| | | Great article on WDC. I agree with a LOT of what this author says and I suspect a lot of others here do too.

Link: seekingalpha.com

The Emergence Of Value At Western Digital

Aug. 2, 2018 4:03 AM ET

| About: Western Digital Corporation (WDC), Includes: HXSCF, SSNLF, STX

by: JP Research

JP Research

Long/short equity, Growth, long-term horizon, macro

Summary

Sentiment on WDC down to "horrific" lows.

The market is too fixated on timing the NAND cycle.

Lower NAND ASPs will continue but elasticity could be a source of upside.

WDC is also set to gain share from STX on next-gen HDDs.

WDC looks compelling for patient investors who can weather the cycle.

"Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves." - Peter Lynch

This writeup is going to be a fundamental departure from my prior commentary on Western Digital ( WDC) as a special situation long (which did not turn out as expected) as I think we are seeing good value now emerge from the stock. WDC recently traded down to 52-week lows, presumably on the EPS guidance cut and NAND cycle concerns.

Sentiment was already low coming into the print - one analyst described it as "horrific":

"Our discussions with investors lead us to conclude sentiment is horrific going into the company's print 7/26 AMC, and we now think WDC may miss and guide below for the first time since acquiring SNDK."

And he was dead on. Though, I'm personally quite befuddled as to why investors are so fearful of the NAND cycle rolling over. If history has taught investors anything, it's that timing the market is impossible. Naturally, the WDC analysts on the call repeatedly pushed Milligan into helping them time the NAND cycle rather than attempt to assess WDC's through-cycle earnings power.

At some points, the call deviated into the ridiculous:

"Wells Fargo: Yeah. And so, I guess with that context, I mean is there - as we look back historically, how do you see us currently in terms of the cycle?"

"Loop: Thanks. And where in the cycle do you think we are right now? Best take"

I think WDC's decision to push $5bn into buying back its own stock (~24% of mkt cap) says a fair bit about how it thinks it can navigate the cycle. Milligan clearly thinks the stock is cheap now ("We also think that it's a wise use of our capital to repurchase our stock, particularly at these levels") and is frontloading ~$1.5bn for the first 12 months. That's about as positive a signal as it gets.

Key Puts & Takes from Q4Despite the "horrific" sentiment cited by some analysts, WDC delivered a classic beat for the quarter on sales and EPS. Shipments were up ~31% YoY on an EB basis, with HDD shipments slightly down on softer client and consumer electronics HDDs (offset by stronger Enterprise and Branded HDD shipments) with ASPs also slight down on mix.

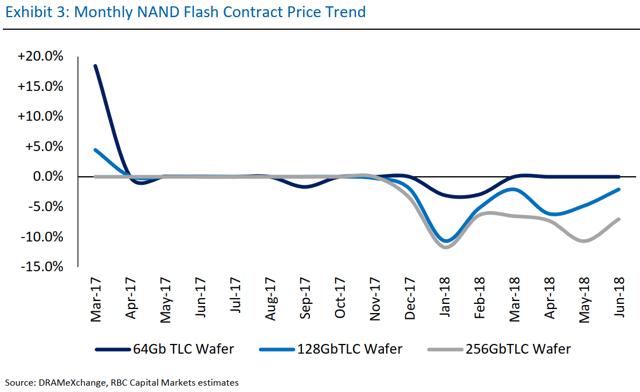

The flash ASP/ GB was the big mover, declining MSD-HSD % QoQ on softer mobility demand. Notably, this is below Samsung's ( OTC:SSNLF) reported low-teens % declines, with Hynix ( OTC:HXSCF) also citing deceleration. The guidance cut on margins was driven by expected NAND deceleration - gross margins are now set for ~38-39% with EPS at $3.00-3.10. In response, WDC is rationalizing its footprint (shutting down its Malaysian factory) and curtailing capex in 2018.

The short-term negatives were enough to drive WDC down to new lows, but the market seemed to have glossed over the long term reset - 1) LT non-GAAP gross margin range is now up to 35-40% (from 33-38% prior) and 2) LT non-GAAP operating margin range is now up to 20-25% (from 18-23% prior). Two key reasons for the higher LT reset - 1) greater mix of higher margin flash revenue and 2) higher mix of capacity enterprise drives.

A quick note on guided calendar EPS of $13 - Milligan is still bullish on exceeding the number ("the answer is yes, we will - we're still confident that we'll be able to exceed $13 a share in calendar 2018 EPS").

