Seeking Alpha article about WDC and current PPS/dividend stream. Is a forward PE of 5.3 a new record low?

UWG

************************************************************************************************************************

seekingalpha.com

Western Digital: 2.6% Yield And On The Clearance Rack

Jun.26.18 | About: Western Digital (WDC)

Gary Alexander

Software and cloud, high-growth technologies, IPOs

Summary

Western Digital's shares have entered a bear market, having fallen more than 25% from a recent peak above $100.

While China-related headlines pose some risk, they are largely a distraction from the strength of Western Digital's underlying business.

Read-through from Micron's recent quarterly results was extremely positive, with NAND and DRAM pricing pointing to stabilization.

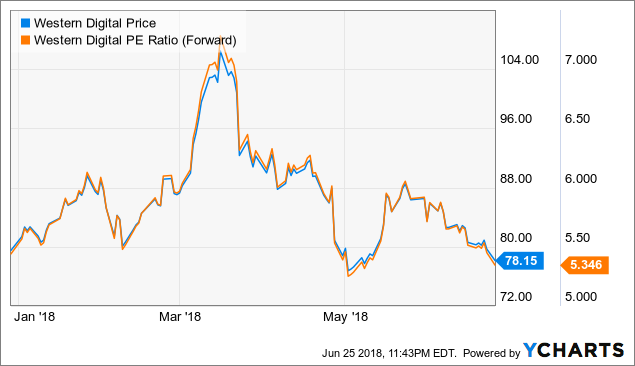

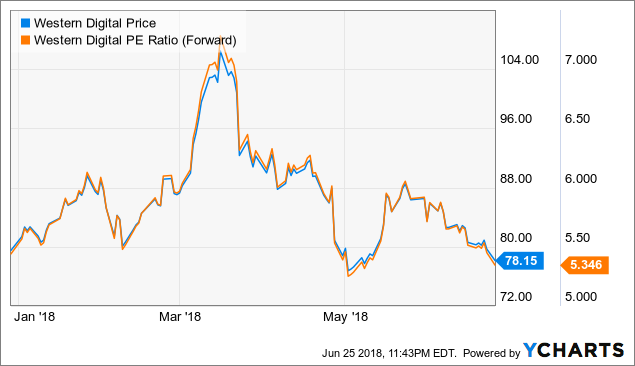

Western Digital remains perennially undervalued at 5.5x forward P/E. Shares are also offering a 2.6% yield for patient investors.

After assuming the crown of top-performing sector over the past several years, it's only natural that the technology sector took the brunt of the beating on the China trade war-fueled selloff. With most high-flying names falling in the range of 5% or more, bargains suddenly abound again in the sector.

One name that has been a bargain for several months - and after the recent extended selloff, is even more of a bargain - is Western Digital ( WDC). It's no secret, of course, that memory chip stocks have been among the most undervalued stocks of the past few years as investors have feared the end of the cyclical upswing in the memory industry. At the beginning of the year, industry analysts were expecting memory prices to fall off a cliff in the back half of 2018. Recent data points, including Micron's (NASDAQ: MU) recent earnings release, however, challenge those bearish assumptions.

Regardless, memory stocks continue to shed gains. In last month's brutal correction, Western Digital has been among the hardest hit. The China-driven selloff has erased Western Digital's gains for the year, and since the beginning of December, Western Digital has shed -2% (hugely underperforming the broader tech sector, which even after the recent selloff is up nearly 10%). From the company's peak in March, shares have lost more than 25%.

WDC data by YChartsIt would be naively optimistic to declare that the pain will be over quickly. Memory stocks have a long history of being volatile names, and for Western Digital in particular, shares may see even further pressure until Q4 earnings, due in mid-July. Regardless, given the strength in the company's earnings growth and cash flow (in the year to date period, Western Digital has achieved 34% y/y operating cash flow growth - how much more robust can a "legacy" hardware's cash flow results be?), it's best to hold on and use dips to continue building a position. I've taken advantage of the recent pullback to add to my holdings at a lower average cost. WDC data by YChartsIt would be naively optimistic to declare that the pain will be over quickly. Memory stocks have a long history of being volatile names, and for Western Digital in particular, shares may see even further pressure until Q4 earnings, due in mid-July. Regardless, given the strength in the company's earnings growth and cash flow (in the year to date period, Western Digital has achieved 34% y/y operating cash flow growth - how much more robust can a "legacy" hardware's cash flow results be?), it's best to hold on and use dips to continue building a position. I've taken advantage of the recent pullback to add to my holdings at a lower average cost.

In the long run, a stock trading at under 5.5x forward P/E is simply unsustainable. There's evidence coming out of Micron's most recent earnings to suggest that memory stocks will be much less cyclical now than in the past, hopefully allowing companies like Western Digital to shed the cyclicality discounts on their valuation.

2.6% yield to reward investors for patienceThough it may take months or even several quarters for Western Digital to regain the >$100 handle (though shares did rally quickly to $105 in March within less than two weeks of trading in the $80 range, which is where it's trading now), Western Digital also now sports a respectable yield that can tide over investors while they wait for a valuation recovery.

