Must have been some good stuff said in the MU analyst day. It is up 6.3% in the pre and is pulling WDC along for the ride as well. WDC is up 2% in the pre. Stifel Nicolaus raised the MU PT up to$106/share from $101.

Article: seekingalpha.com

Emphasis Added.

Micron: Time For A Breakout

May.22.18 | About: Micron Technology (MU)

Gary Alexander

Software and cloud, high-growth technologies, IPOs

(4,283 followers)

Summary

- Micron shares rallied sharply as the company significantly boosted its Q3 guidance alongside its annual investor day.

- A huge new $10 billion buyback program is another major catalyst for EPS growth, which has already been multiplying naturally over the past several quarters.

- The company will also begin shipments of its brand-new 3D NAND technology, a major breakthrough in the industry that can shrink the size of memory chips by using stackable layers.

- Micron's latest estimates of demand growth in the DRAM and NAND markets match the expected supply growth, implying that memory pricing may not fall off a cliff as investors are fearing.

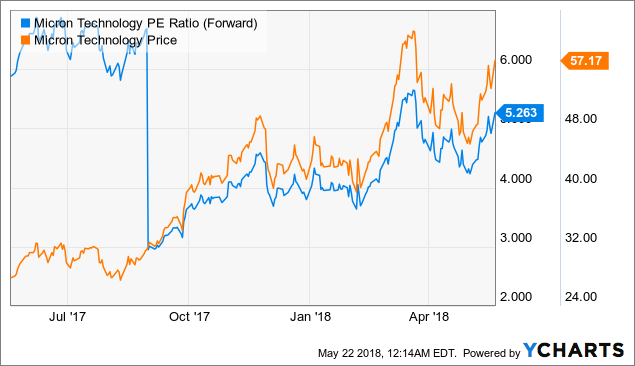

- Despite a massive rally following a pullback earlier this month, Micron shares are still cheap at just over 5x FY18 EPS estimates.

Hang on tight for the ride, Micron ( MU) shareholders: the fast-growing memory stock is about to rip much higher. The company just hosted its 2018 analyst day, and the key takeaways were incredibly bullish, taking shares of Micron up another 7% to add to an already-impressive rally in recent weeks.

Micron suffered a pullback earlier this month as investors reignited their fears over memory pricing decaying in the back half of this year. The commentary coming out of Micron's analyst day, however, suggests that the pricing environment for NAND might be a lot more favorable than investors originally thought.

In my opinion, the huge rally in Micron shares is just a trace of the company's upward momentum. Shares are still extremely cheap against FY18 EPS estimates of $10.98, as reported by Yahoo Finance. Yes, memory stocks have always traded at a discount due to their cyclicality, but is it sustainable for a stock to trade at one-thirds of the market's average valuation - especially when all data points to a conclusion that the memory cycle, while still having ups and downs, will be much less lumpy than in the past?

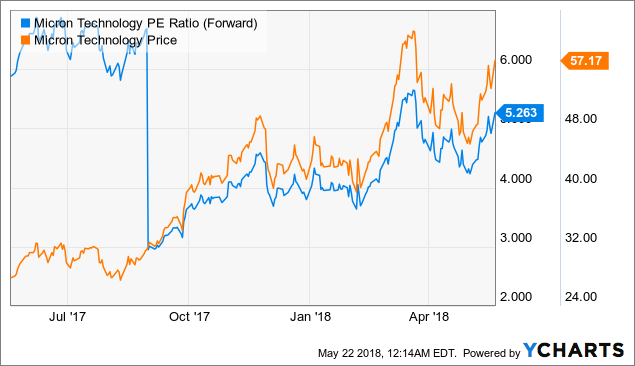

MU PE Ratio (Forward) data by YChartsMicron's announcement of a huge $10 billion share buyback program beginning in FY19 is yet another indicator of its undervaluation, as well as a signal that investors' concerns over the memory cycle crashing are overblown. Micron wouldn't be pledging 50% of its free cash flow over the foreseeable future to share buybacks if it didn't have confidence in its own performance through the memory cycle (in the last rough patch, Micron posted sharp losses and negative free cash flows). MU PE Ratio (Forward) data by YChartsMicron's announcement of a huge $10 billion share buyback program beginning in FY19 is yet another indicator of its undervaluation, as well as a signal that investors' concerns over the memory cycle crashing are overblown. Micron wouldn't be pledging 50% of its free cash flow over the foreseeable future to share buybacks if it didn't have confidence in its own performance through the memory cycle (in the last rough patch, Micron posted sharp losses and negative free cash flows).

