYSE: WDC) has been beating expectations on a regular basis in the last quarters (for a nice overview click here). Although revenue was only about 1% higher in most quarters, the reported EPS could exceed expectations more than just a few cents. In the last quarters, the reported EPS was almost 10% higher than analysts' expectations, yet the stock declined after earnings. Taking the non-GAAP EPS of the last four quarters ($14.07) we get a P/E ratio of 5.5 and therefore one question begs for an answer: Why is Western Digital still valued at such low multiples (as it trades at such ratios for quite some time)? But not just the P/E is ridiculously low (compared to the US stock market), the P/Bv ratio (about 2) is also very unusual for a tech company.

To understand if Western Digital is really undervalued or if the depressed multiples are justified, we will look at different aspects. On the one hand, there are some risks and uncertainties surrounding the company, but we can also look at positive underlying trends that should ensure growth in the years to come. We will also try to calculate the intrinsic value of the company, but first we will start this time with some technical analysis and in order to understand a little better why Western Digital has mostly been moving sideways in the last months (despite beating expectations) we first have to look at the monthly and weekly charts.

Technical Point Of View

If we look at the chart of the last 25 years, we can see that Western Digital Corporation climbed during the 90s (no surprise, all tech companies did!) and reached its temporary high in 1997. It took 16 years - till 2013 - before the stock could break out over the orange line and generate new highs after the 16-year long correction. In 2016 we saw the pullback on the orange trendline as well as the 200-month exponential moving average - a great entry point by the way, as Western Digital was extremely undervalued at that point. Following the pullback, we first saw Western Digital almost triple in value within a few months and after that the correction we are still in right now.

(Source: TraderFox Trading-Desk - 8.000 Aktien und Realtimekurse weltweit in Echtzeit!)

To understand why the stock was moving sideways in the last few months despite Western Digital beating expectations every quarter and reporting very solid numbers, a closer look at the chart might help. Since the lows of $35, the stock almost tripled within a few months and after such a rally it is not unusual that a stock will be in a corrective phase a little longer. This is simple how markets behave - an impulsive (upward) wave is always followed by a corrective wave (and the fact that we are only seeing a sideward corrective phase can be a hint for the strong underlying trend). When switching to the weekly chart, we can see the correction pattern more clearly. More or less, we have a descending triangle with an outbreak on the upper side a few weeks ago (breakout through the blue dotted trendline). But as we know now, the breakout was not successful because what looked like a pullback to the dotted blue line at first - and should have been followed by a climbing stock price - is now a failed breakout and we are inside the correction pattern once again.

(Source: TraderFox Trading-Desk - 8.000 Aktien und Realtimekurse weltweit in Echtzeit!)

We mentioned above, that a sideward correction is a positive sign - the failed breakout however could be a hint for disaster as a failed breakout is sometimes followed by a stepper correction in the opposite direction. However, I think we have a good support level at about $75 as there are the former lows as well as the 200-week exponential moving average. At some point in time, the upward trend will continue and the correction pattern will be finished - at least when the stock is still undervalued and that is the question we will focus on in the next sections. We never look solely at technical analysis to decide if a stock is a good investment or not - fundamental aspects are more important.

Risks With Western Digital

As the stock is currently declining and the sentiments seems to be rather negative, let's look at the risks and bearish arguments first. When searching for reasons, why Western Digital couldn't continue its upward trend so far, we usually hear the same arguments. One of them was the dispute with Toshiba, which seemed to be lasting forever and was an often-quoted argument why the stock didn't climb higher. In my last article I also wrote about the dispute and called it a risk and an uncertainty that was a burden on the stock price. But the dispute seems solved right now and is therefore no longer a risk the investor has to consider.

A second, often-mentioned risk are the high debt levels. It is true that Western Digital took on quite some debt when it acquired SanDisk for $19 billion in 2016 and the interest rates are rather high. But to be honest, Western Digital's debt isn't that high and definitely manageable. Right now, Western Digital has about $11.1 billion in long-term debt and therefore a D/E ratio of a little below 1.0 which is acceptable. But we also have to point out the $5 billion in cash and cash equivalents on the balance sheet - leaving WDC with only $6 billion of missing cash to repay the debt. We also have to consider that WDC generated almost $1 billion in operating income in the last quarters and it would therefore take only about 2 years of operating income to repay the debt.

A third risk for the entire data storage industry is the cyclicality, which is one of the crucial dynamics. As we are not talking about essential products, customers are buying SDDs not out of necessity, but rather for entertainment. A logical consequence is, that the purchase can easily be postponed in times of economic downturns. And especially if chipmakers and data storage companies think that demand will be stable over a long period of time, these companies spend billions on additional capacity and when demand declines and customers don't order any more, the high product capacities make the price drop rapidly.

These are all reasons one can read on a regular basis when discussing why the stock couldn't continue its bullish trend. But in my opinion, it is mostly a technical reason - the bullish upward wave before has to be corrected and when that corrective wave is finish, the stock will continue to climb higher.

Positive Trends

Despite all the risks and uncertainties surrounding Western Digital - and as mentioned in the section above, these risks shouldn't trouble investors too much - there are positive underlying trends for Western Digital. On the last earnings call, Steve Milligan talked about the long-term strategy:

"We continue to pursue a long-term value creation strategy underpinned by secular growth in Big Data and Fast Data applications. Rapid advancements in artificial intelligence, machine learning and IoT applications are fueling creation of valuable data at an unprecedented pace. The number of connected devices worldwide is expected to grow from 9 billion today to upwards of 75 billion by 2025. This exponential growth will require robust storage infrastructures and purpose-built solutions that allow users to capture, preserve, access and transform an ever-increasing diversity of data. The Western Digital platform is strategically positioned to play a key role in supporting these long-term growth trends."