On valuations - $13 in CY EPS would equate to ~5.4x PE at $70/ share, which just seems excessively pessimistic. Even if EPS were to halve at the trough, this would still be a fairly valued 10-11x PE stock.

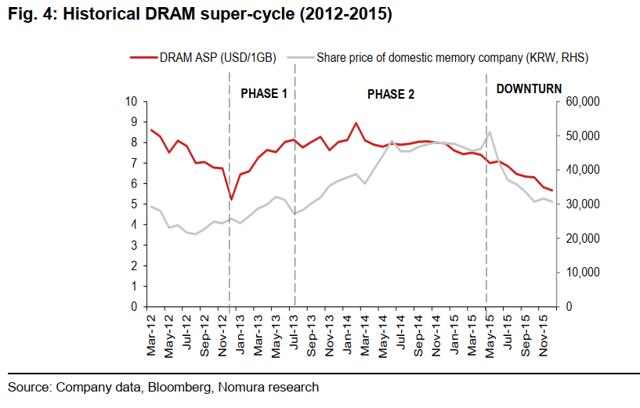

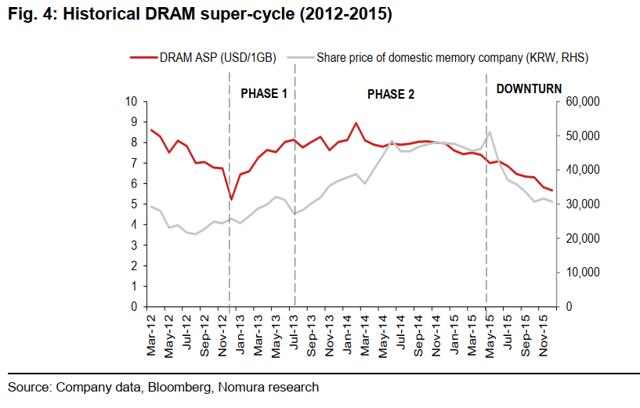

The NAND Debate - Lower Prices vs. Higher ElasticityValue investor or not, I still think it's important to put the analyst hat on and get a handle on what's driving the NAND cycle. To understand why the market is so fearful of memory boom-bust cycles, it helps to revisit the '12-'15 cycle through the eyes of a Korean memory producer. The cycle can be broadly split into three phases - 1) Phase 1 - ASP hikes, 2) sustain profitability on cost reductions, and 3) downturn w/ falling ASP and profitability.

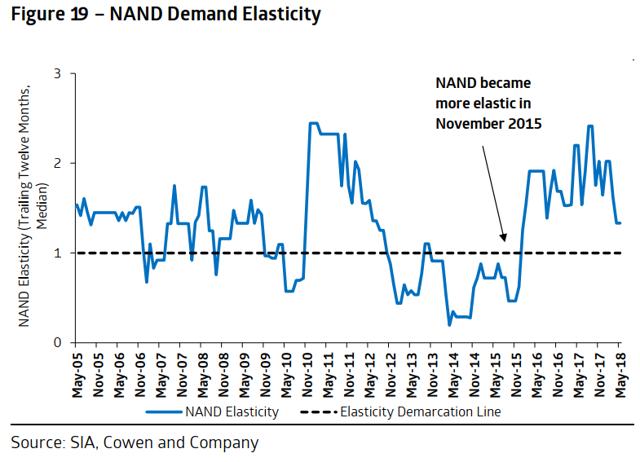

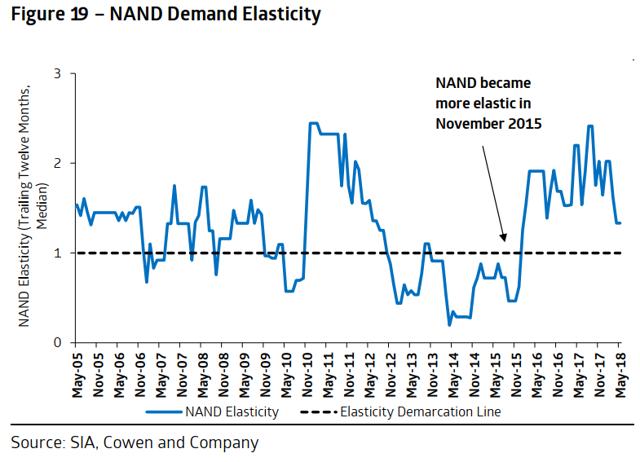

I don't think prior cycles are directly comparable to today's however as this NAND cycle is structurally different. Today's end markets are highly diverse (more end markets), elasticity is higher (on SSD adoption), slower bit growth rate (~100+% in '08 vs. 40+% today), and growth constraints (higher fab costs, transition complexity).