The company has already been driving plenty of earnings growth without buybacks. In Micron's last reported quarter (Q2), the company posted EPS of $2.67 - almost quadruple the $0.77 it had posted in the year-ago period. It's doing just fine growing earnings organically. Upon the completion of a $10 billion buyback program that chips away at only a $64 billion market cap, however, there is significant earnings growth to be had in share count reduction alone - even if memory pricing trends turn south and Micron takes a small hit on margins, it will still be able to produce phenomenal earnings growth.

I'm in Micron for the long haul, using every dip to add shares and enjoying the gradual ride up to a normalized valuation. Key takeaways from the analyst day also reinforce a bullish position, which we'll discuss in turn:

Generous guidance boost lifts earnings estimates for the yearPerhaps the most important update Micron gave to investors was an increase in its third-quarter guidance. Micron always blows past its estimates anyway, but a boost in guidance is always a welcome sight on Wall Street.

Here's a look at the company's latest numbers:

Note that Micron tightened the ranges on both the revenue and EPS side, and those ranges are squarely higher than the high end of the original guidance - a huge signal of certainty in the quarter's results.

Note that the latest guidance ranges imply 39% y/y growth to the top line (versus $5.57 billion in 3Q17) and essentially a doubling of EPS (versus $1.62 in 3Q17). These are already robust growth expectations for a company of Micron's scale, but noting that Micron grew revenue and earnings by 58% y/y and 4x in Q2, respectively, I wouldn't be surprised in Micron exceeds even this increased guidance.

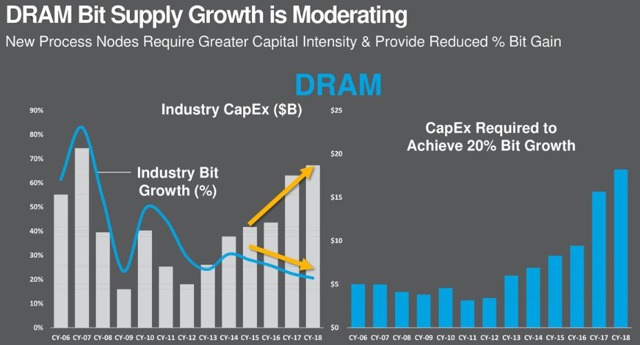

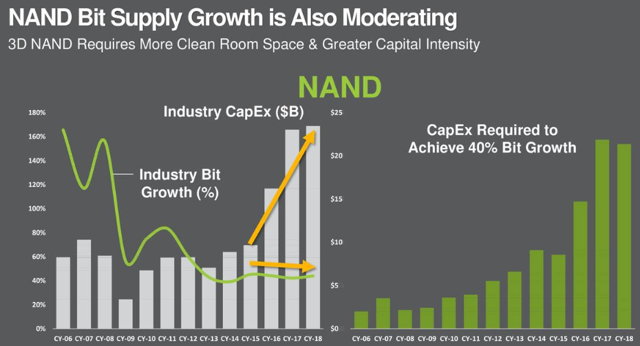

Demand drivers for NAND and DRAM still strongMuch of the conversation this year has been about the supply side of the memory markets. The conventional wisdom goes something like this: almost all of the major memory suppliers have drastically increased their capex spending to boost their output capacity. This industry, like the airline industry, has historically shown no pricing discipline whatsoever, undercutting each other in an all-out market share grab for bit shipments. Thus, prices in the back half of this year should fall.

Well, maybe. DRAM prices (DRAM is two-thirds of Micron's business) have certainly softened already in recent months, as reported by DRAMexchange, but overall pricing may not see the complete pummeling that investors are fearing. The demand side of the equation is holding up equally strong.

