Madrigal: Buy The Dip

Sep. 28, 2018 7:18 AM ET

|

About: Madrigal Pharmaceuticals, Inc. (MDGL), Includes: VKTX

Summary

Prices in Madrigal have dipped considerably following Phase 2 data in NASH.

While prices over $280/share seem stretched to me, I believe Madrigal is now an attractive investment at current prices.

MDGL remains a leader in NASH, and recent developments serve to solidify this notion.

Madrigal is a "buy" at these prices.

Looking for more? I update all of my investing ideas and strategies to members of The Formula. Get started today »

Figure 1: Ironically, the purchase and subsequent consumption of this literal dip may lead to NAFLD/NASH.

Preface Madrigal Pharmaceuticals ( MDGL) is developing MGL-3196, a thyroid beta agonist, for the treatment of nonalcoholic steatohepatitis (NASH). NASH is perhaps the last large chronic, highly prevalent disease to be untapped by pharmaceuticals, as there are no approved drugs (lifestyle changes, such as diet and exercise, help reduce/resolve NASH). Madrigal reported encouraging phase 2 NASH data in June, inspiring share prices to hit all-time highs.

In July, Madrigal was trading at $287/share when I suggested it was " unreasonably priced" and predicted prices would "dip near $200" due to competitive concerns. Immediately following positive NAFLD from competitor Viking Therapeutics ( VKTX), shares in Madrigal, as projected, dipped below $200 and have since stabilized a bit:

Figure 2: A steady and sustained downtrend since the beginning of July may be in the process of stabilizing (Chart courtesy of StockCharts.com)

I still believe it is certainly possible that prices could revisit the 200MA ($177), but I wouldn't bet on it. I would suggest initiating a position now and adding aggressively in the event prices fall below $180/share.

Recent Developments Viking Reports Positive NAFLD For Its Own Thyroid Beta Receptor Agonist

Viking Therapeutics reported positive NAFLD phase 2 data recently. Granted, Viking may serve as a relevant competition going forward, so a depreciation in price was arguably warranted. However, Viking's data does provide additional validity to thyroid beta agonists in NALFD/NASH.

Madrigal Is Funded For A Phase 3 NASH Trial

Madrigal reported quarterly earnings on August 7. As of June 30, it reported $264M in cash and cash equivalents. A phase 3 NASH trial alone will cost possibly as much as $50M (NASH trials have very high screen fail rates, requiring a lot of money just to screen/enroll; because NASH is a chronic condition that impacts millions, trials will require, at the least, ~2,000 patients). Considering its typical cash burn, other clinical prospects, and the costs associated with simply running a business, Madrigal should be appropriately funded through the duration of a phase 3 trial (~2 years' cash runway).

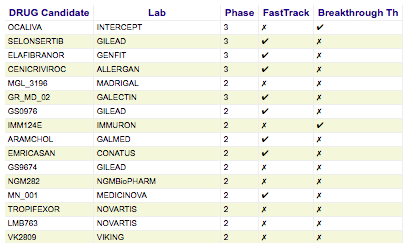

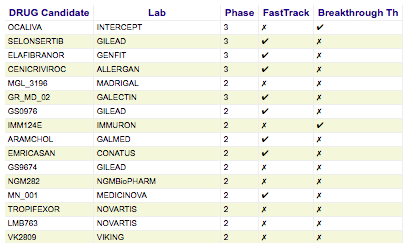

MGL-3196: Top-3 NASH Leader? The efficacy of thyroid beta agonists so far in NAFLD/NASH although still early demonstrates best-in-class potential. Additionally, Madrigal remains amongst the companies that could be first to market in a NASH indication:

Source: Nashbiotechs.com

*% of patients with NAS improvement equal to or greater than 2**% of patients with complete NASH resolution#difficult to interpret efficacy data; drug failed to show statistically significant reductions after 2 years^relevant safety concerns; blackbox warning for drug in another indication; difficult to interpret efficacy data Take the above table with a grain of salt. I have simplified something that is far more complicated than it appears and depends on a number of factors. One cannot look at the above table alone and ascertain what drug is "most efficacious". For example, upon quick glance, it appears the placebo responses in Madrigal's trial, for whatever reason, were higher than normal (meaning the efficacy numbers may be superficially bloated to some extent). Additionally, the endpoints may have been tested at different times (36 weeks, 52 weeks, etc.).

All in all, my point is this: Madrigal's drug seems very promising and has demonstrated superior efficacy data so far. Additionally, MDL-3196 was well tolerated with no severe adverse events. Importantly (especially for this class of medicine), long-term animal studies did not suggest any safety/toxicity issues that have hindered thyroid agonist drugs in the past.

It is reasonable to believe, based on time-to-market, efficacy, and safety, that Madrigal is a top-3 NASH leader at this time.

Summary At writing, Madrigal is valued at $3.26B. I think this is a reasonable valuation. What are some things that can increase the value in Madrigal going forward?

Continued validation of MGL-3196Big pharma failures in NASH trials Given the likelihood of a similarly designed phase 3 trial, solid, long-term animal safety studies, and historical odds of metabolic phase 3 success, I believe the odds of eventual approval are quite high (~75%). Because of its differentiated mechanism of action and favorable time-to-market, I believe MGL-3196 is likely to secure a lucrative portion of the NASH market, either alone or in augmentation with another NASH drug.

Madrigal is valued attractively at these prices and may have a niche in your diversified biotech portfolio.

Authors note: For my top conviction ideas, be sure to subscribe to my exclusive marketplace, The Formula.

Disclaimer: The intention of this article is to provide insight not investment advice. While the information provided in this article is intended to be factual, there is no guarantee and prospect investors are encouraged to do their own fact-checking and research before investing in a company. One must also consider one's own financial standings, risk tolerance, portfolio diversification, etc. before making a decision to buy shares in a company. Many of my articles detail biotechnology companies with little or no revenue. These stocks are, therefore, speculative and volatile. Even when prospects seem promising, there is no predicting the future. Losses incurred may be significant.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

seekingalpha.com |