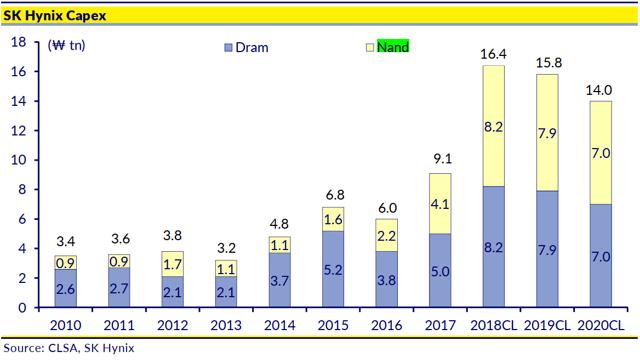

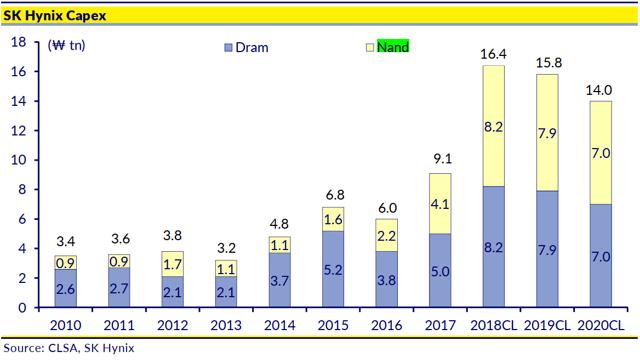

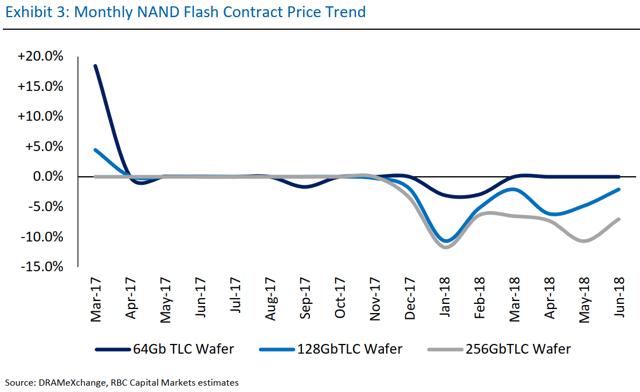

NAND has clearly entered Phase 3 - commentary out of Samsung indicates shipment growth at ~40% for the industry (Samsung in line) for 2018 with price deceleration predicted across the board. Hynix has even raised capex by ~W2tn (mostly NAND) on its recent call, going against WDC's plan to curtail capex into 2019.

Samsung is not holding back either - it raised its 2018 NAND bit supply growth guidance to low-40% yoy from 40% yoy prior. WDC has stated that its cost declines run ~20% YoY so clearly, there's some leeway relative to ASP declines (15-25% LT). But all that supply talk has led to a fair bit of bearish commentary around NAND prospects going into the next few years.

Now, I do agree with the theory that we are currently in phase 3 of the cycle, but I do think there's some comfort to be taken from NAND elasticity. Logically, it makes a lot of sense that SSD penetration would rise as NAND ASPs fall, while the adoption of higher density NAND for mobile is also a key driver. Samsung also cited higher SSD adoption in data centres and other high storage applications as potential drivers.

Milligan made the right noises on elasticity kicking in for WDC as well, with callouts for smartphones and client SSDs:

"We'll see as the rest of this calendar year and early calendar 2019 occur, but you would expect there will be some elasticity there. That's been the case in the past, and we would expect we will see some of it."

