WDC is undervalued. No kidding...

seekingalpha.com

The Market Doesn't Care About Western Digital

Jul. 11, 2018 7:52 PM ET

| About: Western Digital Corporation (WDC)

Michael Wiggins De Oliveira

Long only, value, contrarian

Marketplace

Deep Value Returns

Summary

Western Digital's stock is undervalued.

A discussion of Western Digital's cash commitments to Toshiba.

Investors' fears over the sector's cyclicality are overblown.

This idea was discussed in more depth with members of my private investing community, Deep Value Returns.

Investment ThesisWestern Digital ( WDC) is cheaply valued. Although there is one blemish on Western's financials which I'll touch on in the article, overall there is minimal reason for such apathy towards this data storage solutions company. Further, Western Digital and its peers will ultimately be the foundation that will allow the data revolution to take place.

BackgroundMany investors are concerned by the cyclicality of the sector. Right away, from following the tech space very closely I would disagree with these overarching concerns. There are in fact strong secular tailwinds in the cloud sector and other data center companies with large requirements for storage solutions.

The second concern which many investors have is that these companies are largely commodity-like companies, with no real competitive advantage. Which I would tend to agree on. However, my argument here would be, if you mine for lithium and lithium is in very high demand, then it makes little difference whether the mineral is a commodity, because as long as demand remains high there is little to be concerned about. Presently investors are so fearful of the potential cyclicality of this sector that they are leaving meaningful returns on the table.

High Free Cash Flow Margin: ProtectionOver time, I have found that buying businesses with high free cash flow margins (defined as FCF/Revenue expressed as a percentage), offers investors protection against downturns. Specifically, a cyclical company which sells a high margin product can afford to take a hit on its price (say a 30% discount) and still remain profitable during a sector's downturn. How does this apply to Western Digital? Roughly, we can see that Western Digital generates $2 billion in free cash flow and approximately $15.5 billion in revenue (both figures are normalized). This would imply Western Digital has a free cash flow margin of approximately 13%. Which means, that if the investor is wrong, and Western Digital is indeed headed for a sector contraction, then Western Digital would be able to weather the downturn relatively well.

Financial Health

In the introduction, I mentioned that there was a blemish in Western Digital's financials. And that is if I'm wrong, and the market's concern about its upcoming industry contraction is an actuality, and we are now operating at the peak of the market, I would not be overly happy to be invested in Western Digital with its unwieldy balance sheet. More specifically, Western Digital's contractual obligations and commitments add up to $27 billion.

Of course, shareholders would immediately counter this by highlighting that a large portion of this $27 billion figure comes from Western Digital's commitment to its Flash Ventures joint venture with Toshiba Memory Corp. (roughly $9 billion) - which is true, but nevertheless, that is still a drag on Western Digital's cash output. Offsetting these cash commitments is Western Digital's cash balance of $5 billion, leaving Western Digital with a net debt position of $22 billion - which is not great for a company which generates close to $2 billion in free cash flow per year.

On the other hand, in spite of my concerns regarding Western Digital's less-than-optimal balance sheet, I feel that my concerns are fully put to rest, as this concern and many others are already accounted for by its present valuation.

Valuation

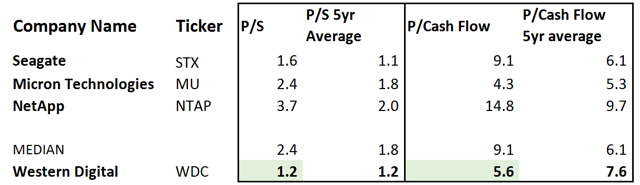

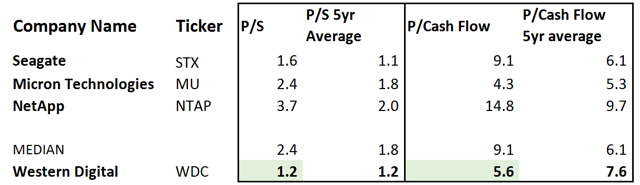

Source: author's calculations, morningstar.com

Note, in the interest of disclosure, I wish to highlight that I am a Micron Technologies ( MU) shareholder. Thus, as much as I try to be objective in my assessment of Western Digital there could be some unknown cognitive-bias creeping into my valuation of Western Digital.

Moving on, the table above shows that with the exception of NetApp ( NTAP) the rest of its peers' cash flows are being quite lowly valued - although I would argue that NetApp is now fully priced and in the event of a sector correction, this stock would be the most punished.

Furthermore, SA readers familiar with my work will know my focus on a company's P/Sales ratio, as I believe that the P/Sales ratio is nicely reflective of investors' sentiment towards a stock and useful for cutting through much PR spin.

Here once more, we can see how the rest of its peers are all trading with inflated P/Sales ratio relative to their own historical averages, while Western Digital's P/Sales ratio is firmly in line with its 5-year average and trading for approximately half of its peers' P/Sales ratio.

TakeawayWestern Digital and its peers are unjustifiably out of favor with the investment community. I believe that patient investors getting in now, and willing to fully disregard the vicissitudes in Western Digital's share price over the next few quarters, will be pleasantly rewarded within 2-3 years, once positive investors' sentiment returns to the sector.

Disclaimer: Please do your own due diligence to reach your own conclusions.

Note: The only favor I ask is that you click the "Follow" button, so I can grow my Seeking Alpha friendships and our Deep Value network. Please excuse any grammatical errors. |