In my first article about Western Digital I also wrote about the positive underlying trends. People take pictures, create videos, want to stream movies and series and companies are collecting data about customers and these are only a few examples why more storage capacity is needed. The biggest driver of revenue growth might be the internet of things leading to the fact that many items we know will communicate and start collecting data - our cars, the refrigerator, wristbands people wear and so on. But of course we have the above-mentioned cyclicality to keep in mind.

For Western Digital alone, the number of exabytes shipped has been growing more than 33% YoY and supports the thesis that much more digital storage capacity is needed in the years to come. The biggest growth in revenue came from "data center devices and solutions". Compared to the year before, revenue grew 25% in the last quarter. But revenue and free cash flow growth alone is no reason to invest in a company - we also have to look at its intrinsic value.

Valuation

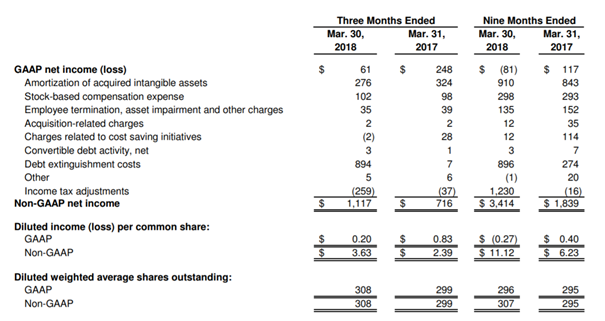

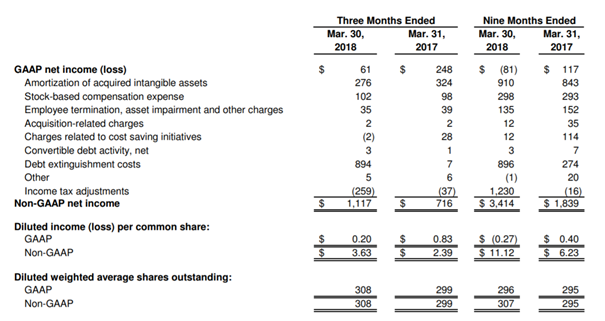

In many articles about Western Digital, authors, contributors and commentators mention the extremely cheap valuation of Western Digital, but WDC has only a low P/E ratio if you use non-GAAP numbers. According to US GAAP, Western Digital could only report $61 million in net income ($0.20 EPS) in the last quarter instead of $1,117 million ($3.63 EPS) on a non-GAAP basis. The huge difference mostly stems from $894 million in "debt extinguishment costs". I will not argue for or against GAAP accounting standard but will only point out that investors should not just pick the number they like (in case of bulls, the non-GAAP number) because it proofs their (bullish) point.

(Source: Western Digital Corporation Press Release)

In the end, I won't pay too much attention to GAAP or non-GAAP net income, because what counts is the free cash flow a company can generate now and in the future. If we use the average free cash flow of the last ten years ($1,624 million) and assume that Western Digital will only be able to grow about 3% for eternity, we get an intrinsic value of $74.79 for the stock (assuming a 10% discount rate). Taking these numbers, the stock would be fairly valued right now. But we have to ask ourselves if the growth rate is accurate and also if we should use the average free cash flow of the last ten years.

Looking at the different numbers, we see a clear buoyancy not just for the stock price, but also for the company's revenue and the free cash flow. The cap spending has been between $500 and $800 million for most years (with one exception where it came close to $1 billion) and hence assuming a CAPEX of $750 million on average for the next years is very realistic. As the free cash flow is the cash flow from operations minus CAPEX, we also have to examine the expected cash flow from operations for the future. A net cash provided from operations over $4 billion (as in the last four quarters) is certainly too optimistic as number for our calculations especially with depreciation and amortization being much higher than in the years before. But I think it is realistic to assume up to $3 billion operating cash flow and take about $2 billion free cash flow as basis for our calculation - and this is very conservative in my opinion. Using those number in our intrinsic value calculation from above, the fair value of WDC would be $92.10.

The second important question is if a growth rate of 3% is realistic for Western Digital for the years to come. Keeping in mind that we are dealing with a cyclical industry that will have phases of boom and bust a too optimistic average growth rate might be unrealistic, but considering the underlying trends mentioned above, I think we can use 4% or 5% as realistic growth rate. To be conservative once again, let's say 4% annual growth for Western Digital. Using the $2 billion free cash flow and 4% growth, we get an intrinsic value of $108.70. Keeping in mind that this calculation is still conservative, WDC is definitely undervalued right now and a good pick at current prices.

Conclusion

Of course, we don't have a similar buying opportunity right now as we had back in 2016 when the stock dipped briefly under $40. But with a dividend yield of currently 2.6% the stock could also be interesting for dividend investors and although I applaud Western Digital's decision to keep the dividend stable and reduce the debt levels first, the company has at least the possibility of increasing the dividend in the years to come. And finally - although this is rather a short-term argument - the stock is oversold right now as it dropped from $105 to $77 within a few weeks and the decline should stop at this point. Western Digital is at a very similar price level as it was when I published my last article Western Digital: Buy the dip and the advice is the same as back then: Buy the dip, because the stock is supported from a technical point of view and is also undervalued right now.

Disclosure: I am/we are long WDC.

************************************************************************************************************************************************

UWG |