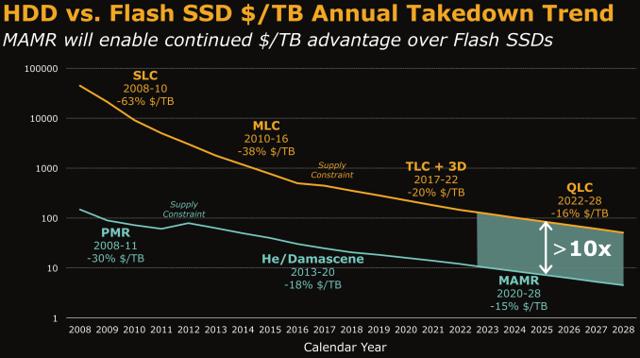

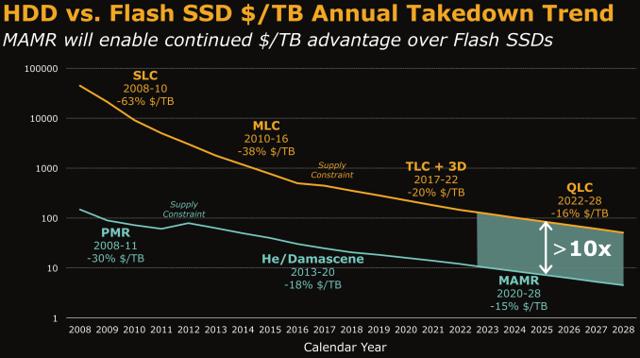

HDDs Are Far from DeadWhile the market seems to be completely fixated on NAND supply/ demand dynamics, a separate race is going on in HDDs - and WDC is winning. WDC and Seagate ( STX) have diverged in their approaches toward high capacity drives - WDC with Microwave-Assisted Magnetic Recording (MAMR) and STX with Heat-Assisted Magnetic Recording (HAMR).

Prior to WDC's announcement last year, the industry had been heading for HAMR approach to scaling above 1.5TB/ sq in. WDC however decided not to pursue HAMR likely on cost and development concerns. The HAMR vs. MAMR debate revolves around scaling potential (HAMR offers potential for higher recording density) vs. production and costs (MAMR production requires less investments).

As HAMR utilizes a laser in the write head to prepare the disk for writing, it requires glass disks instead of the typical aluminium ones. This, along with laser unit, adds to costs. MAMR on the other hand uses a microwave field to assist in writing the disk without heat, therefore retaining the ability to use (cheaper) aluminium disks. HAMR BOM costs run ~20% higher than MAMR at volume production.

In hindsight, WDC's pivot was a smart one - HAMR development has been pushed out to 2019 on 1) glass substrate shortages and 2) tech difficulties related to the laser (thermal issues). For the foreseeable future, MAMR is a lock on next-gen HDDs as scaling will start near term, while HAMR continues to run into production difficulties.

According to WDC, MAMR will help sustain the >10x cost advantage of HDDs over SSDs. WDC has the roadmap to reach >4 Tb/ sq inch (vs STX's 2TB/ sq inch) which will allow WDC to grow HDD capacity by 15% per year while reducing the cost of storage by a similar amount.

(Source: WDC)

The challenge to WDC's claim of retaining a >10x cost advantage is that it will have to outpace 3D NAND's scaling progress. Optimistic or not, I do think MAMR is a key point against the "HDD is dead" bears out there. The MAMR launch in 2019 (test samples in 2018) for data centres will give us more clues on progress. WDC has targeted 40TB/ unit by 2025, with introduction coming in after the 12/ 14TB node.

The initial cost advantage and earlier production ramp should see WDC taking a couple of points off Seagate's nearline share.

How to Play the NAND CycleThe consensus narrative is that the NAND price downturn is set to continue - and I'd tend to agree with that notion. I'm not entirely sure WDC will re-rate anytime soon if NAND prices remain in the doldrums, but longer term, I think WDC is compelling.

I do think however, there's some modest upside near-term to accumulating WDC, but a lot more for longer term, patient investors who can weather the cycle. In fact, I have a feeling WDC's latest GM guide (~38-39%) is intentionally conservative - sensitizing for low 40s % bit supply growth and ~20% ASP decline (mid-point) gets WDC to the 39% mark with a ~23% decline needed to hit 38% GM. With expectations reset down, WDC's $5bn buyback program is opportunistic to say the least.

Overall, I'm not sure we've hit peak pessimism on NAND and expect declines to continue into '20. Having said that, a lot of that pessimism has already been priced into the stock, and I do like WDC at these levels.

Disclosure: I am/we are long WDC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

**************************************************************************************************************************

UWG |

|