Western Digital is currently yielding $0.50 per quarter, or $2.00 per year. At current share prices, this represents a yield of 2.6%, much more than the typical technology stock and certainly more than memory peer Micron. In the past five years, Western Digital has kept a stable dividend and has doubled its payout since 2013:

Figure 1. Western Digital dividend history

Western Digital's earnings and cash flow growth, largely powered by Trump's corporate tax reform, also leaves open the door to a dividend hike or a significantly expanded buyback program. Micron recently announced a brand new, $10 billion buyback program that can single-handedly produce 16% inorganic EPS growth. Given Western Digital has about $5 billion of cash on the books and ~$3 billion in annual FCF, it could mount a similarly-sized program. Over the past year, much of Western Digital's investment has been focused on getting its foot in the door with NAND production, but with the Toshiba deal sealed, Western Digital may be looking toward shareholder returns in spending its considerable cash intake.

Positive memory read-through from MicronIn general, chip stocks tend to rise and fall as a group: what benefits or harms one stock generally cascades down to the rest of the group. Just a few weeks ago, we received an extremely strong quarterly read from Micron's Q3 results, pointing to similar strength when Western Digital reports results next month.

The key points from Micron's quarter, in my view, were not company-specific. The most salient takeaway was that Micron managed to achieve a sequential lift in NAND and DRAM pricing - quite contrary to the bearish opinion that memory prices were headed for a steep drop-off this year. While Micron doesn't give exact ASP figures or growth rates, it pointed to "mid-to-upper single digit" growth rates on a quarter-over-quarter basis for both DRAM and NAND. It would be plausible to assume that Western Digital was able to benefit from the same pricing tailwinds as Micron, though magnitudes may differ.

The other positive note was that, for both Western Digital and Micron as well as other memory stocks, a lot of growth is being driven by end-customer diversification. Cloud computing, in particular, has driven massive double-digit growth in bit shipments, helping to stave off price decay and memory supply and OEM capacity begin to pick up this year.

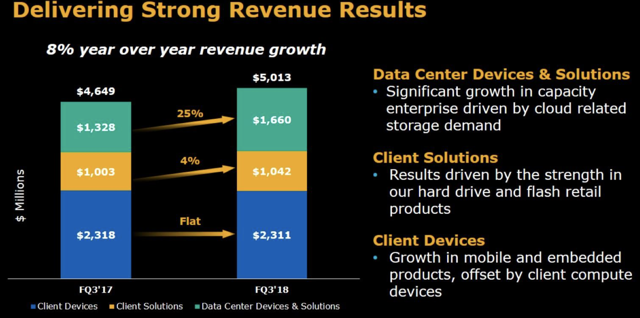

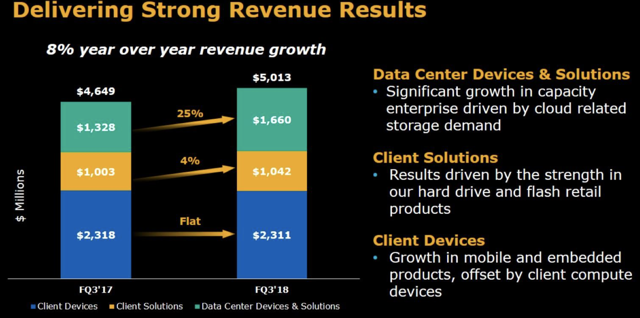

In Western Digital's most recent quarter, its largest historical segment - client devices, or embedded memory chips in devices such as PCs - saw flat y/y growth, while detached hard drives and flash drives as well as cloud computing units saw tremendous growth, as shown in the chart below:

Figure 2. Western Digital Q3 revenue growth by end-customer segment

Source: Western Digital investor relations

We've already seen, from HP's ( HPQ) most recent earnings quarter, that the stagnant PC/desktop market is starting to show signs of life again. While this will provide a boost to Western Digital's shipments, it's also no longer as dependent on PCs and memory-embedded hardware to drive its business. In the past, client devices represented about half of Western Digital's revenues; now, it's slightly less than half.

Diversification in Western Digital's customer base, particularly from the hot cloud market, will continue to protect elevated prices in the memory market. In addition, less dependence on PC shipments as well as a healthy demand environment that keeps up with growing supply helps to ensure that Western Digital's peaks and valleys may be less exaggerated this time around than in the previous cycle.

Final thoughtsIn my view, the market is being overly bearish on Western Digital. In the year to date, Western Digital has driven tremendous earnings and cash flow growth, driven not just by tax reform but also by strength in memory pricing and robust end-customer demand that is now diversified across a broader mix of use cases. Micron's most recent quarterly post corroborates the thesis that fundamentals in the memory market have never been brighter, and Western Digital also stands to benefit.

Even if Western Digital takes some more time to get back into its groove, it's currently offering investors a juicy yield just shy of 3%, far more than most technology stocks offer. With such a lowball valuation that over exaggerates how cyclical Western Digital's business really is, the stock has tremendous upside potential - even doubling the current share price would put Western Digital at a below-market average P/E ratio. In my view, investors are best staying along for the ride and collecting dividends while they wait.

Disclosure: I am/we are long WDC. |

WDC data by

WDC data by