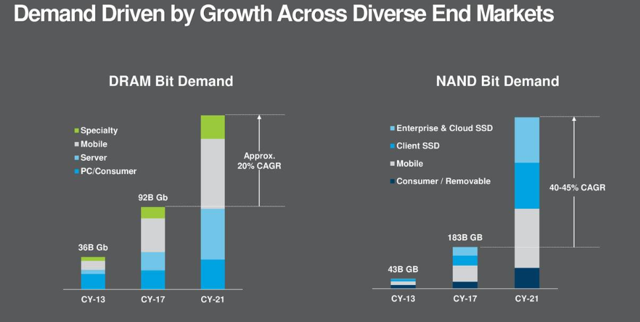

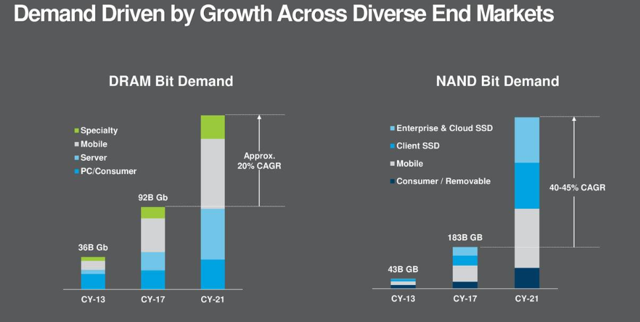

Micron flashed a slide in its investor day showing that it expects DRAM and NAND bit demand to grow at a 20% and 40-45% CAGR, respectively, through 2021:

Figure 2. DRAM and NAND demand growth  Source: Micron investor relations Source: Micron investor relations

Demand growth is also supported by the fact that Micron will begin shipping brand-new 3D NAND technology, in partnership with Intel, shortly. 3D NAND essentially enables manufacturers to stack more memory chips on top of each other, preserving space and allowing for smaller end-devices. Continued innovation on this front will drive fresh, incremental demand for Micron chips.

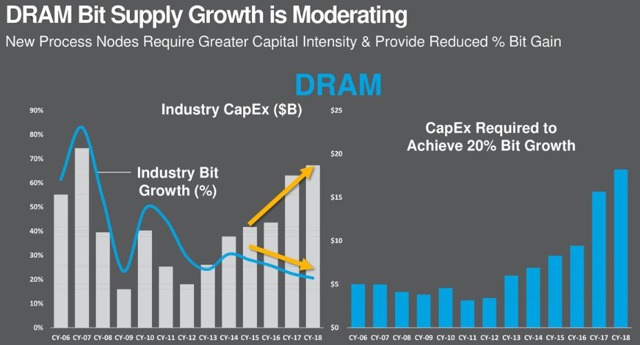

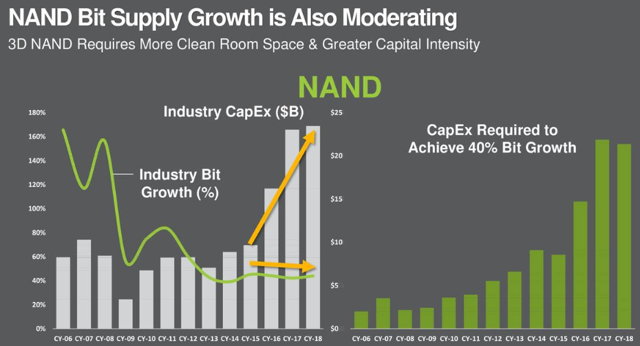

On the supply side, industry bit growth is also expected to moderate, matching estimates for demand growthAnd even the supply picture looks a lot better than investors were originally thinking. Micron also showed a pair of slides showing that industry bit growth in both the DRAM and NAND markets, far from accelerating sharply in the back half of this year, will actually level off to a moderate pace:

Figure 3. DRAM and NAND bit growth   Source: Micron investor relations Source: Micron investor relations

Micron expects industry bit growth of 20% and 40%, respectively, in the DRAM and NAND sectors. This is on par with Micron's expected growth CAGR of 20% and 40-45%.

If we believe Micron's industry estimates to be accurate, then a balanced supply/demand picture implies that memory pricing, in fact, won't fall of the cliff that investors were expecting. This means Micron's "supercycle" of huge EPS figures may last much longer than investors are giving it credit for.

How should investors react?Micron has essentially released a clear-skies narrative into the market. Its investor day presentation has effectively communicated a bullish picture for memory demand through FY21. At the same time, it seems that all of the major industry players (Micron included) are showing discipline in capacity growth this time around, such that bit supply growth is expected to fall roughly in line with demand growth.

This means that Micron perhaps isn't in a phase of "peak earnings" - perhaps this peak is the new normal. Micron's lifted guidance for Q3 and its huge capital returns announcement is certainly a harbinger of the company's confidence in the futures.

Micron has traded like a hot potato so far in 2018 with its constant ups and downs, but the overwhelmingly bullish commentary coming out of its analyst day (as well as the Wall Street praise soon to follow) are sure to lift the tide in Micron's favor. Stay long on this name and take every opportunity to add shares.

Disclosure: I am/we are long MU.

***********************************************************************************************************

UWG |