| | | OT - Re: ENPH Exit strategy?

I used to own this over a year ago and held for about 24 months but showed little growth but had tons of potential. I closed out my starter position since they never could report positive EPS (they did have positive EBITA in 2014 but that was a one year/one time event). I believe the company is much better positioned now than when I owned it and just needs to achieve scale w/ their converters (probably the one component in the solar system w/ the disruptive technology potential).

Management had a service/cloud feature that should/could produce a steady predictable income stream once they achieved scale w/ units installed that could be connected to their cloud service. I was in the investment too early but thought this part of their business was the most interesting as I would even subscribe and pay a monthly fee for this 'active' monitoring service. It would replace the fee I already paid to the electric utility to have a service technician come out 24/7 if there was some type of service outage.

What's you Exit plan for ENPH?

Their marketcap of $673mln is still small (in the small cap range), so there are plenty of growth possibilities w/ JV partners, regional footprint expansion, ongoing cloud service monitoring and other add-on and/or complementary services (ie home monitoring: utility,security).

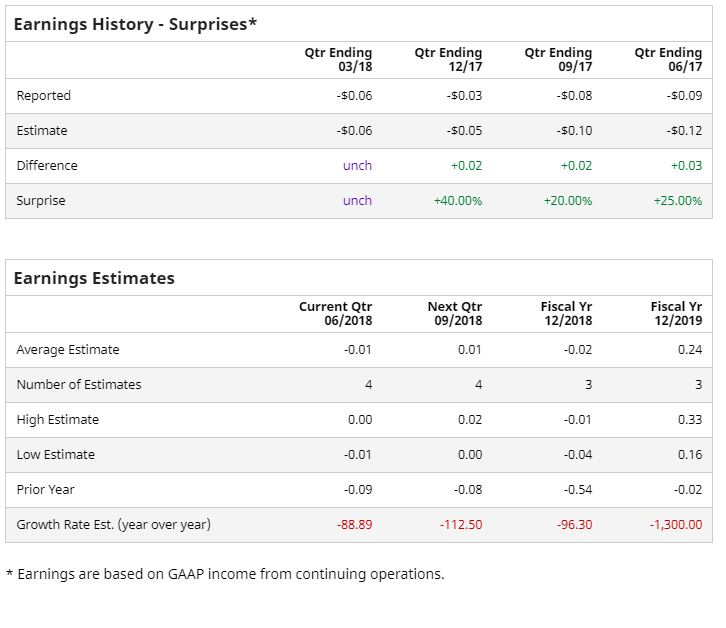

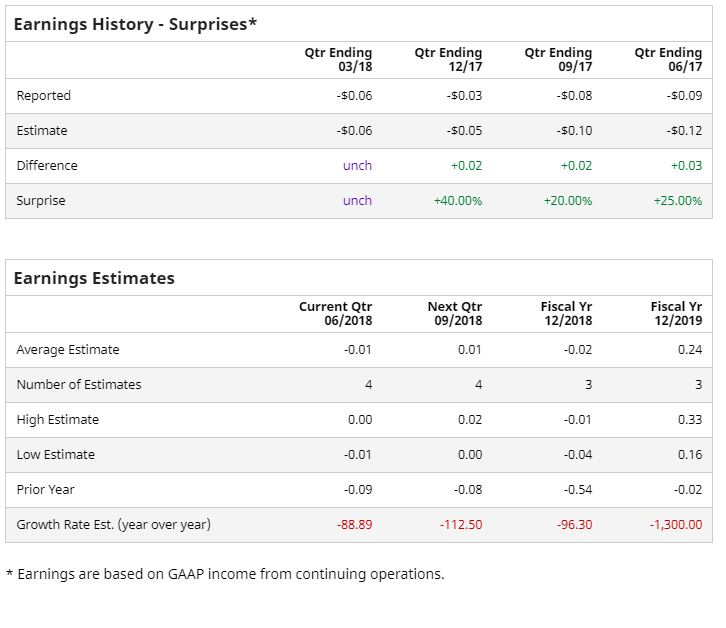

I notice that 3 analysts follow the company now and they s/d book positive EPS in 2019 maybe even turning positive as early as next quarter (9/2018).

(EPS estimates - barchart,com)

Enphase Energy Inc (ENPH)

It's a pretty big bet. My approach would be to peel off some shares and build a basket of similar and/or complementary companies that are partners w/ ENPH or provide support and/or support their customers on-going service needs. At some point there will be consolidation by larger operators (I am thinking Solar City and/or a large Utility subsidiary) . ENPH's sales (and services) are worldwide (big exposure in EU & Australia) so no one utility would be interested (maybe ABB) but some large cap company w/ boots on the groud to support their installed base (ie 24/7 on-site service).

Expand your thinking on what ABB is doing for their large Utilities & Industrial customers? I wonder if they would have interest in ENPH's small business and/or residential customer base?

ABB Ltd, headquartered in Zurich, Switzerland, is engaged in providing power and automation technologies for its utility and industrial customers. The Company provides a range of products, systems, solutions and services that are designed to improve power grid reliability, increase industrial productivity and enhance energy efficiency. ABB is focused on power transmission, distribution and power-plant automation and serves electric, gas and water utilities, as well as industrial and commercial customers. Its Power Products division manufactures three categories of products: High-voltage Products, Medium-voltage Products and Transformers. The key technologies include high- and medium-voltage switchgear, circuit breakers for various current and voltage levels, power and distribution transformers, as well as sensors and products to automate and control electrical and other utility networks. ABB Ltd is structured into four regions: Europe, the Americas, Asia and the Middle East and Africa (MEA).

ABB has a market Cap of $46Bln or about 70x the size of ENPH but more importantly has the world footprint where ENPH's installed base is, is developing a cloud service 'real-time' monitoring systems to control utility/commercial electrical networks.

Good Investing

EKS |

|